Investor Insights

Flynn Gold’s massive, high-grade gold footprint in Tasmania offers a compelling investor proposition that leverages a unbroken gold bull market.

Overview

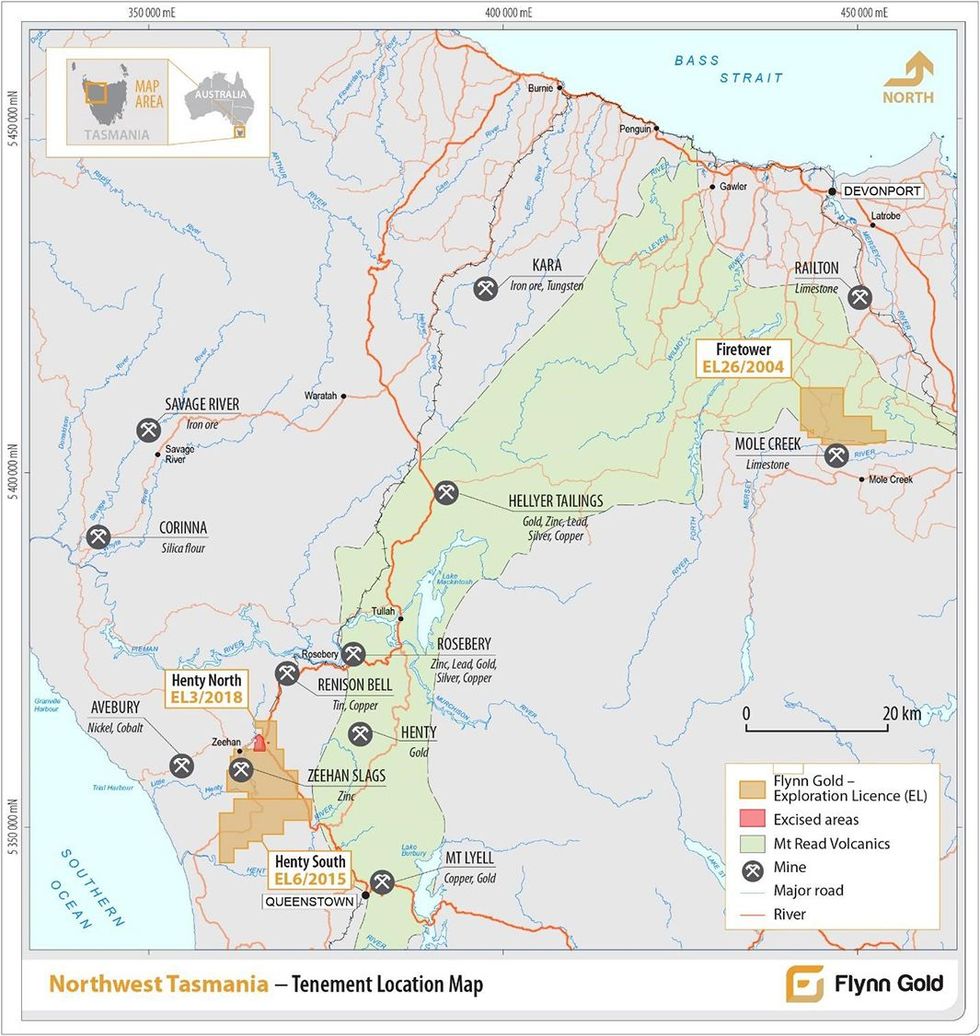

Flynn Gold (ASX:FG1) is an Australian mineral exploration firm with a portfolio of tasks in Tasmania and Western Australia.

Tasmania is dwelling to a number of world-renowned deposits and is wealthy in numerous mineral sources and working mines. The area has established mining districts, glorious infrastructure corresponding to rail and ports, and a talented workforce, with a steady political and regulatory atmosphere. These options are an enormous optimistic for the corporate’s tasks on this area.

