Overview

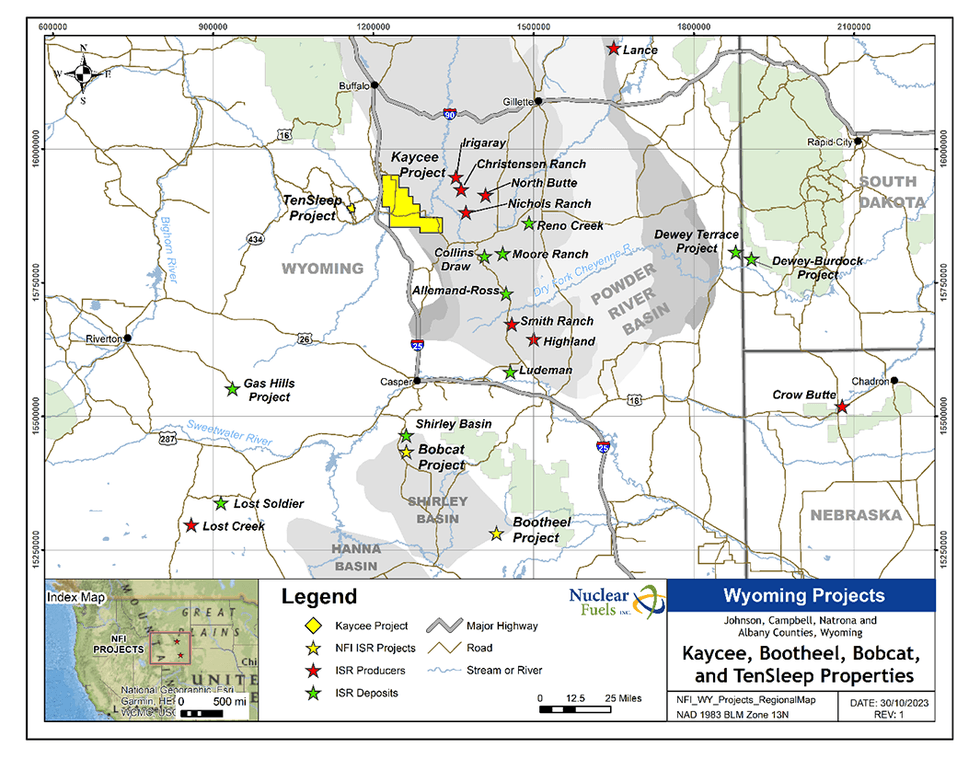

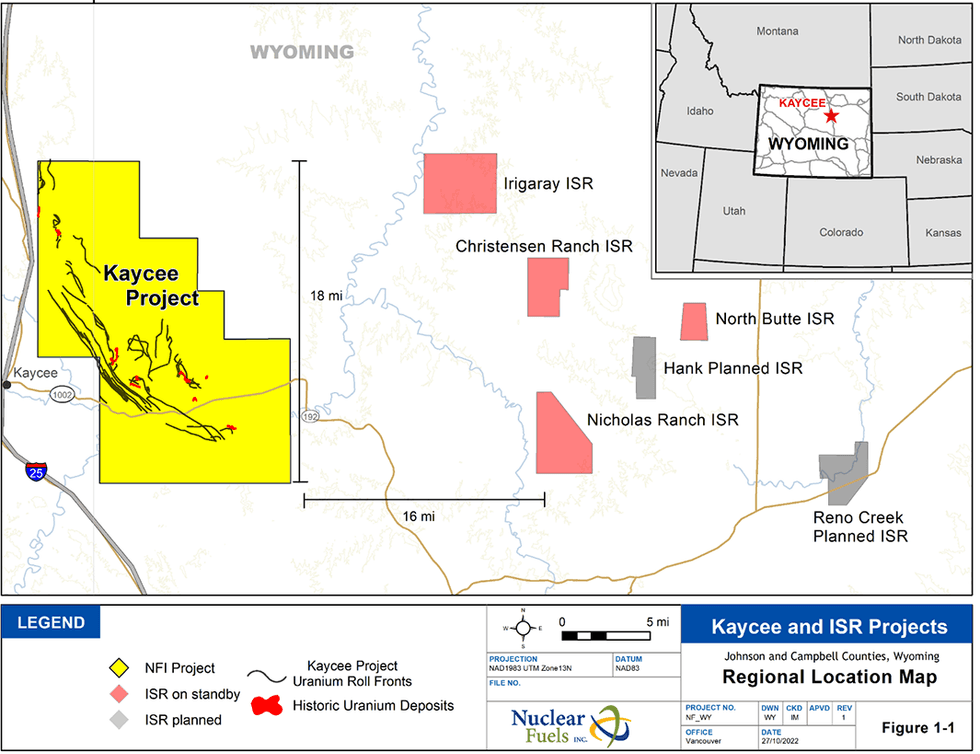

Nuclear Fuels Inc. (CSE:NF|OTCQX:NFUNF) is a uranium exploration firm advancing early-stage, district-scale In-Situ Restoration (“ISR”) amenable uranium tasks in direction of manufacturing in the USA of America. Leveraging in depth proprietary historic databases and deep trade experience, Nuclear Fuels is well-positioned in a sector poised for vital and sustained development on the again of sturdy authorities assist. Nuclear Fuels has consolidated the Kaycee district in Wyoming’s Powder River Basin underneath single-company management for the primary time for the reason that early Eighties. Presently executing its second drill program on the Kaycee Undertaking, the Firm goals to develop on historic assets throughout a 33-mile pattern with over 110 miles of mapped roll-fronts outlined by 3,800 drill holes.

The Firm’s strategic relationship with enCore Vitality Corp., America’s Clear Vitality Firm™, presents a mutually helpful “pathway to manufacturing,” with enCore proudly owning an ~18% fairness curiosity and retaining the precise to back-in to 51% possession within the flagship Kaycee Undertaking in Wyoming’s prolific Powder River Basin.

