Investor Perception

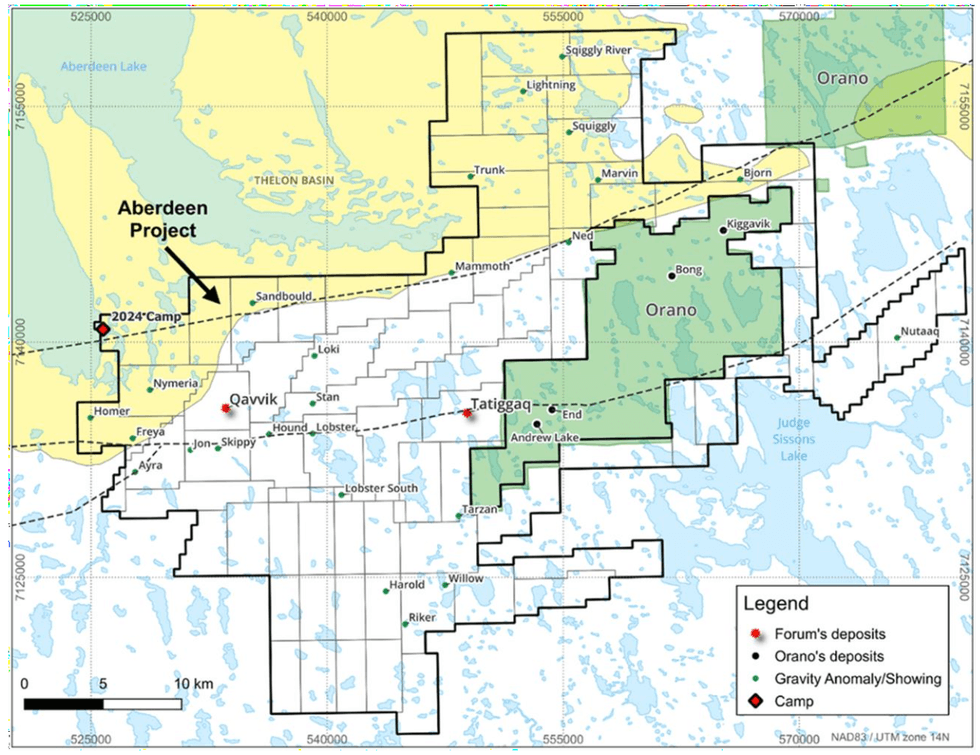

Actively exploring the extremely potential Aberdeen uranium property in Nunavut’s Thelon Basin, Discussion board Vitality’s extremely skilled technical crew led by former Cameco geologist Dr. Rebecca Hunter is poised to construct on its vital Tatiggaq discovery amid a unbroken uranium bull market.

