Investor Perception

EMU NL is an Australia-focused base and treasured metals exploration firm providing a compelling alternative within the extremely profitable copper area. A strategic give attention to delineating a possible large-scale copper porphyry system at its Fiery Creek copper deposit in Northern Queensland, mixed with a management workforce of serious world expertise and experience, and an upward trending copper market, all make EMU NL worthy of appreciable consideration for any buyers wanting on the copper sector.

Overview

EMU NL (ASX:EMU) is an ASX-listed treasured and base metals exploration firm with three initiatives in Queensland, Australia: Georgetown, Badja and Sunfire. EMU’s major focus is accelerating exploration on the extremely promising Fiery Creek prospect, positioned inside the Georgetown venture in Northern Queensland.

Australia is without doubt one of the most engaging areas for mining, in keeping with the Fraser Institute. It ranks Queensland because the 13th most engaging vacation spot for mining funding.

In 2023, Queensland’s mines yielded 12.6 tons of gold, positioning it as Australia’s fourth most prolific state for this treasured metallic. The corporate’s presence in comparatively engaging mining jurisdictions positions it to capitalize on alternatives in Australia’s useful resource sector and ship sustainable returns to its shareholders. The current fundraises of A$1.45 million have offered ample funding to advance its exploration initiatives.

Gold and copper proceed to reveal bullish developments. Varied components are driving the surge in copper costs, together with demand patterns resembling upgrades in utility grids, the growing use of copper in electrical automobiles, and housing building. Moreover, the rising power demand from information centres powering AI functions and servers contributes to the elevated want for copper. Each gold and copper costs have hit their all-time excessive in 2024, which additionally improve the prospects for junior miners to progress their initiatives and doubtlessly safe financing simply.