The corporate’s flagship undertaking, Kaycee, is positioned in Wyoming’s Powder River Basin, the spine of the USA’ home uranium manufacturing. With present historic assets of almost 2.5 million kilos (Mlbs) of uranium, the undertaking has the potential to change into a large-scale uranium producer. Eighty-nine drill holes have been accomplished in 2023. Part 2 of the drill program commenced on April 29, 2024, with a further 700 permitted drill holes designed to develop the areas drilled in 2023 and outline new mineralized zones alongside pattern.

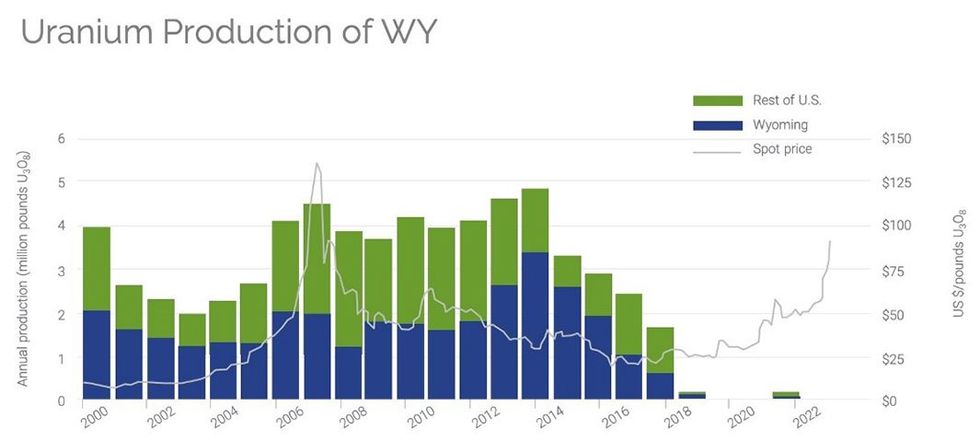

Wyoming is the USA’s main uranium-producing state, residence to the most important identified uranium ore reserves within the US. Wyoming can be a jurisdiction that helps vitality growth, being amongst a handful of US states with an ‘Settlement State’ standing, which offers for a “one-window” streamlined allowing program for brand spanking new uranium tasks.

Nuclear Gasoline’s Kaycee undertaking is probably amenable for in-situ restoration (ISR) extraction know-how, an environmentally accountable and economically superior uranium extraction course of. Over 60 p.c of all uranium extractions globally use this know-how.

