‘The Claman Countdown’ panelists Scott Bauer and Jay Woods unpack the corporate’s earnings.

Nvidia launched its earnings report on Wednesday and projected that fourth-quarter gross sales have been above Wall Avenue estimates, however traders balked as these figures fell in need of the lofty expectations the synthetic intelligence (AI) large has garnered throughout its historic rise.

Nvidia forecast fourth-quarter income of $37.5 billion, plus or minus 2%, in comparison with analysts’ common estimate of $37.09 billion, in keeping with information compiled by LSEG.

The corporate’s inventory closed down 0.76% in Wednesday’s buying and selling session. It fell additional in after-hours buying and selling, declining by 3.4% at one level, although that drop was pared again to about 1.9%.

“The age of AI is in full steam, propelling a worldwide shift to Nvidia computing,” stated Jensen Huang, founder and CEO of Nvidia. “Demand for Hopper and anticipation for Blackwell — in full manufacturing — are unbelievable as basis mannequin makers scale pretraining, post-training and inference.”

TOP 2024 ETFS TIED TO ONE STOCK: NVIDIA

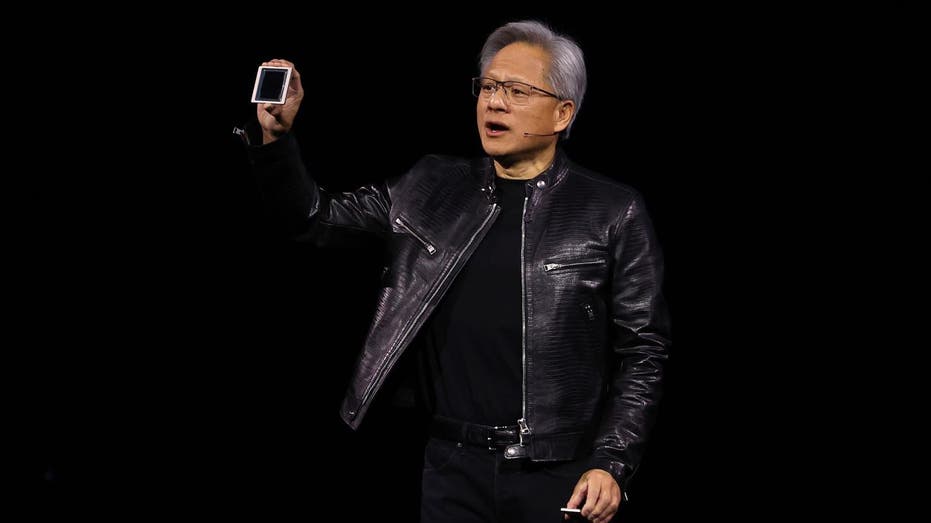

Nvidia issued an optimistic forecast for fourth-quarter gross sales that got here in forward of analysts’ expectations. (David Paul Morris/Bloomberg by way of Getty Photos / Getty Photos)

“AI is remodeling each trade, firm and nation. Enterprises are adopting agentic AI to revolutionize workflows. Industrial robotics investments are surging with breakthroughs in bodily AI. And nations have woke up to the significance of creating their nationwide AI and infrastructure,” Huang stated.

| Ticker | Safety | Final | Change | Change % |

|---|---|---|---|---|

| NVDA | NVIDIA CORP. | 145.89 | -1.12 | -0.76% |

Nvidia’s report confirmed that in its fiscal third quarter of 2025, income was up 17% from the prior quarter and 94% on a year-over-year foundation. Working bills have been up 9% from final quarter and rose by 110% from a 12 months in the past.

Internet earnings got here in at greater than $19.3 billion within the quarter — a rise of 16% from the prior quarter and 109% from this time final 12 months.

HOW NVIDIA BECAME THE KING CHIPMAKER, FROM A DENNY’S TO $2.3T MARKET CAP

Nvidia CEO Jensen Huang reveals off the Blackwell chip at a convention in March. (Justin Sullivan/Getty Photos / Getty Photos)

Nvidia set firm data within the third quarter for quarterly income at $35.1 billion, in addition to income from its essential information heart section that got here in at $30.8 billion.

Nvidia’s information heart gross sales are pushed by corporations spending on AI chips amid an growth of knowledge facilities geared toward enabling them to deal with the complicated processing wants of generative AI applications.

The next-generation Blackwell chip was the main focus of some concern amongst traders amid stories a design flaw was inflicting the superior chips to overheat, however Nvidia stated it has mounted the design flaw and labored with producer TSMC on the treatment.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Nvidia’s inventory is up about 202% for 2024 to this point and 189% over the previous 12 months amid the generative AI increase.

Reuters contributed to this report.