CoTec Holdings Corp. (TSXV:CTH)(OTCQB:CTHCF) (“CoTec”) and Mkango Sources Ltd. (AIM:MKA)(TSX-V:MKA) (“Mkango”) are happy to announce the outcomes of an impartial Feasibility Examine (the “Feasibility Examine”) for HyProMag USA, LLC, (“HyProMag USA or the Undertaking”) on the event of a state-of-the artwork uncommon earth magnet recycling and manufacturing operation in america.

The Undertaking is underpinned by the patented Hydrogen Processing of Magnet Scrap (“HPMS”) know-how developed on the College of Birmingham Magnetic Supplies Group and being commercialized by HyProMag in america, United Kingdom and Germany. The HPMS course of recovers neodymium iron boron (“NdFeB”) everlasting magnets from end-of-life scrap streams within the type of a demagnetized NdFeB metallized alloy powder for remanufacture into recycled NdFeB magnets with a considerably decreased carbon footprint, and has main aggressive benefits versus different magnet recycling strategies utilizing chemical processes.

Sintered NdFeB magnets will likely be produced in america utilizing supplies sourced in america, contributing to safety of NdFeB everlasting magnet provide and enabling economical, traceable, home U.S. manufacturing of recycled NdFeB magnets (DFARS compliant [1] ) supporting the protection, aerospace, automotive, medical science, hyperscale knowledge facilities, robotics, and power transition industries.

Highlights

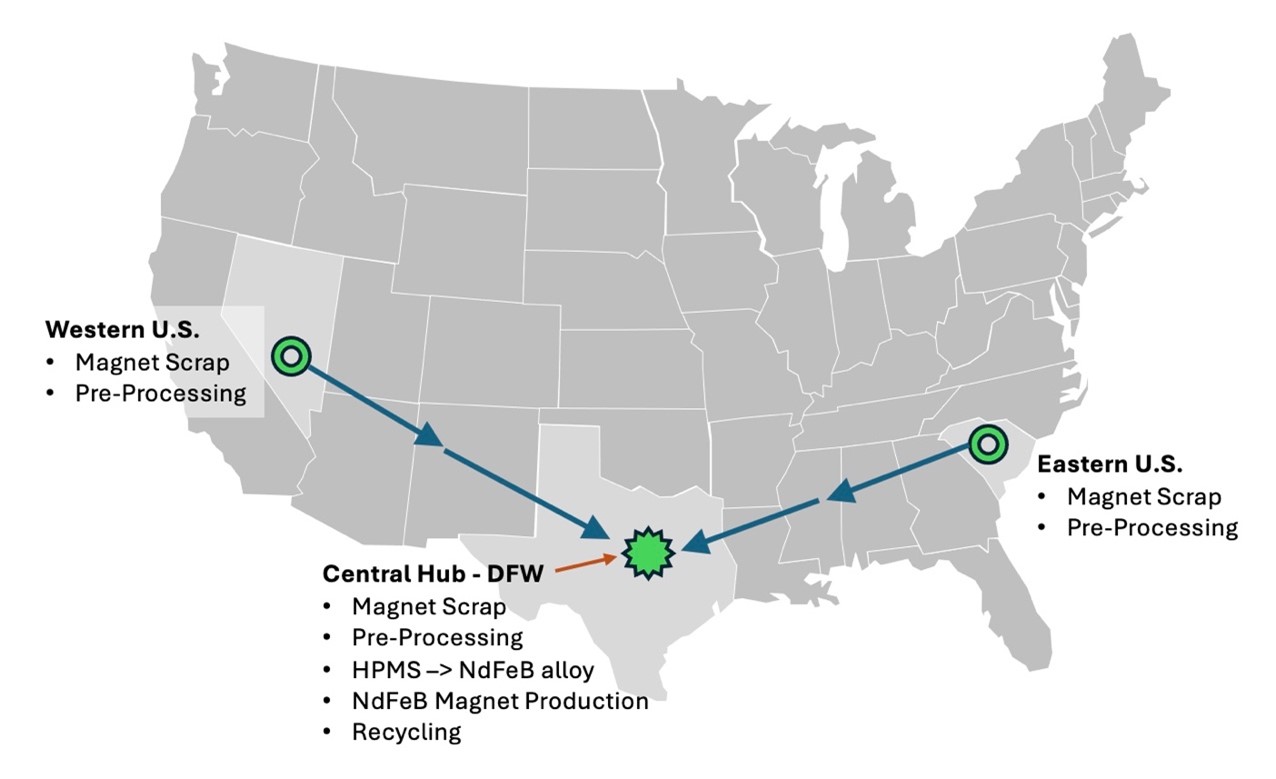

- Optimistic Feasibility Examine outcomes for state-of-the artwork uncommon earth magnet recycling and manufacturing operation in america (the “Undertaking”), with a central Dallas Fort Value (“DFW”), Texas hub supported by two pre-processing spoke websites within the jap and western areas of america:

