FTSE 100 (UK) Elliott Wave Evaluation – Buying and selling Lounge Day Chart

FTSE 100 (UK) Elliott Wave technical evaluation

Operate: Bullish Development.

Mode: Impulsive.

Construction: Grey Wave 3.

Place: Orange Wave 5.

Course: North.

Subsequent larger levels: Grey Wave 3 (began).

Particulars: Grey Wave 2 seems accomplished. Grey Wave 3 is now lively.

Wave cancelation stage: 7,920.18.

The FTSE 100 Elliott Wave Evaluation for the day by day chart outlines a bullish development, showcasing a strong upward market motion. The mode of this motion is impulsive, which means that the market is advancing with momentum within the path of the dominant development. Presently, the wave construction below focus is Grey Wave 3, which is progressing inside the bigger bullish sequence.

At this level, the market is located in Orange Wave 5, a part of the broader Grey Wave 3. The evaluation means that Grey Wave 2 has concluded, marking the top of its corrective section. Now, Grey Wave 3 is actively progressing, signaling continued upward momentum because the market enters the subsequent impulsive stage. In accordance with Elliott Wave Idea, Wave 3 is often the strongest and most prolonged inside an impulsive development, suggesting additional potential market positive aspects.

The following important motion anticipated is Grey Wave 3, which provides to the expectation of sustained bullish momentum available in the market. The present Orange Wave 5 additional helps the notion that the market is within the superior levels of this bullish push.

The important thing invalidation stage to observe is 7,920.18. A market drop under this stage would invalidate the present Elliott Wave Evaluation, necessitating a reevaluation of each the wave construction and the general market development. This invalidation level acts as a vital marker for confirming the continuation of the upward motion.

Abstract:

The FTSE 100 Elliott Wave Evaluation for the day by day chart displays a bullish development, with Grey Wave 3 and Orange Wave 5 in progress. The market is anticipated to proceed its rise, pushed by the sturdy construction of Wave 3. Merchants ought to control the invalidation stage of 7,920.18 to confirm the continuing bullish development.

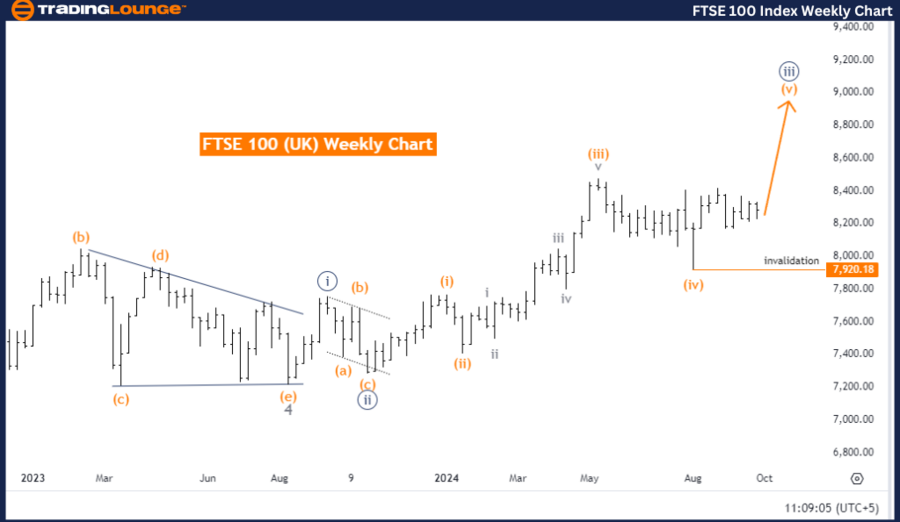

FTSE 100 (UK) Elliott Wave Evaluation – Buying and selling Lounge Weekly Chart.

FTSE 100 (UK) Elliott Wave technical evaluation

Operate: Development.

Mode: Impulsive.

Construction: Orange Wave 5.

Place: Navy Blue Wave 3.

Subsequent decrease levels: Navy Blue Wave 4.

Particulars: Orange Wave 4 seems accomplished. Orange Wave 5 is now in progress.

Wave cancelation stage: 7,920.18.

The FTSE 100 Elliott Wave Evaluation for the weekly chart outlines an impulsive development, indicating a robust upward motion available in the market. The main focus of this evaluation is on the construction of Orange Wave 5, which is a component of a bigger bullish development. Presently, the market is positioned in Navy Blue Wave 3, a big section on this impulsive development.

The prior section, Orange Wave 4, is now thought-about full, signaling the top of its corrective interval. Orange Wave 5 is at the moment lively, pointing to a continuation of the upward motion. In accordance with Elliott Wave Idea, Wave 5 sometimes marks the ultimate stage of an impulsive construction, indicating that the market is perhaps nearing the top of its present bullish cycle. Nevertheless, this section can nonetheless ship substantial upward momentum.

As soon as Navy Blue Wave 3 completes, the subsequent anticipated motion is Navy Blue Wave 4, which is predicted to introduce a corrective section earlier than any additional advances. This correction would come after the completion of the continuing Wave 5, however till that time, the market is predicted to proceed its rise.

The crucial invalidation stage for this evaluation is 7,920.18. If the market dips under this stage, the present Elliott Wave construction would change into invalid, requiring a reassessment of the wave sample. This stage serves as a crucial threshold for confirming the continuation of the upward development.

Abstract:

The FTSE 100 Elliott Wave Evaluation for the weekly chart exhibits that Orange Wave 5 is at the moment unfolding, following the completion of Orange Wave 4. The market is positioned in Navy Blue Wave 3, with expectations of additional upward motion. The invalidation stage of 7,920.18 ought to be carefully monitored to make sure the continuing bullish development.

Technical analyst: Malik Awais.

![FTSE 100 (UK) Elliott Wave technical evaluation [Video] FTSE 100 (UK) Elliott Wave technical evaluation [Video]](https://i1.wp.com/editorial.fxstreet.com/miscelaneous/p7-638636251015573098.png?w=860&resize=860,0&ssl=1)