KEY

TAKEAWAYS

- Regardless of numerous turmoil, SPY continues to point out robust rotations on each weekly and day by day RRGs.

- Rising yields haven’t broken the inventory rally but.

- Inventory/Bond ratio stays strongly in favor of shares.

After the election, issues have hardly settled on the planet. New developments within the Ukraine-Russian battle and the Center East are nonetheless risky. Worst of all, I’m in Redmond, WA this week, the place final night time’s storm precipitated an enormous energy outage on this area.

For sure, producing digital content material is a problem for the time being 😉

However I discovered a small pocket the place issues appear to function decently, so I am going to give it a attempt.

When market circumstances turn into cloudy, I at all times prefer to step again and zoom out to see the large image.

Weekly Asset Class Rotation

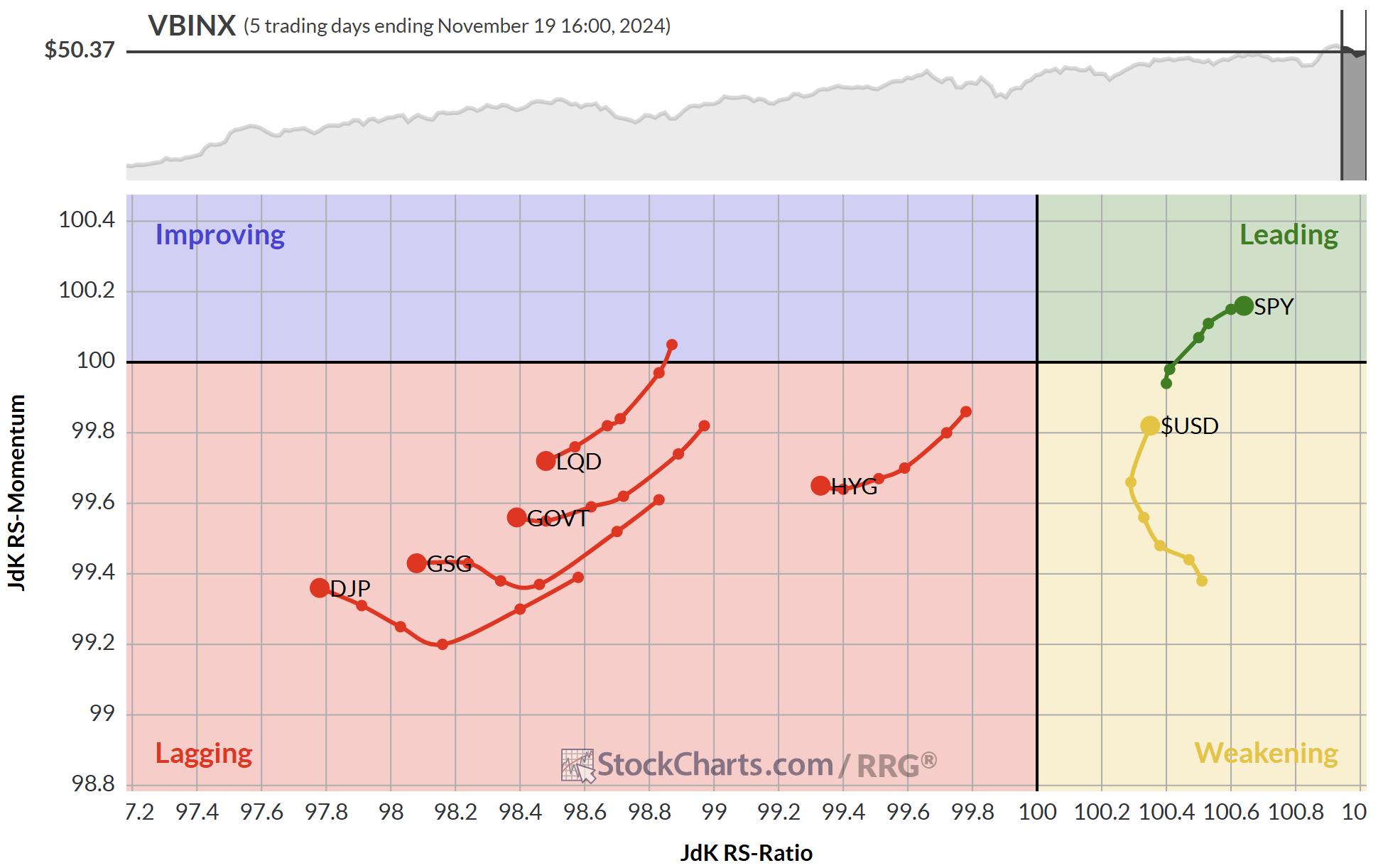

Utilizing Relative Rotation Graphs, I try this, citing an RRG for asset lessons as plotted on the prime of this text. It is a weekly RRG, and the rotations appear fairly easy. (Word: I’ve overlooked BTC as it’s powering means up into the main quadrant and residing a lifetime of its personal.) Shares are the one asset class contained in the main quadrant, and they’re on an honest RRG-Heading, suggesting that extra relative power lies forward.

On the alternative trajectory, we discover the three fixed-income-related asset lessons on this universe: authorities bonds, Company bonds, and Excessive-Yield bonds. All three are touring on a southwestern heading and are shifting deeper into the lagging quadrant. This means additional relative weak spot for this group within the coming weeks.