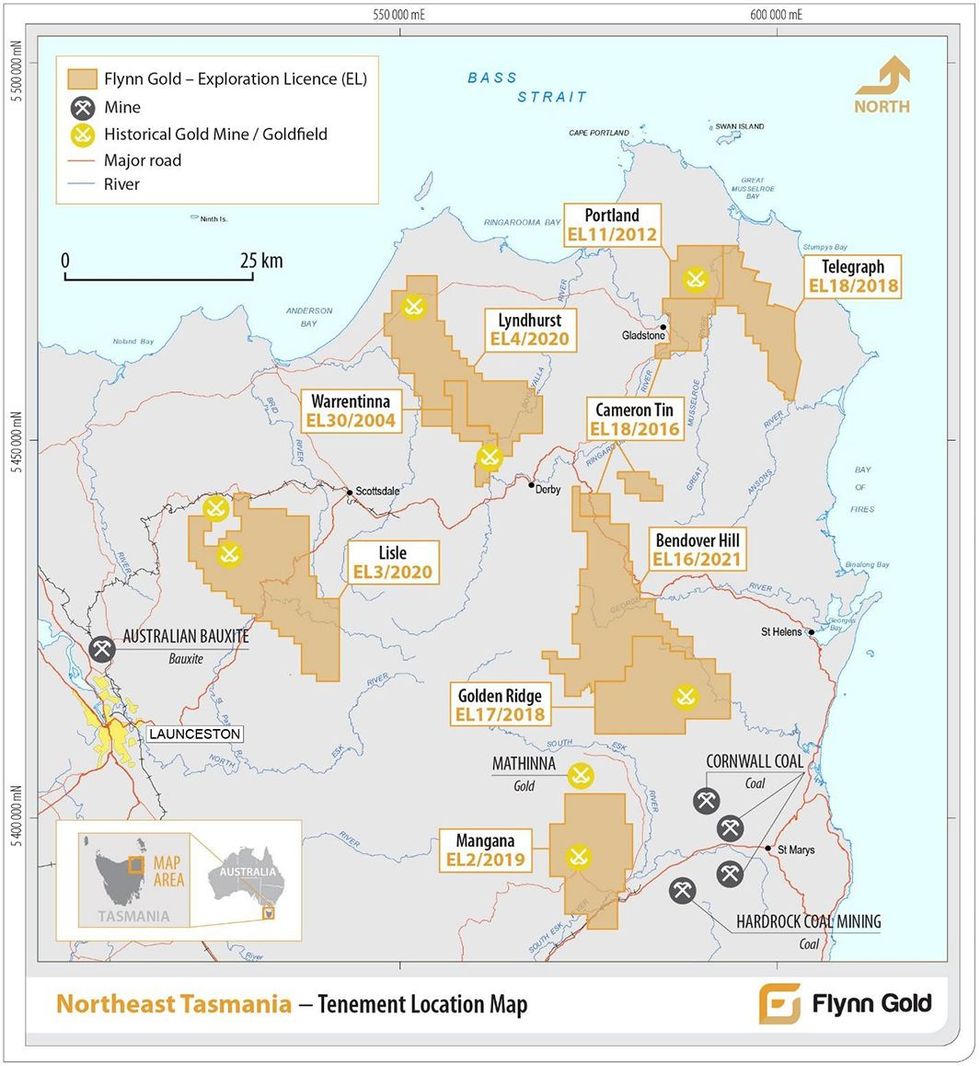

The corporate has 9 100% owned tenements in Northeast Tasmania that are extremely potential for gold and tin/tungsten with three main tasks — Golden Ridge, Portland and Warrentinna. In Northwest Tasmania, it has the Henty zinc-lead-silver and the Firetower gold and crucial minerals tasks.

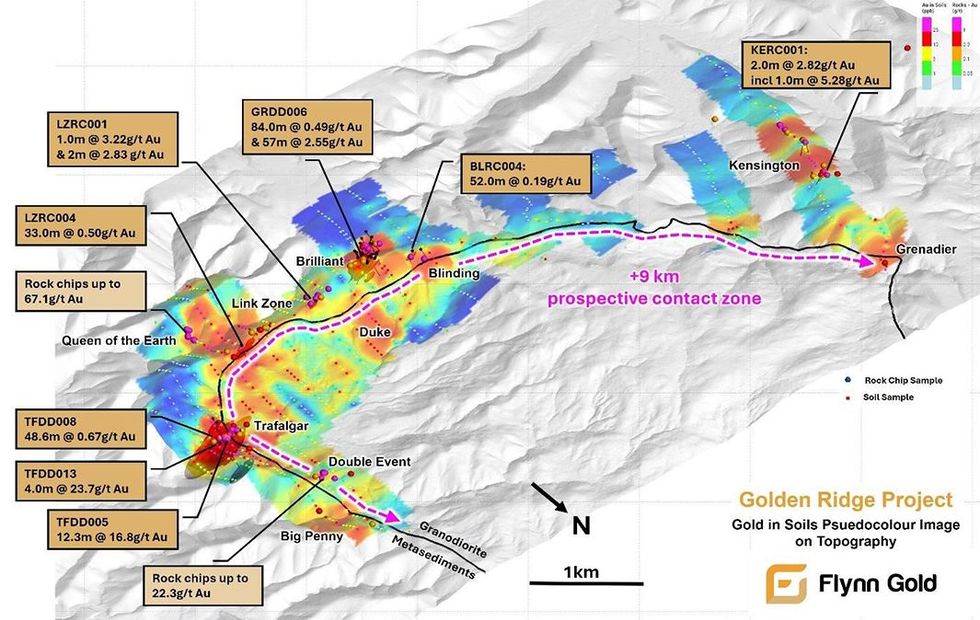

Flynn Gold’s exploration at its Golden Ridge venture has targeted on an 9-kilometre-long granodiorite-metasediment contact zone with diamond drilling packages accomplished on the Sensible and Trafalgar prospects, with a number of high-grade gold vein intersections.

