Welcome to a brand new report of my Dividend Diary on the TEV Weblog. Right here, I report the event of a money flow-oriented funding strategy that focuses on producing a passive earnings via dividends. Towards this background, the aim is to not outperform the market however to place meals on the desk via a daily earnings through dividends.

With the Dividend Diary, I doc how a cash-flow funding strategy might be a part of well-balanced wealth administration. To maintain issues easy, I’ve constructed three pillars:

- Energetic earnings.

- Passive earnings.

- Conversion.

Dividends fall into the final two classes. They’re passive as a result of they supply a money circulation with out me going to work. Moreover, they’re a vital pillar for conversion since they are often reinvested to generate much more earnings sooner or later. That’s the Concept. Now let’s get all the way down to observe.

My month-to-month earnings with dividends in June:

This month, my cash-flow strategy generated the next earnings via dividends:

- Johnson & Johnson (16.97 EUR)

- Archer Daniels Midlands (11.96 EUR)

- Mensch und Maschine (202.53 EUR)

- Pfizer (38.48 EUR)

- Snap-on (37.77 EUR)

- IBM (31.52 EUR)

- 3M (13.02 EUR)

- Vonovia (94.50 EUR)

- Unilever (37.43 EUR)

- Realty Earnings (18.92 EUR)

- Stanley Black & Decker (10.06 EUR)

- Most important Road Capital (8.94 EUR)

- Cboe World Markets (5.14 EUR)

- Ströer (31.30 EUR)

- Broadcom (25.45 EUR)

- Meta (2.40 EUR)

- FTSE Japan USD ETF (34.39 EUR)

- Imperial Manufacturers (4.88 EUR)

- PepsiCo (30.09 EUR)

- Qualcomm (32.82 EUR)

- MSCI World Power ETF (57.97 EUR)

- Further House Storage REIT (23.73 EUR)

- Reserving Holdings (2.97 EUR).

The whole month-to-month earnings with dividends in June (after taxes) was: € 773.27 / appr. $ 828

Dividend earnings report test

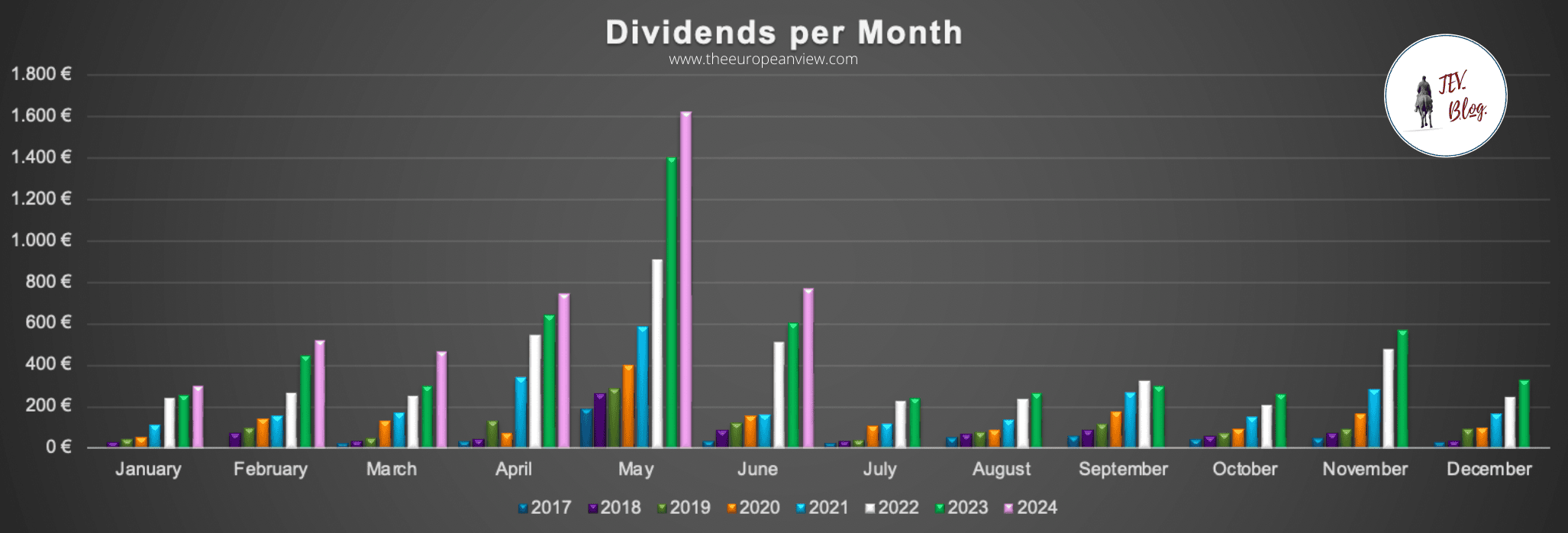

In comparison with final 12 months, the efficiency was good (+ 25 p.c YoY). General, the event appears to be like like this:

Inventory purchases in June

I purchased extra shares of nice firms:

- AbbVie

- Assa Abloy

- Amdocs

- Alexandria Actual Property REIT

- Computerized Knowledge Processing

- Reserving Holdings

- Cboe World Markets

- Diageo

- Further House Storage

- Rising Markets ETF

- Japan ETF

- Kontron

- Mensch & Maschine

- Meta

- PepsiCo.

- Realty Earnings

- Snap-on

- Siemens (new)

- Qualcomm

- Williams-Sonoma

Generals Mills(paused in June attributable to disappointing dividend hike).