Samsung está generando noticias con sus próximos dispositivos Samsung Galaxy A y XR. Filtraciones recientes han revelado accesorios oficiales para los Galaxy A56, A36 y A26, junto con nuevos detalles emocionantes sobre las gafas XR del Proyecto Moohan de Samsung.

Accesorios oficiales para Galaxy A56, A36 y A26

Un nuevo informe muestra accesorios oficiales diseñados para los últimos modelos Samsung Galaxy A, que incluyen:

- Fundas protectoras de inserción

- Cubiertas transparentes

- Fundas reforzadas

- Protectores de silicona

- Protectores de pantalla

Estos accesorios estarán disponibles en múltiples colores, ofreciendo más opciones de personalización.

Samsung Galaxy A26 5G: Características clave y especificaciones

El próximo Samsung Galaxy A26 5G según rumores incluiría:

- Dimensiones de 164 × 77,5 × 7,7 mm y peso de 209 g

- Pantalla FHD de 6,64 pulgadas o 6,7 pulgadas con tasa de refresco de 120 Hz

- Procesador Exynos 2400e SoC o un Exynos 1280 overclockeado

- Máximo de 8 GB de RAM y 256 GB de almacenamiento

- Batería de 4.565 mAh

Samsung Galaxy A56 5G y Galaxy A36 5G: ¿Qué hay de nuevo?

Se espera que el Samsung Galaxy A56 5G funcione con el chipset Exynos 1580, con configuraciones:

- 8 GB de RAM 128 GB de almacenamiento

- 12 GB de RAM 256 GB de almacenamiento

- Batería de 4.905 mAh

- Posible lanzamiento en China

Mientras tanto, el Samsung Galaxy A36 5G contará con pantalla perforada de 1080 × 2340 y procesador Qualcomm Snapdragon 6 Gen 3, con al menos 6 GB de RAM.

Gafas XR del Proyecto Moohan: Un salto en realidad extendida

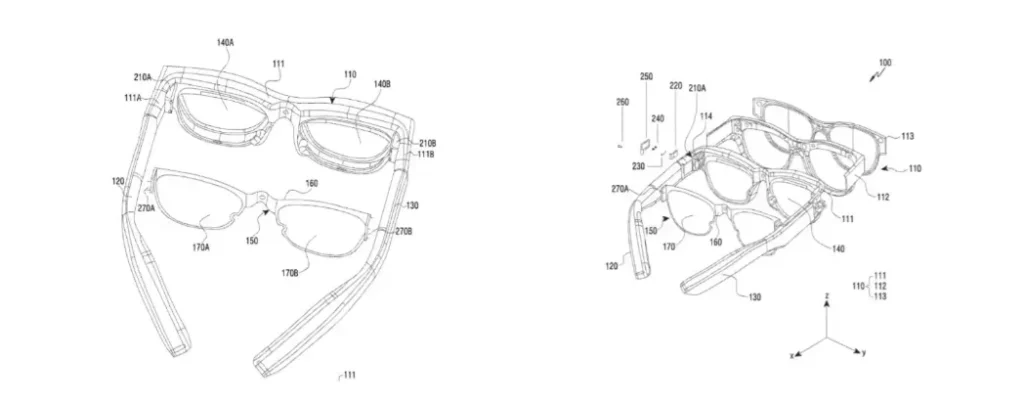

Nueva patente confirma funciones innovadoras

En el evento Samsung Un

Estas mejoras indican que el visor admitirá perfectamente experiencias de realidad aumentada (AR) y realidad virtual (VR). El Proyecto Moohan de Samsung funcionará en la plataforma Android XR, permitiendo: El visor presenta un diseño tipo gafas con un botón integrado en el marco de la pantalla, que probablemente funciona como interruptor de encendido. Comparado con Apple Vision Pro, el dispositivo de Samsung parece más ligero y compacto. Samsung ha confirmado que el visor: Durante una demostración en vivo, un tester operó el visor completamente mediante gestos manuales y comandos de voz con Gemini. Un indicador virtual rastreaba la actividad conversacional multimodal, mostrando controles intuitivos con IA. Aunque Samsung no ha demostrado oficialmente capacidades gaming, filtraciones confirman que el visor: Según Google, las aplicaciones funcionarán en formato “ventana espacial”, permitiendo redimensionar y reposicionar pantallas virtuales mediante gestos manuales, replicando esencialmente el funcionamiento de pantallas físicas en entornos reales. Samsung afirma que el Proyecto Moohan ofrece comodidad excepcional, diseño ultraligero y campo de visión inmersivo, proporcionando una verdadera experiencia XR de próxima generación. Sin embargo, sigue sin aclararse si la unidad demostrada era un modelo final o un prototipo. Las configuraciones finales de hardware y software podrían sufr

En cuanto al calendario de lanzamiento, Google ha confirmado que el primer auricular XR de Samsung llegará al mercado el próximo año. ¡Manténganse atentos para más actualizaciones!

Tecnología inmersiva e interacción multimodal

Cambio entre VR/AR Batería externa

Gaming de próxima generación y sistema de ventana espacial

¿Y los juegos?

Ventanas espaciales: Una revolución en pantallas virtuales

Cronograma de lanzamiento y reflexiones finales