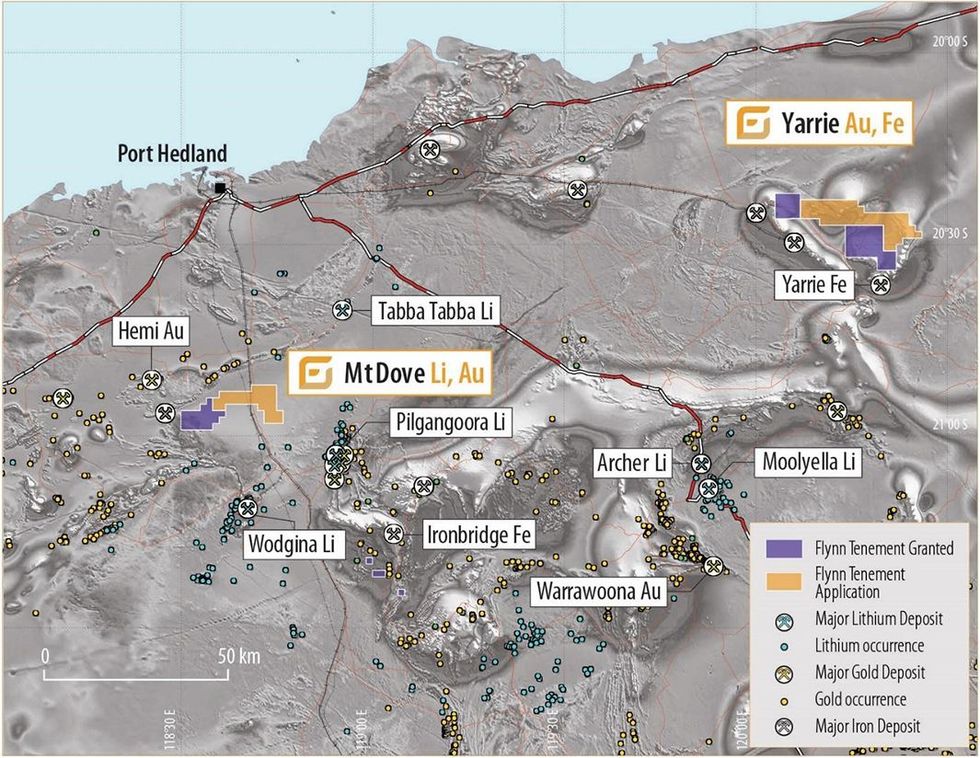

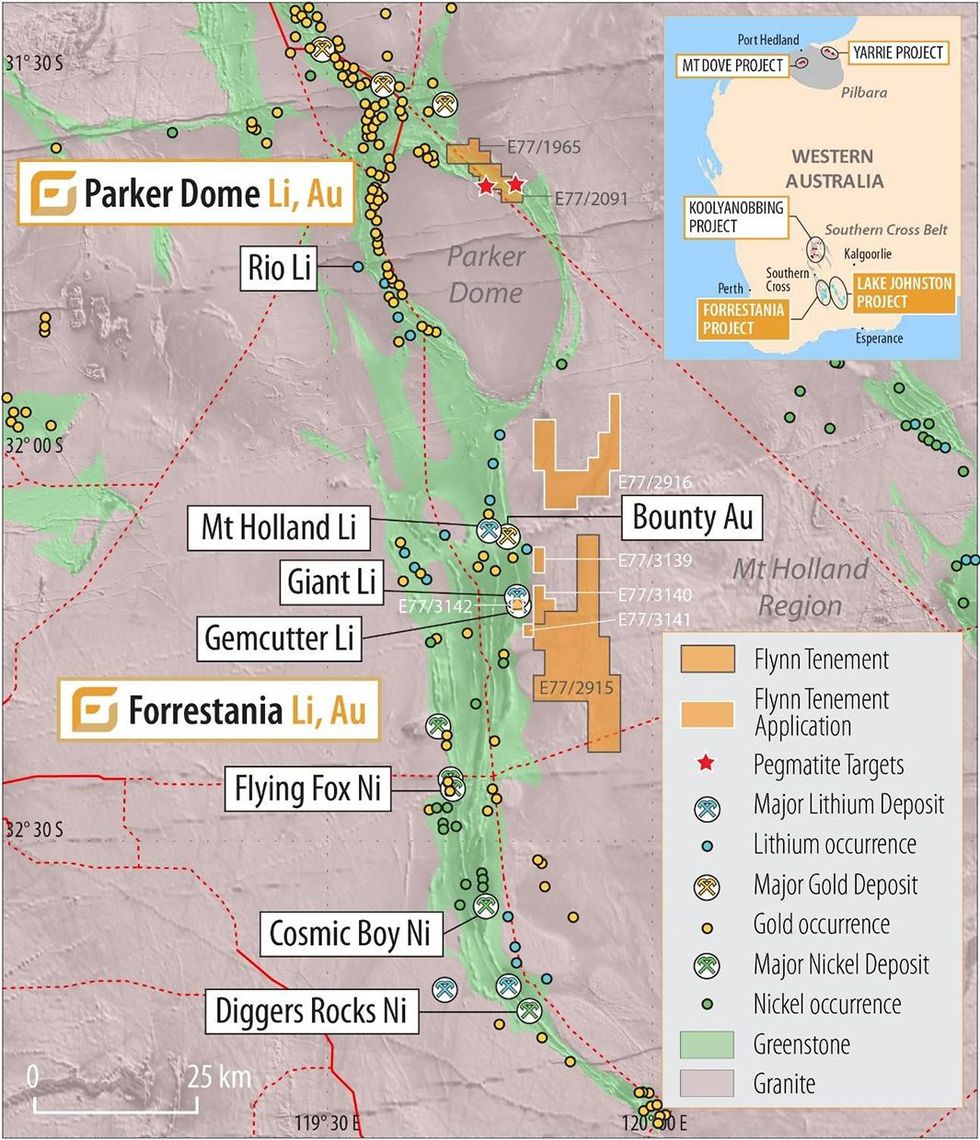

Other than Tasmania, the corporate is constructing a strategic lithium and gold portfolio in Western Australia, concentrating on hard-rock lithium pegmatites and intrusive associated gold deposits within the Pilbara area and Yilgarn Craton. Its 5 lithium-gold tasks in Western Australia are strategically positioned in districts internet hosting massive gold and lithium deposits or in areas which can be comparatively under-explored for lithium. Of those, three lithium-gold tasks are within the Yilgarn area: Forrestania, Lake Johnston and Koolyanobbing. The remaining two are within the Pilbara area: Mt Dove and Yarrie.

Firm Highlights

- Flynn Gold is an Australian mineral exploration firm with a portfolio of gold and battery metals tasks in Tasmania and Western Australia.

- In Tasmania, the corporate holds 12 tenements unfold throughout 1,403 sq km, together with three principal tasks in Northeast Tasmania — Golden Ridge, Warrentinna and Portland — which can be potential for gold and tin. Furthermore, it has two tasks in Northwest Tasmania: the Henty zinc-lead-silver venture and the Firetower gold-cobalt-tungsten-copper venture.

- Flynn Gold is concentrated on advancing exploration and drilling at three high-grade gold tasks in Tasmania – Golden Ridge, Warrentinna and Firetower.

- In Western Australia, Flynn holds 20 tenements throughout 1,200 sq km, together with lithium-gold tasks within the Pilbara and Yilgarn areas. The Yilgarn area has three lithium-gold tasks: Forrestania; Lake Johnston and Koolyanobbing. The Pilbara hosts two gold-lithium tasks: Mt Dove and Yarrie.

- The corporate’s senior management crew has a confirmed observe document within the mining sector to capitalize on the excessive useful resource potential of its tasks.

Key Tasks

Northeast Tasmania

The corporate is concentrated on three high-grade gold tasks in Tasmania — Golden Ridge, Warrentinna and Firetower. The under-explored Northeast Tasmania area is interpreted to be a part of the Western Lachlan Orogen, a geological extension of the wealthy Victorian Goldfields which boast of historic gold manufacturing of over 80 million ounces (Moz). The corporate’s landholding throughout 9 100% owned tenements within the area has offered it with vital potential for gold and tin discoveries.

