Yesterday, the S&P 500 index reached a brand new document excessive of 5,670.81, briefly surpassing the earlier excessive from July 16 earlier than reversing and shutting simply 0.03% increased. Immediately’s focus is on the FOMC price resolution, with the announcement scheduled for two:00 p.m., adopted by a press convention at 2:30 p.m. The index is predicted to open just about flat and can doubtless consolidate forward of the Fed launch, which is predicted to extend market volatility.

I’m sustaining a speculative quick place, opened on Monday.

Final week, the investor sentiment deteriorated, as proven by AAII Investor Sentiment Survey on Wednesday, which reported that 39.8% of particular person traders are bullish, whereas 31.0% of them are bearish, up from 24.9% final week.

The S&P 500 index rebounded from its July excessive yesterday, as we will see on the each day chart.

Nasdaq 100 continues to fluctuate

The tech-focused Nasdaq 100 gained 0.05% yesterday, following a 0.5% decline on Monday. It continued fluctuating close to the 19,500 stage.

The index stays comparatively weaker than the broader market, buying and selling under the native excessive from August 22 and considerably under the July 10 document excessive of 20,690.97. This morning, the Nasdaq 100 is predicted to open 0.1% increased.

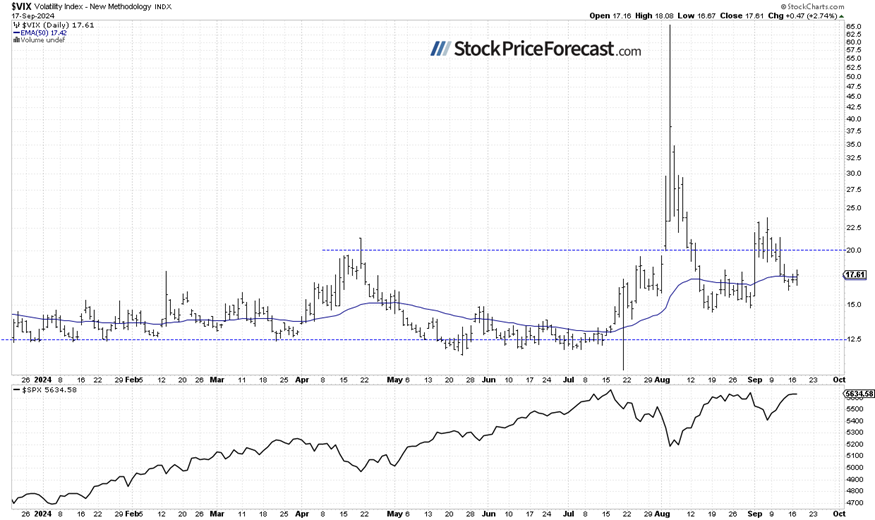

VIX: Shifting alongside 17

On the earlier Friday, the VIX index, a measure of market concern, reached a neighborhood excessive of 23.76. It was indicating elevated concern amongst traders. Nevertheless, a inventory rebound on final week pushed the VIX decrease; yesterday, it remained under 18.

Traditionally, a dropping VIX signifies much less concern out there, and rising VIX accompanies inventory market downturns. Nevertheless, the decrease the VIX, the upper the chance of the market’s downward reversal. Conversely, the upper the VIX, the upper the chance of the market’s upward reversal.

S&P 500 futures contract: Sideways forward of the Fed

Let’s check out the hourly chart of the S&P 500 futures contract (December collection). The market continues to commerce alongside the 5,700 stage this morning. The assist stage stays at 5,680-5,700. Volatility is predicted to extend after the Fed launch, and the market seems to be forming a short-term prime.

Conclusion

This morning, inventory costs are anticipated to open flat, with all eyes on the Fed’s price resolution later as we speak. The market has been rallying forward of the occasion, however the important thing query stays: what is going to occur afterward? A “purchase the rumor, promote the information” state of affairs appears doubtless, however a bullish breakout to new highs cannot be dominated out both.

I opened a speculative quick place within the S&P 500 futures contract on Monday.

In my Inventory Worth Forecast for September 2024, I famous that, “the market skilled vital volatility in August, with a roller-coaster trip that included a sell-off to the August 5 native low and a subsequent advance, resulting in a consolidation close to the document excessive. (…) sharp reversal suggests extra volatility in September. Final month, I wrote that ‘August is starting on a really bearish observe, however the market might discover a native backside in some unspecified time in the future.’ The identical could possibly be stated as we speak, and September will doubtless not be completely bearish for shares.”

For now, my short-term outlook is bearish.

Right here’s the breakdown:

-

The S&P 500 reached a brand new document excessive, briefly surpassing its July peak.

-

Traders await as we speak’s FOMC price resolution.

-

In my view, the short-term outlook is bearish.

Need free follow-ups to the above article and particulars not out there to 99%+ traders? Signal as much as our free e-newsletter as we speak!