Making an attempt to foretell the subsequent sizzling actual property market is like catching an eel with grease in your fingers: The second you assume you’ve acquired a deal with on the subsequent sizzling spot, everybody else has the identical thought. Stock shrinks whereas costs shoot up, and what as soon as appeared good abruptly cools.

Nevertheless, when you’re ready to be particular in your search, you possibly can pinpoint the subsequent nice funding alternative for various market segments.

Affordably Priced Markets

In response to Realtor.com knowledge, just a few markets stand out when you’re searching for an inexpensive funding however are cautious of excessive rates of interest. Nevertheless, you might need to rush as a result of—you guessed it—different buyers are already waving their checkbooks. Latest knowledge reveals buyers made up 14.8% of dwelling purchases within the first quarter of 2024 —the best share within the historical past of the information commenced, relationship again to 2001.

“Traders are usually the primary to tug out of the market, as seen in 2023, in addition to the primary to reenter, which we’re seeing now,” Realtor.com senior financial analyst Hannah Jones mentioned in a press launch concerning Realtor.com’s Q1 financial report.

The buyers Jones speaks of are largely smaller ones, buying 10 or fewer houses, which made up 62.6% of funding buys—one other groundbreaking quantity. Apparently, Jones famous that increased rates of interest and residential costs induced bigger buyers to again away, whereas smaller buyers, sensing offers, grew to become extra engaged in inexpensive markets.

The Midwest and South Are Good Bets for Traders

Crunching the numbers, these are the burgeoning, inexpensive markets the place buyers are snapping up offers. Not surprisingly, many are within the Midwest, with three of Missouri’s prime 5 cities seeing round 1 in 5 houses bought by buyers in Q1:

Southern metro cities are additionally proving fashionable, specifically Birmingham, Alabama (18.7%) and Memphis, Tennessee (18.2%).

Different cities which have seen elevated investor exercise and are returning to pre-pandemic ranges embody:

9 Cities Anticipated to Develop Over the Subsequent 10 Years

GoBankingRates.com, as revealed on yahoo.com, spoke to a roundtable of Realtors from Keller Williams, Seaside Life Premier, Caldwell Banker-Caine, and Berkshire Hathaway HomeServices Verani Realty. Listed here are their picks for markets that can develop within the subsequent 10 years, plus my evaluation of every.

1. Boise, Idaho

With dwelling appreciation of 218% and year-over-year progress of 12% for the final decade, it’d make you assume that Boise has already gone via its golden years. However, not so, based on the specialists, who declare extra of the identical lies forward.

Boise’s housing market is anticipated to proceed rising over the subsequent decade resulting from a number of components. For one, town is experiencing sturdy inhabitants progress, pushed by an inflow of residents attracted by Boise’s inexpensive price of dwelling and prime quality of life. Second, Boise’s sturdy job market, with rising wages and a diversified financial system, contributes to sustained demand for housing. The truth is, Boise is a mini Silicon Valley and has loads of tech job choices, an indication of sturdy wages and stability.

2. Fort Wayne, Indiana

Fort Wayne‘s median itemizing worth of slightly below $200,000 is 102% lower than the nationwide median, but it surely has seen a worth decline of seven.6% over the past 12 months. Regardless of this, the basics are there, with general appreciation, inhabitants progress, and low property taxes, making this a strong place to place your money.

3. Las Vegas, Nevada

What occurs in Vegas stays in Vegas until it’s discussing actual property—during which the entire nation is in on the dialogue.

Nevada’s low taxes have seen Californians depart en masse for Las Vegas and surrounding areas. The hospitality business, excessive rental demand for inexpensive housing, a rising inhabitants, and vital infrastructure funding have made Sin Metropolis an ongoing funding hub. With added industries corresponding to healthcare, expertise, and leisure, buyers must be OK with betting large on Vegas for years to return.

