- EUR/GBP stays pressured at two-year lows on hypothesis the ECB might slash rates of interest earlier than year-end.

- Decrease rates of interest would cut back international capital inflows, weighing on the Euro.

- The Pound holds its floor regardless of weak PMI knowledge and mildly dovish feedback from BoE Governor Bailey.

EUR/GBP trades at two-year lows within the 0.8320s on Thursday, having fallen 1 / 4 of a % on the day primarily attributable to a softer Euro (EUR). The Single Foreign money is falling on account of growing market hypothesis that the European Central Financial institution (ECB) must reduce rates of interest extra aggressively – and to a decrease base – than beforehand anticipated, to avert a tough touchdown for the Eurozone financial system.

The Pound Sterling (GBP), in the meantime, stays secure as a result of comparatively excessive 5.00% financial institution fee of the Financial institution of England (BoE) which now stands out as one of many highest within the G10, and acts as a magnet to capital. As well as, the BoE just isn’t anticipated to chop rates of interest on the identical tempo as most different main central banks, suggesting this might favor the Pound into the tip of 2024.

EUR/GBP declines as markets revise outlook for Eurozone

EUR/GBP is dropping floor on Thursday and lies at multi-year lows because the Euro weakens in opposition to the Pound Sterling.

The catalyst for this weak spot stems from a shock drop in Eurozone financial knowledge, specifically inflation. Headline inflation within the Euro Space was revised all the way down to 1.7% in September from its 1.8% preliminary estimate, and fell beneath the ECB’s 2.0% goal for the primary time in over three years, in keeping with latest knowledge from Eurostat. The shock fall offered the catalyst for hypothesis the financial institution would possibly want to chop rates of interest extra aggressively than beforehand anticipated.

A Reuter’s story on Wednesday added gasoline to the hearth after it reported that the ECB was contemplating reducing rates of interest to beneath the “impartial” fee. The impartial fee, also referred to as the “equilibrium degree” of rates of interest, is a theoretical degree at which inflation ought to stay unchanged. The story added to hypothesis the ECB was sharpening its sword and led buyers to promote the Euro.