- US$262 million post-tax Internet Current Worth (NPV) [2] and 23% actual inner price of return (IRR) primarily based on present market costs [3],[4]

- US$503 million post-tax NPV [2] and 31% actual IRR primarily based on forecast market Costs [5],[4]

- Low all-in sustaining Price (AISC) of US$19.6 per kg of NdFeB product which compares to present weighted common market costs of US$55 per kg of NdFeB merchandise, the latter displays underlying prevailing low uncommon earth costs with vital scope for worth restoration

- Enlargement potential with the inclusion of a 3rd HPMS vessel inside three years following commissioning for an extra capital value of roughly US$7 million

- A 3D fly by means of of the Undertaking feasibility design will be discovered at HyProMag USA Facility Flythrough

- Manufacturing of 750 metric tons every year of recycled sintered NdFeB magnets and 291 metric tons every year of related NdFeB co-products (whole payable capability – 1,041 metric tons NdFeB) over a 40 12 months working life

- Up-front capital value of the Undertaking is US$125 million (inclusive of a ten% contingency margin and Class 3 AACE estimated detailed design examine and engineering prices) over a 1.7 12 months building part

- Payback [6] is achieved at present market costs in 3.9 years at a profitability index (“PI”) [7] of two.1, at forecast market costs payback is achieved in 3.1 years at a PI of 4.0

- First Income focused in Q1 2027 with a Discover to Proceed (“NTP”) anticipated in mid-2025 following completion of Detailed Engineering Design and Worth Engineering part, which can start shortly and embrace:

- Analysis of serious alternatives to optimize building and operational effectivity, and to scale back capital expenditure and working prices, in addition to to broaden manufacturing

- Parallel product and operational testing within the UK on the College of Birmingham Magnetic Supplies Group (“MMG”) pilot plant and together with HyProMag industrial developments in UK and Germany

- Completion of economic preparations with potential feed provide and product off taker – discussions with a number of potential events underway

- Continued discussions with federal, state and municipal governments, in relation to financing alternatives and different financial incentives together with carbon worth premiums which might enhance economics

- Undertaking will assist safe the re-vitalization of NdFeB magnet manufacturing in america with the creation of roughly 90 jobs throughout Texas, South Carolina and Nevada

- Minviro Restricted [8] has been commissioned to finish an ISO-14067 compliant “Product Carbon Footprint” evaluation of sintered supplies by the tip of This fall 2024 utilizing the outcomes of the Feasibility Examine

- HyProMag USA is focusing on 10% of U.S home demand for NdFeB magnets inside 5 years of commissioning – design is modular, will be replicated and accelerated to amenities in jap and western United States

- The Feasibility Examine was undertaken by a multidisciplinary crew appointed by CoTec and Mkango and led by impartial engineers, Canada-based BBA USA Inc. (“BBA”) and U.S. primarily based PegasusTSI Inc. (“PegasusTSI”) with different impartial consultants and assist from College of Birmingham, HyProMag Ltd and HyProMag GmbH

Julian Treger, CoTec CEO commented: “We are more than happy with the outcomes of the impartial Feasibility Examine, which additional demonstrates the superior commercialization potential of HyProMag’s know-how. HyProMag has the capability to offer america with a safe home supply of everlasting magnets to speed up the revitalizing of U.S. magnet manufacturing, metallization, and expertise growth, a strategic precedence for the U.S. Authorities.”

“The Detailed Engineering Design part is predicted to ship additional value financial savings and design enhancements which ought to improve the challenge’s metrics even additional. The corporate is now centered on securing funding from the U.S. Authorities, financing, off-take and feed provide. The tip-to-end technique of recycling end-of-life NdFeB magnets into new sintered NdFeB magnets is supported by the Minerals Safety Partnership [9] which goals to speed up the event of safe, various, and sustainable provide chains for crucial minerals. We’re very excited the enterprise can be utilized as a platform to create a market main place for low value, low carbon magnet recycling.”

Will Dawes, Mkango CEO commented: “This can be a main milestone for HyProMag, additional validating the HPMS know-how and alternative to roll-out into america. Our technique to develop uncommon earth magnet recycling and manufacturing hubs in america, UK, Germany and, sooner or later, Asia, is aligned with the evolving geopolitical surroundings by means of the event of extra sturdy uncommon earth provide chains for the respective home markets, whereas catalyzing new facilities of excellence in magnetic supplies and cross-fertilization of expertise throughout jurisdictions and between business and academia.”

