Si alguna vez te has preguntado por qué tu práctica de yoga no está produciendo resultados, no estás solo. Muchas personas experimentan molestias, como dolor de espalda y músculos apretados, en lugar de sentirse ligeros y más estirados después de sus sesiones. Los supuestos beneficios del yoga, como la pérdida de peso y la escultura corporal, simplemente no parecen aparecer.

¡La verdad es que el 90% de las personas luchan con yoga ineficaz porque su respiración está mal! La respiración es la potencia oculta detrás de la extensión espinal y la activación del núcleo. Si te equivocas la respiración, incluso la pose perfecta se convierte en “yoga ineficaz”. La bengala de costillas, el dolor de espalda y la baja eficiencia de quema de grasas son causadas por una respiración incorrecta.

Hoy, compartiré 9 técnicas de respiración simples pero efectivas que complementarán sus poses de yoga, lo que hace que su práctica sea mucho más impactante. ¡Vamos a sumergirnos!

1. Inhalar, exhalar

En poses como Pose de Mountain (Tadasana), inhale mientras imagina que la energía se eleva del suelo, alargando su columna vertebral. Mientras exhala, permita que su cuerpo se relaje y se hunda más profundamente. Este método ayuda a encontrar el equilibrio en la pose y estabiliza su cuerpo.

Beneficios de la pose de montaña: Mejora el equilibrio y el enfoque.

2. Inhale hacia adelante, exhale hacia atrás

En poses como la pose de la copa de gato, inhale mientras abre el pecho hacia adelante y exhala mientras su columna se arquea y se mueve hacia atrás. Esta técnica de respiración agrega flexibilidad a su columna mientras disminuye la tensión.

Beneficios de la pose de la vaca de gato: Digestión del SIDA y ayuda a eliminar la grasa del vientre.

3. Inhalar para abrir, exhalar para cerrar

En Warrior, planteo, inhalo mientras extiende los brazos hacia arriba y exhala mientras reúne las manos frente a su pecho. Este ritmo respirador permite que su energía fluya con el movimiento, dando a su práctica una sensación más rítmica.

Beneficios de Warrior I Pose: Reduce el exceso de grasa en la cintura, el abdomen y las caderas.

4. Exhale a la curva lateral, inhale para regresar

EnPose de triángulo, exhale mientras dobla su cuerpo a un lado e inhala mientras regresa a la posición vertical. Esta técnica ayuda a profundizar su estiramiento y permite que su cuerpo se relaje aún más.

Beneficios de la pose de Triangle: Estira la columna vertebral y mejora la digestión.

5. Exhale para girar, inhalar para regresar

En giro espinal sentado, exhale mientras gira su cuerpo e inhala mientras regresa a una posición neutral. Este método de respiración lo ayuda a girar más profundamente y le da a sus órganos internos un masaje suave.

Beneficios del giro espinal sentado: Tones el abdomen y promueve la eliminación de toxinas.

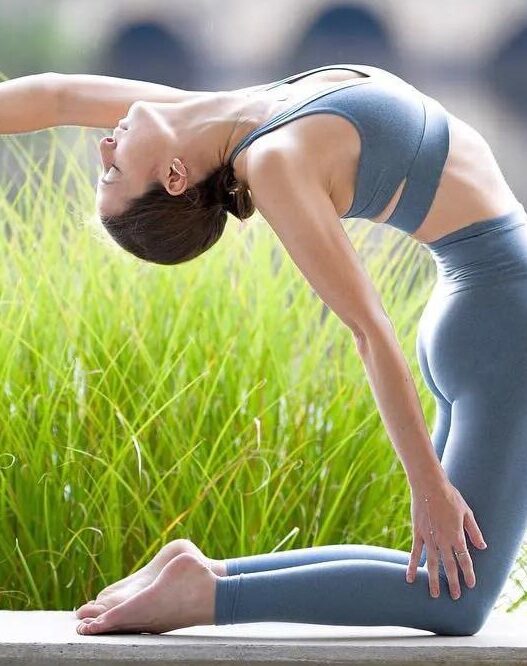

6. Exhale para Backbend, inhale para la extensión

En la pose de camello, inhale mientras extiende la columna vertebral y levanta el pecho, y exhala mientras aprieta el núcleo y realiza el backbend. Esto garantiza un poderoso backbend sin sobrecargar la espalda baja.