Key Tasks

Georgetown Undertaking

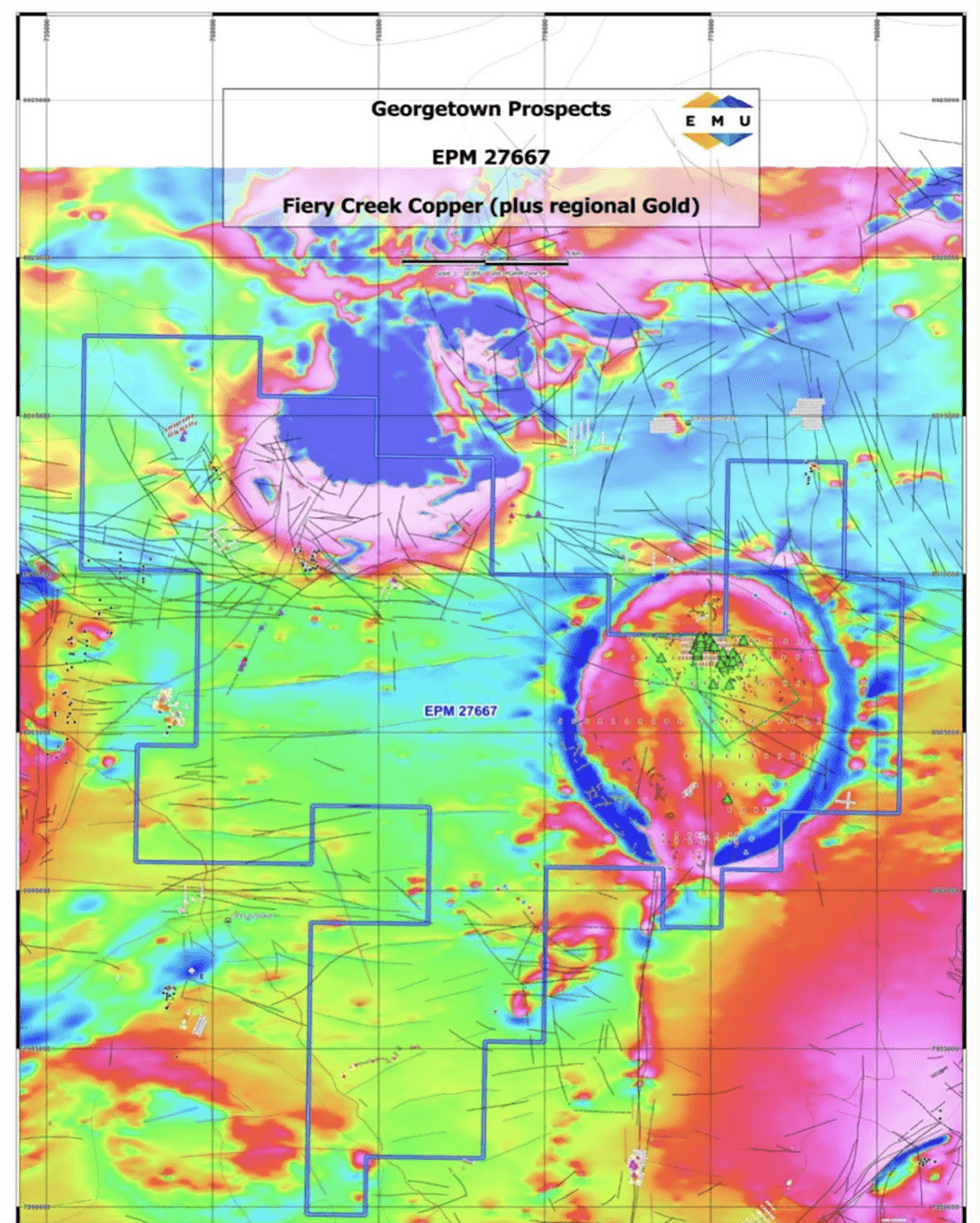

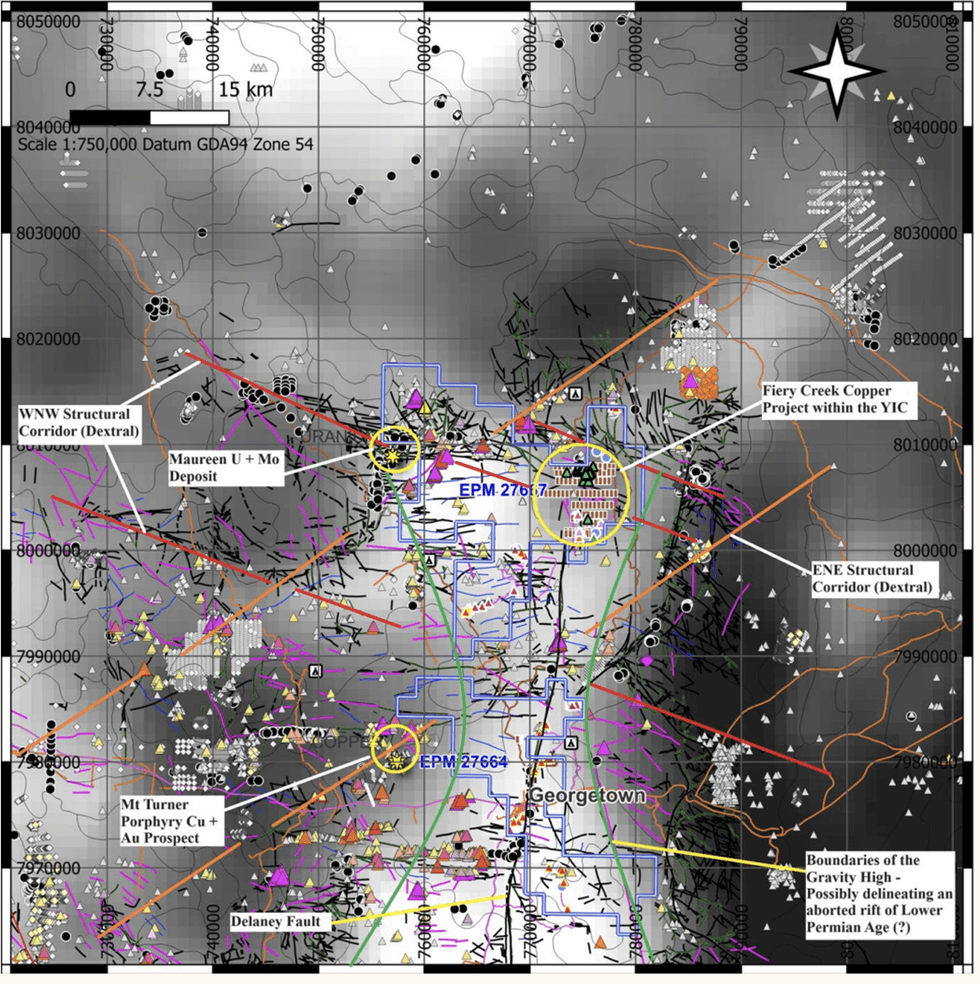

The Georgetown venture tenements span 850 sq. km. in North Queensland and includes three exploration permits: Georgetown, Perpendicular Peak and the Fiery Creek copper prospect. Of those, Fiery Creek is probably the most promising and the present exploration curiosity for EMU.

