KEY

TAKEAWAYS

- The main sector right now was the Financials, adopted by Well being Care and Utilities.

- Expertise shares bought off considerably and was the worst sector performer.

- With rate of interest cuts anticipated within the subsequent FOMC assembly, monetary shares have the potential to rise additional.

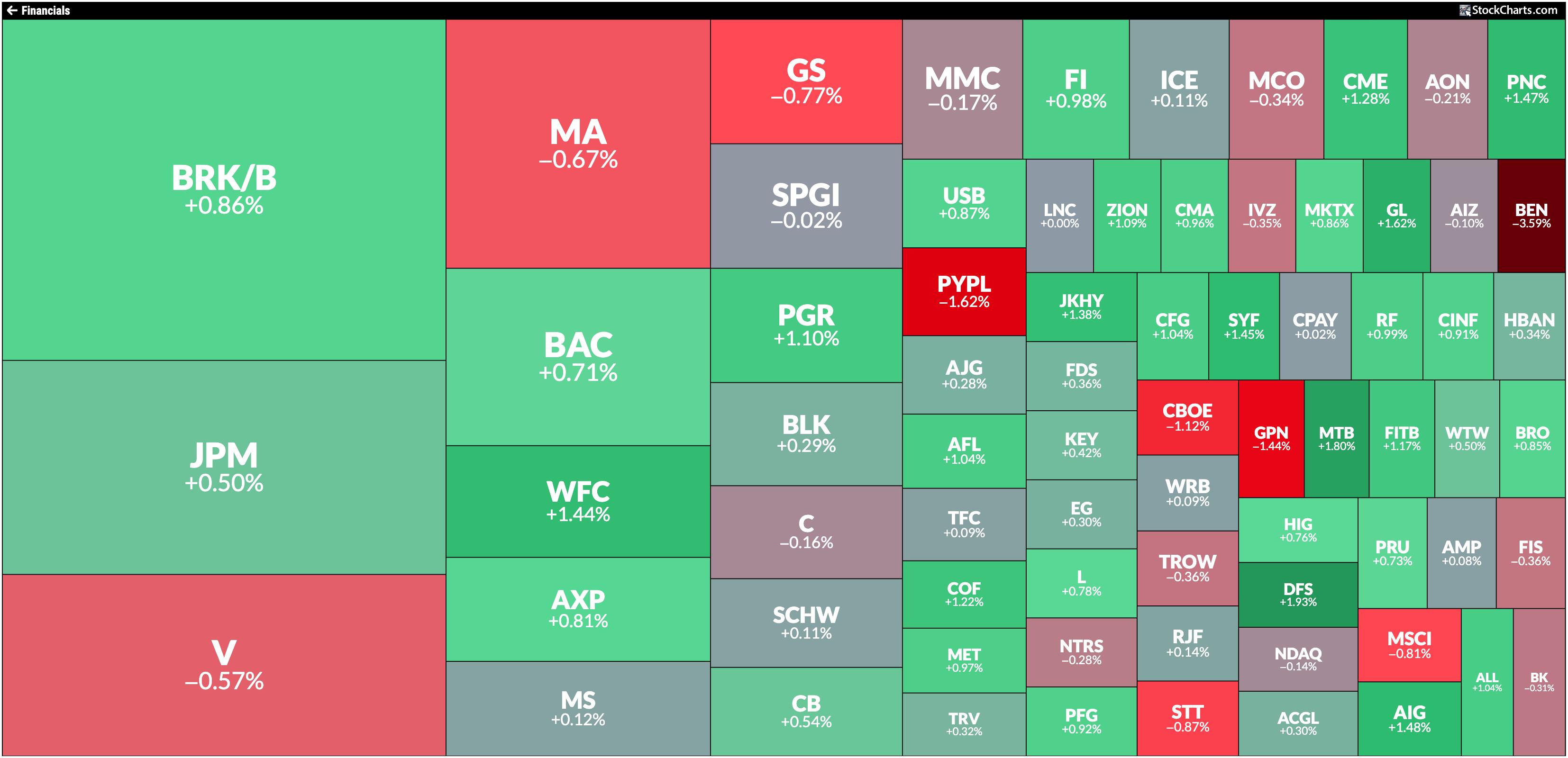

In the present day’s MarketCarpet was a sea of crimson with just some dabs of inexperienced. Financials took the lead, adopted by Well being Care and Utilities.