Overview

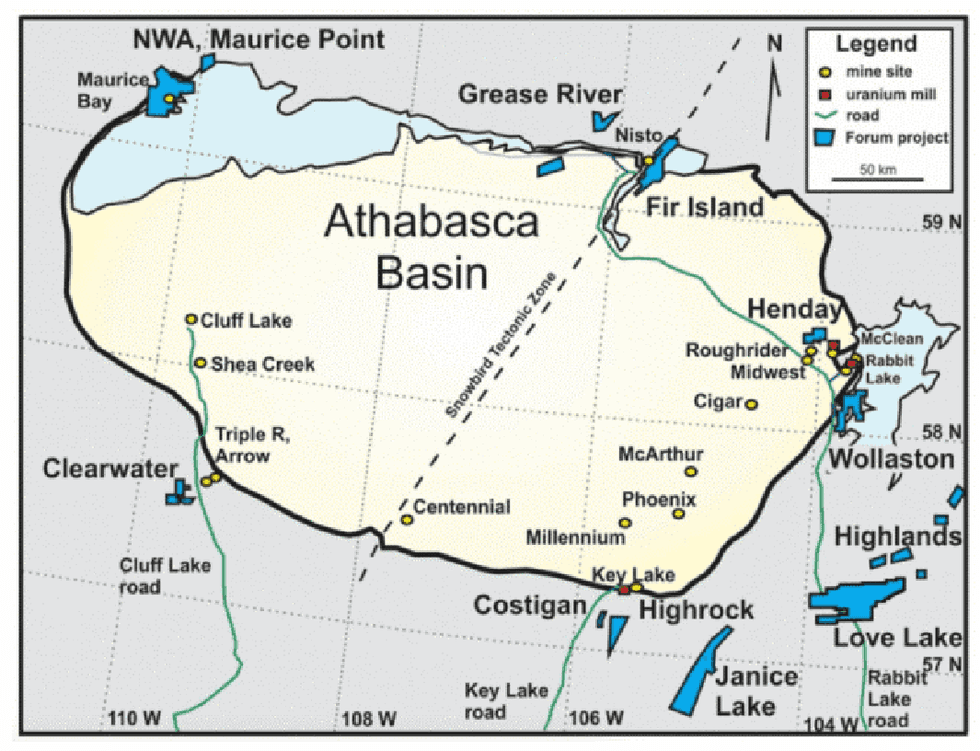

Discussion board Vitality Metals (TSXV:FMC,OTCQB:FDCFF) is a longtime uranium explorer trying to find high-grade deposits in Saskatchewan’s Athabasca Basin and Nunavut’s Thelon Basin. In 2024, the corporate is primarily targeted on exploring the Aberdeen venture in Nunavut, the place profitable drilling confirmed and expanded high-grade uranium mineralization over vital widths on the Tatiggaq discovery. Nunavut’s underexplored Thelon Basin often is the most potential area for locating new, high-grade uranium deposits exterior Saskatchewan.

With a robust native and regional presence in Saskatchewan, Discussion board took benefit of weak metals markets to broaden its commodity publicity by including a various portfolio of vitality metals exploration tasks within the copper, cobalt and nickel house.

Firm Highlights

Saskatchewan (Athabasca Basin) and Nunavut (Thelon Basin) Uranium Tasks

- Aberdeen Uranium Venture (Thelon Basin-Nunavut): Athabasca Basin 2.0? – The Thelon Basin often is the most potential area on the earth for locating new high- grade uranium deposits exterior Saskatchewan’s Athabasca Basin. Each basins exhibit related geological traits.

Discussion board’s 2023 Aberdeen Maiden Drill Program Intersects Excessive-grade Uranium

- Between July and August 2023, Discussion board accomplished 5 drill holes totalling 991 meters. This system efficiently expanded shallow high-grade uranium mineralization on the major Tatiggaq Major and West Zones, and confirmed the crew’s understanding of the controls of mineralization. Gap TAT23-002 intersected 2.25 p.c U3O8 over 11.1 meters at a depth of 148.5 meters within the Major Zone and Gap TAT23-003, a 200-meter step-out to the southwest of the West Zone intersected 0.40 p.c U3O8 over 12.8 meters at a depth of 136.8 meters.

Discussion board’s 2024 Aberdeen 7,000 Meter Drill Program Underway

- Comply with-up drilling in 2024 has continued to intersect uranium mineralization on the Major and West deposits alongside the Tatiggaq Fault. As of August 2024, 17 holes totalling 4,307 meters (inside the 1.5 km by 0.7 km Tatiggaq anomaly have been accomplished. A complete 685 samples have been shipped to SRC Laboratories in Saskatoon, Saskatchewan for evaluation. Outcomes are anticipated by the tip of September 2024. Drilling deliberate to check 20 different excessive precedence targets on the property.

- Wollaston Uranium: Discussion board: 100% – Positioned in japanese Athabasca Basin. Restricted drilling in 2023 recognized elevated uranium and boron values on a number of geophysical targets on this huge property, nicely positioned near the Orano/Denison McClean Lake mill. Discussion board is reviewing knowledge from its magnetic/electromagnetic survey to plan the following exploration steps.

- Highrock Uranium: Discussion board: 80 p.c, Sassy Gold 20 p.c – On pattern with Cameco’s past-producing Key Lake Mine.

- Fir Island: Discussion board: 49 p.c, Orano Canada: 51 p.c (operator) – Positioned on the northeastern fringe of the Athabasca Basin. Discussion board is awaiting additional exploration plans following Orano’s knowledge evaluation from an intensive resistivity survey.

