After initially forming a recent incremental lifetime excessive, the markets succumbed to promoting stress from increased ranges after spending some indecisive classes in the course of the week. The week that glided by noticed some early indicators of the Nifty coming into into broad corrective consolidation whereas ending close to its low level of the buying and selling vary. Given the corrective undertone, the buying and selling vary acquired wider as nicely; the Nifty 50 oscillated in a 532.35-point buying and selling vary. The volatility spiked as nicely; the volatility barometer India VIX surged by 13.63% to fifteen.22 on a weekly foundation. Whereas setting a definite corrective undertone, the headline index closed with a web weekly lack of 383.75 factors (-1.52%).

Within the earlier technical be aware, it was categorically identified that the Nifty stays considerably deviated from its means; the closest 20-week MA which is at 23795 is 1057 factors under the present ranges. The 50-week MA which is at 22208 is at the moment over 2640 factors under the present shut. Even when the Nifty makes an attempt a modest mean-reversion, it could actually see this corrective bias getting prolonged. The spinoff information means that the Index has dragged its resistance ranges decrease; the zone of 25000-25250 is now an vital resistance for the index. As long as the Nifty is under this zone, it’s more likely to keep susceptible to profit-taking bouts from increased ranges.

Count on the markets to begin the recent week on a mushy and tepid be aware. The degrees of 25075 and 25250 are more likely to act as resistance factors for Nifty; the helps are available decrease at 24600 and 24480 ranges.

The weekly RSI stands at 67.74; it has slipped under the 70 ranges from the overbought space which is bearish. It nonetheless stays impartial and doesn’t present any divergence towards the worth. The weekly MACD is bullish and above its sign line; nonetheless, the narrowing Histogram hints at an imminent unfavourable crossover within the coming weeks.

A Bearish Engulfing candle has emerged; the incidence of such a candle following an uptrend has the potential to disrupt the present development. Nevertheless, this can want affirmation going forward from right here.

The sample evaluation of the weekly chart exhibits that the markets are displaying some first indicators of fatigue at increased ranges. The zone of 25000-25250 has turn into a right away resistance zone and till the Nifty strikes previous this zone convincingly, it’s unlikely to indicate any trending transfer on the upside. It continues to deviate from its imply; this may increasingly preserve the index considerably susceptible to corrective retracements.

All in all, the markets will possible proceed exhibiting tentative habits; except the talked about resistance zone is just not taken out convincingly, the Nifty might stay below broad consolidation or corrective pressures. Defensive setup may additionally stay evident, pockets like IT, Pharma, FMCG, Power, and many others., might do nicely. Avoiding extreme leveraged exposures and staying extremely selective whereas making recent purchases is strongly really useful. Whereas vigilantly guarding earnings at increased ranges, a cautious strategy is suggested for the approaching week.

