Having used many technical evaluation platforms over my profession as a technical analyst, I can inform you with a transparent conscience that the ChartList characteristic on StockCharts supplies distinctive capabilities that will help you establish funding alternatives and handle danger in your portfolio.

When you get your portfolio or watch record arrange utilizing the ChartList characteristic, you need to use these 5 highly effective instruments to interrupt down the record of shares or ETFs, establish patterns of power and weak point, and anticipate the place the subsequent alternatives could come up!

Abstract View to Determine Outliers

The Abstract view is a superb start line, form of like a excessive stage menu of what all we will do with this record of charts. The entire columns are sortable, so we will start to search out patterns and relationships by grouping related shares by sector or sorting by market cap.

Certainly one of my favourite issues to do proper off the bat is kind by “Subsequent Earnings Date”. Whether or not you are a long-term investor or a swing dealer or someplace in between, you at all times need to know when earnings might create a sudden transfer in both course!

ChartList View to Analyze Technical Patterns

As soon as I’ve made some basic assessments concerning the shares on my record utilizing the Abstract View, I like to make use of the ChartList view to overview every chart, one after the other. This view makes use of the alphabetical order of the titles of your charts, so be certain that so as to add numbers earlier than the tickers should you choose a specific order.

Particularly once I’m reviewing an extended record of tickers, I am going to use the ChartList view to undergo a bunch of charts, jotting down tickers on my notepad for additional overview later within the day. It is easy to change all the charts to a distinct ChartStyle, which turns out to be useful if you wish to swap to weekly or month-to-month charts, for instance. Simply choose one of many charts, change the ChartStyle, then search for a hyperlink referred to as “Apply ChartStyle to All” on the backside!