- Northwest Athabasca Joint Enterprise (NWA): Discussion board: 43.3 p.c, NexGen: 26.3 p.c, Cameco: 18.7 p.c, Orano:11.7 p.c – Winter 2025 drilling is deliberate with funding by World Uranium. The NWA venture hosts the historic 1.5-million-lb Maurice Bay deposit grading 0.6 p.c uranium oxide to a depth of fifty meters (Not NI 43-101 compliant. Enough exploration work has not been accomplished to confirm and classify as a present mineral useful resource, however the estimate is taken into account related and dependable as a consequence of intensive exploration work accomplished by earlier operators and sourced from Saskatchewan Trade & Assets Miscellaneous Experiences 2003-07).

- Maurice Level: Discussion board: 100%

- Grease River: Discussion board: 100% (Traction Uranium earn-in possibility) – Discussion board and Traction not too long ago accomplished airborne magnetic, electromagnetic (EM) and radiometric surveys over your complete venture space to help structural mapping and assist outline drill targets. Evaluation of the EM knowledge has outlined potential targets alongside a number of conductive developments within the East declare block north of the Grease River shear zone.

- Henday: UEC: 60 p.c, Discussion board: 40 p.c – Strategically positioned alongside the Midwest/Roughrider pattern close to UEC’s Roughrider uranium deposit

- Costigan: Discussion board: 100% – On pattern with Cameco’s past-producing Key Lake mine.

- Clearwater: Discussion board: 75 p.c, Vanadian: 25 p.c – Positioned within the Patterson Lake Hall, Western Athabasca Basin

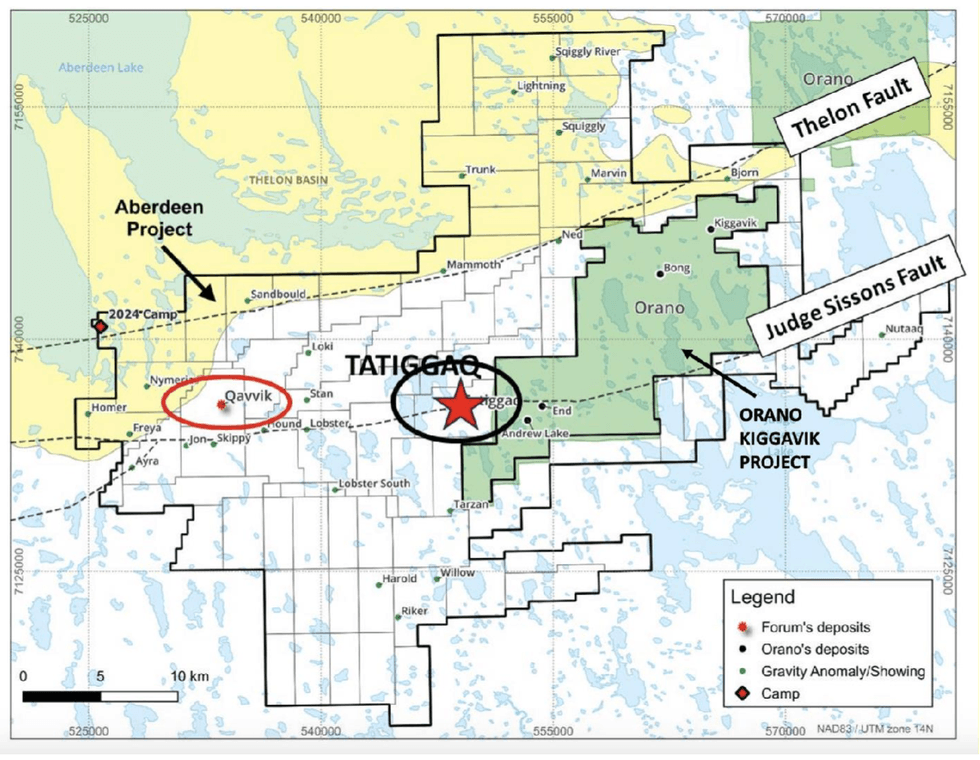

Nunavut Uranium: Discussion board’s Aberdeen venture claims comprise floor previously held by Cameco with discoveries made at Tatiggaq, Qavvik and Ayra. The claims encompass Orano’s Kiggavik uranium deposit.

Beforehand explored by Cameco between 2005 and 2012, this floor hosts two uranium discoveries made by former Cameco geologist Dr. Rebecca Hunter, who now leads Discussion board’s crew as VP of exploration.