4. Seattle, Washington

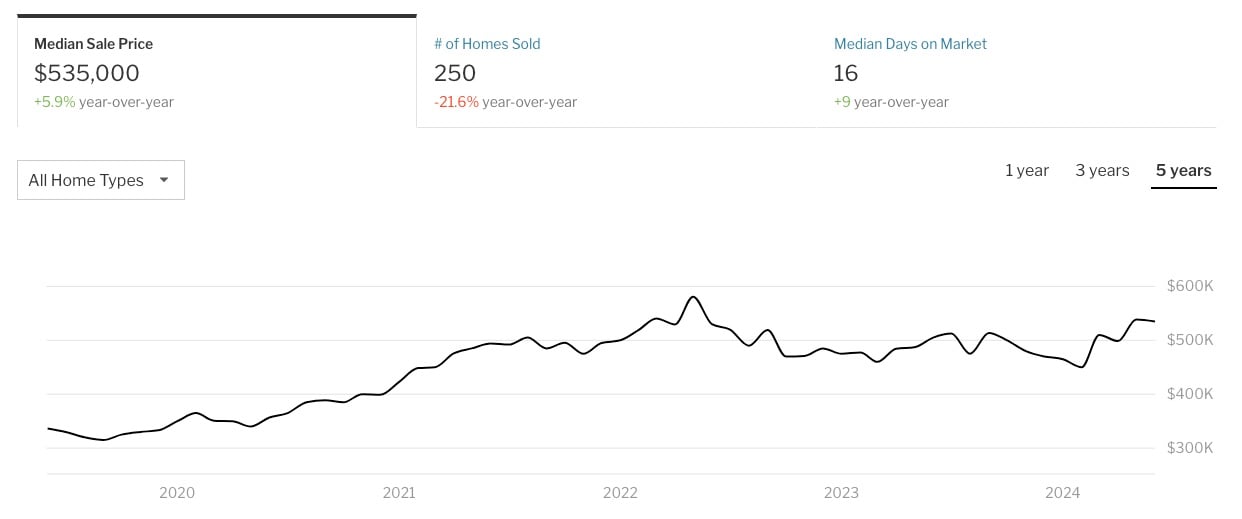

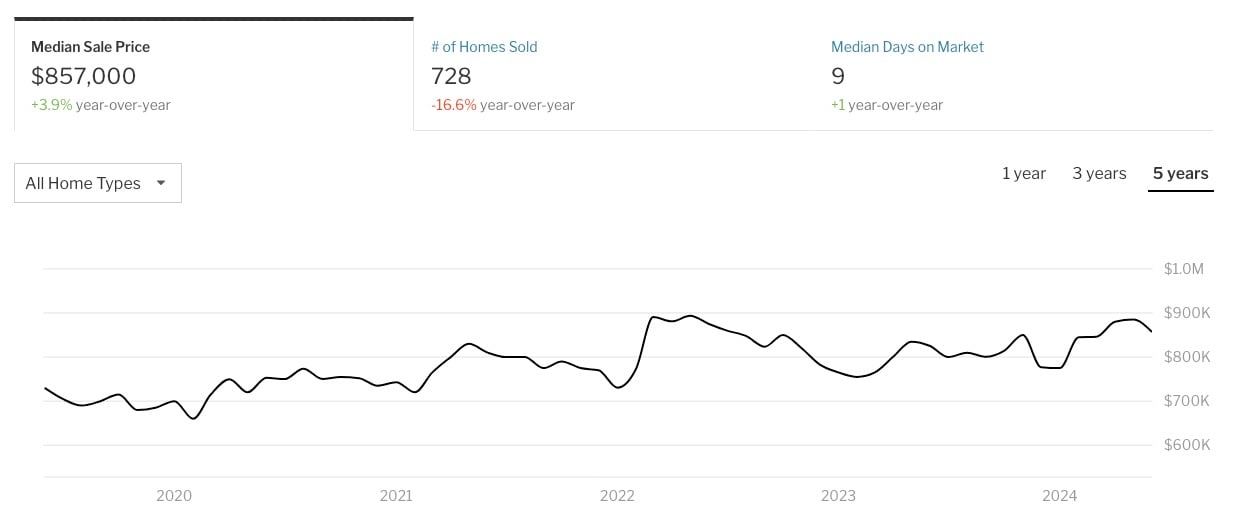

Sure, Seattle is costly, but it surely’s remarkably steady. The house of mega-corporations Amazon, Nike, and Starbucks—and now a brand new wave of tech companies—has a sturdy monitor document of appreciation, with costs excessive and rising. House values have doubled up to now 5 years, rising twice as quick because the nationwide common since 2016. Final 12 months, median dwelling costs confirmed a 5.9% year-over-year improve, with continued progress anticipated.

