KEY

TAKEAWAYS

- Homebuilders are preparing for a possible comeback in 2025.

- Many homebuilder shares are exhibiting tepid-to-poor technical power.

- When the homebuilding business flips to the upside, there are undervalued names that would provide early funding alternatives.

Homebuyers are nonetheless on the sidelines, ready for higher mortgage charges, whereas homebuilders are gearing up for a doubtlessly robust 2025. Regardless of mortgage charges hitting two-year lows, consumers are holding again, anticipating charges and costs to drop additional.

This is the massive query: Are we seeing the underside of a downward cycle about to show up? In different phrases, are we seeing the early levels of an uptrend in homebuilders? And if that’s the case, which homebuilding inventory would possibly you wish to add to your ChartLists?

Let’s begin by analyzing the homebuilders utilizing SPDR S&P Homebuilders ETF (XHB) as a proxy. Check out the weekly chart.

FIGURE 1. WEEKLY CHART OF XHB. Notice how XHB has been reacting to the 50-week exponential transferring common envelope.Chart supply: StockCharts.com. For instructional functions.

Since XHB crossed above the 50-week exponential transferring common envelope (EMA envelope) in early 2023, be aware the ETF’s bullish response, bouncing inside vary of the channel’s uptrend. You may also use the EMA envelope channel to gauge the power of the uptrend (the additional away it’s towards the upside, the stronger the pattern).

The large query: Can XHB maintain using its present uptrend? The ETF has bounced off the 50-week EMA envelope thrice previously two years, hinting at a attainable pattern continuation.

However not all of XHB’s holdings are pure homebuilders—corporations like House Depot and Lowe’s are within the combine too. Meaning you may want to choose your shares properly. So, let’s decide essentially the most liquid and recognizable homebuilder shares and examine their technical power by taking a look at their StockChartsTechnicalRank (SCTR) scores.

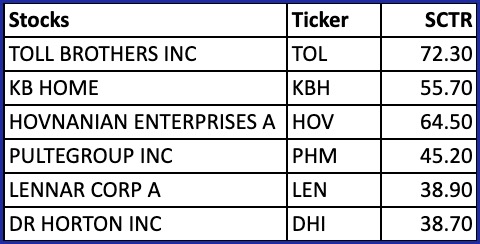

Homebuilding Shares Ranked by SCTR

The next desk lists the six most well-known shares within the XHB fund and their corresponding SCTR rating.

What would possibly this appear like on a year-to-date foundation by way of market efficiency? To get a perspective on this, check out every inventory utilizing PerfCharts:

FIGURE 2. PERFCHARTS YEAR-TO-DATE VIEW OF ALL STOX STOCKS’ MARKET PERFORMANCE. Notice that TOL, KBH, and PHM outperformed XHB.Chart supply: StockCharts.com. For instructional functions.

12 months-to-date, TOL, XBH, and PHM had been the highest performers, however, since TOL’s SCTR rating was considerably greater, maybe it is best to zero in on TOL, letting the opposite ones go for the second. Nonetheless, add all six to your ChartLists in anticipation of a broad homebuilder restoration. As soon as the business turns upward, their SCTRs will possible present adjustments which may make a few of them extra appropriate for a “lengthy” alternative.

We’ll start with a long-term view of TOL’s weekly chart.

TOL: Three 12 months Look-Again

Much like XHB, however maybe much more so, TOL is exhibiting a transparent uptrend that’s gaining robust traction. Notice the pin bar this final week, signaling robust rejection from the weekly session lows.

FIGURE 3. WEEKLY CHART OF TOL. There is a clear uptrend within the weekly worth motion and the inventory is outperforming XHB.Chart supply: StockCharts.com. For instructional functions.

Above the chart, you possibly can see TOL’s relative efficiency in opposition to XHB. how far the road has risen above the zero degree, you possibly can see that TOL is outperforming its homebuilding friends by over 68%. Let’s shift to a day by day chart.

TOL’s Every day Worth Motion

FIGURE 4. DAILY CHART OF TOL. The Raff Regression Line greatest captures TOL’s cyclical motion inside an uptrend.Chart supply: StockCharts.com. For instructional functions.

For TOL, you would possibly think about plotting a Raff Regression Line for the next causes:

- It identifies the pattern course.

- It captures TOL’s large cyclical motion whereas projecting a variety of potential help and resistance.

- It plots a transparent channel to determine breaks and reversals.

With the regression line offering a transparent image of TOL’s pattern, it is best to make use of the On Stability Quantity (OBV) to see the extent to which momentum helps (or diverges from) the worth motion. Within the instance above, shopping for strain aligns with TOL’s continued uptrend (see magenta line).

When you plan to go lengthy, the most effective shopping for alternative inside the Raff Regression Channel sometimes happens close to the decrease boundary (which attests to its current bounce), as this space typically serves as dynamic help and displays potential worth bounces. For threat administration, putting a cease loss just under the decrease boundary or beneath the newest swing low might be your greatest wager. This ensures safety in case the worth closes beneath the channel, which may point out a break in help and a possible pattern reversal.

On the Shut

Homebuilders are gearing up for a rebound regardless of homebuyers standing on the sidelines. If the business begins exhibiting inexperienced shoots of capital inflows (keep watch over XHB to observe this), it’d current a possibility to get in early on a doubtlessly robust uptrend. However, till then, maintain a number of homebuilding shares in your ChartLists and monitor them commonly. For now, TOL is exhibiting appreciable power, however, as soon as the business’s tide rises, it’s going to take the strongest shares up with it, so be prepared.

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled.

Karl Montevirgen is knowledgeable freelance author who makes a speciality of finance, crypto markets, content material technique, and the humanities. Karl works with a number of organizations within the equities, futures, bodily metals, and blockchain industries. He holds FINRA Collection 3 and Collection 34 licenses along with a twin MFA in crucial research/writing and music composition from the California Institute of the Arts.

Be taught Extra