Beneficios de la pose de camello: Previene la piel caída y abre el cofre, evitando la caída de los senos.

7. Exhale para la curva hacia adelante, inhale para regresar

En la curva hacia adelante, exhale mientras dobla hacia adelante e inhala mientras se levanta de nuevo. Esta técnica de respiración mejora su curva hacia adelante y mantiene la columna relajada.

Beneficios de estar de pie hacia adelante Bend: Fortalece el hígado, nutre la cara y ayuda con la desintoxicación.

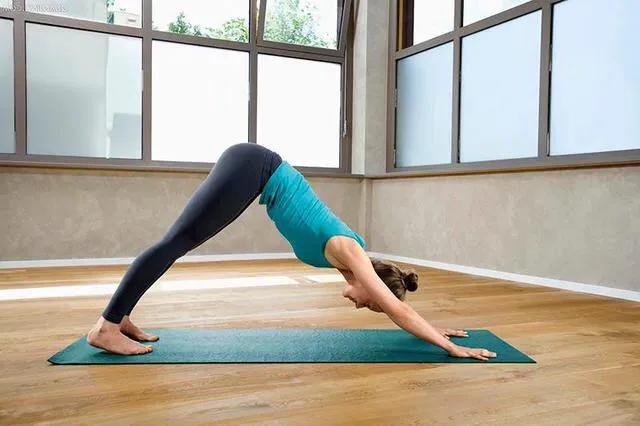

8. inhalar para entrar en pose, exhalar para regresar

En el perro orientado hacia abajo, inhale mientras te mueves a la pose y exhala mientras haz la transición a la postura de la tabla. Esto suaviza sus transiciones y mantiene su cuerpo sincronizado con cada movimiento.

Beneficios del perro con orientación hacia abajo: Fortalece las piernas y esculpa la parte posterior.

9. inhalar para alargar, exhalar para profundizar

En la pose del niño, inhale mientras alarga su columna vertebral y exhala mientras profundiza el estiramiento. Esto ayuda a relajar el cuerpo mientras permite un estiramiento más profundo y más restaurativo.

Beneficios de la pose del niño: Alivia el estrés, relaja el cuerpo y reduce la fatiga.

¿Por qué respirar es tan crucial en el yoga?

La respiración no se trata solo de mantenerse con vida, es fundamental para la práctica del yoga. La respiración correcta ayuda:

✅ profundizar sus poses y aumentar la estabilidad

✅ Aliviar el estrés y la ansiedad

✅ Aumenta tu energía y enfoque

✅ Mejorar la circulación sanguínea y la salud digestiva

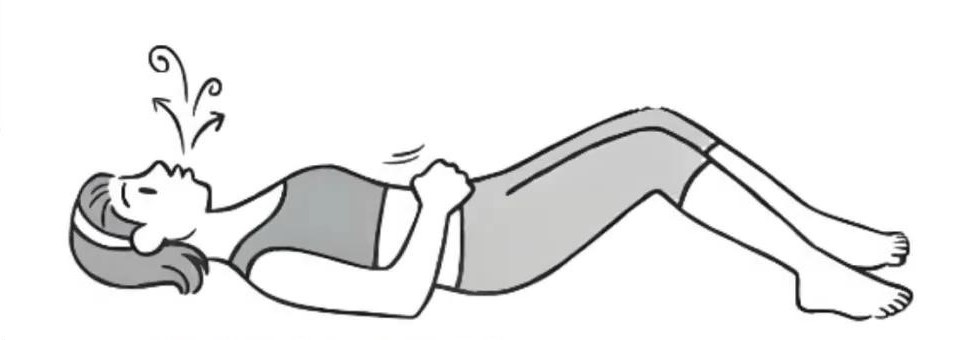

¿Cómo practicar la respiración diafragmática?

Para comenzar, encuentre una posición cómoda, preferiblemente acostada en el piso, una cama o cualquier superficie que se sienta relajante. Esto hace que sea más fácil sentirse y conectarse con la respiración.

Concéntrese en su aliento. Inhale profundamente y sienta que su cuerpo se expande. Exhale y contrata a sus músculos a medida que se contraen.

Dominar la respiración adecuada mejorará naturalmente su práctica de yoga y le dará mayores resultados. El primer paso es aprender a respirar correctamente, ¡entonces las posturas seguirán naturalmente!