As Halloween approaches, it’s not simply ghosts and ghouls which are inflicting worry – monetary markets are additionally giving us loads of causes to be spooked. From crumbling client confidence to rising debt burdens, the financial panorama is suffering from eerie indicators of instability.

On this yr’s roundup, we discover 5 charts that reveal unsettling developments in international markets. Whereas surface-level knowledge could look reassuring, a deeper dive exhibits that the scariest threats may very well be those lurking simply out of sight…

Pleased Halloween!

- Automobiles and homes? … Too scary a proposition

In keeping with College of Michigan surveys, shoppers view this because the worst time in 40 years to purchase a home or automotive – a worrying signal for client intent. Large purchases like these will be essential drivers of financial progress, and with shopping for intent so low, we may very well be underestimating the severity of the slowdown.

As client intent wobbles, may the labour market be telling its personal story of uncertainty?

- Staff frightened to give up; corporations frightened to rent

The US labour market seems wholesome, particularly after September’s non-farm payrolls exceeded economists’ expectations and unemployment fell to 4.1%. Nonetheless, beneath the floor, each hiring and quits charges have dropped to ranges usually seen in recessions. Corporations are hesitant to rent full-time staff, and workers are reluctant to give up resulting from job safety considerations and fewer alternatives out there. These indicators of weak point counsel that the results of restrictive financial coverage could also be extra extreme than the headline labour market numbers suggest.

It will not be simply the labour market – financial fragility is reverberating by the financial system, pushed by the enduring grip of financial coverage…

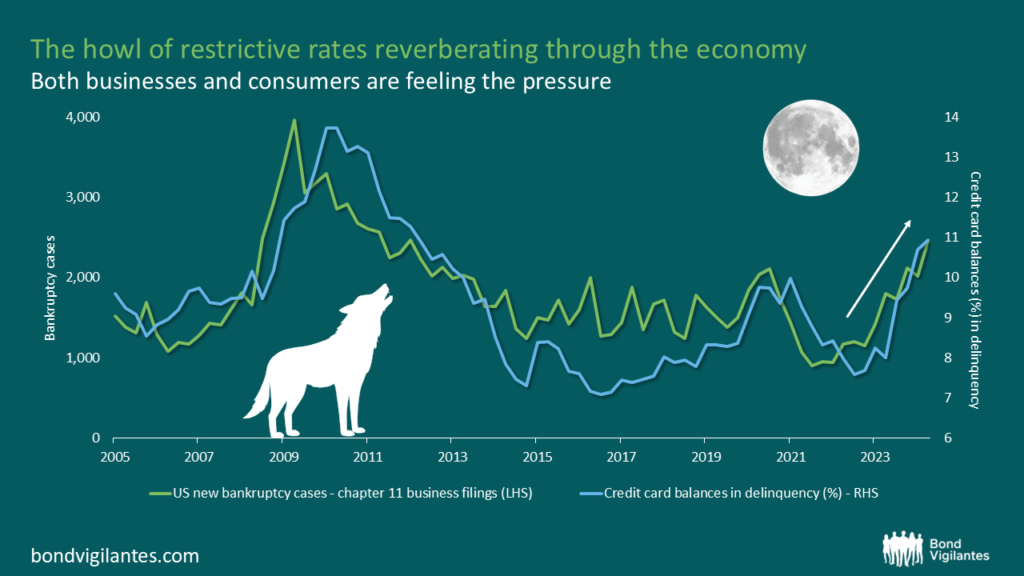

- The howl of restrictive charges reverberating by the financial system

Financial coverage was restrictive for a very long time, and since it really works with a lag, its results are solely now changing into evident. Though central banks have begun easing, coverage stays extra restrictive than what could be deemed impartial, and that is impacting each companies and shoppers. Chapter 11 filings are rising steadily, whereas bank card delinquencies over 90 days are climbing to ranges final seen following the International Monetary Disaster. Till financial coverage considerably loosens, these developments could proceed to persist.

Whereas financial and monetary pressures mount, are all dangers being priced into credit score markets?