The Georgetown venture is positioned in a resource-rich but under-explored area in Queensland’s far north, located inside the Georgetown mining district, with a major historical past of mining actions and mineral discoveries.

EMU has recognized the Fiery Creek copper prospect as a doubtlessly massive-scale copper porphyry system inside the 29 sq. km. Yataga Igneous advanced. In the course of 2023, EMU’s reconnaissance efforts at Fiery Creek yielded quite a few cases of heightened copper and polymetallic values. EMU performed further sampling to additional assess the potential of the Fiery Creek prospect.

The work confirmed the numerous, large-scale potential of the Fiery Creek copper prospect. It recognized further high-priority targets inside the Yataga Granitoid advanced, revealing polymetallic rock chip values reaching as much as 0.27 elements per million (ppm) gold, 460 ppm silver, 1.9 p.c bismuth, 23.5 p.c copper, 43 ppm indium, 2.7 p.c lead, and 341 ppm antimony. Equally, values of 0.13 ppm gold, 44 ppm silver, 0.28 p.c bismuth, 13.5 p.c copper, 89 ppm indium, 1.62 p.c lead, and 667 ppm antimony had been recorded at Yataga South.

Preliminary fieldwork has offered robust indications of a possible large-scale copper porphyry system at Fiery Creek. EMU is planning additional geological mapping, systematic geochemistry and a geophysics survey to delineate the indicated porphyry system.

Badja Undertaking

The Badja venture is positioned 32 kilometres southeast of the township of Yalgoo and covers an space of 870 hectares. The venture’s tenements embody a centrally granted mining lease overlaying 7.3 hectares, an adjoining mining lease software overlaying 279.3 hectares, and a granted exploration license overlaying 590.3 hectares. EMU’s earlier drilling work has recognized areas which can be potential for high-grade gold, tungsten and lithium.

EMU is evaluating choices to maximise the worth of the venture, both by sale or retention.