Possession

HyProMag is 100 per cent owned by Maginito Restricted (“Maginito”), which is owned on a 79.4/20.6 per cent foundation by Mkango and CoTec. HyProMag USA is owned 50:50 by CoTec and Maginito.

Detailed Engineering Design and Worth Engineering

Following completion of the Feasibility Examine, the Undertaking will now proceed to the Detailed Engineering Design and Worth Engineering phases.

The Detailed Engineering Design will embrace the completion of adequate engineering design works to assist a AACE Class 1 capital estimate, in addition to remaining web site choice is predicted to be accomplished in H1 2025 and web site allowing focused for completion by This fall 2025 in step with the preliminary challenge schedule. This targets preliminary income in Q1 2027. Environmental and allowing research are supported by U.S. primarily based Weston Options, Inc. Following completion of the Detailed Engineering Design, a NTP determination will likely be taken mid-2025 as as to whether HyProMag USA will proceed with the development of the Undertaking.

Detailed Engineering Design will deal with optimization of building and operational effectivity and figuring out potential enhancements that might result in substantial capital expenditure and working value financial savings. It is going to additionally embody definition and optimization of the third HPMS enlargement case. In parallel with Detailed Engineering Design and Worth Engineering, product and operational testing will proceed within the UK on the College of Birmingham Magnetic Supplies Group (MMG) pilot plant together with HyProMag industrial developments in UK and Germany.

The info used to develop the processing flowsheet relies on historic check work and magnet manufacturing on the HPMS Pilot vessel by means of the MMG on the College of Birmingham within the UK, which developed the HPMS know-how being commercialized by HyProMag. Extra check work will likely be undertaken to additional optimise the flowsheet, notably within the HPMS operations. The capital and working prices will likely be refined in step with the anticipated enhancements to the general course of flowsheet, which can affect long-lead capital objects. A proper request for proposal (“RfP”) course of will even be undertaken as a part of the Detailed Engineering Design part of the Engineering, Procurement, Building Administration (“EPCM”) contract to solicit remaining vendor quotes to enhance the accuracy of the capital value estimate. The detailed engineering considers a “one contractor” strategy who’s appointed to develop and construct the entire course of crops.

In parallel, HyProMag USA is working in direction of securing potential U.S. Authorities funding, U.S. State monetary grants and incentives and strategic partnerships with U.S. corporations. Important progress was achieved within the areas of feed provide and recycled NdFeB magnet offtake in the course of the Feasibility Examine and the Undertaking is now in a position to proceed with securing long run industrial agreements.

CoTec is chargeable for funding the Detailed Engineering Design, Worth Engineering and the challenge growth prices. Funding supplied by CoTec can be within the type of shareholder loans to HyProMag USA.

The Feasibility Examine

The Undertaking will use a “hub-and-spoke” operational mannequin, with the central, DFW, Texas hub supported by two pre-processing spoke websites in jap and western United States.

The Feasibility Examine relies on the event of a state-of-the-art 40-year magnet manufacturing facility in DFW, Texas, able to producing as much as 750 metric tons payable of sintered NdFeB magnets and 291 metric tons of related NdFeB co-products (whole payable capability – 1,041 metric tons NdFeB) yearly. First Income is focused in Q1 2027 with a Discover to Proceed (the “NTP”) anticipated in mid- 2025 following completion of the Detailed Engineering Design part.

The Feasibility Examine demonstrates sturdy economics at Present Costs and signifies a major upside primarily based on the forecast restoration within the uncommon earths market. Primarily based on a present market costs, derived from present market pricing for the assorted merchandise, the Feasibility Examine signifies a post-tax NPV[ 10] of US$262 million and actual IRR of 23% (pre-tax NPV US$343 million and actual IRR of 27%) at an actual low cost price of seven.0%. Primarily based on forecast market costs, the Feasibility Examine signifies an post-tax NPV of US$503 million and actual IRR of 31% (pre-tax NPV of US$647 milliion and actual IRR of 36%) at an actual low cost price of seven.0%.

The up-front capital value of the Undertaking is US$125 million (inclusive of a ten% contingency margin and Class 3 AACE [11] estimated detailed design examine and engineering prices). The present market worth payback [12] is achieved in 3.9 years at a profitability index (“PI”) of two.1 [13] , while at Forecast Costs, payback is achieved in 3.1 years at a PI of 4.0.

The Undertaking has a low all-in Sustaining Price of value manufacturing at US$19.6 per kg of NdFeB which compares to present market costs of US$55 per kg of NdFeB product.