EUR/GBP Day by day Chart

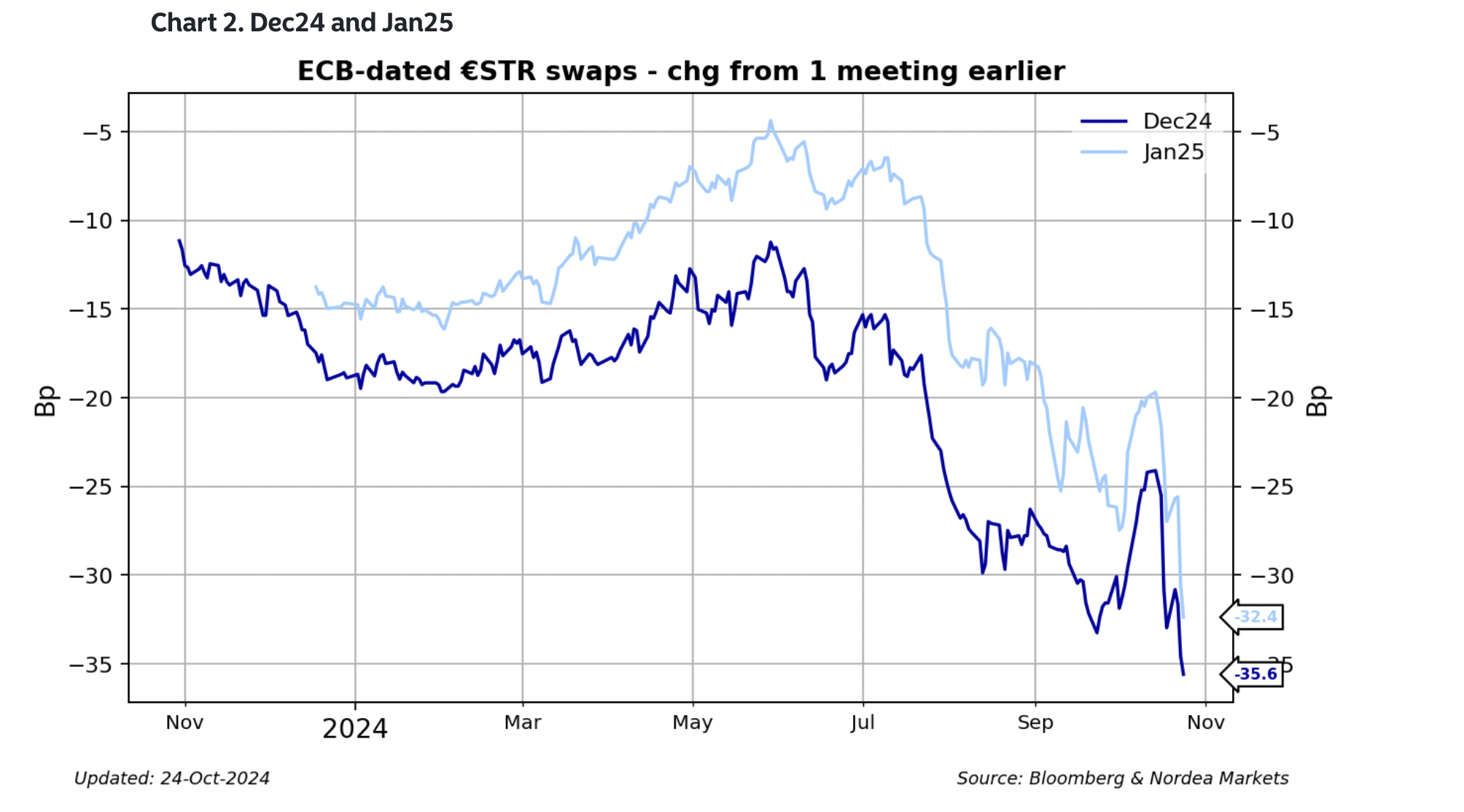

“Charges are falling considerably as markets are pricing the next chance of the ECB going for a 50 bps fee reduce in December,” mentioned Andres Larsson, Senior FX Analyst at Nordea Financial institution, including, “..and the next chance of the ECB ultimately reducing charges to beneath impartial,”

Based on Larsson, the market is pricing in “-35.6bp for the December ECB assembly and -32.4bp for the ECB assembly on 25 January.” That is considerably larger than just a few weeks in the past.

Eurozone knowledge out on Thursday didn’t quell hypothesis. Combined preliminary October PMIs revealed Manufacturing exercise rising however nonetheless in contraction territory (beneath 50) at 45.9 vs. 45.1 anticipated. The Providers PMI dipped to 51.2 vs. 51.5 anticipated and 51.4 in September.

“Immediately’s PMIs have been kind of according to expectations, though the employment part dropped beneath 50, pointing to the danger of rising unemployment forward,” mentioned Larsson.