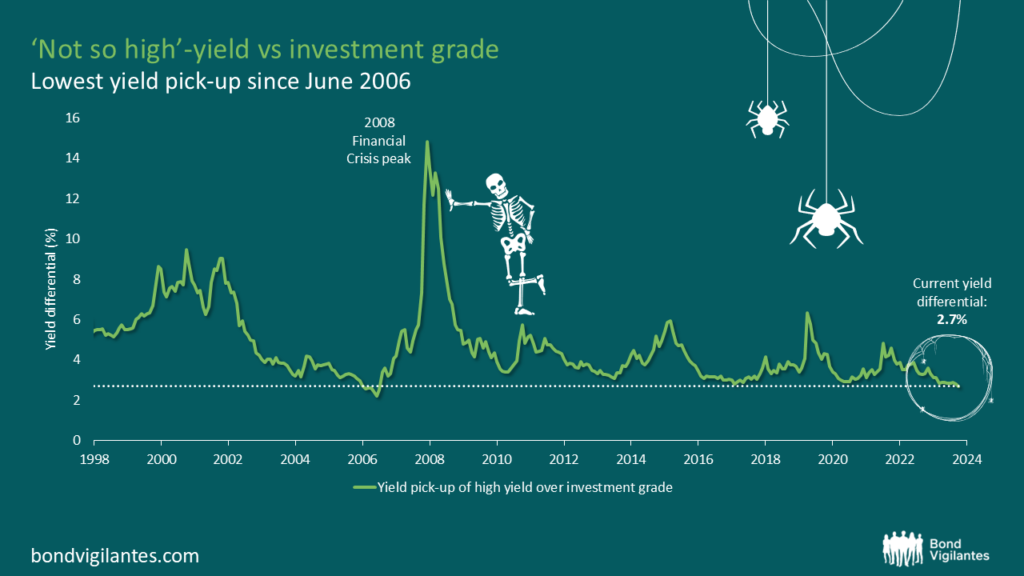

- ‘Not so excessive’-yield vs funding grade

Regardless of the unsettling warning indicators, credit score markets are pricing in minimal danger of a serious slowdown, not to mention a recession that might considerably affect credit score fundamentals. In truth, the unfold between funding grade and excessive yield bonds has narrowed to simply below 2.7% — the bottom degree since 2006. May traders be underestimating the potential for financial turbulence forward?

Past the bond markets, one other haunting problem brews within the type of rising authorities debt…

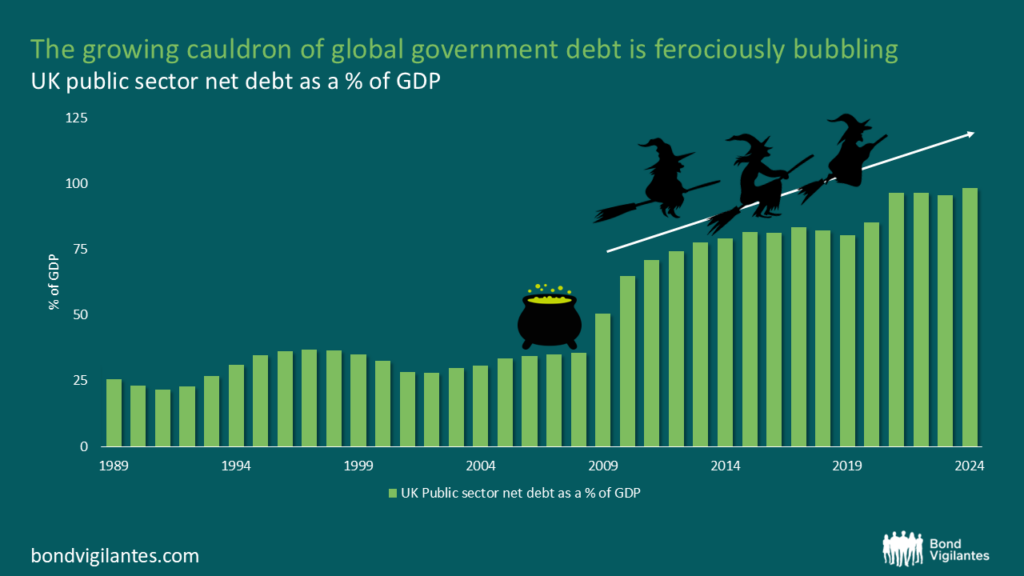

- The rising cauldron of world authorities debt is ferociously effervescent

It’s no shock that international authorities debt ranges have been steadily rising, but it surely’s price highlighting how regarding this development is. Within the UK, for instance, public sector internet debt as a share of GDP is alarmingly excessive. Excessive debt can affect progress by diverting authorities spending away from productive investments towards debt servicing. It might additionally drive central banks to think about fiscal dangers when elevating rates of interest, as aggressive hikes may destabilise public funds. With present debt ranges resembling these seen throughout recessions, will governments be capable to reply when the subsequent downturn hits?