Sector Evaluation for the approaching week

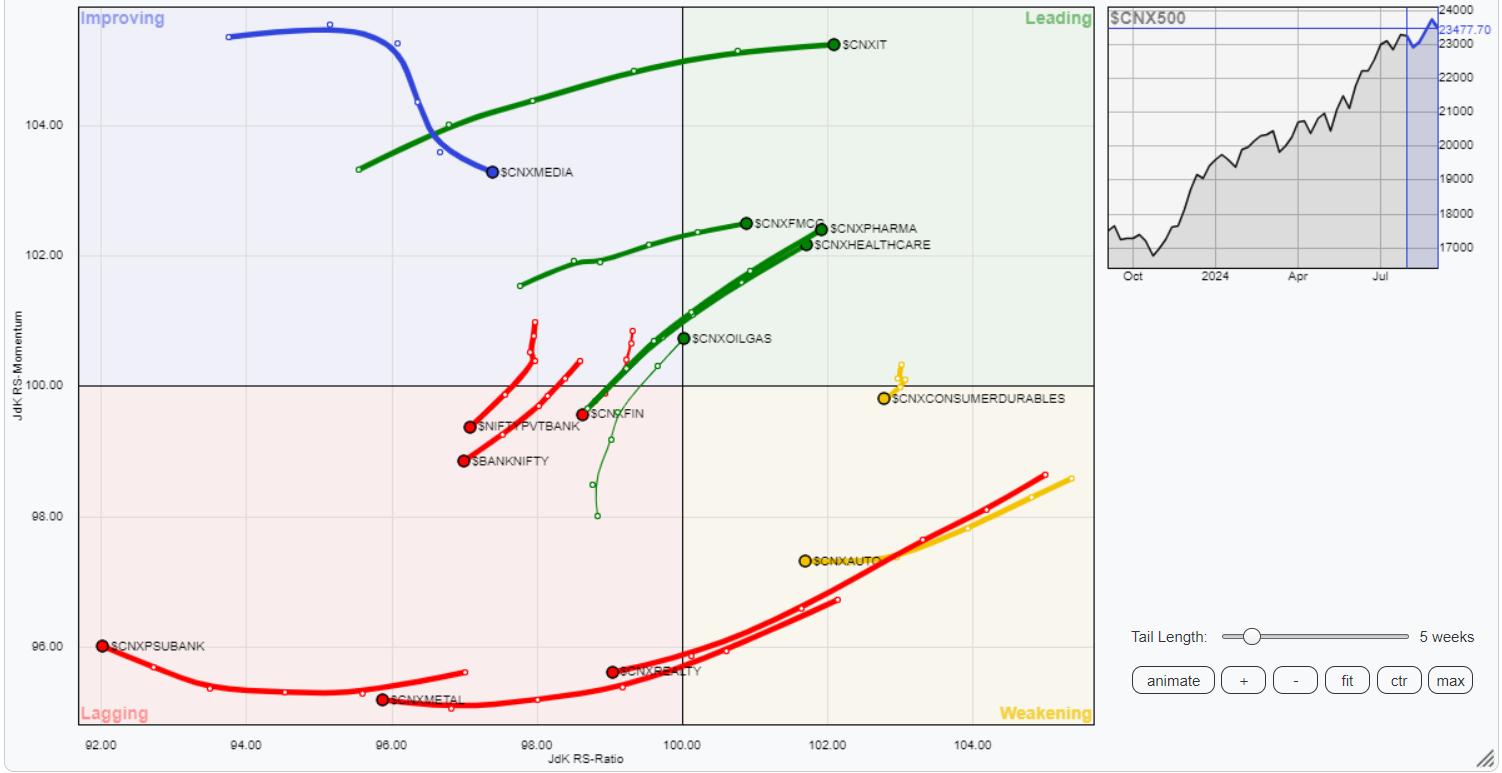

In our have a look at Relative Rotation Graphs®, we in contrast varied sectors towards CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all of the shares listed.

Relative Rotation Graphs (RRG) present the Nifty Pharma, IT, Consumption, and Midcap 100 indices are contained in the main quadrant. Although the Midcap 100 index is giving up on its relative momentum, these teams are more likely to comparatively outperform the broader markets over the approaching weeks.

The Nifty Auto and PSE Indicex are contained in the weakening quadrant; the PSE pack is displaying sturdy enchancment in its relative momentum towards the broader Nifty 500 index.

The Nifty Monetary Companies, Commodities, Infrastructure, Banknifty, PSU Financial institution, Metallic, the Realty indices proceed to languish contained in the lagging quadrant are are set to comparatively underperform the broader Nifty 500 index. The Nifty Power Index can be contained in the lagging quadrant; nonetheless, it’s seen sharply enhancing its relative momentum towards the broader markets.

The Media and the Companies sector indices are at the moment positioned contained in the enhancing quadrant.

Vital Observe: RRG™ charts present the relative energy and momentum of a bunch of shares. Within the above Chart, they present relative efficiency towards NIFTY500 Index (Broader Markets) and shouldn’t be used instantly as purchase or promote indicators.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

www.EquityResearch.asia | www.ChartWizard.ae

Milan Vaishnav, CMT, MSTA is a capital market skilled with expertise spanning near twenty years. His space of experience contains consulting in Portfolio/Funds Administration and Advisory Companies. Milan is the founding father of ChartWizard FZE (UAE) and Gemstone Fairness Analysis & Advisory Companies. As a Consulting Technical Analysis Analyst and along with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Impartial Technical Analysis to the Purchasers. He presently contributes every day to ET Markets and The Financial Occasions of India. He additionally authors one of many India’s most correct “Day by day / Weekly Market Outlook” — A Day by day / Weekly E-newsletter, at the moment in its 18th 12 months of publication.

Be taught Extra