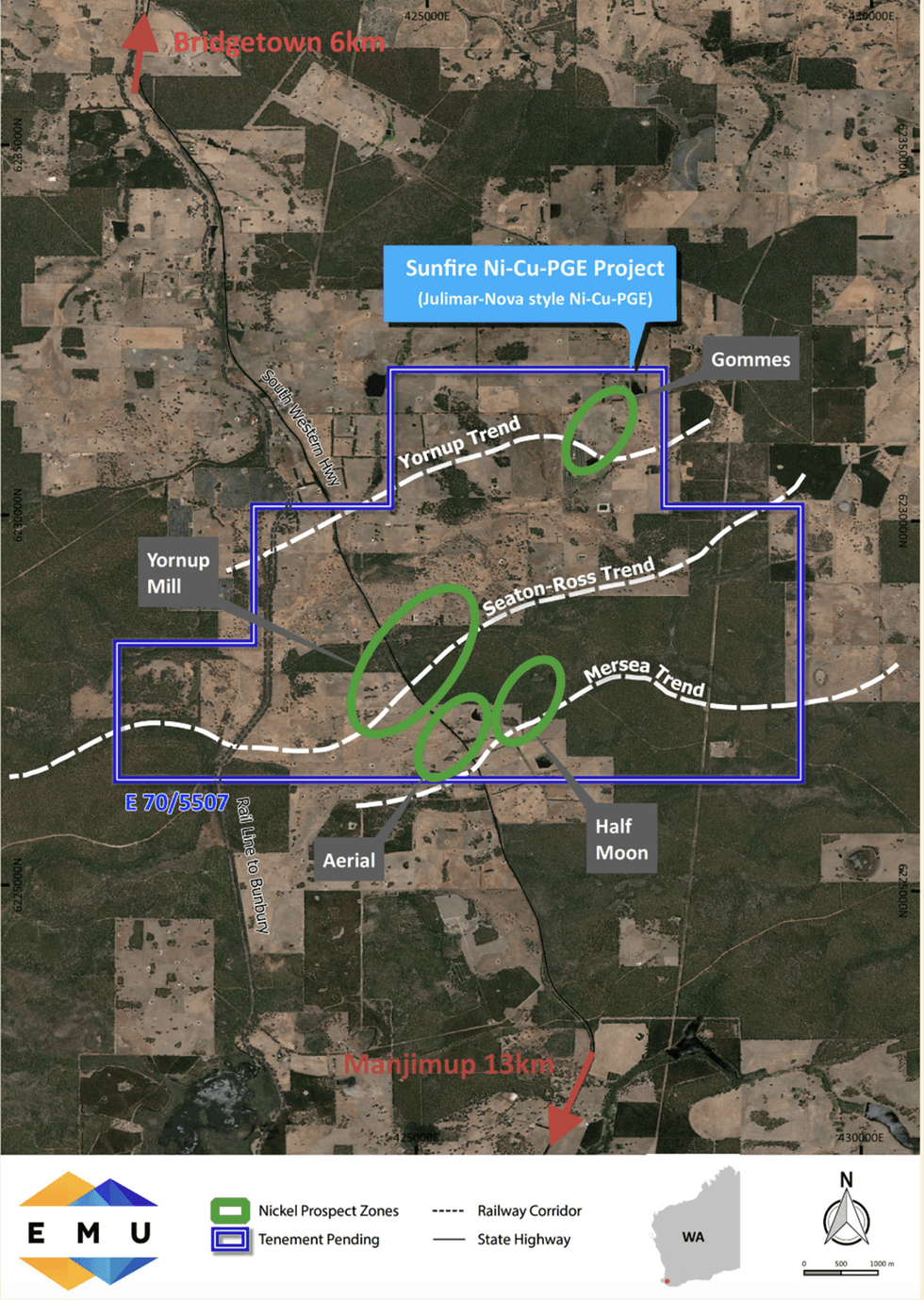

Sunfire Undertaking

Sunfire is a nickel, copper and PGE exploration venture in Western Australia. The venture is presently awaiting permission from the Western Australian authorities to permit drilling actions within the space inside the State forest. EMU has fulfilled all needed environmental necessities for accessing these areas inside the venture and initiated onsite exploration actions. Nevertheless, there was no important development to this point, and authorities departments haven’t indicated the probability of granting drilling consent.

Administration Workforce

Peter Thomas – Non-executive Chairman

Peter Thomas has over thirty years of expertise working a authorized observe specializing in giving recommendation to listed explorers and miners. He has served on the boards of assorted listed corporations, together with because the founding chairman of copper producer Sandfire Assets and mineral sands producer Picture Assets. His present ASX-listed firm board positions embody non-executive director of Picture Assets and non-executive chair of Center Island Assets.

Terry Streeter – Non-executive Director

Terry Streeter brings over 30 years of expertise within the exploration sector. He served as a director of West Australian nickel explorer and miner Jubilee Mines NL from 1993 to Might 2004. In 1999, he grew to become a founding shareholder of Western Areas NL (ASX:WSA), which later found and developed two high-grade nickel sulphide mines within the Forrestania area of Western Australia, producing 22,000 to 25,000 tons of nickel yearly. He has served in management roles at Fox Assets, Midas Assets, Minera IRL and Alto Metals.

Gavin Rutherford – Non-executive Director

Gavin Rutherford has amassed over 20 years of expertise within the mining providers, fabrication and contracting sectors. He served as managing director of a contracting and building firm within the water trade. His present endeavors contain venture growth within the renewable power sector, enterprise growth within the Indigenous mining section, and pursuits associated to aviation.

Tim Staermose – Non-executive Director

Tim Staermose boasts 23 years of experience in fairness capital markets and fairness analysis. His skilled journey consists of roles at worldwide sell-side fairness brokerage companies based mostly in South Korea and Hong Kong, notably Banque Indosuez (now a part of Credit score Agricole) within the late Nineteen Nineties and Lehman Brothers within the early 2000s. Transitioning from sell-side fairness analysis, Staermose has since operated as an unbiased researcher and stock-picker for a number of personal analysis companies, specializing in pure assets, gold and mining investments.