Manufacturing on the hub facility is quickly expandable with the inclusion of a 3rd HPMS vessel inside three years following commissioning for an extra capital value of roughly US$7 million – the third HPMS vessel is predicted to produce extra HPMS NdFeB payable powder to the united statesmarket for the growing home magnet manufacturing business.

The primary merchandise are sintered magnet supplies cut up between blocks and completed magnets at magnet grades which were beforehand demonstrated on the College of Birmingham pilot facility [14] . These embrace DFARS compliant merchandise and can assist a closed loop system in america whereby end-of-life U.S.-sourced NdFeB magnets are recycled into new magnets through HyProMag’s short-loop course of.

The Undertaking will subsequently present a long-term, traceable supply of everlasting magnets for U.S business together with functions for electrical autos, wind generators, and plenty of digital gadgets crucial for U.S. crucial mineral provide chains and the power transition. Moreover, the Undertaking will assist safe the re-vitalization of NdFeB magnet manufacturing in america with the creation of roughly 90 jobs in relation to magnet manufacturing, additional catalyzing the growing uncommon earth business ecosystem in Texas and the cross fertilization of expertise, coaching and R&D between america, UK and Europe.

The important thing Feasibility Examine metrics of the Undertaking are summarized in Desk 1. The Feasibility Examine didn’t incorporate prospects for potential financial assist from governments, funding alternatives, or different financial incentives which might enhance the economics and affect a future up to date detailed design engineering and funding determination.

Desk 1: Feasibility Examine Key Metrics in US$

|

Assumptions |

Unit |

Present Costs |

Forecast Costs |

|

Undertaking Period (Lifetime of Asset) |

Years |

40 |

40 |

|

Common annual system capability |

Metric tons NdFeB every year |

1,147 |

1,147 |

|

Common annual payable manufacturing |

Metric tons NdFeB every year |

1,041 |

1,041 |

|

Common whole payable Sintered Magnets |

Metric tons NdFeB every year |

750 |

750 |

|

Common whole payable co-products excluding residual scrap |

Metric tons NdFeB every year |

291 |

291 |

|

Financial Assumptions |

|||

|

Weighted common worth (Lifetime of Asset) |

US$/Kg |

55 |

94 |

|

Capital Price |

|||

|

Building interval |

Years |

1.7 |

1.7 |

|

Preliminary CAPEX (excl. closure and sustaining) |

US$ million |

125.3 |

125.3 |

|

Sustaining CAPEX |

US$ million every year |

0.21 |

0.21 |

|

Working value per metric ton |

|||

|

Transport Price (Spoke to Hub) |

US$/kg NdFeB |

0.46 |

0.46 |

|

Royalty Price |

US$/kg NdFeB |

0.23 |

0.69 |

|

TOTAL AISC [15] LIFE OF ASSET |

US$/kg NdFeB |

19.63 |

31.86 |

Foundation of Feasibility Examine

Feasibility design and financial evaluation thereof was undertaken for the Undertaking. A system capability of 1,147 metric tons every year has been used as a foundation for the Feasibility Examine.

The method begins with scrap pre-processing on the spoke amenities positioned within the jap and western United States, the place digital and industrial scrap containing NdFeB magnets is pre-processed, sorted, and ready for HPMS on the hub. This pre-processed materials is then transported to the central hub in DFW for HPMS and magnet manufacturing.

On the DFW hub in Texas, the HPMS system makes use of hydrogen to extract NdFeB powder from the scrap materials in a sequence of managed reactions that happen at close to atmospheric stress. This methodology minimizes power consumption and reduces environmental affect in comparison with standard extraction strategies. Following extraction, the NdFeB alloy powder undergoes standard magnet manufacturing to provide high-performance magnets that meet business requirements.

Financial evaluation has been carried out in accordance with the method design and schedule, metallurgical testing, and product payability evaluation developed within the examine, and the estimates and analyses therein have been ready to a Class 3 AACE Feasibility degree.

Processing Design

The proposed plant relies on each historic, and 2022 to 2024 pilot check work on the College of Birmingham along with the approximate US$100 million of historic R&D expenditure and the numerous know-how and associated mental property for HPMS.