Golden Ridge Challenge

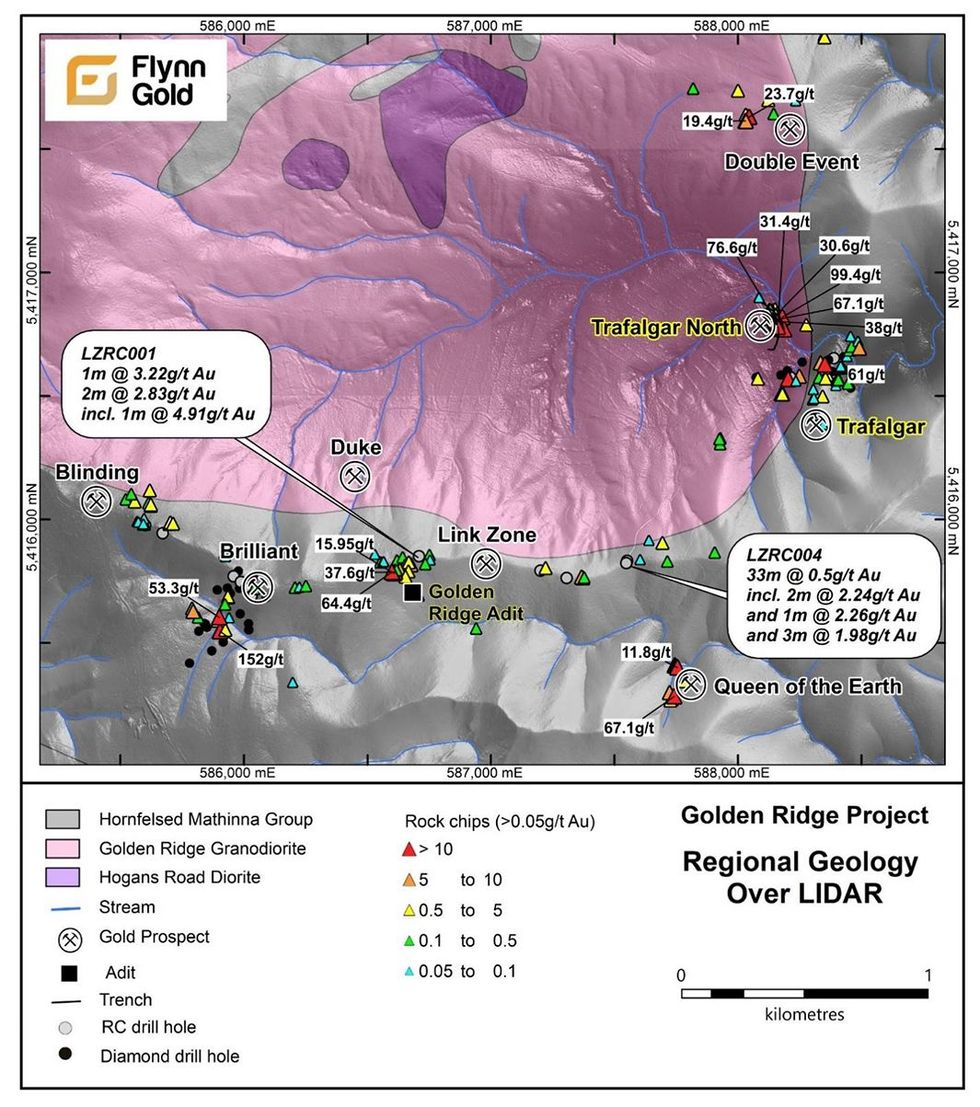

Focused for intrusive associated gold system (IRGS) fashion mineralization, the Golden Ridge venture is positioned 75 kilometres east of Launceston in Northeast Tasmania. Earlier gold exploration on the Golden Ridge Challenge has been very restricted with shallow historic workings positioned over an 9-kilometre-long granodiorite-metasediment contact zone. Flynn Gold’s exploration has targeted on the Sensible and Trafalgar prospects, with diamond drilling packages accomplished at each areas between June 2021 and August 2023. As well as, a restricted reconnaissance RC drilling program in late 2022 to check for gold mineralisation on the Hyperlink Zone confirmed the presence of shallow gold mineralisation between the Sensible and Trafalgar prospects, highlighting the numerous gold potential of the granodiorite-metasediment contact zone.

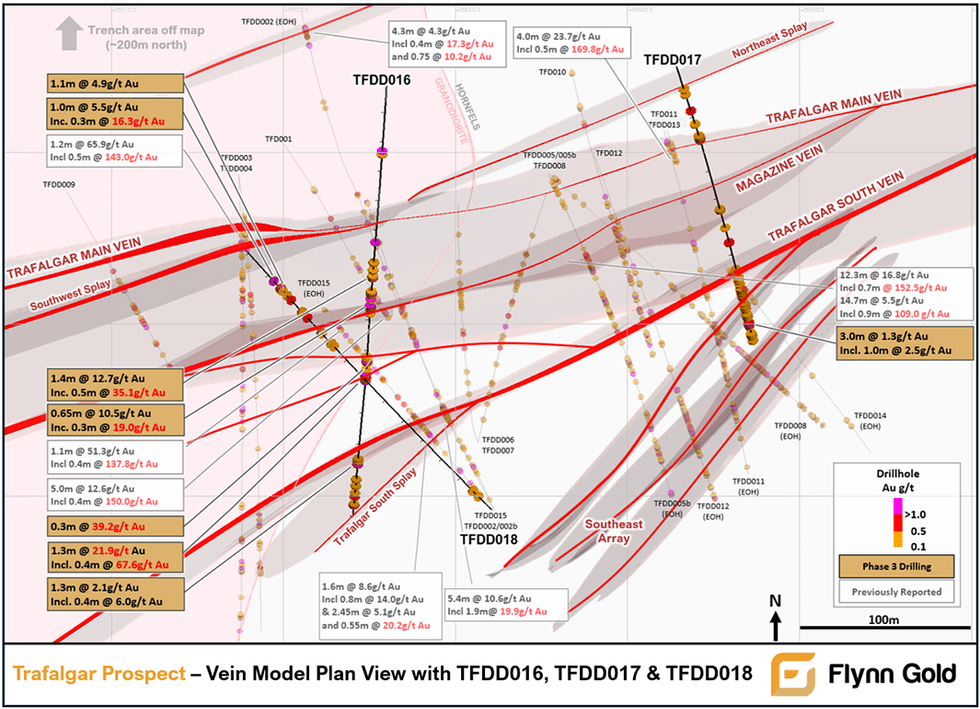

Drilling at Trafalgar consisted of 14 holes for five,218.3 metres with a number of vein intersections grading >100 grams per ton (g/t) gold reported. The very best intersections recorded in drilling at Trafalgar have been 16.8 g/t gold over 12.3 metres (from 108.7 to 121 metres), together with 0.7m at 152.5 g/t gold and 23.7 g/t gold over 4 metres (from 23 to 27 metres), together with a high-grade zone of 0.5 metre at 169.8 g/t gold.

Soil sampling on the Golden Ridge venture has been progressively undertaken since an preliminary sampling trial utilizing the UltraFine+ method was initiated in Might 2022. The results of this soil sampling have highlighted the recognized prospect areas, in addition to a number of new goal areas at Grenadier and Large Penny, with gold anomalism not related to historic workings.

Part 3 drilling has commenced on the Trafalgar high-grade gold prospect confirming the continuity of a number of sub-parallel high-grade gold veins.

New high-grade gold discoveries have additionally been made on the Hyperlink Zone and Trafalgar North prospects.