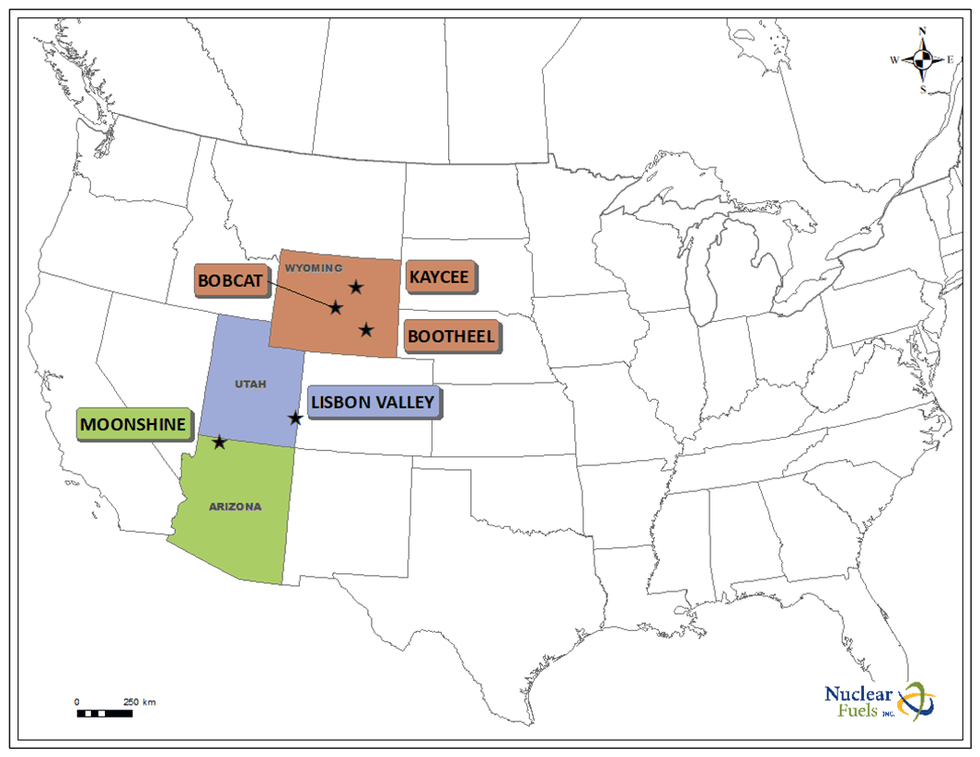

Along with the Kaycee undertaking, a number of the firm’s different belongings embody the Bootheel undertaking in Wyoming (uranium) and the Moonshine undertaking in Arizona (uranium). By this portfolio of tasks, Nuclear Fuels is assured it may contribute to the U.S.’ have to develop a protected, environmentally superior, and dependable supply of home uranium, thereby lowering international provide dependence and in the end contributing to the worldwide vitality transition.

Property in uranium mining jurisdictions

A few of the most necessary challenges confronted by the world at present are local weather change and vitality safety. Nuclear vitality can play an necessary function in addressing these considerations.

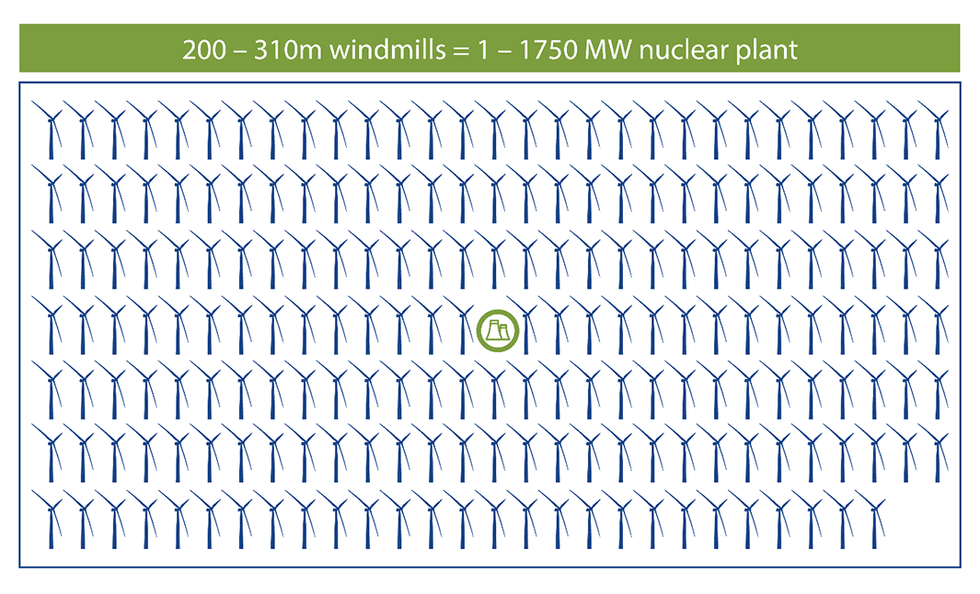

Nuclear vitality is a clear and carbon-free vitality supply. It’s the largest supply of carbon-free electrical energy within the US, because it generates electrical energy with out dangerous pollution reminiscent of nitrogen oxide, sulfur dioxide, particulate matter, or mercury. As well as, nuclear vitality has a small land footprint that means it may produce comparatively giant quantities of energy utilizing small land mass. Usually, a 1,000-MW nuclear plant requires round 1 sq. mile to function. As compared, wind farms require 360 occasions extra land space to provide the identical quantity of electrical energy, and photo voltaic photovoltaic crops require 75 occasions extra space, in keeping with the Nuclear Vitality Institute. Nuclear gasoline can be extraordinarily vitality dense. For perspective, a half-inch-tall uranium pellet creates as a lot vitality as 17,000 cubic toes of pure gasoline, 120 gallons (about 454.25 L) of oil, or 1 ton of coal. Lastly, the nuclear energy trade has a robust security tradition; delivering energy safely and effectively, particularly so compared to coal-fired energy crops.