HyProMag USA will produce NdFeB everlasting magnets in america utilizing recycled finish of life NdFeB magnets embedded in digital and industrial scrap because the supply materials. The HPMS course of liberates embedded uncommon earth everlasting magnets, within the type of a demagnetised NdFeB powder, from any electrical drive, be it together with laborious disk drives (“HDD”), electrical motors, MRI magnetic models, audio system and different end-of-life assemblies containing NdFeB, enabling restoration of the NdFeB while abandoning the related casing supplies. These casing supplies are recovered and despatched to any appropriate scrap recycling plant for processing. The recovered NdFeB magnet materials will be fed again into any level within the uncommon earth provide chain, the popular and principal route for HyProMag being short-loop magnet manufacturing which is facilitated by HPMS. Within the short-loop magnet manufacturing course of, the recovered NdFeB magnet materials is handled and reformed into blocks that may then be formed and magnetized to be used in tools requiring everlasting uncommon earth magnets of the NdFeB composition. Any scrap materials produced from the shaping of the magnet blocks will likely be recycled to be used throughout the plant or bought to 3rd events. The one waste merchandise from the method are the casing supplies housing the uncommon earth magnets, that are recycled, and minor discharges of steam and inert gases.

Determine 1: A easy Block Circulate Diagram of the magnet recycling and manufacturing operation

Pre-Processing know-how

Maginito and Inserma Anoia S.L (“Inserma”) have entered right into a binding and unique settlement to collaborate on the optimization, commercialization and roll-out of pre-processing applied sciences for HyProMag in the UK, Germany, america and different areas. The applied sciences autonomously pre-process scrap resembling laborious disk drives to take away the NdFeB magnet containing part which will be processed through HPMS to ship purified alloy powder on a really giant scale.

The most recent cell Inserma unit for HDD will be co-located at hyperscale knowledge facilities, shredding, recycling or HyProMag amenities. These Inserma models quickly take away (at HyProMag USA with Inserma HDD Pre Processing Fly Via , Knowledge Heart with HyProMag USA + Inserma Expertise

The objective of the collaboration is to allow deployment of lots of of pre-processing models, throughout a number of jurisdictions, offering pre-processing options for a spread of end-of-life functions, together with HDDs, loudspeakers and electrical motors, and producing feed for HyProMag’s brief loop uncommon earth magnet recycling course of.

Undertaking Website, Infrastructure and Companies

Website choice was centered on finding a web site in DFW, Texas for the hub. DFW was recognized as an appropriate location to construct the magnet recycling operation primarily based on its central location within the U.S., its sizable e-waste recycling actions, proximity to nationwide rail roads and interstate highways and ease of doing enterprise there. DFW additionally has different current and growing magnet and uncommon earth associated companies within the space.

A variety standards strategy was used to find out potential web site areas throughout the DFW space. The potential web site is roughly 100,000 sq. toes in space, 36 toes in peak and makes use of a pre-existing manufacturing unit storage unit with fundamental utilities totally put in. The Undertaking design assumes the location will likely be secured by means of long run leases in Q1 2025.

The logistics for the challenge embrace two essential satellite tv for pc spokes: Satellite tv for pc Spoke 1, doubtlessly positioned in Las Vegas, or Reno, Nevada and a Satellite tv for pc Spoke 2, doubtlessly positioned in South Carolina. The transportation course of from every Satellite tv for pc Spoke to the hub employs intermodal (truck and rail) transportation.

Energy provide will likely be supplied by means of native utility suppliers. The present Undertaking design is assuming grid sourced energy, nonetheless the place attainable the Undertaking will contract renewably sourced energy when it’s out there.

Provide of Hydrogen, Nitrogen, and Argon on the DFW hub will likely be supplied by means of specialised corporations which give industrial gases in liquid type. These gases will likely be delivered and saved on-site in devoted tanks geared up with vaporizers to make sure the conversion from liquid to gasoline as wanted for the operations in a “over the fence” answer.

Determine 2: Map of america exhibiting deliberate areas of HyProMag USA’s operations and capabilities.

Capital Prices

Preliminary capital expenditure (CAPEX) prices for the Undertaking are primarily based on a system capability of 1,147 metric tons every year with a nominal payable manufacturing capability of roughly 1,041 metric tons every year of which 750 metric tons every year are sintered blocks and completed magnets. CAPEX prices are estimated at US$125 million, together with EPCM prices, future Detailed Engineering Design examine prices and a ten% contingency.

Sustaining capital over the lifetime of asset (40 years) is estimated at US$9.4 million. Closure value is estimated at $1M leading to whole lifetime of asset CAPEX value of US$134.8 million.

Desk 2: Capital Prices

|

Description |

US$ (M) |

|

Hub Plant |

95.0 |

|

Spoke Pre-Processing |

6.0 |

|

Oblique Prices (DE Examine and EPCM) |

13.5 |

|

Estimated Sub-Complete Price |

114.5 |

|

Contingency 10% |

10.9 |

|

Complete Estimated Preliminary CAPEX |

125.4 |

|

Sustaining (over lifetime of asset) |

8.4 |

|

Closure value |

1.0 |

|

ESTIMATED TOTAL CAPEX OF LIFE OF ASSET |

134.8 |

Working Prices

The working prices embrace manpower to run the general operations, energy and utilities, supplies dealing with, scrap feed, transport of the scrap supplies from the Spoke pre-processing websites to the Hub in DFW, Texas and G&A.

