KEY

TAKEAWAYS

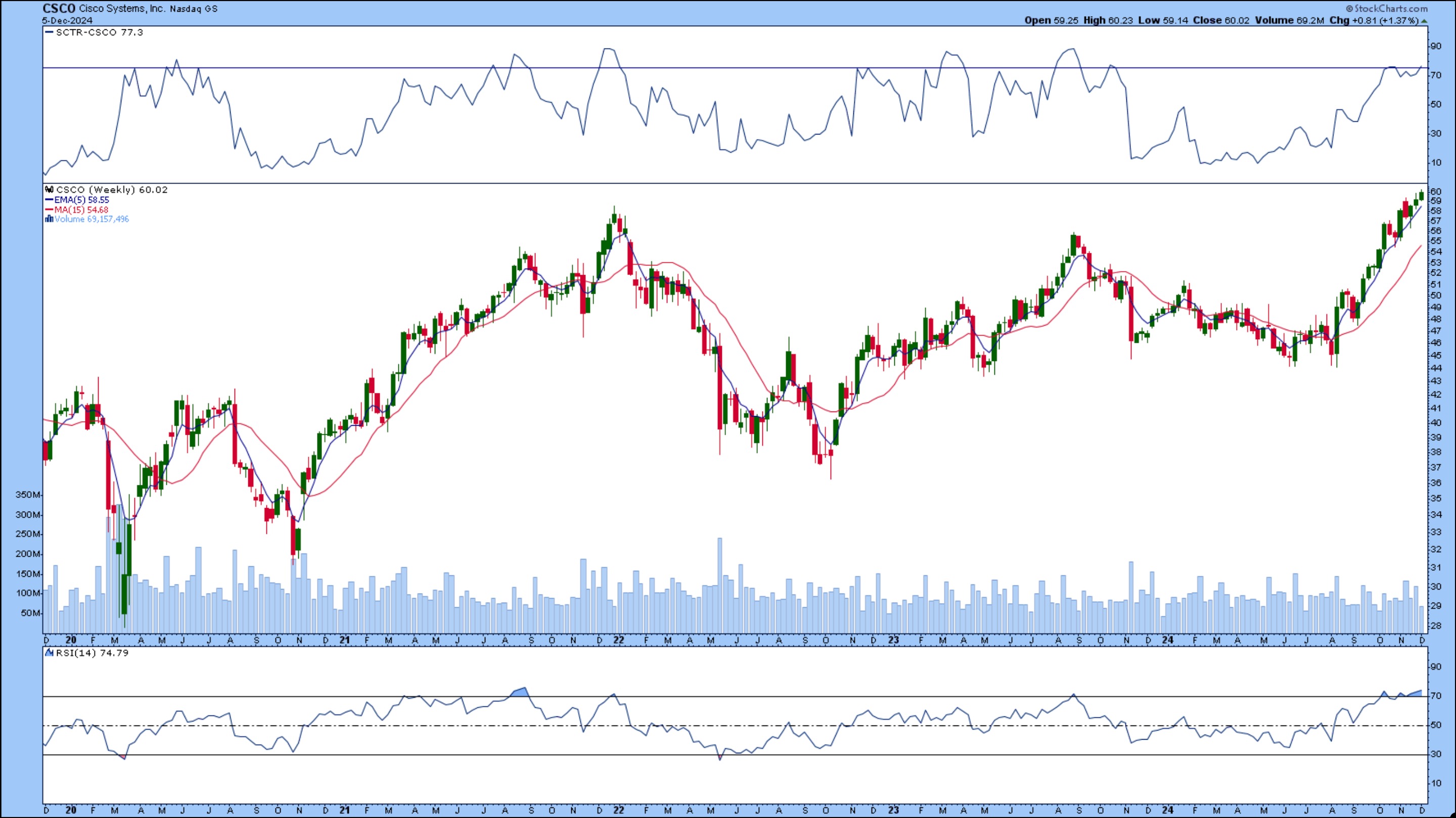

- CSCO inventory has been in a gradual uptrend since August and is outperforming the Nasdaq Composite.