Given these advantages, the world at present is experiencing a nuclear renaissance. Roughly 200 nuclear reactors are at present underneath development or deliberate – a rise of greater than 40 p.c of the at present working nuclear fleet. In Japan, 10 reactors have restarted, and 16 further reactors have utilized for restarts. Likewise, the UK plans to construct eight new nuclear reactors to extend its vitality manufacturing. Moreover, the US is closely targeted on nuclear vitality, with a number of nuclear energy crops in America at present present process the allowing course of to restart energy era. Roughly 20 p.c of electrical energy generated within the US comes from nuclear vitality sources, in keeping with information from the US Division of Vitality. Nonetheless, about 95 p.c of the uranium that fuels America’s nuclear reactors is imported. The continued improve within the worth of uranium is fueling the drive to speed up uranium exploration within the US to spice up home manufacturing.

To provide giant quantities of nuclear vitality, the US wants domestically produced uranium gasoline. Presently, nearly all of uranium is imported from international producers reminiscent of Russia, Kazakhstan and China. To cut back dependence on international uranium provide, the US is in search of to strengthen its home provide sources. Nuclear Fuels is nicely positioned to change into a number one home uranium exploration firm with a possible pathway to manufacturing with enCore Vitality, with the Kaycee Undertaking in Wyoming.

Wyoming is a confirmed and efficient uranium allowing jurisdiction. Its standing as an Settlement State ensures allowing and advancing uranium tasks are extra environment friendly and streamlined in comparison with most different states. It is usually necessary to notice that almost all uranium manufacturing in Wyoming, particularly within the Powder River Basin, includes the ISR extraction methodology. Wyoming hosts a minimum of 10 ISR operations which have produced greater than 45 Mlbs of U3O8.

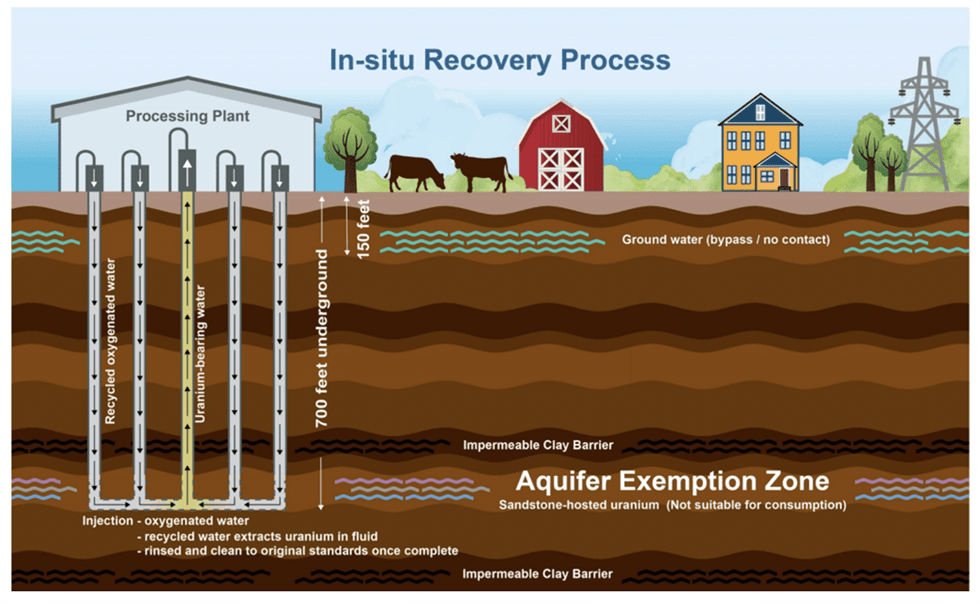

What’s in-situ restoration?

In-situ restoration (ISR) presents a minimally intrusive, eco-friendly and economically aggressive method to mineral extraction. It’s been confirmed a profitable approach for mining uranium, particularly from lower-grade deposits that may not warrant typical open pit or underground mining on account of prices. Not like conventional mining, ISR doesn’t contain open pits, waste dumps or tailings, making it extra environmentally pleasant. This methodology additionally streamlines the allowing, growth, and remediation processes. With ISR, uranium is extracted with out disturbing the floor, and as soon as the method is full, the land is restored to its unique state and objective.