Cameco deserted the claims because of the decade-long interval of low uranium costs through the post-Fukushima interval, which had been later acquired by Discussion board. Renamed the Aberdeen venture, Discussion board’s claims encompass Orano Canada-Denison-UEC’s 133-million-lb Kiggavik uranium deposit.

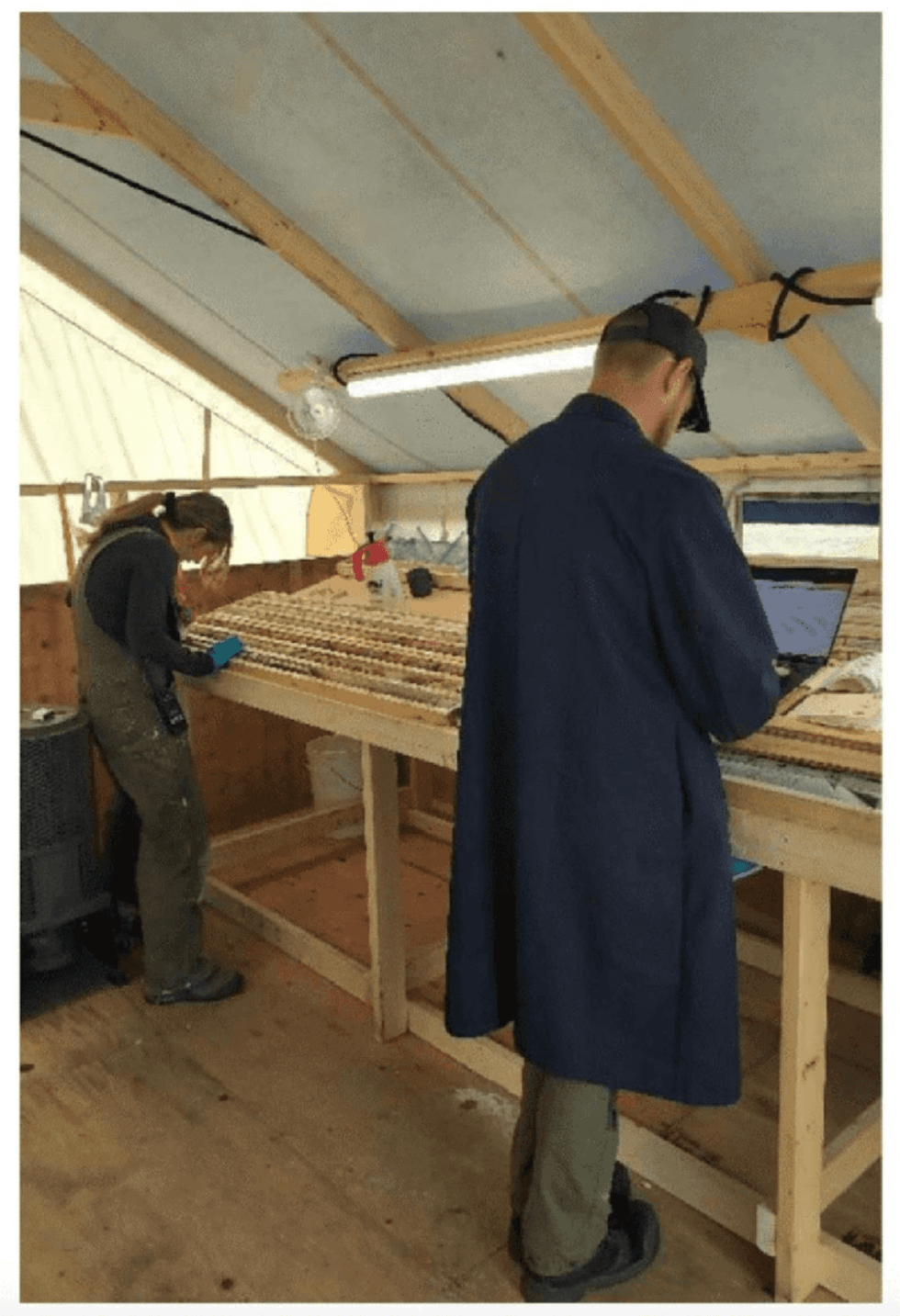

Dr. Rebecca Hunter recognizing drill gap areas. As Discussion board’s VP of exploration, Hunter is managing the Aberdeen uranium exploration venture.

