Right this moment the 20-12 months Bond ETF (TLT) 50-day EMA crossed down by the 200-day EMA (Dying Cross), producing an LT Pattern Mannequin SELL Sign. This was the results of a down pattern lasting over two months. We notice that the PMO has been working flat under the zero line for a month, which tells us that regular downward stress has been utilized to cost.

On the weekly chart we observe a bullish reverse head and shoulders sample, which executed when worth broke above the neckline and rallied for a few weeks. Subsequent it carried out a technical pullback to the assist line. If the assist fails, the sample will abort, and we are going to assume a bearish outlook on this timeframe.

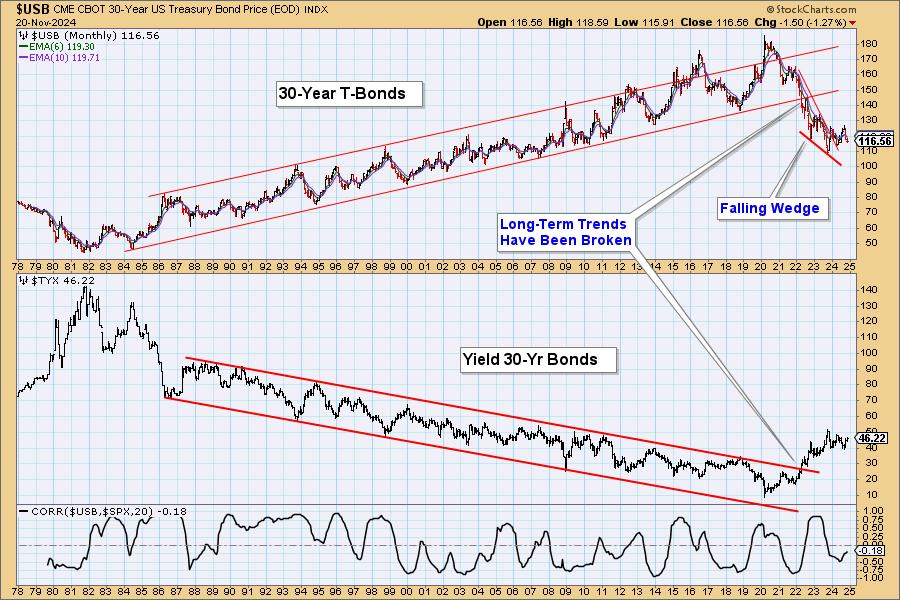

We’ve got been watching this 46-year month-to-month chart of the 30-12 months Bond for just a few years now. A particularly long-term (40-year) rising pattern line was violated in 2022. On the time we asserted that bonds had turned bearish and that situation would most probably persist for a few years. We’ve got not modified our outlook. There could also be encouraging rallies every now and then, however we imagine they are going to fail.

Conclusion: The LT Pattern Mannequin SELL Sign was triggered by a persistent two-month decline. Within the longer-term, bonds seem like making an attempt a rally. Our outlook is bearish, however we have to see how far the rally can go. In any case, we imagine the last word final result can be bearish.

Introducing the brand new Scan Alert System!

Delivered to your e mail field on the finish of the market day. You will get the outcomes of our proprietary scans that Erin makes use of to select her “Diamonds within the Tough” for the DecisionPoint Diamonds Report. Get all the outcomes and see which of them you want greatest! Solely $29/month! Or, use our free trial to attempt it out for 2 weeks utilizing coupon code: DPTRIAL2. Click on HERE to subscribe NOW!

Study extra about DecisionPoint.com:

Watch the newest episode of the DecisionPointBuying and selling Room on DP’s YouTube channel right here!

Strive us out for 2 weeks with a trial subscription!

Use coupon code: DPTRIAL2 Subscribe HERE!

Technical Evaluation is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2024 DecisionPoint.com

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled. Any opinions expressed herein are solely these of the writer, and don’t in any method characterize the views or opinions of another individual or entity.

DecisionPoint shouldn’t be a registered funding advisor. Funding and buying and selling choices are solely your duty. DecisionPoint newsletters, blogs or web site supplies ought to NOT be interpreted as a advice or solicitation to purchase or promote any safety or to take any particular motion.

Useful DecisionPoint Hyperlinks:

Pattern Fashions

Worth Momentum Oscillator (PMO)

On Stability Quantity

Swenlin Buying and selling Oscillators (STO-B and STO-V)

ITBM and ITVM

SCTR Rating

Bear Market Guidelines

D

Carl Swenlin is a veteran technical analyst who has been actively engaged in market evaluation since 1981. A pioneer within the creation of on-line technical sources, he was president and founding father of DecisionPoint.com, one of many premier market timing and technical evaluation web sites on the internet. DecisionPoint makes a speciality of inventory market indicators and charting. Since DecisionPoint merged with StockCharts.com in 2013, Carl has served a consulting technical analyst and weblog contributor.

Study Extra