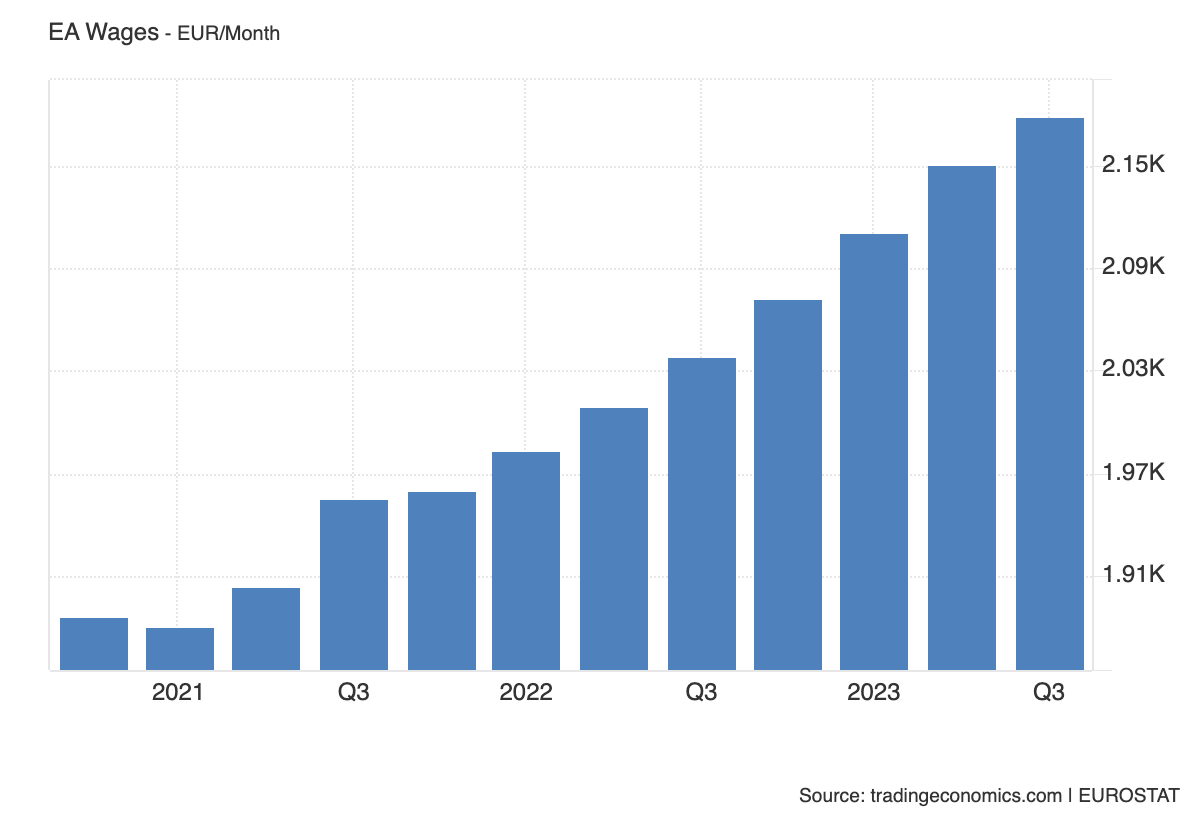

Employment and wages may very well be a key figuring out issue for whether or not the ECB decides to go for a “Christmas slasher” or not.

The ECB’s Chief Economist Philip Lane has mentioned that wage inflation is more likely to keep elevated within the second half of 2024 and contribute to larger broad inflation in the course of the interval earlier than falling in 2025.

Based on Q2 Wage Development knowledge, Eurozone wages rose 4.5% which, although decrease than the 5.2% within the earlier quarter, remained excessive. There’s nonetheless no knowledge for Q3, nonetheless, however the Eurozone Common Month-to-month Wage continues to rise fairly strongly, reaching EUR 2,180 in September.

EUR/GBP at historic lows as Pound stands agency regardless of weak knowledge

Sterling, in the meantime, stays agency regardless of weaker-than-expected UK PMI knowledge for October. This confirmed Manufacturing PMI falling to 50.3 vs. 51.5 anticipated and precise in September, and Providers PMI at 51.8 vs. 52.4 anticipated and precise in September. The info might restrict beneficial properties for the EUR/GBP pair.

“The weak PMI print together with the sharp slowdown in inflation elevate the chance the BoE dials up its easing cycle, which might additional curtail GBP upside momentum on the crosses,” mentioned Elias Haddad, Senior Markets Strategist at Brown Brothers Harriman (BBH).

The Consortium of British Business (CBI) October distributive trades survey was additionally softer than anticipated. CBI Complete orders got here in at -27 vs. -28 anticipated whereas promoting costs got here in at 0 vs. 9 anticipated and eight in September. “Most significantly, its quarterly measure of enterprise optimism got here in at -24 vs. -5 anticipated and -9 in July and is the bottom since October 2022,” mentioned Haddad.

In a latest speech, BoE Governor Andrew Bailey struck a mildly dovish chord after saying that “disinflation is going on I feel quicker than we anticipated it to, however now we have nonetheless real query marks about whether or not there have been some structural modifications within the financial system.”

On the identical time Bailey didn’t reiterate the necessity for a extra “activist” and “aggressive” stance on reducing rates of interest as he had accomplished in a earlier speech. Markets took the view that this meant Bailey acknowledged he had overstepped the mark within the earlier feedback and that he was making an attempt to steer the ship again to a extra “cautious” method. As such, Sterling held its floor.