Desk 3: Working prices

|

Space |

US$/kg (present costs) [16] |

US$/kg (Forecast Costs) [ 4] |

|

Pre-processing – Spokes x2 |

1.84 |

1.84 |

|

Processing – Hub (contains feed provide) |

16.23 |

28.00 |

|

Transport from Spoke to Hub |

0.46 |

0.46 |

|

G&A |

0.67 |

0.67 |

|

Royalty |

0.23 |

0.69 |

|

ESTIMATED TOTAL AVE. OPEX US$/kg (LIFE OF ASSET) |

19.43 |

31.66 |

Financial Evaluation and Sensitivity Evaluation

Desk 4: Financial Outcomes

|

Financial Assumptions |

Unit |

Present Costs |

Forecast Costs |

|

Weighted common worth (Lifetime of Asset) |

US$/kg NdFeB |

55 |

94 |

|

Income (Lifetime of Asset) |

US$M |

2,325 |

3,941 |

|

EBITDA (Lifetime of Asset) |

US$M |

1,528 |

2,642 |

|

Pre-Tax NPV at 7% low cost price |

US$M |

343 |

647 |

|

Pre-Tax actual IRR |

% |

27% |

36% |

|

Submit-Tax NPV 7% low cost price |

US$M |

262 |

503 |

|

Submit-Tax actual IRR |

% |

23% |

31% |

|

Payback |

years |

3.9 |

3.1 |

|

PI |

2.1 |

4.0 |

A sensitivity evaluation was carried out whereby preliminary infrastructure capital value, annual working prices and product promoting worth have been individually diverse between +/-15% to find out the affect on Undertaking IRR and NPV between 0 and 10 % low cost charges.

Outcomes are offered in Desk 5 and 6. The challenge financials are most delicate to the product promoting worth adopted by working prices and at last preliminary capital expenditures.

Desk 5: Sensitivity Evaluation (US$, Million, Submit Tax) – Present Costs

|

Base Case |

CAPEX |

Present costs |

LOA OPEX |

|||||

|

15% |

-15% |

15% |

-15% |

15% |

-15% |

|||

|

IRR |

23% |

20% |

26% |

27% |

19% |

22% |

24% |

|

|

NPV |

||||||||

|

0% |

1,113 |

1,097 |

1,128 |

1,362 |

864 |

1,049 |

1,177 |

|

|

5% |

380 |

365 |

396 |

479 |

281 |

355 |

406 |

|

|

7% |

262 |

246 |

277 |

336 |

187 |

243 |

281 |

|

|

10% |

154 |

139 |

169 |

206 |

102 |

141 |

167 |

Desk 6: Sensitivity Evaluation (US$, Million, Submit Tax) – Forecast Costs

|

Base Case |

CAPEX |

Forecast costs |

LOA OPEX |

|||||

|---|---|---|---|---|---|---|---|---|

|

15% |

-15% |

15% |

-15% |

15% |

-15% |

|||

|

IRR |

31% |

28% |

35% |

36% |

26% |

30% |

32% |

|

|

NPV |

||||||||

|

0% |

2,005 |

1,990 |

2,021 |

2,416 |

1,594 |

1,939 |

2,071 |

|

|

5% |

711 |

695 |

726 |

870 |

552 |

684 |

737 |

|

|

7% |

503 |

487 |

518 |

621 |

384 |

483 |

522 |

|

|

10% |

314 |

299 |

330 |

396 |

233 |

300 |

328 |

Undertaking Timeline and Phased Execution

The Undertaking is strategically phased to make sure cost-effective growth, operational effectivity, and suppleness for future enlargement. Subsequent steps:

- Detailed Design and Engineering (2025): The Detailed Engineering Design will embrace the completion of adequate engineering design works to assist a AACE Class 1 capital estimate to finish the bankable Feasibility Examine in addition to remaining web site choice to be accomplished in H1 2025 and the graduation of web site allowing.

- Website Growth and Facility Building (2025-2026): The preliminary part contains web site preparations and facility building on the DFW hub and two spoke areas. The DFW hub will likely be geared up with purpose-built infrastructure for HPMS recycling, magnet alignment, and sintering operations. The modular structure helps scalability, permitting for future enlargement as demand for NdFeB magnets grows. The spoke amenities in east and west United States will deal with sorting and preliminary processing of NdFeB-containing scrap to scale back transportation prices and streamline materials circulation to the DFW hub.