On the Hyperlink Zone, mapping and vein sampling throughout the historic Golden Ridge adit has recognized a big new zone of high-grade gold mineralisation with underground seize sampling of mineralised veins within the adit recorded high-grade gold assays together with 64.4 g/t gold, 37.6 g/t gold and 15.9 g/t gold.

At Trafalgar North, a high-grade gold vein zone has been found in trenching 250 m north of the historic Trafalgar mine with 17 out of 36 seize rock chip samples assayed over 10 g/t gold, together with 99.4 g/t gold, 76.6 g/t gold and 67.1 g/t gold. Drilling at Trafalgar North commenced in July 2024.

Warrentinna Challenge

The Warrentinna venture was acquired in 2023 from Greatland Gold plc (LSE:GGP). The venture is positioned in northeast Tasmania and covers an space of roughly 37 sq km instantly adjoining to Flynn’s present Lyndhurst Challenge. The tenement encompasses two historic goldfields, Forester and Warrentinna. Each fields produced high-grade gold deposits within the late 1800s and early 1900s. The Warrentinna goldfield is outlined by quite a few historic workings and largely untested prospects over a strike size of 6 kilometres.

Preliminary drilling by Flynn in September/October 2023 at Warrentinna consisted of two diamond drill holes, designed to check the continuity and extension of orogenic fashion gold mineralisation recognized in historic drilling. The holes are additionally designed to offer stratigraphic and structural data crucial to advancing understanding of the venture.

Portland Challenge

The Portland gold venture contains three adjoining tenements: Portland, Telegraph and Cameron Tin. The venture falls throughout the area mined traditionally from 1870 to 1917 and is similar to Victorian geology with high-grade “Fosterville-style” gold mineralization confirmed. Geochemical surveys and costean sampling packages at Portland confirmed the presence of anomalous gold zones. Drilling on the Grand Flaneur prospect in 2022 and the Popes prospect in 2023 have each confirmed the presence of gold mineralization.

Northwest Tasmania

The corporate has two tasks within the Northwest Tasmania area: the Firetower venture and the Henty zinc venture.