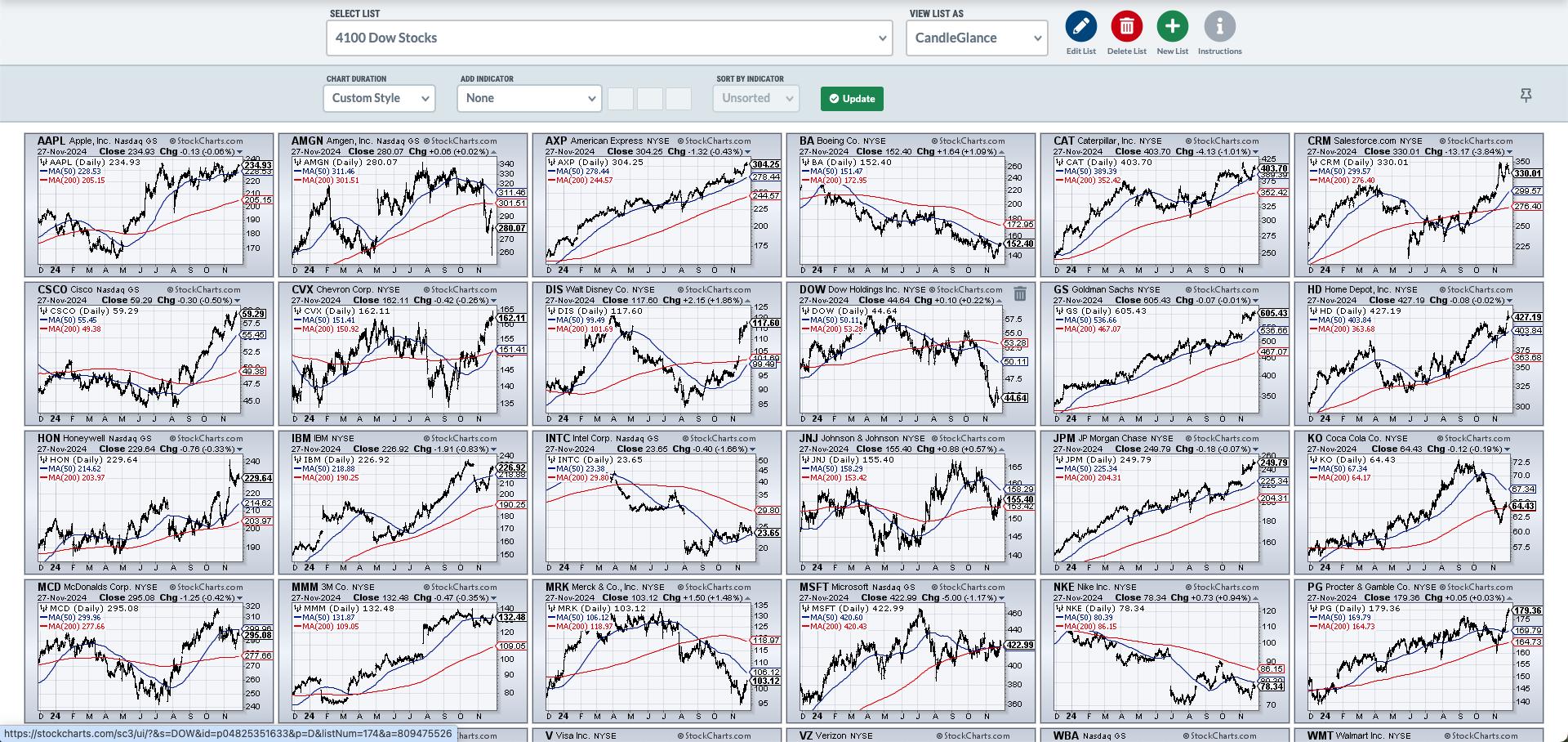

CandleGlance View to Separate Into Buckets

Once I labored at a big monetary establishment in Boston, I might print out a bunch of charts representing a specific fund’s holdings, then unfold the charts out on a convention desk. I would search for related patterns and constructions, and begin to separate the charts into bullish, bearish, and impartial piles. From there, I might focus my consideration on probably the most actionable charts.

The CandleGlance view supplies this functionality with out having to print out all of these charts! We will simply detect related patterns and alerts, serving to me spend my time on probably the most actionable charts inside a bigger record. I can not inform you how a lot time this one characteristic has saved me by way of effectively breaking down an inventory of charts! Remember you can customise the ChartStyle you utilize for this view, permitting you to use your individual proprietary charting strategy to this visualization.

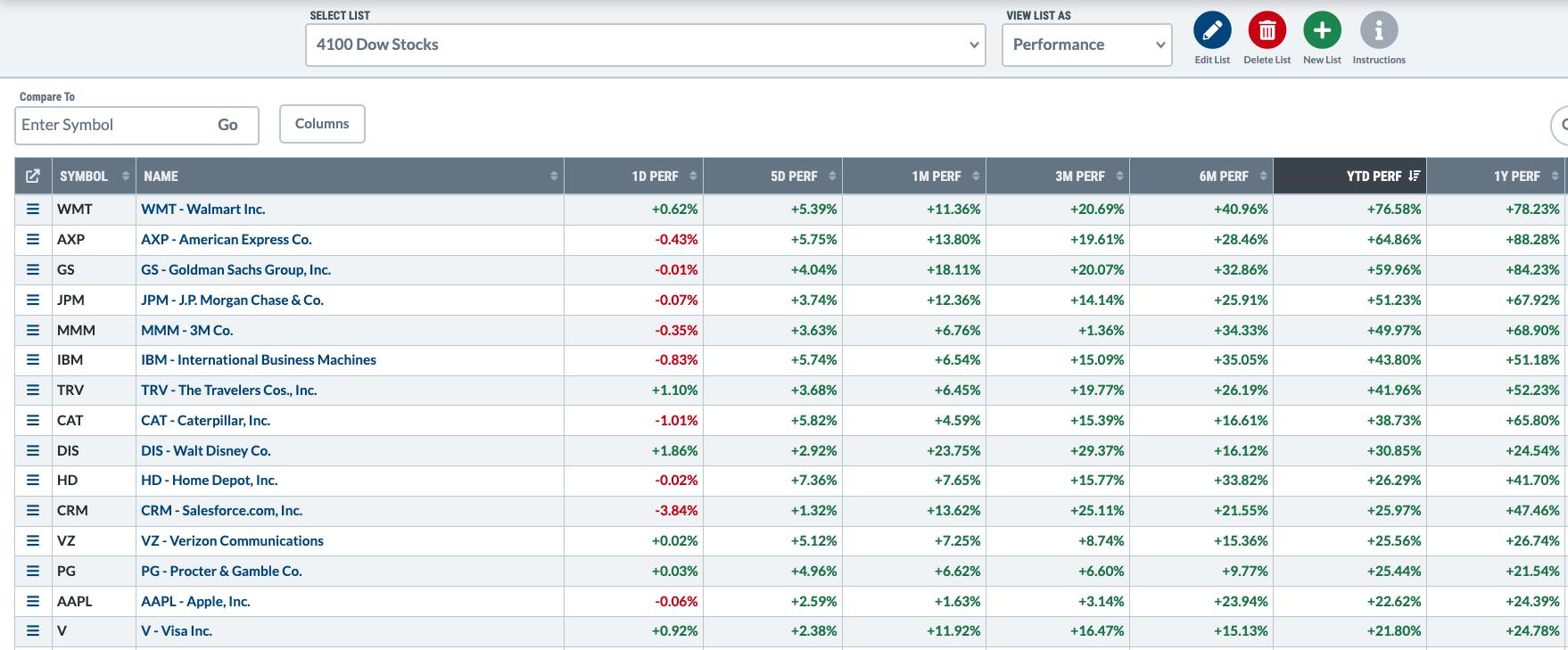

Efficiency View to Deal with Constant Winners

What should you simply need to analyze the efficiency of a gaggle of shares or ETFs, to higher perceive which charts have been probably the most and least worthwhile over a time frame? The Efficiency View exhibits a sequence of time frames in tabular format, permitting you to deal with high and backside intervals over a number of time frames.

