It has been one other nice yr for the inventory market. As of this writing, the benchmark index, the S&P 500, is up almost 18%.

But, if the place to look, there are even higher long-term buy-and-hold alternatives on the market. Let’s cowl two tech shares which are every up greater than 50% yr up to now.

Spotify Applied sciences

Spotify Applied sciences (NYSE: SPOT) tops the listing of tech shares you should buy and maintain for the subsequent decade. The corporate, which operates the world’s largest audio streaming platform, continues to impress.

Since the beginning of 2023, shares of Spotify are up 339%, making it one of many top-performing shares over that interval. The key to its inventory market success? Spotify has mixed income development with cost-cutting. When accomplished proper, that is a strong mixture.

Spotify’s trailing-12-month income has elevated to $15.7 billion, up from $13.6 billion one yr in the past. Equally, 12-month web earnings has elevated to $500 million versus a virtually $800 million loss a yr earlier.

When it comes to income, the corporate depends on its premium customers to offer roughly 90% of its gross sales. These customers pay a subscription payment for entry to ad-free music, podcasts, and audiobooks. In the meantime, the corporate derives about 10% of its complete income from ad-based listening.

Concerning its bills, Spotify has launched into a collection of cost-cutting measures over the previous couple of years, together with lowering employees ranges, trimming its advertising price range, and canceling some content material initiatives.

In flip, the corporate is firing on all cylinders. Granted, Spotify operates in a aggressive area, with Apple, Amazon, and Alphabet all providing their personal type of audio streaming.

Nonetheless, Spotify has greater than held its personal. With over 600 million listeners and virtually 250 million subscribers, Spotify has established itself throughout the audio streaming market. Buyers on the lookout for a development inventory with legs ought to take into account Spotify.

Meta Platforms

Subsequent is Meta Platforms (NASDAQ: META), the operator of Fb and Instagram.

Granted, I’ve had my considerations with Meta, notably across the tens of billions of {dollars} the corporate selected to spend on the Metaverse. Nonetheless, one reality is plain: Meta generates money at an virtually unbelievable stage. This firm can afford to take some costly dangers. And I am certain that is one of many causes Meta CEO Mark Zuckerberg felt snug pouring $46 billion into the corporate’s Actuality Labs section — cash that heretofore has not generated any return.

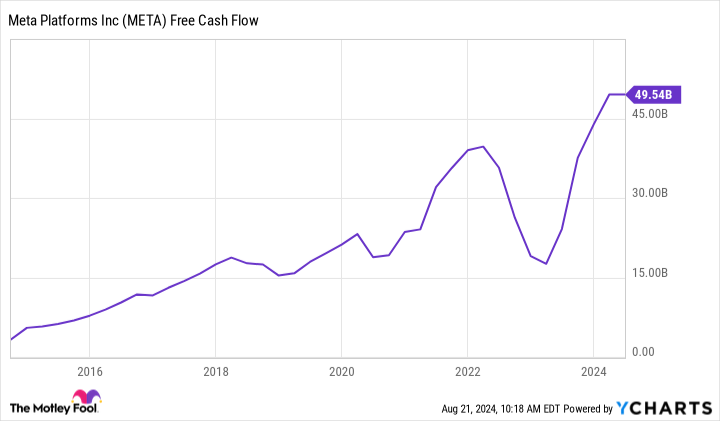

At any fee, let’s take a better take a look at Meta’s money circulation. Within the final 12 months, the corporate has generated $50 billion in free money circulation.

META Free Money Stream knowledge by YCharts

It is a staggering sum, and it places Meta into rarified air. Its $50 billion in free money circulation, for instance, is akin to the full free money flows from vitality giants ExxonMobil and Chevron — mixed.

No marvel the corporate initiated its first-ever common dividend cost this yr. In any case, discovering the money to pay for these dividends isn’t any drawback. The brand new payout coverage exhibits that Fb has loads of surplus money income readily available, looking for a shareholder-friendly money administration coverage.

What’s extra, so long as Meta Platforms stays disciplined in its spending, there’s a lot extra cash circulation on the way in which. Analysts count on the corporate to develop its gross sales by 20% this yr and an extra 13% in 2025. These rising income figures ought to assist much more free money circulation and maybe even larger dividend payouts in some unspecified time in the future. All of this could make traders completely happy to personal Meta Platforms for the subsequent decade.

Must you make investments $1,000 in Meta Platforms proper now?

Before you purchase inventory in Meta Platforms, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 finest shares for traders to purchase now… and Meta Platforms wasn’t one in all them. The ten shares that made the minimize may produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $792,725!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of August 22, 2024

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Jake Lerch has positions in Alphabet, Amazon, ExxonMobil, and Spotify Expertise. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Chevron, Meta Platforms, and Spotify Expertise. The Motley Idiot has a disclosure coverage.

2 Tech Shares You Can Purchase and Maintain for the Subsequent Decade was initially revealed by The Motley Idiot