Since its growth within the Nineteen Sixties, ISR know-how has developed considerably. Immediately, it’s a controllable, protected and benign uranium manufacturing methodology that’s extremely regulated within the US. ISR at present accounts for about 70 p.c of worldwide uranium manufacturing. Some nations, like Kazakhstan and Australia, nonetheless make use of sturdy chemical compounds like sulfuric acid for extraction. Many firms working within the US go for a mixture of oxygen and sodium bicarbonate within the native groundwater, which extracts uranium with minimal environmental impression and at a near-neutral pH.

With ISR, uranium extraction is achieved in liquid type via injection and restoration wells. Oxygen is injected with water and no poisonous chemical compounds are used. In comparison with typical mining, it saves a big quantity of water. The usage of this know-how results in minimal floor disruption, no tailings and no waste piles. Land and water revert to the unique use class as soon as the extraction is accomplished.

Firm Highlights

- Consolidation of the 33-mile pattern of the Kaycee Undertaking in Wyoming’s prolific Powder River Basin.

- Permitted 700 gap drill program underway on the Kaycee Undertaking to develop on historic assets throughout a 33-mile pattern with over 110 miles of mapped roll-fronts outlined by 3,800 drill holes.

- Strategic relationship with enCore Vitality Corp., America’s Clear Vitality Firm™, for a pathway to manufacturing;

- Leveraging in depth proprietary historic databases to construct a long-term pipeline of tasks in progressive jurisdictions.

- The corporate is led by trade specialists with in depth expertise and credentials in uranium exploration and growth, and all features of ISR uranium operations.

- Within the rising international demand for carbon-free sources of vitality manufacturing, Nuclear Fuels is nicely positioned to contribute, via exploration, to a dependable provide of home uranium to gasoline America’s nuclear vitality.

- The US is the world’s largest client of nuclear vitality, with 20 p.c of its electrical grid fueled by nuclear vitality, but most of its uranium gasoline is imported.

- Uranium costs proceed to rise on account of constant and rising uranium demand and constraints on present manufacturing capability.

- enCore Vitality is the corporate’s largest shareholder with an 18.3 p.c stake, whereas administration and different insiders maintain 6.7 p.c, with CEO Greg Huffman holding 3.2% of this.

Key Undertaking

Kaycee Undertaking, Wyoming

The Kaycee undertaking is the corporate’s flagship asset. It’s the largest ISR exploration undertaking in Wyoming’s Powder River Basin (PRB) and covers a 33-mile mineralized pattern with over 110 miles of recognized roll fronts and over 42 sq. miles of mineral rights. The undertaking includes three traditionally productive sandstone formations – Wasatch, Fort Union and Lance – which can be mineralized and probably amenable to ISR extraction. For the primary time for the reason that Eighties, the Kaycee Undertaking is now held by a single firm.

