KEY

TAKEAWAYS

- Whereas the day by day quantity studying can provide us restricted perception on the steadiness of consumers and sellers, Chaikin Cash Circulation offers a a lot clearer image of tendencies in quantity.

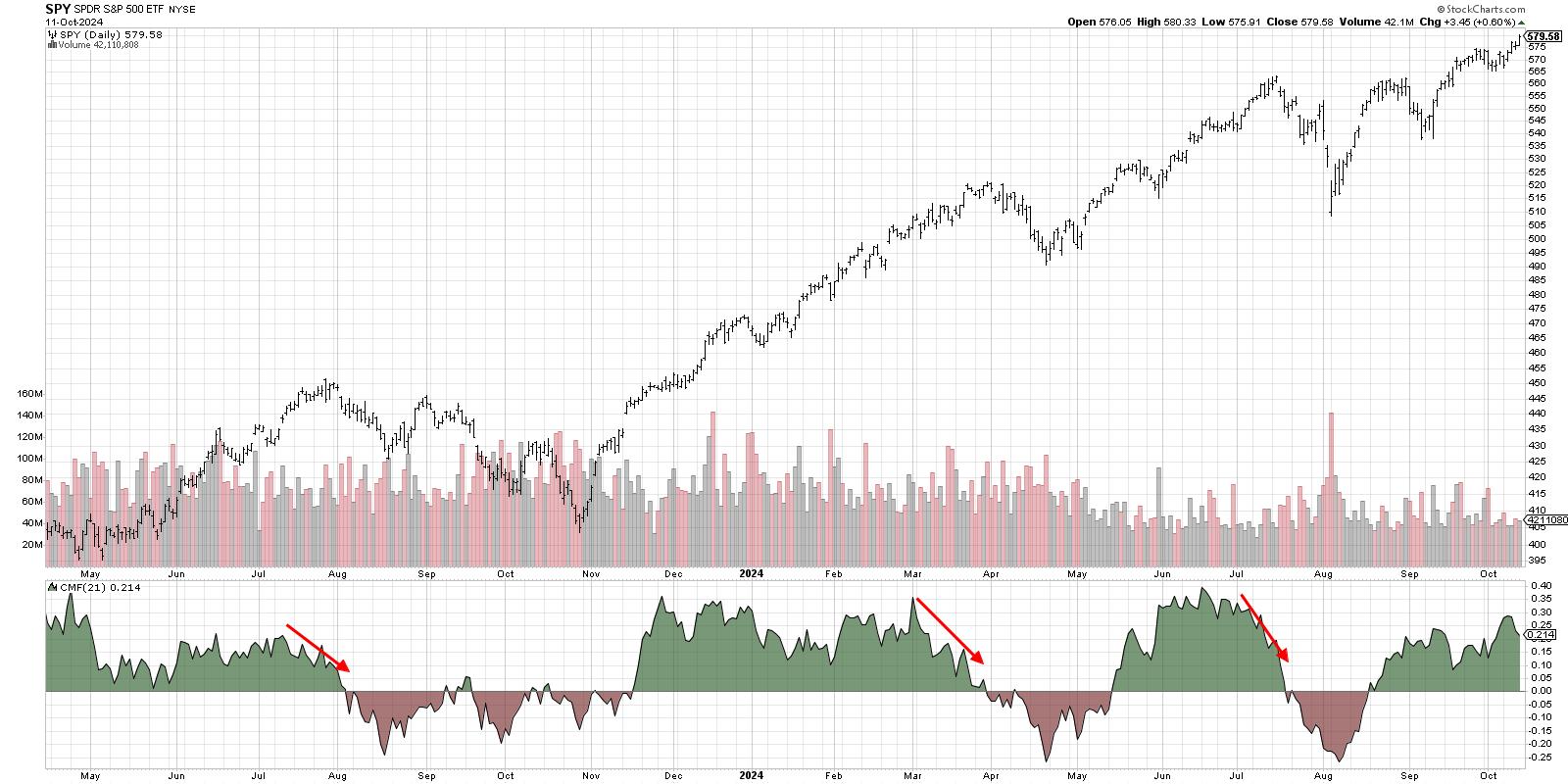

- Main tops within the final 12-18 months have been marked with a selected sample within the S&P 500’s CMF indicator, so that is the sign we’re awaiting in October 2024.