5. Denver, Colorado

Denver has already loved some main appreciation lately, with its median dwelling worth at present sitting at a strapping $600,000. Nevertheless, based on actual property specialists, its proximity to main cities corresponding to Boulder, Fort Collins, and Colorado Springs, in addition to nature-rich geography, has buyers and residents teeming in, with extra progress on the horizon.

6. Raleigh-Durham, North Carolina

Often known as the Analysis Triangle, the most important universities of the College of North Carolina at Chapel Hill, Duke, and North Carolina State College name Raleigh-Durham dwelling. House costs right here usually observe the nationwide common, and there are many high-paying jobs in healthcare, expertise, and prescribed drugs, with giant corporations corresponding to IBM, Apple, and Epic Video games situated within the space. These employment alternatives, matched with cheap dwelling costs, imply this space has loads of progress potential.

7. Charlotte, North Carolina

A light local weather, only some hours away from the seaside or mountains, a vibrant job market (significantly in banking), and an inexpensive price of dwelling have many specialists predicting that Charlotte will solely proceed to rise. House costs are anticipated to extend by round 145% over the subsequent decade.

8. Phoenix, Arizona

House costs right here have risen quicker than a Phoenix thermometer’s mid-summer readings. Nevertheless, tech jobs provided by Uber and Amazon, 200 golf programs, and a vibrant nightlife and restaurant scene all imply Phoenix remains to be guess for additional dwelling worth hikes of 130% over the subsequent decade— supplied excessive climate doesn’t get too excessive.

9. Nashua, New Hampshire

Southern New Hampshire has been one of many beneficiaries of the work-from-home development, with former Bostonians forgoing skyrocketing dwelling costs and transferring inside a hybrid-work commuting distance. Specialists predict the small however mighty Nashua will see dwelling costs improve by 25% to 50% over the subsequent decade.

Bonus: Three Small Cities to Make investments In Inside the Subsequent 5 Years

In case you like the concept of individuals understanding you on the publish workplace or saying “hello” to you on the grocery retailer, small-town investing may be extra your pace. Small markets are usually extra inexpensive than bigger cities and cities and might produce unimaginable actual property alternatives.

Three small cities, specifically, are highlighted beneath. These are near bigger cities however actually rural. With sensible due diligence, you possibly can line up nice investments over the subsequent few years.

1. Morganton, North Carolina

Whereas the Analysis Triangle of North Carolina has boomed lately, Morganton (inhabitants 20,000) may quickly be on individuals’s radars as a less expensive different resulting from main grants from the U.S. Nationwide Science Basis (NSF). A kind of grants is for the North Carolina Sustainable Textiles Innovation Engine, which is about to obtain as much as $160 million in NSF funding over the subsequent 10 years. Because of its proximity to close by Asheville and the Blue Ridge Mountains, plus affordability, Morganton is anticipated to do effectively.

2. Shelbyville, Tennessee

“Because the rising costs in Nashville drive the extra budget-conscious homebuyers additional out, I anticipate these areas to be a wonderful place to park your actual property {dollars} over the subsequent few years,” mentioned Joe Hafner, dealer and proprietor at Hafner Actual Property, on this article.

Positioned about 60 miles from Nashville and 25 miles from Murfreesboro, Shelbyville (inhabitants 25,000) ought to profit from appreciation over the subsequent decade because of the city’s location of whiskey maker Nearest Inexperienced Distillery, which has pumped thousands and thousands of {dollars} into the world, making it an enthralling small city primed for additional improvement.