We discover commodity ETFs and the Greenback Index contained in the bettering quadrant. DJP and GSG are within the bettering quadrant whereas nonetheless in the midst of their respective buying and selling ranges, each in value and relative.

The Greenback index, alternatively, is fascinating, having reached the highest of a broad buying and selling vary after a major rally that began on the backside of that vary again in September. It’s now pushing in opposition to heavy overhead resistance.

Zooming in on the Every day Timeframe

Issues are getting extra fascinating after I zoom in on the day by day timeframe. This RRG is plotted above.

Just a few observations together with the rotations as seen on the weekly model. Within the day by day timeframe, shares additionally head deeper into the main quadrant on a powerful RRG heading. This occurs after a leading-weakening-leading rotation, which suggests it’s a moderately dependable begin for a brand new up-leg within the already established relative uptrend. Conversely, the fixed-income asset lessons affirm their weaker rotation again into the lagging quadrant after a lagging-improving-lagging rotation.

Total, the choice for shares over bonds is firmly proven based mostly on RRG. Commodities are heading additional into the lagging quadrant on this day by day RRG, which tells me that the optimistic rotation on a weekly foundation could be slowing down quickly.

$USD Near Breaking from Broad Vary

This leaves $USD with an fascinating rotation. The lengthy tail touring upward contained in the bettering quadrant on the weekly is getting assist from the leading-weakening-leading rotation that’s growing on the day by day RRG.

On the value chart, $USD could be very near overhead resistance, and, with its present power, there’s a truthful likelihood of breaking it upward. When that occurs, $USD appears to be like set for a powerful follow-through that might attain the degrees of the earlier highs round 114. This goal could be calculated by including the vary’s peak, round 7 factors, to the breakout degree, round 107.

Shares vs. Bonds

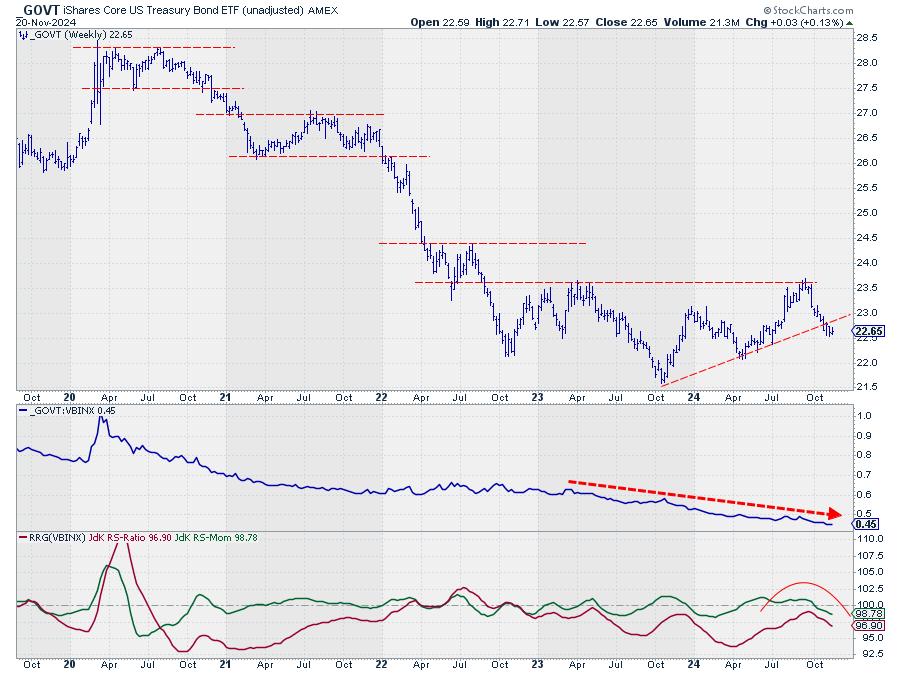

SPY continues to make greater highs and decrease lows, confirming its uptrend despite the fact that unfavourable divergence continues to be current and weaker breadth knowledge (not proven right here). Nevertheless, on the finish of the day, you may solely commerce SPY.

There was a pleasant rally in bonds, pushing yields down, however the decline of the 23.50 highs appears to be breaking the rising trendline.

The first relative pattern for GOVT vs. VBINX has been down for a very long time, and the latest uptick appears to have ended, as soon as once more with a excessive for the JdK RS-Ratio line under 100, leading to one other lagging-improving-lagging rotation, the fifth since late 2022. Thus far, the rise in yields has not been damaging to shares, and consequently, the stock-bond ratio has once more accelerated in favor of shares.

Total, the choice for shares over bonds continues whereas $USD appears to be organising for an ideal rally!!

#StayAlert –Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels beneath the Bio under.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can not promise to answer every message, however I’ll definitely learn them and, the place moderately doable, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered emblems of RRG Analysis.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This distinctive technique to visualise relative power inside a universe of securities was first launched on Bloomberg skilled companies terminals in January of 2011 and was launched on StockCharts.com in July of 2014.

After graduating from the Dutch Royal Navy Academy, Julius served within the Dutch Air Pressure in a number of officer ranks. He retired from the navy as a captain in 1990 to enter the monetary trade as a portfolio supervisor for Fairness & Regulation (now a part of AXA Funding Managers).

Study Extra