FIGURE 1. A SEA OF RED. In the present day’s inventory market motion was dominated by promoting strain, however some sectors noticed extra shopping for.Picture supply: StockCharts.com. For instructional functions.

The Expertise sector, yesterday’s chief, is on the backside right now. The three shares with the biggest market cap on this sector, Apple (AAPL), Nvidia (NVDA), and Microsoft (MSFT), bought off, with NVDA buying and selling 2.10% decrease. That is forward of NVDA’s earnings, which had been reported after the shut. Regardless that NVDA beat estimates and supplied robust steering, the inventory was extraordinarily unstable, with extra promoting strain.

On condition that NVDA makes up about 7% of the S&P 500 ($SPX) and eight% of the Nasdaq Composite ($COMPQ), the indexes observe NVDA’s path. We’ll have to attend until tomorrow’s open to see if issues quiet down.

Discovering Funding Alternatives

Within the meantime, let’s pinpoint areas within the inventory market that present stability. The one sector that stands out is Financials. In yesterday’s publish, the main target was on the Monetary Choose Sector SPDR Fund (XLF), which continues to hit all-time highs. The Financials quadrant in right now’s MarketCarpet reveals that Uncover Monetary (DFS) led the pack with a 1.94% rise.

The every day chart of XLF under reveals that XLF is buying and selling above its 5-day exponential shifting common (EMA) and its 20-day easy shifting common (SMA).

FIGURE 2. DAILY CHART OF FINANCIAL SELECT SECTOR SPDR FUND (XLF). Relative to the SPDR S&P 500 Fund (SPY), XLF is beginning to achieve energy. The ETF can be buying and selling above its one-week EMA and 20-day SMA.Chart supply: StockChartsACP. For instructional functions.

Additionally, notice that, relative to the SPDR S&P 500 Fund (SPY), XLF is gaining energy. It is now outperforming SPY by a modest 1.06%.

Whereas all the eye was on know-how, communication providers, and client discretionary shares, monetary shares had been quietly gaining energy. Given the following FOMC assembly is a couple of weeks away, XLF might proceed rising larger. After Fed Chair Jerome Powell’s speech in Jackson Gap on August 23, the place he prompt that the Fed is ready to chop rates of interest, XLF has persistently been hitting new all-time highs. With rate of interest cuts anticipated this yr—there is a risk of a goal price of 4.25%–4.5% by December in line with the CME FedWatch Software—consider how excessive XLF might go!

For those who’re weary of investing in exchange-traded funds, take into account deciding on a handful of shares within the Monetary sector. Click on the Financials header within the MarketCarpet to see the shares within the sector.

FIGURE 3. FINANCIAL SECTOR MARKETCARPET. The biggest squares signify the biggest shares by market cap, whereas the darkest inexperienced squares signify shares with the biggest positive aspects.Picture supply: StockCharts.com. For instructional functions.

On the Shut

The inventory market will be extraordinarily unstable, particularly near massive earnings report releases. To keep away from getting caught up in all of the market noise, determine sectors which might be exhibiting stability. Proper now, it might be the Monetary sector. However that may change, so be versatile and, whenever you see issues altering, be ready to promote your positions.

StockCharts Tip.

StockCharts Tip.

Create a ChartList of the 11 sector ETFs StockCharts makes use of as sector proxies.

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary scenario, or with out consulting a monetary skilled.

Jayanthi Gopalakrishnan is Director of Website Content material at StockCharts.com. She spends her time developing with content material methods, delivering content material to teach merchants and traders, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising company for monetary manufacturers. Previous to that, she was Managing Editor of Technical Evaluation of Shares & Commodities journal for 15+ years.

Study Extra