The 2 huge traits for the remainder of the last decade shall be synthetic intelligence and electrification.

Behind each of these megatrends? Electrical energy … and many it.

In reality, electrical energy demand is rising within the U.S. at a price we have not skilled in over 20 years. In keeping with Goldman Sachs (NYSE: GS), U.S. electrical energy demand will develop at a 2.4% annualized price by the top of this decade. Whereas that does not sound like a lot, think about that electrical energy demand development for the previous 10 years has been zero.

That development would require some $50 billion of funding in new energy manufacturing, to not point out billions extra in connecting these sources of energy to the grid. That huge funding ought to handsomely profit the next three shares.

Quanta Companies

Quanta Companies (NYSE: PWR) is a full-solutions supplier for electrical energy infrastructure, together with design, development, and recurring upkeep and restore. The corporate serves the normal electrical energy, renewable power, and underground infrastructure industries.

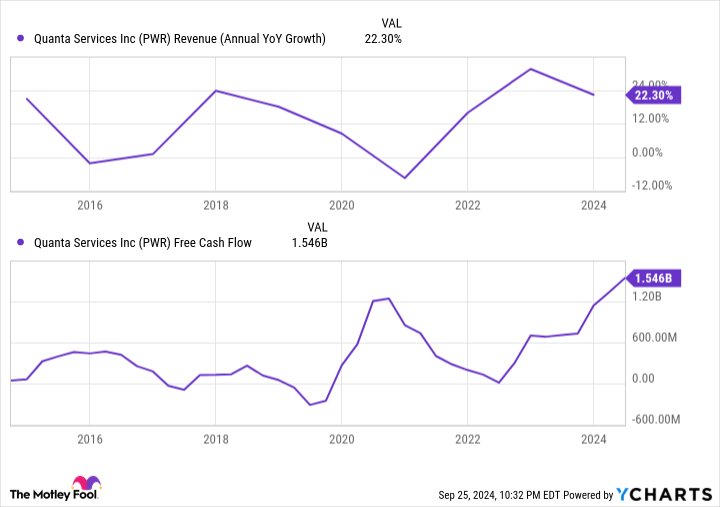

Quanta is a big within the trade, with a $44 billion market cap and $22 billion in trailing 12-month income. However regardless of its already massive measurement, development has been strong, particularly for the reason that passage of the massive infrastructure payments beneath the Biden administration in 2021 and 2022. In the meantime, free money stream has inflected larger with scale, surging to roughly $1.5 billion.

PWR Income (Annual YoY Progress) information by YCharts

Quanta has additionally been rising by acquisitions, with the latest being its buy of Cupertino Electrical Inc. (CEI). CEI has a specific specialty in modular information middle electrical methods, and it has a very shut relationship with the know-how trade.

On condition that AI information facilities are imagined to contribute 0.9% of the two.4% electrical energy demand development by 2030, the biggest contributor to development, this seems like a sensible buy by Quanta, giving it inroads into the fastest-growing a part of the market.

Emcor Group

The Emcor Group (NYSE: EME) performs design, development, and upkeep providers like Quanta, however is a tad extra diversified, working each inside and outdoors of {the electrical} energy sector. Little question, its electrical section is a giant one. Emcor’s electrical division not solely handles energy era and distribution, but in addition installs photo voltaic modules and electrical charging stations, and it supplies electrical methods reminiscent of lighting and management automation to finish prospects.

Emcor serves different verticals exterior of electrical energy that even have tailwinds behind them, because of the public-private investments spurred by the Bipartisan Infrastructure Act of 2021. These embrace putting in manufacturing services, information facilities, communications infrastructure, warehouses, roadway and site visitors management, chemical and refining crops, water and wastewater methods, and others.

As well as, Emcor performs ongoing upkeep on all of those tasks, with providers accounting for about 30% of income, resulting in comparatively steady income and revenue development.

Like Quanta, Emcor has had a superb few years of low-teens development and surging free money stream, which simply exceeded $1 billion over the previous 12 months. Income even accelerated final quarter to over 20% development.

At simply 25 occasions trailing earnings and 20 occasions money stream, Emcor’s inventory is not costly for an organization rising that quick and increasing margins. So, analysts seem to suppose development will gradual within the years forward.

But with the AI and electrification buildouts nonetheless ongoing, stimulus nonetheless flowing by the financial system, and rates of interest starting to fall, it is fairly doable Emcor retains up better-than-expected development.

American Superconductor Corp.

American Superconductor Corp. (NASDAQ: AMSC) is a small-cap participant in electrical methods, with a market cap of simply $920 million at present. However the firm is rising quick, with income up about 33% in its latest quarter.

For the grid, AMSC makes energy methods, voltage management tools, transformers, fast-switching tools, and different methods that assist make grid interconnects extra environment friendly. Its tools is put in each on the energy supply in addition to by the distribution and transmission system.

American Superconductor’s secret sauce is its know-how of novel supplies. The corporate pioneered using yttrium barium copper oxide to make its high-temperature superconductors. This materials is ready to conduct extra electrical energy than conventional copper or aluminum wire, with minimal energy loss. AMSC combines its tools with full software program and administration methods, providing turnkey options for energy turbines and grid operators in all places.

Along with options for the grid, AMSC additionally has wind energy options and turbine designs that it licenses to operators.

Lastly, as a show of its technological course of, AMSC sells energy options to the U.S. Navy. One notably attention-grabbing know-how is its degaussing methods, which decrease a ship’s magnetic signature, permitting naval ships to keep away from detection by mines at sea.

AMSC simply additional bolstered its army enterprise with the latest acquisition of NWL, which makes energy provides and controls to army and industrial prospects. AMSC solely paid about one occasions gross sales for NWL, and can doubtless garner substantial synergies from the deal.

With robust income development and the corporate’s backside line nearly reaching breakeven, AMSC is a small-cap electrical inventory that would do thrilling issues sooner or later.

Must you make investments $1,000 in Quanta Companies proper now?

Before you purchase inventory in Quanta Companies, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 finest shares for traders to purchase now… and Quanta Companies wasn’t certainly one of them. The ten shares that made the lower might produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $743,952!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

Billy Duberstein and/or his purchasers haven’t any place in any of the shares talked about. The Motley Idiot has positions in and recommends Goldman Sachs Group. The Motley Idiot has a disclosure coverage.

U.S. Electrical energy Demand is Exploding: 3 Shares to Play its Monster Progress was initially printed by The Motley Idiot