- CSCO’s inventory value is at an all-time excessive and indicators recommend the inventory can proceed trending larger.

- Search for a pullback and a bounce off its 21-day exponential shifting common.

The broader inventory market indexes offered off barely forward of the November Non-Farm Payrolls knowledge, which will probably be launched Friday morning. Relying on which manner the information goes, the market may unload additional or proceed its bullish experience. If the market sells off, which shares are flashing purchase indicators? To assist me determine shares to look at, I ran my StockCharts Technical Rank (SCTR) scan to determine which shares have been gaining technical power.

My SCTR scan filtered 53 shares and ETFs, which I sorted primarily based on the universe (U) (the scan syntax is on the finish of the article). I favor to have a look at large-cap shares and determine which of them are potential investing candidates. Taking place Thursday’s listing, the primary inventory that me was Cisco Methods (CSCO), primarily due to its easy and clear-looking chart.

Simplicity Attracts

The weekly chart of CSCO inventory reveals it reached a brand new all-time excessive on a comparatively sharp upside transfer because the week of September 9. CSCO’s inventory value is buying and selling above its 5-week exponential shifting common (EMA) and its 15-week easy shifting common (SMA).

FIGURE 1. WEEKLY CHART OF CSCO STOCK. The SCTR rating is simply above 76, the inventory value is buying and selling above its 5-week EMA, and its RSI has crossed above 70. There is no indication of a reversal within the uptrend.Chart supply: StockCharts.com. For academic functions.

The SCTR rating has crossed above the 76 threshold, and its relative power index (RSI) is simply above 70. From the information within the Image Abstract web page for CSCO, the inventory is up 29.29% over one yr. These are all indications that the worth motion in CSCO inventory stays bullish.

Let’s now study the every day chart of CSCO inventory to find out whether or not it’s value shopping for and what the best entry and exit factors will probably be. The every day chart confirms the shorter-term pattern continues to be up. The upward-sloping trendline coincides with the 21-day EMA, and buying and selling quantity is barely growing.

FIGURE 2. DAILY CHART OF CSCO STOCK. The inventory has retained its uptrend bouncing off its 21-day EMA. CSCO can be outperforming the Nasdaq Composite barely. The Full Stochastic oscillator signifies the inventory is overbought.Chart supply: StockCharts.com. For academic functions.

CSCO’s efficiency reveals it is outperforming the Nasdaq Composite ($COMPQ) by 15.64% (see panel under CSCO inventory value chart). The Full Stochastic oscillator reveals the inventory is overbought however, as you may see from previous knowledge, the oscillator can keep overbought for an prolonged interval.

The Recreation Plan

CSCO is probably not as glamorous as among the different mega-cap tech shares, however its path is a gentle and gradual uptrend. This can be the rationale it is outperforming the Nasdaq and presumably among the different extra unstable mega-cap shares, equivalent to NVIDIA Corp. (NVDA), Microsoft Corp. (MSFT), and Apple, Inc. (AAPL).

If CSCO’s value motion continues grinding larger slowly and steadily, I’d search for a pullback, which could be to the 21-day EMA or above. I am going to watch the market intently on Friday after the November NFP report is launched to see if there is a selloff or if market continues rising larger.

So long as the technicals keep in place for an uptrend, the inventory is a purchase. When any of the symptoms now not assist the uptrend, you abandon the inventory or don’t even contemplate shopping for it.

Typically, as Bruce Lee would say, “Simplicity is the important thing to brilliance.”

The SCTR Scan

[country is US] and [sma(20,volume) > 100000] and [[SCTR.us.etf x 76] or [SCTR.large x 76] or [SCTR.us.etf x 78] or [SCTR.large x 78] or [SCTR.us.etf x 80] or [SCTR.large x 80]]

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled.

Jayanthi Gopalakrishnan is Director of Web site Content material at StockCharts.com. She spends her time arising with content material methods, delivering content material to teach merchants and traders, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising company for monetary manufacturers. Previous to that, she was Managing Editor of Technical Evaluation of Shares & Commodities journal for 15+ years.

Be taught Extra