This generally is a incredible solution to break down your portfolio, serving to you higher perceive which positions have been serving to your efficiency, and which of them may very well have been holding you again!

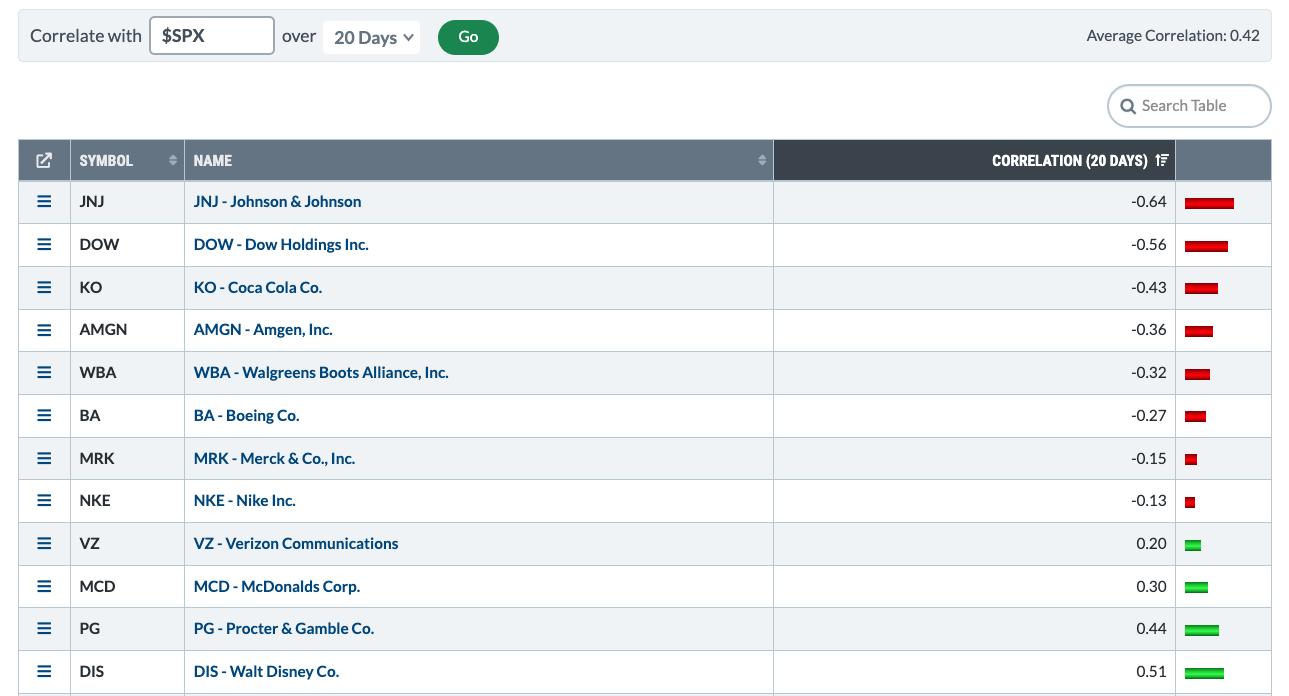

Correlation View to Perceive Worth Relationships

Lastly, we come to one of the underutilized options of ChartLists, and that is the Correlation View. This might help higher outline the connection between two completely different knowledge sequence, and establish which shares or ETFs might assist us diversify our portfolio.

I wish to kind this view in ascending order based mostly on the 20-day correlation as a place to begin. Which shares demonstrated a really completely different return profile from the S&P 500? When it feels as if all shares are doing about the identical factor, this one characteristic might help you shortly establish outliers and positions which might aid you enhance your efficiency by way of diversification.

I’ve discovered the ChartList capabilities to be among the strongest options on the StockCharts platform. When you get into the behavior of utilizing these unimaginable record administration and analytical instruments, I hope you will take pleasure in a better quantity of market consciousness in your life!

RR#6,

Dave

PS- Able to improve your funding course of? Try my free behavioral investing course!

David Keller, CMT

President and Chief Strategist

Sierra Alpha Analysis LLC

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled.

The writer doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the writer and don’t in any means characterize the views or opinions of every other particular person or entity.

David Keller, CMT is President and Chief Strategist at Sierra Alpha Analysis LLC, the place he helps lively buyers make higher choices utilizing behavioral finance and technical evaluation. Dave is a CNBC Contributor, and he recaps market exercise and interviews main specialists on his “Market Misbehavior” YouTube channel. A former President of the CMT Affiliation, Dave can also be a member of the Technical Securities Analysts Affiliation San Francisco and the Worldwide Federation of Technical Analysts. He was previously a Managing Director of Analysis at Constancy Investments, the place he managed the famend Constancy Chart Room, and Chief Market Strategist at StockCharts, persevering with the work of legendary technical analyst John Murphy.

Study Extra