Areas like this go to point out how a lot of an affect companies can have on a city and the way that cascades into the native housing market. The perfect buyers would search this lesser-known alternative out on their very own.

3. Accord, New York

In case you’re searching for a scenic hamlet within the Rondout Valley of New York, Accord in Ulster County presents views of the Shawangunk Mountains and accessibility from New York Metropolis. Crammed with native farmer’s markets, artisanal outlets, and a severe foodie scene, this quaint cease on the way in which additional north to the state capital, Albany, appeals to these in search of a progressive sensibility, accessibility, and an agreeable tempo of life.

Whereas Accord is a sleepy small city, Ulster County as an entire presents a number of actual property alternatives, from money flowing long-term holds to short-term leases. That is positively a spot you’ll need to do a little analysis on.

Better of the Luxurious Market

However what if you wish to put money into someplace extra upscale? Draper, Utah, is a vacation spot to think about.

In case you’re searching for a luxurious dwelling with the potential for fairness appreciation, based on the Wall Avenue Journal, you can do a lot worse than parking your money on Utah’s Silicon Slopes, particularly Draper.

Positioned close to the Wasatch Mountain Vary, between Salt Lake Metropolis and Provo, Draper has boomed for the reason that pandemic. A brand new multibillion-dollar undertaking known as the Level is being developed on 600 acres of state-owned land, which will combine workplace buildings, housing, retail, leisure and extra.

Nice colleges, a 30-minute commute to giant cities and airports, and a hanging pure panorama have seen dwelling costs soar over the previous few years. As of 2023, the annual median dwelling worth was $749,895. The realm’s main improvement will likely be comparable within the upcoming years. Nevertheless, the danger of wildfires and landslides might improve dwelling insurance coverage prices, together with dwelling costs.

Streamlining Your Actual Property Investments

As you discover these up-and-coming markets, it’s good to think about the way you’ll handle your rising portfolio. That is the place property administration software program like Hemlane generally is a game-changer, particularly these venturing into new and unfamiliar markets.

Hemlane is designed to simplify property administration duties, from tenant screening and hire assortment to upkeep coordination. For buyers focusing on a number of markets throughout totally different states, Hemlane’s potential to handle properties remotely might be useful. Its nationwide community of native brokers and upkeep professionals ensures you have got boots on the bottom, even when you’re investing from afar.

Furthermore, Hemlane’s clear monetary reviews present you ways your investments are performing throughout numerous markets, permitting you to make data-driven choices about the place to focus your efforts subsequent. Whether or not you’re simply beginning with a single property in Fort Wayne or managing a various portfolio spanning from Boise to Charlotte, streamlining your operations with the appropriate instruments, you possibly can give attention to discovering your subsequent large alternative.

Remaining Ideas

With rates of interest anticipated to fall considerably within the subsequent 24 months whereas stock will increase, homebuying might quickly be again in trend after a turgid few years. Nevertheless, buyers must purchase sensible for long-term appreciation and hedge towards one other downturn.

Most of the cities and cities talked about right here will not be main metros however provide accessibility and the potential for progress in their very own proper resulting from funding. They’re additionally inexpensive and will money stream as soon as charges drop.

Nevertheless, if in case you have the cash and are searching for appreciation slightly than leases, main cities corresponding to Las Vegas, Phoenix, and Seattle or a tech hub like Draper may be a wonderful place to park your cash.

This text is introduced by Hemlane

Hemlane is reworking the property administration panorama with its revolutionary, tech-driven strategy. What units Hemlane aside isn’t just its expertise but additionally its distinctive customer-facing group, which handles tenant calls, late hire disputes, tenant communications, lease negotiations, and offers entry to a community of vetted distributors, permitting landlords to be extra hands-off. Hemlane’s user-friendly interface and built-in strategy empower property homeowners and managers with real-time insights and higher communication with tenants, setting new requirements for effectivity, transparency, and effectiveness within the property administration business.

Word By BiggerPockets: These are opinions written by the creator and don’t essentially signify the opinions of BiggerPockets.