Firetower Challenge

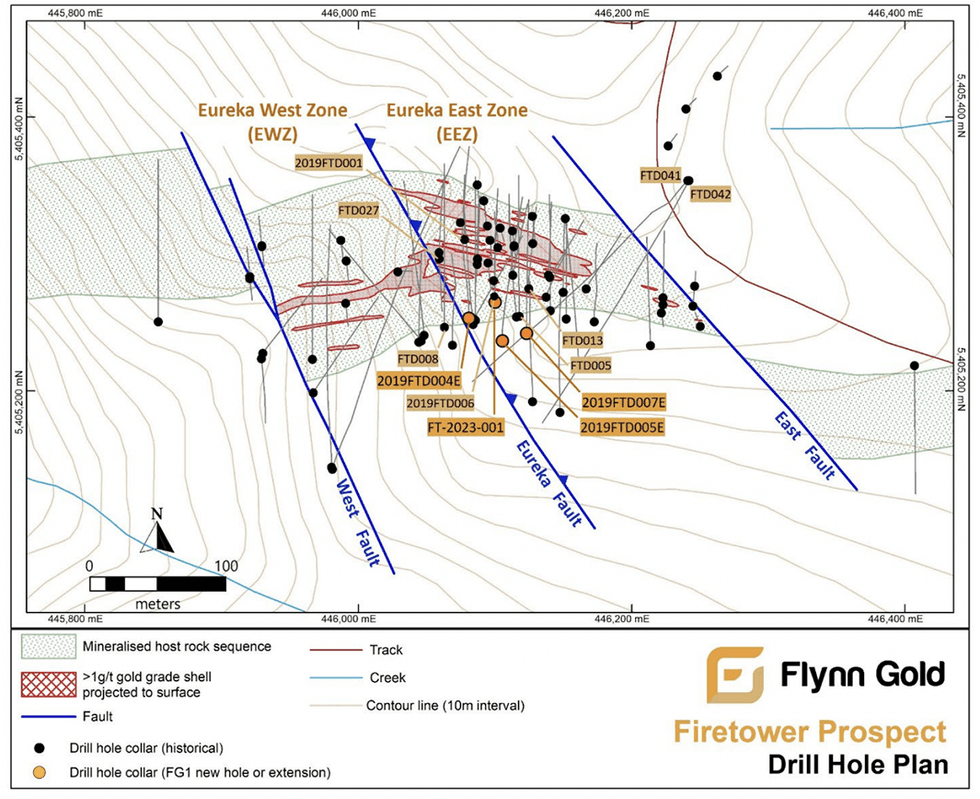

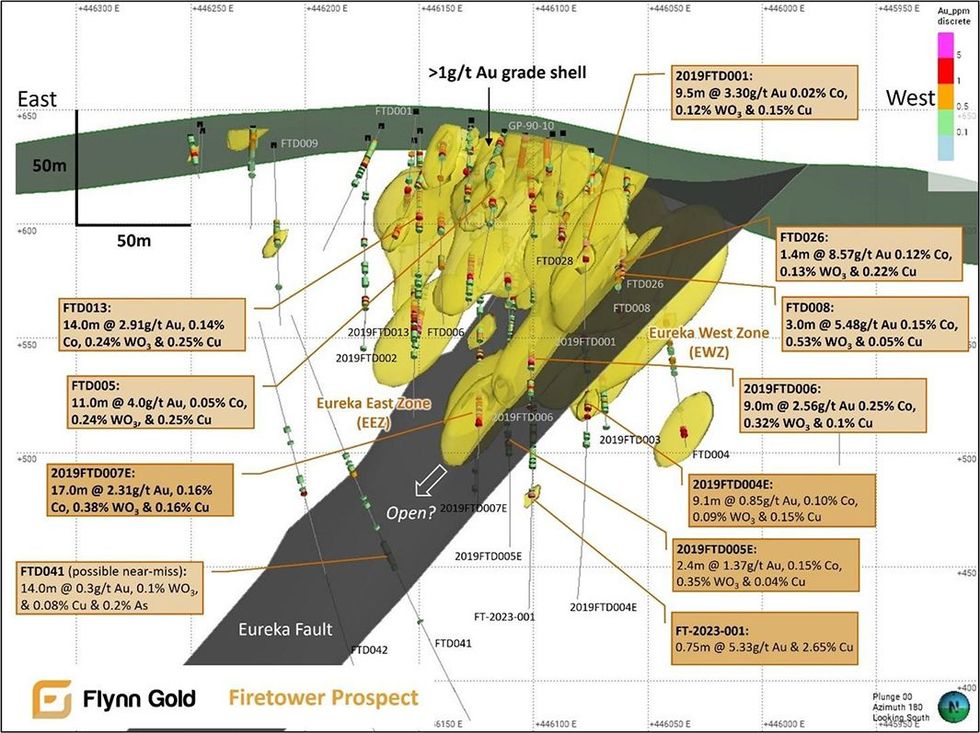

The venture was acquired in 2023 from Greatland Gold plc (LSE:GGP). The venture spans greater than 62 sq kms and represents a complicated gold plus battery metals venture, which incorporates three notable prospects: Firetower, Firetower East and Firetower West. The Firetower venture lies within the extremely mineralized Mt Learn volcanic sequence which hosts main polymetallic base metals and gold deposits corresponding to Hellyer and Rosebery, copper-gold deposits corresponding to Mt Lyell (3 million tons contained copper, 3.1 Moz contained gold), and the Henty gold mine (1.64 Moz gold @ 12.5 g/t gold).

Resampling of the historic core at Firetower has confirmed the numerous potential for gold and important minerals – cobalt, tungsten and copper. The outcomes have made it clear this venture represents an thrilling polymetallic alternative. The corporate accomplished a diamond drilling program in late 2023 to focus on each the gold and polymetallic minerals potential.

The drilling program was profitable in testing for depth extensions of the principle mineralised zone with the outcomes demonstrating the continuity of polymetallic mineralisation and highlighting the numerous potential for high-grade mineralisation to proceed at depth and alongside strike.

Henty Zinc Challenge

The venture is a 130 sq. km land holding below two 100% owned exploration licences and offers the corporate with a dominant place in a wealthy base metals discipline with proximity to an present zinc/lead focus producer (MMG’s Rosebery mine).

The Henty Challenge has a big pipeline of exploration targets with the Mariposa and Grieves Siding prospects prepared for useful resource drilling

Western Australia

Flynn holds 5 gold-lithium tasks within the resources-rich state of Western Australia, strategically positioned close to massive gold and lithium deposits or in areas which can be comparatively under-explored for lithium.

The 5 tasks embrace: Mt. Dove and Yarrie within the Pilbara area; and Koolyanobbing, Forrestania and Lake Johnston within the Yilgarn.

Mt Dove Challenge

Positioned 70 kilometres south of Port Hedland within the Pilbara area, Mt Dove contains 4 granted licences and one tenement utility masking 190 sq. kms. The venture is positioned close to the massive Hemi gold deposit (De Gray Mining, ASX:DEG) and the massive lithium mines at Pilgangoora and Wodgina. The corporate has accomplished two soil sampling packages at Mt Dove, which have recognized lithium and gold anomalies. The follow-up exploration, which is prone to embrace aircore drilling, intends to check lithium and gold anomalies recognized through the soil sampling program accomplished in 2022 and 2023.

Yarrie Challenge

The Yarrie Challenge contains two tenements and one utility masking 385 sq. kms. Very restricted historic exploration has been undertaken for lithium, gold and copper on the venture. The venture is very potential for iron ore, being near historic mining operations and present rail infrastructure.

Forrestania Challenge

The Forrestania venture consists of 1 exploration licence and 5 exploration licence purposes over a 320 sq km space. It’s positioned close to the Mt Holland lithium deposit (Wesfarmers (ASX:WES)/ SQM (NYSE:SQM) JV) and the high-grade nickel deposit at Flying Fox (IGO Restricted (ASX:IGO)).

Outcomes from the corporate’s auger soil sampling program, accomplished on E77/2915, outlined 4 high-priority lithium anomalies of as much as 4,200 metres in size and 500 metres in width.