I used to be requested lately about quantity, particularly why I do not function quantity typically on my day by day market recap present, CHART THIS with David Keller, CMT. I replied that after I was studying the technical evaluation toolkit earlier in my profession, I very a lot paid consideration to quantity indicators.

However within the years to observe, I developed a course of that centered extra on pattern and momentum, and I felt the strategy labored fairly effectively regardless of the shortage of quantity inputs. However there may be one indicator that has been pretty profitable at recognizing market turns over the past yr, and it is a chart I shall be following intently within the weeks to return.

Quantity to Chaikin Cash Circulation

First, let’s speak about how we measure quantity over time. The best option to signify quantity is with the day by day quantity bars, serving to us decide if at this time’s quantity is above or under common. And whereas that may be useful for navigating the short-term surroundings, it would not assist us assess how quantity is evolving over time.

Well-known strategist Joe Granville developed the idea of “On Steadiness Quantity” the place he created a cumulative whole of quantity by including up days’ quantity and subtracting down days’ quantity. Much like an advance-decline line, it does assist to point the overall directional pattern in quantity.

The difficulty right here is that we’re taking a complete day’s quantity and contemplating all of it bullish or all bearish, relying on whether or not the shut was greater than yesterday. What about if we completed on the excessive or the low of the day. Should not that matter indirectly?

An Advance-Decline Line for Quantity

One other legendary technician, Marc Chaikin, improved on Granville’s work by every single day’s value bar. If the shut was nearer to the excessive, then that day’s quantity must be value extra within the working whole. And if the shut was close to the center of the vary, that day’s quantity must be value much less within the calculation.

Now we will see the working whole of day by day quantity, however with extra worth given to the times with highs close to the excessive or low for the day. So massive up days and down days turn out to be way more necessary after we think about the general pattern in quantity.

When the indicator is above zero it is shaded inexperienced, and long-term uptrends typically function prolonged intervals of inexperienced. When the indicator is under zero, represented with the crimson shading, this means a interval of distribution because the down quantity seems heavier.

Waiting for Quantity Divergences

Whereas crossing under the zero line would signify a normal rotation in quantity from extra accumulation to distribution, the true advantage of this indicator is within the early warning signal primarily based on divergence.

Because the market was shifting greater in July 2023 into the eventual August excessive, we noticed a decline within the Chaikin Cash Circulation. We noticed the same sample in March 2024, because the SPY pushed greater even because the CMF was trending decrease, in addition to in July 2024.

Discover how the present studying exhibits the Chaikin Cash Circulation studying as nonetheless fairly sturdy for the S&P 500? This implies that the market continues to be able of power, given the stronger bullish quantity in current weeks. However this chart additionally tells us to maintain a cautious eye on the CMF within the coming weeks. As a result of a bearish divergence right here might present an early warning signal to conscious traders staying attuned to the rhythm of the markets.

Heads up! We simply launched our new podcast, Market Misbehavior with David Keller, CMT, in October! Take a look at our current interviews with Mark Newton, Joe Rabil, Mish Schneider, and Mike Livingston. Tons extra nice conversations coming your means very quickly!

RR#6,

Dave

PS- Able to improve your funding course of? Take a look at my free behavioral investing course!

David Keller, CMT

President and Chief Strategist

Sierra Alpha Analysis LLC

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your personal private and monetary scenario, or with out consulting a monetary skilled.

The creator doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the creator and don’t in any means signify the views or opinions of another individual or entity.

David Keller, CMT is President and Chief Strategist at Sierra Alpha Analysis LLC, the place he helps energetic traders make higher selections utilizing behavioral finance and technical evaluation. Dave is a CNBC Contributor, and he recaps market exercise and interviews main consultants on his “Market Misbehavior” YouTube channel. A former President of the CMT Affiliation, Dave can be a member of the Technical Securities Analysts Affiliation San Francisco and the Worldwide Federation of Technical Analysts. He was previously a Managing Director of Analysis at Constancy Investments, the place he managed the famend Constancy Chart Room, and Chief Market Strategist at StockCharts, persevering with the work of legendary technical analyst John Murphy.

Be taught Extra