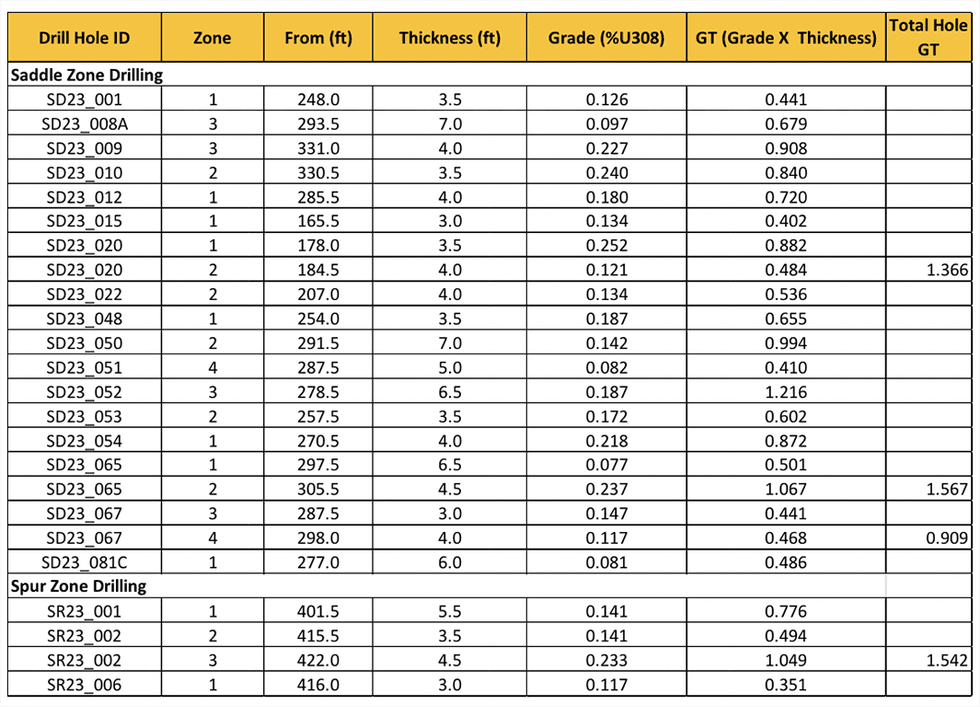

With over 3,800 drill holes, historic drilling has confirmed uranium mineralization in all three traditionally productive sandstones inside the PRB, occurring over greater than 1,000 toes of vertical part. Nearly all of the undertaking is just not well-explored, with drilling targeting roughly 10 p.c of the realm. The corporate’s Part 1 drilling program, performed in 2023, targeted on the Saddle Zone which hosts a historic useful resource of 519,000 lbs. The preliminary outcomes from the primary 12 holes have been encouraging. Excessive-grade mineralization was encountered in 5 holes with grade thickness (GT) starting from 0.441 to 0.908. The best-grade intercept is 3 toes of 0.240 p.c e U3O8. 5 holes have a GT of >0.3 which is taken into account appropriate for inclusion in a wellfield.

Desk of Vital Outcomes

Part 1 drilling throughout 2023 efficiently confirmed and expanded historic assets returning grades starting from hint to six.5 toes at 0.187 p.c U3O8 (Gamma log) with a grade thickness of 1.216; Part 2 of the drill program, commenced on April 29, 2024, to develop historic uranium mineralization at depth and develop mineralization alongside pattern and on different high-priority targets recognized with a further 700 permitted drill holes.

Nuclear Fuels acquired this undertaking from enCore Vitality, which, upon Nuclear Fuels establishing a minimal of an NI 43-101 compliant useful resource of 15 Mlbs U3O8, retains a back-in proper for 51 p.c of the undertaking by paying 2.5 occasions the exploration prices and financing the undertaking to manufacturing. This offers a transparent path to manufacturing in case of main discovery at Kaycee.

