Adéntrate en el Mercado Navideño / Un Viaje a Través del Tiempo

Cuando piensas en mercados navideños, quizás imaginas el aroma del vino caliente, la calidez de las casitas de jengibre y paisajes nevados del norte o centro de Europa. Pero en Cataluña, España, encontrarás sol, calor y un espectáculo medieval. El bullicio te recordará a las ferias del Año Lunar, aunque aquí la gente carga turrón español en vez de coplas festivas.

En Vic, cerca de Barcelona, se revive un drama medieval anual durante el mercado navideño. Los vendedores se visten como herreros, tejedores y taberneros, manteniendo su personaje y usando lenguaje de la época.

“¡Señorita, esta bufanda artesanal cuesta solo 3 monedas de oro!” Espera… ¿puedo pagar en euros?

Los puestos imitan estilos medievales con madera y tela, decorados con artesanías manuales. Los vendedores presentan productos con técnicas antiguas, transportándote en el tiempo.

Come y Bebe / Cuanto Más Comes, Más Feliz Eres

Postres

Los postres son estrellas de estos mercados. En Cataluña, los churros con chocolate caliente (Churros con Chocolate) son imprescindibles. El chocolate es denso y sedoso, aromatizado con canela, piel de naranja o vainilla.

Los churros se fríen hasta dorarse, espolvoreados con azúcar glass. Versiones creativas llevan relleno de chocolate, crema o pasta de pistacho, bañados en chocolate y decorados con nueces o perlitas.

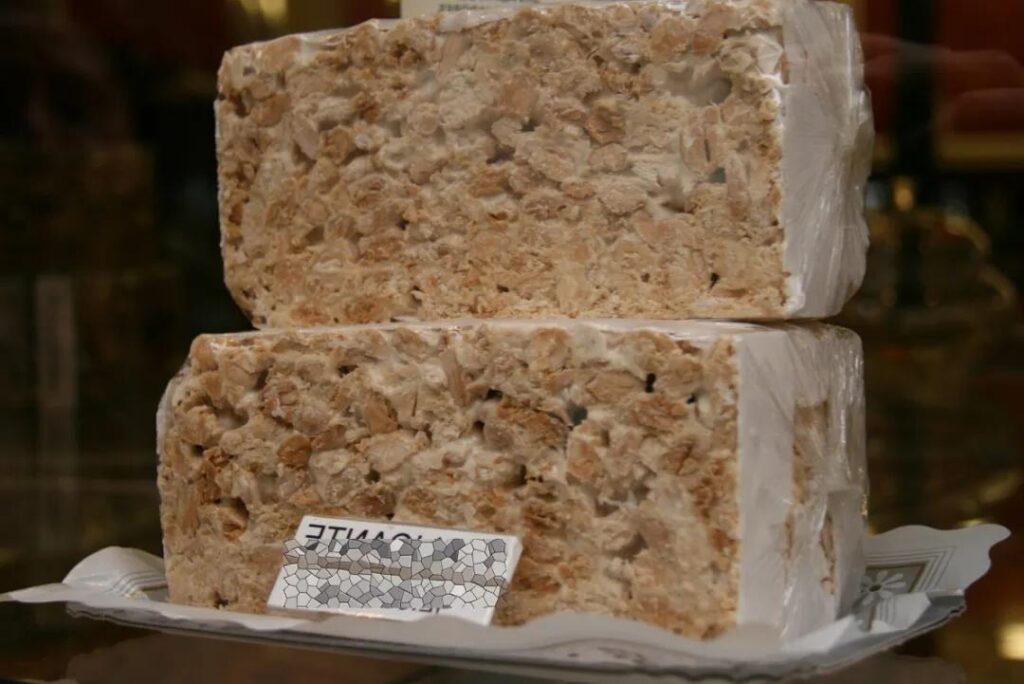

Otra estrella es el Turrón, dulce tradicional de almendras, miel y clara de huevo. Existe en versiones dura y blanda, cada una con textura única.

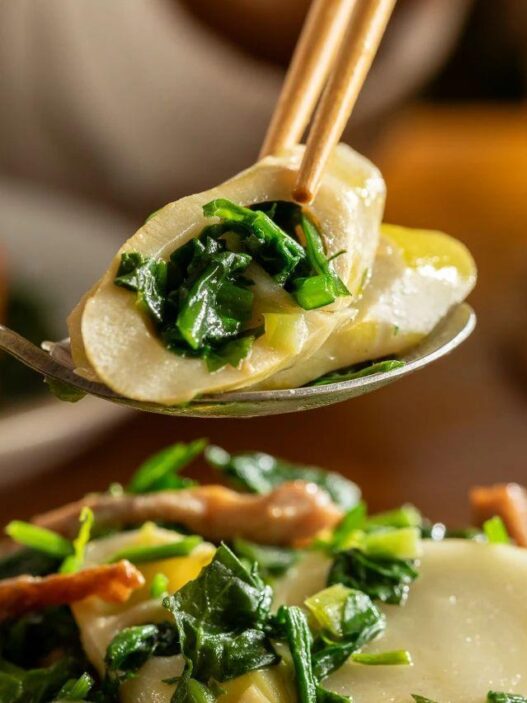

Calçots a la Brasa

Los calçots asados son una delicia única. Estos vegetales entre cebolla y puerro se carbonizan para revelar su interior dulce. Se acompañan con salsa Romesco de pimientos rojos, tomate, ajo y almendras.

La primera vez que vi filas para calçots, me recordó a los puestos de cebollas verdes en Shandong. Ahí entendí el encanto universal de las cebollas.

Conservas

Las conservas son básicas en mercados catalanes. España es pionera en tecnología de enlatado.

Anchoas en salazón (Anchoas en Salazón) se conservan en aceite de oliva, ofreciendo sabor salado y delicado. Aceitunas marinadas (Aceitunas Marinadas) son jugosas con hierbas, chili y cáscara de limón.

Estos sabores preservan la esencia del Mediterráneo, y suelen acompañarse con queso y pan para degustación.

Embutidos

Los embutidos son otro protagonista. El fuet y la longaniza son populares. El fuet resalta aromas naturales, mientras la longaniza tiene especias intensas. Los vendedores suelen cortarlos al momento para probar.

Bebidas

En vez de vino caliente, Cataluña ofrece hidromiel (Hidromiel) y sangría (Sangría). La hidromiel de miel fermentada es dulce y ácida. La sangría mezcla vino tinto, zumo de naranja y frutas: refrescante pero engañosamente fuerte.

Más que Comida / Cuando lo Medieval Encuentra lo Moderno

El Caganer y el Caga Tió

Tradiciones navideñas catalanas incluyen al Caganer (hombre defecando) y el Caga Tió (tronco que “caga” dulces). El Caganer simboliza fertilidad, mientras el Caga Tió “regala” caramelos tras ser golpeado.

Diversión Interactiva y Espectáculos

Más allá de comida, hay actividades como tiro con arco o alfarería. Los niños pueden tejer adornos o hacer velas.

Espectáculos callejeros añaden energía. Incluso podrías unirte a un “ensayo” de boda medieval.

Conclusión

Los mercados navideños catalanes son una aventura mágica. Desde el hilarante Caganer hasta los conmovedores calçots, desde la hidromiel encantadora hasta la vibrante sangría: esto no es solo un mercado, es un festín para tus sentidos y alma.