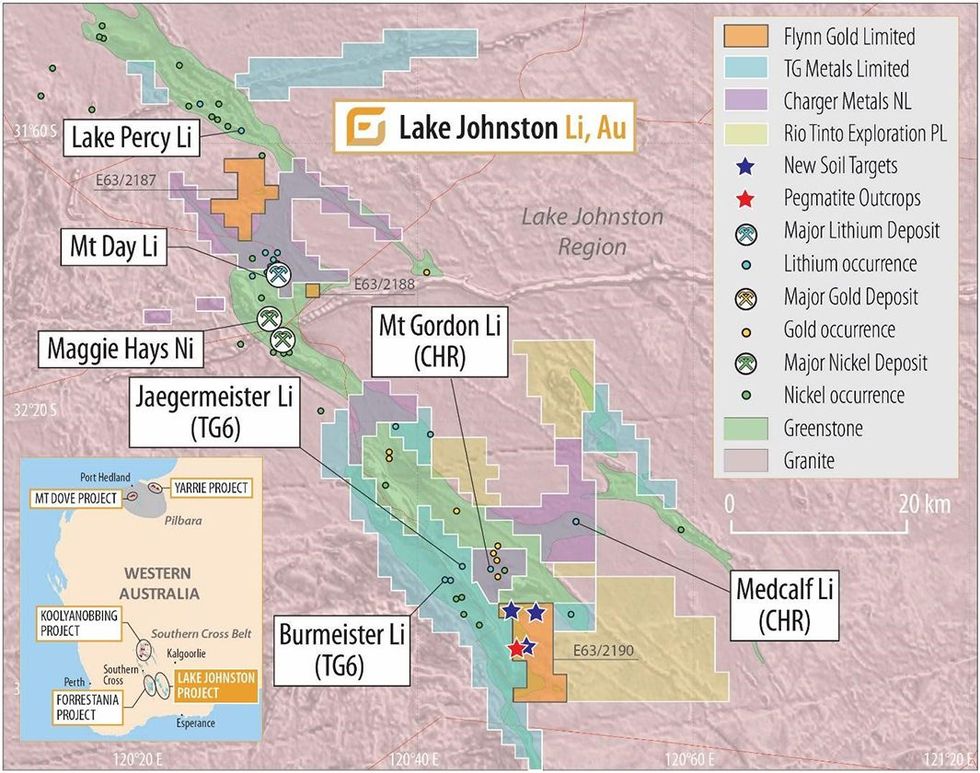

Lake Johnston Challenge

Lake Johnston consists of three exploration licences over a 110 sq. km space, and is positioned close to the latest Burmeister and Jaegermeister lithium discoveries of TG Metals (ASX:TG6)) and the Medcalf, Mount Gordon, Lake Percy and Mt Day Lithium tasks.

Koolyanobbing Challenge

Koolyanobbing contains one exploration licence and two purposes concentrating on gold and lithium mineralization over an 82 sq. km. space within the Marda-Diemals greenstone belt.

Parker Dome Challenge

Along with the above-mentioned tasks, Flynn has secured an choice settlement to buy two exploration licences on the Parker Dome venture in Western Australia, which is taken into account extremely potential for lithium. The Parker Dome venture covers 42 sq. kms. and is located 50 kilometres north of the world-class Mount Holland lithium venture in Western Australia.

Outcomes from soil sampling have recognized a number of, large-scale, high-priority lithium anomalies. The licences are absolutely permitted permitting for a direct graduation of drilling.

Administration Workforce

Clive Duncan – Non-executive Chair

Clive Duncan has over 4 many years of expertise at large field {hardware} chain Bunnings, together with as chief working officer and firm director. He has wealthy expertise in company and enterprise growth, together with mergers and acquisitions, enterprise integrations, company authorities, technique growth and advertising and marketing. He has accomplished post-graduate research at Harvard College and London Enterprise College and is a member of the Australian Institute of Firm Administrators. He’s a long-term vital shareholder of Flynn Gold’s predecessor corporations.

Neil Marston – Chief Government Officer and Managing Director

Neil Marston was appointed managing director in Might 2023 and has been the corporate CEO since August 2022. He has greater than 30 years of expertise within the mining and minerals exploration sector and is a confirmed ASX-listed firm chief, with a powerful governance and company finance background. Beforehand, he held a number of senior roles together with managing director at Bryah Assets (ASX:BYH) and Horseshoe Metals (ASX:HOR).

Sam Garrett – Technical Director

Sam Garrett has greater than 30 years of exploration administration, venture evaluation and operational expertise with multinational and junior mining and exploration corporations, together with Phelps Dodge and Cyprus Gold. He has a background in copper and gold exploration with sturdy publicity to iron ore, base metals and specialist commodities. He’s related to discoveries at Mt Elliott (copper), Havieron (copper-gold), and Tujuh Bukit (gold). Furthermore, he co-founded Flynn Gold and its predecessor Pacific Developments Assets.

John Forwood – Non-executive Director

John Forwood is a director and chief funding officer of Lowell Assets Funds Administration (LRFM). He’s certified as a lawyer and geologist and has greater than 20 years of sources financing expertise, together with with ASX-listed Lowell Assets Belief (ASX:LRT), as a director of RMB Assets, and as supervisor of Telluride Funding Belief.