Different Tasks

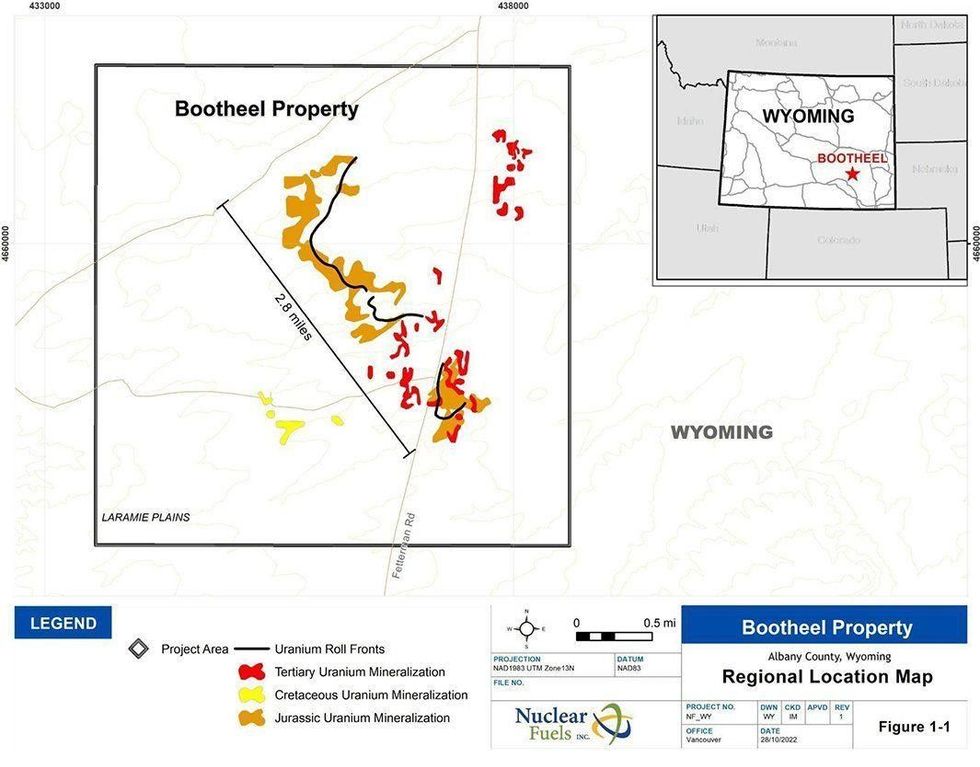

Bootheel Undertaking, Wyoming

The Bootheel undertaking in Southeast Wyoming consists of roll-front mineralized zones recognized in three distinct, stacked sandstone formations. Historic metallurgical testing has indicated better-than-average uranium restoration kinetics and aquifer rehabilitation. A historic NI 43-101 report in 2007, contains an indicated useful resource of 1.443 million (Mt) @ 0.038 p.c U3O8 for 1.089 Mlbs U3O8, and inferred useful resource of 4.399 Mt @ 0.037 p.c U3O8 for 3.249 Mlbs U3O8.

Bobcat Undertaking, Wyoming

This undertaking is positioned within the Shirley Basin, 25 miles south of Casper, Wyoming in Albany County. The Shirley Basin is a confirmed and prolific producer of uranium credited with over 84 million kilos produced between 1959 and 1992 from producers together with Getty Oil Firm, Texaco, Pathfinder Mines Company, and Cogema Mining. Furthermore, the Shirley Basin is residence to the primary business use of the ISR approach to extract uranium from sandstone-host deposits.

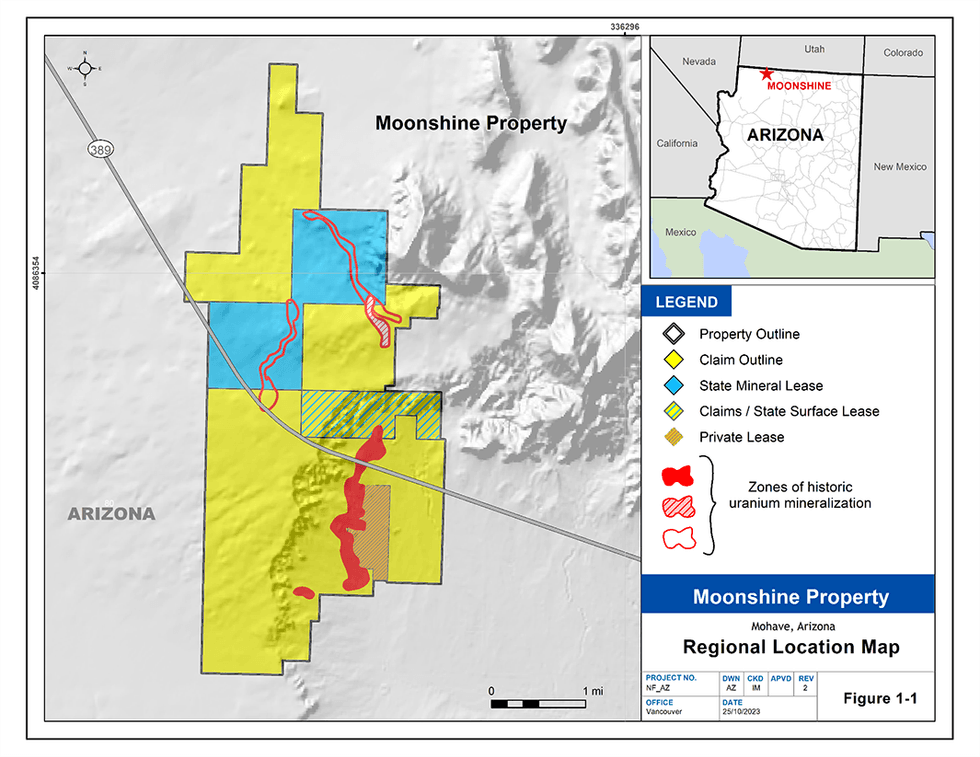

Moonshine Undertaking, Arizona

The Moonshine Springs undertaking is in Mohave County, Arizona. The undertaking includes roughly 1,000 acres, together with 23 owned lode mining claims together with seven lode mining claims and 320 acres of payment land held underneath lease. This property was earlier explored throughout the Seventies and Eighties by Exxon Corp and later by Pathfinder.

This undertaking consists of a minimum of three stratigraphic zones, the place the sandstone-hosted uranium happens. The higher two zones lie at a median depth of 170 toes and are thought of open pit candidates with the decrease zone mendacity at a depth of 760 toes. The undertaking is amenable to ISR with a historic useful resource of two.4 Mlbs grading 0.16

Lisbon Valley Undertaking, Utah

This undertaking is within the Lisbon Valley Uranium District in Southeast Utah and covers roughly 2,211 acres. The undertaking has two declare blocks – LS and JB. The LS declare group is positioned southeast and adjoining to the Lisbon mine, which was operational between 1972 and 1988, producing roughly 22 Mlbs of U3O8. Historic drilling at LS declare relationship again to 2007 reported uranium mineralization amounting to 17.5 toes grading 0.11 p.c U3O8.