- Tools Set up and Commissioning (2026): Building will observe to tools set up, together with HPMS vessels, sintering furnaces, alignment presses, and auxiliary methods. Each bit of kit will likely be examined and calibrated to fulfill high quality and operational requirements. The commissioning part verifies that the power operates as designed, guaranteeing clean transitions between manufacturing levels and mitigating dangers of downtime.

- Preliminary Manufacturing Ramp-Up (2027): The Undertaking’s first manufacturing part is predicted to start Q1 2027, with a gradual enhance in output to stabilize operations and optimize tools efficiency. Preliminary manufacturing volumes will likely be devoted to fulfilling contracts with key clients in sectors resembling protection, renewable power, and electronics.

- Full Operational Capability and Modular Enlargement (2027 Onward): By H2 2027, the Undertaking goals to succeed in full capability at 750 metric tons per 12 months, positioning HyProMag USA as a serious participant within the U.S. NdFeB magnet market. The power’s modular design helps phased expansions, permitting for the addition of processing strains and spoke websites as demand will increase. This versatile strategy permits HyProMag to scale up with minimal disruption and align manufacturing with market progress, notably in EVs, wind power, and protection.

- Modular Enlargement (2030 Onward): By 2030 potential set up of the third HPMS vessel, debottlenecking and enlargement of system capability.

- Regional enlargement (2030 Onward): HyProMag USA is focusing on 10% of the united statesdomestic demand [17] inside 5 years of commissioning – design is modular, will be replicated and accelerated to amenities on jap and western United States. Any laws to assist recycling will additional speed up enlargement.

Certified Individuals and Knowledge Verification

The impartial Certified Individuals are Skilled Engineers employed by BBA, Pegasus TSI and Weston Options who’re chargeable for Engineering Design, Processing, Infrastructure, Transportation, Companies, Capital Prices, Working Prices, Undertaking Timeline, Allowing and Financial Evaluation and Sensitivity.

The Certified Individuals have reviewed and authorised the scientific and technical content material of this information launch.

About HyProMag

HyProMag is commercializing HPMS recycling know-how within the UK, Germany and United States. HyProMag can be evaluating different jurisdictions, and in mid-2024 launched a collaboration with Envipro on uncommon earth magnet recycling in Japan. HPMS know-how was developed on the Magnetic Supplies Group (MMG) at College of Birmingham, underpinned by roughly US$100 million of analysis and growth funding, and has main aggressive benefits versus different uncommon earth magnet recycling applied sciences, that are largely centered on chemical processes however don’t resolve the challenges of liberating magnets from end-of-life scrap streams – HPMS supplies this answer.

The MMG is internationally acknowledged for its work on the round financial system of uncommon earth magnets. The group has made main contributions to analysis and industrial utility of hydrogen for processing of magnets. Professor Emeritus Harris pioneered the preliminary work on hydrogen decrepitation (HD), presently used worldwide to provide magnets, and co-authored the 1986 paper on the world’s first hydrogen primarily based sintered magnet. At present, nearly all NdFeB magnet manufacturing and recycling strategies reap the benefits of the HD course of.

About CoTec Holdings Corp.

CoTec is a publicly traded funding issuer listed on the Toronto Enterprise Inventory Change (“TSX- V”) and the OTCQB and trades below the image CTH and CTHCF respectively. CoTec is an surroundings, social, and governance (“ESG”)-focused firm investing in progressive applied sciences which have the potential to basically change the way in which metals and minerals will be extracted and processed for the aim of making use of these applied sciences to undervalued working property and recycling alternatives, because it transitions right into a mid-tier mineral useful resource producer.

CoTec is dedicated to supporting the transition to a decrease carbon future for the extraction business, a sector on the cusp of a inexperienced revolution because it embraces know-how and innovation. It has made 4 investments thus far and is actively pursuing working alternatives the place present know-how investments could possibly be deployed.

For extra data, please go to www.cotec.ca .

About Mkango Sources Ltd.

Mkango is listed on the AIM and the TSX-V. Mkango’s company technique is to develop into a market chief within the manufacturing of recycled uncommon earth magnets, alloys and oxides, by means of its curiosity in Maginito Restricted (“Maginito”), which is owned 79.4 per cent by Mkango and 20.6 per cent by CoTec, and to develop new sustainable sources of neodymium, praseodymium, dysprosium and terbium to produce accelerating demand from electrical autos, wind generators and different clear power applied sciences.

Maginito holds a 100 per cent curiosity in HyProMag and a 90 per cent direct and oblique curiosity (assuming conversion of Maginito’s convertible mortgage) in HyProMag GmbH, centered on brief loop uncommon earth magnet recycling within the UK and Germany, respectively, and a 100 per cent curiosity in Mkango Uncommon Earths UK Ltd (“Mkango UK”), centered on lengthy loop uncommon earth magnet recycling within the UK through a chemical route.