Cameco accomplished 36,000 meters of drilling in 135 drill holes. After reviewing Cameco’s knowledge, Discussion board’s technical crew decided the Tatiggaq deposit to be the first exploration goal. Tatiggaq is discovered inside a big gravity anomaly that is still open alongside strike for 1.5 kilometers and at depth. Earlier drilling by Cameco recognized outcomes as excessive as 2.69 p.c U3O8 over 7.9 meters, together with 24.8 p.c U3O8 over 0.4 meters at a depth of roughly 200 meters.

Inspecting drill core within the discipline on the Nunavut camp, August 2023

Discussion board’s maiden drill program, accomplished in August 2023, efficiently confirmed and expanded high-grade uranium mineralization on the Tatiggaq and West Zones. At Tatiggaq, drilling intersected high-grade near-surface uranium mineralization with TAT23-002 (Major Zone) intersecting 2.25 p.c U3O8 over 11.1 meters, whereas TAT23-003 a 200-meter step-out on the West Zone) intersected 0.40 p.c U3O8 over 12.8 meters.

Additional drilling in 2024 has continued to intersect uranium mineralization on the Major and West deposits alongside the Tatiggaq Fault. As of August 2024, 17 holes have been accomplished, totalling 4,307 meters alongside the Tatiggaq Fault inside the 1.5 km by 0.7 km Tatiggaq anomaly. A complete of 685 samples have been shipped to SRC Laboratories in Saskatoon, Saskatchewan for evaluation. Outcomes are anticipated by the tip of September 2024.

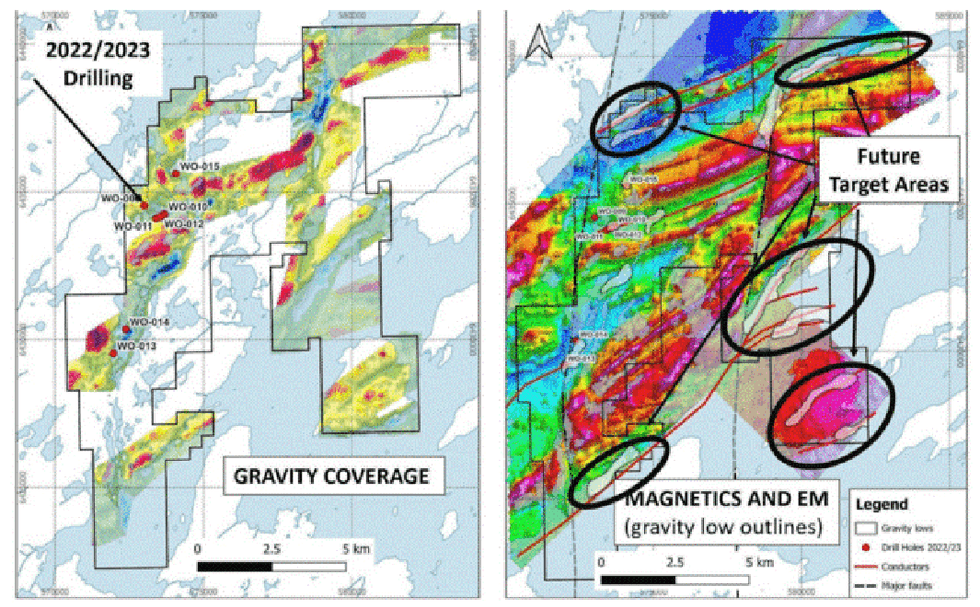

Wollaston Uranium Venture

The property is positioned inside 10 kilometers of Cameco’s Rabbit Lake uranium mill and 30 kilometers of Orano/Denison’s McClean Lake uranium mill. Its profitable winter 2022 drilling program found anomalous uranium in all 4 holes on the Gizmo goal. Discussion board not too long ago obtained outcomes of an airborne electromagnetic (EM) and magnetic survey to enhance structural interpretations and exactly find the EM conductors. The next maps present these outcomes and establish new goal areas for diamond drilling.