Administration Group

William M. Sheriff – Chairman

William Sheriff is the founder and presently serves as the chief chair of enCore Vitality Corp., a pacesetter in ISR uranium manufacturing. He was a pioneer within the uranium renaissance as co-founder and chairman of Vitality Metals, which was acquired by Uranium One for $1.8 billion and owns the most important home uranium useful resource base in US historical past.

Gregory Huffman – Chief Govt Officer, President and Director

Gregory Huffman brings greater than 20 years of mining evaluation and fairness finance expertise with a concentrate on uranium and different energy-related metals. Huffman’s various background contains roles in mining specialty gross sales, fund administration, and fairness analysis within the metals and mining sector. In his profession, he has been instrumental in main cross border coordination in international mining monetary issues, together with his work as a mining analyst targeted on uranium from 2004 to 2007. His most up-to-date expertise, from 2016 to 2024, was as the worldwide head of mining gross sales at Canaccord Genuity the place he employed his broad vary of geological and monetary abilities to guage mining firms exploring, growing, and producing valuable, base and energy-related metals, together with uranium. Huffman is understood for his insightful trade publications, the “Canaccord Genuity Excessive Grade Mining Minute” and “Huffer’s Excessive Grade Nuggets.”

Eugene Spiering – Director

Eugene Spiering is a registered geologist with greater than 30 years of expertise and just lately served as VP of exploration for Quaterra Sources, the place he led the invention of the one two uranium deposits in Arizona. He additionally labored on the Kaycee Uranium District within the early Eighties.

David Miller – Director

David Miller is a businessman, skilled financial geologist, and a previous member of the Wyoming State Legislature. He beforehand served because the chief government officer of Strathmore Minerals earlier than its merger with Vitality Fuels in 2013. His profession has spanned greater than 40 years and began with Utah Worldwide within the US, which developed into Orano Group, the French nuclear energy conglomerate.

Larry Lahusen – Director

Larry Lahusen holds a BSc in geology from the College of New Mexico (1969) and has been lively as an exploration geologist for greater than 30 years. He started his profession exploring for uranium deposits within the Colorado Plateau area within the US. He has directed and designed exploration applications that resulted within the discovery and subsequent growth of the 2 uranium deposits positioned within the Lisbon Valley District, Utah.

Richard Munson – Director

Richard Munson has been lively within the pure assets enterprise for greater than 35 years, beginning as a pure assets lawyer specializing in taxation. He moved to the non-public sector within the mid-80s when he joined the Vitality Fuels firms owned by John Adams. Vitality Fuels Nuclear turned the most important US uranium producer within the late Eighties and early Nineties. In 1999, Munson and John Adams co-founded ETK, which then owned the Toroparu gold-copper undertaking in Guyana, South Africa. Munson continues to be lively within the worldwide useful resource sector.

Brahm Spilfogel – Director

Brahm Spilfogel is an award-winning monetary government with over 25 years of expertise in useful resource portfolio administration. He just lately retired from RBC International Asset Administration the place he served as managing director and senior portfolio supervisor, co-managing quite a few portfolios together with the RBC International Valuable Steel Fund, RBC International Sources Fund, and the RBC Small and Mid-Cap Sources Fund, with belongings exceeding $2 billion. As one among Canada’s most well-regarded useful resource portfolio managers, Spilfogel has actively engaged with company boards, providing strategic insights and contributing to governance, security, and sustainability discussions. His deep experience within the assets sector extends to monetary evaluation, mergers and acquisitions, and capital markets.

Monty Sutton – Chief Monetary Officer

Monty Sutton brings greater than 35 years of expertise in public markets, company governance, senior administration and accounting and has served on the administration groups and boards for a lot of non-public and publicly traded firms. Sutton has held positions as senior administration accountant for MacMillan Bloedel, funding advisor, insurance coverage specialist, company growth supervisor and most just lately chief monetary officer.

Mark Travis – Undertaking Supervisor

Mark Travis has over 17 years of mineral trade expertise in quite a lot of totally different settings together with each vitality and valuable metals. He was instrumental within the Strathmore Minerals growth of the Gasoline Hills Wyoming properties throughout the 2006-2013 uranium cycle. He’s the director of the Geological Society of Nevada and the Nevada Mineral Exploration Coalition and is a licensed skilled geologist via AIPG.