Maginito and CoTec are additionally rolling out HyProMag’s recycling know-how into america through the 50/50 owned HyProMag USA LLC three way partnership firm. HyProMag can be evaluating different jurisdictions, and not too long ago launched a collaboration with Envipro on uncommon earth magnet recycling in Japan.

Mkango additionally owns the superior stage Songwe Hill uncommon earths challenge and an in depth uncommon earths, uranium, tantalum, niobium, rutile, nickel and cobalt exploration portfolio in Malawi, and the Pulawy uncommon earths separation challenge in Poland.

For extra data, please go to www.mkango.ca

Market Abuse Regulation (MAR) Disclosure

The knowledge contained inside this announcement is deemed by the Firm to represent inside data as stipulated below the Market Abuse Rules(EU) No. 596/2014 (‘MAR’) which has been integrated into UK legislation by the European Union (Withdrawal) Act 2018. Upon the publication of this announcement through Regulatory Data Service, this inside data is now thought of to be within the public area.

Cautionary Be aware Concerning Ahead-Wanting Statements

This information launch comprises forward-looking statements (throughout the which means of that time period below relevant securities legal guidelines) with respect to Mkango and CoTec. Usually, ahead trying statements will be recognized by means of phrases resembling “plans”, “expects” or “is predicted to”, “scheduled”, “estimates” “intends”, “anticipates”, “believes”, or variations of such phrases and phrases, or statements that sure actions, occasions or outcomes “can”, “might”, “might”, “would”, “ought to”, “would possibly” or “will”, happen or be achieved, or the unfavorable connotations thereof. Readers are cautioned to not place undue reliance on forward-looking statements, as there will be no assurance that the plans, intentions or expectations upon which they’re primarily based will happen. By their nature, forward-looking statements contain quite a few assumptions, identified and unknown dangers and uncertainties, each common and particular, that contribute to the likelihood that the predictions, forecasts, projections and different forward-looking statements is not going to happen, which can trigger precise efficiency and ends in future intervals to vary materially from any estimates or projections of future efficiency or outcomes expressed or implied by such forward-looking statements. Such components and dangers embrace, with out limiting the foregoing, the provision of (or delays in acquiring) financing to develop the Recycling Vegetation being developed by Maginito within the UK, Germany and the US (the “Maginito Recycling Vegetation”), the implementation of issues set out within the Feasibility Examine, governmental motion and different market results on world demand and pricing for the metals and related downstream merchandise for which Mkango is exploring, researching and growing, the power to scale the HPMS and chemical recycling applied sciences to industrial scale, opponents having better monetary functionality and efficient competing applied sciences within the recycling and separation enterprise of Maginito and Mkango, availability of scrap provides for Maginito’s recycling actions, authorities regulation (together with the affect of environmental and different laws) on and the economics in relation to recycling and the event of the Maginito Recycling Vegetation and future investments in america pursuant to the proposed cooperation settlement between Maginito and CoTec, the result and timing of the completion of the feasibility research, value overruns, complexities in constructing and working the crops, and the optimistic outcomes of feasibility research on the assorted proposed elements of Mkango’s, Maginito’s and CoTec’s actions. The forward-looking statements contained on this information launch are made as of the date of this information launch. Besides as required by legislation, the Firm and CoTec disclaim any intention and assume no obligation to replace or revise any forward-looking statements, whether or not due to new data, future occasions or in any other case, besides as required by relevant legislation. Moreover, the Firm and CoTec undertake no obligation to touch upon the expectations of, or statements made by, third events in respect of the issues mentioned above.

For additional data on Mkango, please contact:

Mkango Sources Restricted

William Dawes

Chief Govt

will@mkango.ca

Canada: +1 403 444 5979

www.mkango.ca

@MkaResource

Alexander Lemon

President

alex@mkango.ca

SP Angel Company Finance LLP

Nominated Adviser and Joint Dealer

Jeff Keating, Caroline Rowe

UK: +44 20 3470 0470

Different Useful resource Capital

Joint Dealer

Alex Wooden, Keith Dowsing

UK: +44 20 7186 9004/5

For additional data on CoTec, please contract:

CoTec Holdings Corp.

Braam Jonker

Chief Monetary Officer

braam.jonker@cotec.ca

Canada: +1 604 992-5600

The TSX Enterprise Change has neither authorised nor disapproved the contents of this press launch. Neither the TSX Enterprise Change nor its Regulation Companies Supplier (as that time period is outlined within the insurance policies of the TSX Enterprise Change) accepts accountability for the adequacy or accuracy of this launch.