You might wonder why you, despite being relatively young and not overweight, are struggling with fatty liver disease. How can you reverse it? The answer might lie in something that most of us overlook – our lifestyle habits, particularly sitting for extended periods.

Sitting for 8 Hours Increases Fatty Liver Risk by 44%

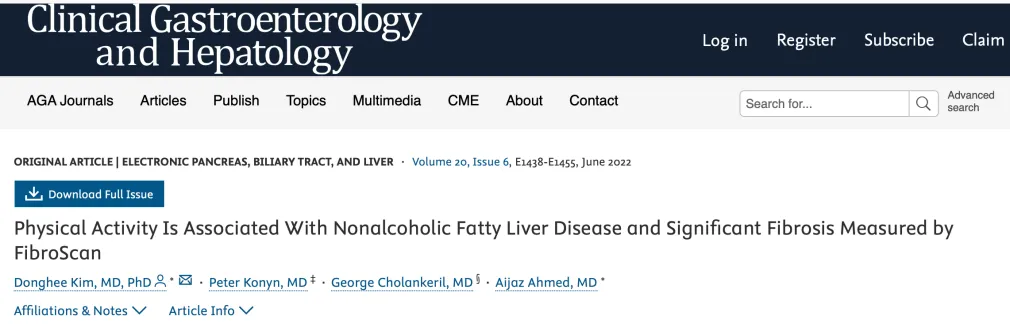

Many people today are “sitters” by default. Whether it’s at work, during commutes, or while relaxing at home, we spend hours sitting. The result? Back pain, fatigue, and of course, the sneaky effects on our organs. One of the most significant risks tied to prolonged sitting is an increased likelihood of fatty liver. A study published in Clinical Gastroenterology and Hepatology in 2021 with over 5,000 participants found that sitting for more than 8 hours a day raised the risk of non-alcoholic fatty liver disease (NAFLD) by 44%.

Conversely, regular physical activity can reverse this damage. Research shows that engaging in at least 150 minutes of moderate-intensity exercise per week or 75 minutes of vigorous activity can reduce the risk of fatty liver by 44%. The longer you exercise, the more you lower your chances of developing this condition.

Research screenshots

Why Sitting Affects Your Liver

Why does sitting affect your liver so much? It all boils down to calorie surplus, abdominal fat, and lack of movement. When you sit for long periods, your body struggles to process fat. Your muscle mass decreases, especially in your limbs. You may not notice weight gain overall, but with a bigger belly and thinner limbs, you’ve got the perfect setup for fatty liver.

Exercise: Even Without Weight Loss, Fatty Liver Improves

Even if weight loss isn’t happening, regular exercise can still help improve fatty liver. A 2023 study published in the American Journal of Gastroenterology found that people who exercised regularly were 3.5 times more likely to see improvements in liver fat reduction (≥30%) than those who didn’t exercise, even without significant weight loss. To put it into perspective, achieving this goal requires 150 minutes of brisk walking or cycling every week.

Nighttime Exercise: A Game-Changer for Fatty Liver

A 2024 study in Pineal Research Journal discovered that both morning and evening exercise reduce liver inflammation. But nighttime workouts appear to have a stronger effect on improving metabolic function related to fatty liver disease. In this study, mice fed a high-fat, high-cholesterol diet were split into three groups: a sedentary control group, a daytime exercise group, and an evening exercise group. The evening exercisers had the best results in reducing liver fat accumulation, alongside a reduction in weight gain compared to their counterparts.

Interestingly, evening exercise might even improve gut microbiota composition, which could play a role in improving fatty liver. While it’s beneficial to get moving at any time of day, there’s something special about exercising in the evening when it comes to liver health.

Three Tips for Nighttime Exercise

- Wait at Least Two Hours After Eating

Nighttime workouts should ideally finish two hours before bedtime. A study published in European Journal of Applied Physiology suggested that exercising right before bed doesn’t disturb sleep quality as long as you leave a two-hour gap between exercise and sleep.

- Leave a One-Hour Gap After Dinner

The timing between your last meal and exercise depends on factors like the meal size, your age, and fitness levels. If you’ve had a large, protein-rich meal, wait at least one hour before exercising. Smaller meals, especially those higher in carbs, may only require a 30-minute to one-hour gap.

- Focus on Aerobic Exercises

Aerobic exercise, like Tai Chi, jogging, or even dancing, can enhance heart and lung endurance, increase energy expenditure, and promote relaxation before bed. Aim for a heart rate of 120-140 beats per minute. Post-exercise, your metabolism remains elevated, and body temperature rises, which continues to help you sleep better. As your body cools down after exercise, melatonin levels increase, helping you fall into a deep sleep more easily.

In addition to exercise, remember that a healthy diet is just as important when it comes to fighting fatty liver disease.