ASX: WESTPAC BANKING CORPORATION – WBC Elliott Elliott Wave Technical Evaluation TradingLounge.

Greetings, Our Elliott Wave evaluation at this time updates the Australian Inventory Trade (ASX) with WESTPAC BANKING CORPORATION – WBC. We see WBC.ASX might be rising with wave iii-grey of wave (v)-orange.

ASX: Westpac Banking Company – WBC 1D chart (semilog scale) evaluation

Perform: Main development (Minute diploma, inexperienced).

Mode: Motive.

Construction: Impulse.

Place: Wave iii-grey of Wave (v)-orange of Wave ((v))-navy.

Particulars: Wave iii-grey of wave (v)-orange is unfolding to push greater. Conversely, a push under 31.13 exhibits that wave (v)-orange will not be prepared but, as an alternative wave (iv)-orange is unfolding as a Triangle and wishes just a little extra time earlier than pushing greater.

Invalidation level: 31.13.

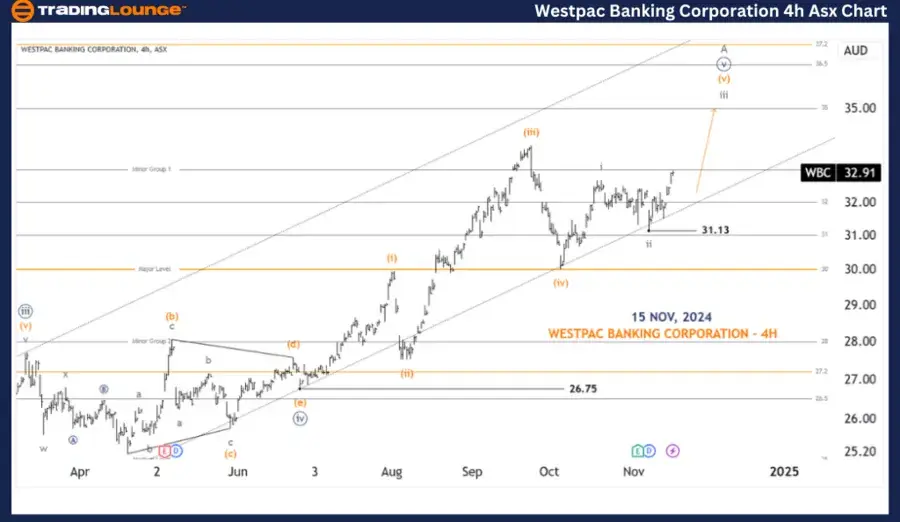

ASX: Westpac Banking Company – WBC four-hour chart evaluation

Perform: Main development (Minute diploma, navy).

Mode: Motive.

Construction: Impulse.

Place: Wave iii-grey of Wave (v)-orange of Wave ((v))-navy of Wave A-grey.

Particulars: Wave (iv)-orange might have ended, and wave (v)-orange is unfolding to push greater, it’s subdividing into waves i,ii,iii-grey. And wave iii-grey might proceed to push greater.

Invalidation level: 31.13.

Conclusion:

Our evaluation, forecast of contextual developments, and short-term outlook for ASX: WESTPAC BANKING CORPORATION – WBC purpose to supply readers with insights into the present market developments and tips on how to capitalize on them successfully. We provide particular worth factors that act as validation or invalidation alerts for our wave depend, enhancing the arrogance in our perspective. By combining these components, we try to supply readers essentially the most goal {and professional} perspective on market developments.

Technical analyst: Hua (Shane) Cuong, CEWA-M (Grasp’s Designation).

![WBC Elliott Wave evaluation and Elliott Wave forecast [Video] WBC Elliott Wave evaluation and Elliott Wave forecast [Video]](https://i0.wp.com/editorial.fxstreet.com/miscelaneous/p3-638672539633602364.webp?w=860&resize=860,0&ssl=1)