New Gravity Traits and Future Goal Areas

Vitality Metals Tasks

- Janice Lake Copper (Discussion board 100%): Former associate Rio Tinto spent $14 million in exploration expenditures to earn a 51 p.c curiosity within the venture. As of November 2023, Discussion board revised and accomplished the acquisition of Rio Tinto’s curiosity within the venture giving Discussion board 100% curiosity.

- Love Lake Nickel-Copper-PGM Venture (Discussion board 100%): Strategically positioned close to Discussion board’s Janice Lake copper venture.

- Nonetheless Nickel-Copper-Cobalt Venture (Discussion board 100%): The 11,411-hectare property surrounds the historic Howard Lake nickel-copper-cobalt deposit positioned 35 kilometers northwest of La Ronge Saskatchewan. Discussion board has accomplished a prospecting and geochemical sampling program, and in Q3 2023, accomplished electromagnetic and magnetic surveys.

- Fisher Copper Claims (Discussion board 100%): The Fisher property is positioned 40 kilometers west of Pelican Narrows, Saskatchewan. The property hosts a stratabound, volcanogenic large sulphide deposit with a historic estimate of 650,000 tons grading 0.5 p.c copper and three p.c zinc (Not NI 43-101 compliant. Enough exploration work has not been accomplished to confirm and classify as a present mineral useful resource, however the estimate is taken into account related and dependable as a consequence of intensive exploration work accomplished by earlier operators). Discussion board’s geological crew has recognized additional targets and accomplished a prospecting and sampling program.

- Quartz Gulch Cobalt, Idaho, USA (Discussion board 100%): On pattern with Jervois Mining’s Idaho Cobalt Venture, the one permitted cobalt mine in North America.

Discussion board’s uranium and vitality metallic tasks in northern Saskatchewan

Administration & Advisory Crew Members

Richard J. Mazur – President, CEO and Director

Richard Mazur is an govt and geoscientist with over 45 years of Canadian and worldwide expertise within the exploration and mining trade as a venture geologist, monetary analyst and senior govt on uranium, gold, diamonds, base metals and industrial minerals tasks. Mazur based Discussion board in 2004. He’s additionally a director of Large Ridge Gold, Influence Silver and Midnight Solar Mining. Mazur graduated with a BSc in geology from the College of Toronto in 1975 and obtained an MBA from Queen’s College in 1985.

Dr. Rebecca Hunter – Vice-President Exploration

Dr. Rebecca Hunter has over 15 years of expertise as a uranium exploration geologist in Saskatchewan and Nunavut. As a venture geologist for Cameco from 2005 to 2016, Hunter led the Turaqvik-Aberdeen exploration venture, the place the high-grade Tatiggaq and Qavvik uranium deposits had been found close by to the west of Orano’s (previously AREVA) Kiggavik uranium venture in Nunavut. Hunter accomplished her PhD at Laurentian College, which targeted on the litho-geochemistry, structural geology and uranium mineralization methods of the Tatiggaq- Qavvik uranium pattern within the Thelon Basin. She was not too long ago appointed VP of Exploration and can proceed her work because the lead member of Discussion board’s Aberdeen uranium venture exploration crew within the Thelon Basin, a geologic analogue to the prolific Athabasca Basin.

Allison Rippin Armstrong – Vice-President, Nunavut Affairs

Allison Rippin Armstrong is a biologist and environmental scientist with over 25 years expertise specializing in Environmental, Social and Governance (ESG) practices throughout Canada and internationally. Allison’s accomplishments over time have been acknowledged on quite a few events, together with being awarded the 2009 Kivalliq Inuit Affiliation Knowledgeable Counsel Award and the 2011 Mike Hine Award for her contributions to the mining trade in Nunavut. A protracted-standing board member of Yukon Ladies in Mining, previous member of the NWT & Nunavut Chamber of Mines, and founding member of the Yukon College Basis Board, she can be the Board Chair of Tectonic Metals Inc.

As VP Nunavut Affairs, Allison’s focus will likely be on group, regulatory and authorities relations in Nunavut Territory.

Dan O’Brien – Chief Monetary Officer

Dan O’Brien is a member of the Institute of Chartered Skilled Accountants of British Columbia and has over 15 years expertise working with public firms within the useful resource trade. O’Brien is the chief monetary officer for quite a few publicly listed exploration firms buying and selling on the TSX and TSXV exchanges and was beforehand a senior supervisor at a number one Canadian accounting agency the place he specialised within the audit of public firms within the mining and useful resource sector.

Richard Aksawnee – Supervisor of Nunavut Affairs

Richard Aksawnee was born and raised in Baker Lake. Impressed by his late father, David, who additionally served as mayor, to pursue management roles, Aksawnee served as mayor from 2019 to 2023 and has chaired the Hunter and Trappers’ Group for 20 years. His dedication to group service is additional demonstrated by his energetic involvement in search and rescue operations and youth sporting actions.

Peter Wollenberg – Technical Advisor

Peter Wollenberg has 45 years of expertise within the uranium exploration and mining enterprise. He has labored in Europe, Canada, Africa and Australia as an exploration geologist and VP of exploration for Urangesellschaft on the Kiggavik Venture, the place he was instrumental within the discovery of the Finish and Andrew Lake deposits. Later he joined Cogema/Areva the place he labored in a number of main roles in Canada, Africa and Australia. He’s presently the director of exploration and useful resource growth for World Atomic in Niger.

Anthony Balme – Director

Anthony Balme is the managing director of Carter Capital and Lymington Underwriting, two personal UK funding funds, the place he’s an energetic participant in a number of world base and valuable metals useful resource ventures in North America, Sweden and the DRC.

Paul Dennison – Director

Paul Dennison labored for 27 years within the entrance finish of three main funding banks: Credit score Suisse, Merrill Lynch & Deutsche Financial institution. His focus was capital markets origination, underwriting, gross sales and buying and selling in all areas exterior the Americas. Thereafter, Dennison managed his personal asset administration firm for 12 years, which was licensed in Singapore, Switzerland and america. He’s presently based mostly in Zurich and Singapore along with his personal agency, specializing as an introducing dealer, sourcing worldwide funding capital for purchasers.

Janet Meiklejohn – Director

Janet Meiklejohn is the principal of Emerald Capital, a consulting firm offering CFO, strategic, valuation, company governance and advertising providers to high-growth firms. She was previously VP of institutional fairness gross sales targeted on the mining sector with a number of Canadian funding banks together with Desjardins Securities, Nationwide Financial institution, Salman Companions and Macquarie Capital from 1997 to 2015. Meiklejohn grew up in Saskatchewan and has a detailed private curiosity within the growth of the uranium trade within the province.

Larry Okada – Director

Larry Okada is a member of each the Canadian Chartered Skilled Accountants and the Washington State Licensed Public Accountants Affiliation with over 45 years of expertise in offering monetary administration providers to publicly traded firms, with emphasis on junior mineral exploration firms. He holds a B.A. in economics and was in public apply along with his personal agency of Staley, Okada and Companions and PricewaterhouseCoopers LLP. Okada additionally serves as chairman of Discussion board’s Audit Committee.

Michael A. Steeves – Director

Michael A. Steeves has been concerned within the mining trade for over 50 years. He has beforehand held govt positions with Zazu Metals, Glamis Gold, Coeur D’Alene Mines,

Homestake Mining and Pegasus Gold. Steeves additionally labored for a number of years as a mining analyst. He holds a Grasp of Science diploma in earth sciences from the College of Manitoba and can be a chartered monetary analyst.

Brian Christie – Director

Brian Christie’s skilled profession spans over 45 years as a geologist, securities analyst, and investor relations govt. Throughout his tenure as vice-president investor relations at Agnico Eagle Mines from 2012 to 2022, Agnico Eagle was persistently acknowledged as having one of many prime investor relations packages in Canada. Christie is presently retained by Agnico Eagle as a senior advisor, investor relations. Previous to becoming a member of Agnico Eagle, he labored for over 17 years as a valuable and base metals analyst with Desjardins Securities, Nationwide Financial institution Monetary, Canaccord Capital, and HSBC Securities, along with 13 years as a geologist with a number of mining firms together with Homestake, Billiton, Falconbridge Copper, and Newmont. Christie holds a BSc. in geology (College of Toronto) and an MSc. in geology (Queen’s College). He’s additionally a member of the Canadian Investor Relations Institute (CIRI) and the Nationwide Investor Relations Institute (NIRI).