Investor Perception

As demand for copper continues to rise, pushed by world electrification tendencies, Los Andes Copper is well-placed to leverage its vital copper place in Chile, pushed on the helm by a gaggle of extremely skilled technical and enterprise leaders.

Overview

The electrification transition is already in movement and driving demand for copper, an important steel for manufacturing rising applied sciences. Copper is already present in electronics worldwide, and as clear vitality applied sciences purpose to interchange fossil fuels, demand will solely improve — it is projected that copper demand will doubtless attain 50 million metric tons by 2035. A separate evaluation estimates the world copper deficit could hit greater than 8.5 metric tons by 2030.

Rising copper demand has put the highlight on Chile which hosts a number of the world’s largest copper deposits. It’s presently the prime copper producer on the planet, producing greater than twice the quantity of its closest competitor, Peru. The nation is a steady, mining-friendly jurisdiction that has already attracted prolific mining firms.

Los Andes Copper (TSXV:LA,OTCQX:LSANF) is a Vancouver-based mining firm specializing in growing its 100% owned, Vizcachitas copper-molybdenum porphyry mission in Chile. Vizcachitas is likely one of the largest superior copper initiatives not owned by a serious mining firm and has the potential to grow to be a world-class mine. An skilled administration group with many years of assorted expertise within the pure assets business offers confidence within the firm’s means to succeed in its objectives.

The corporate filed a optimistic pre-feasibility examine in 2023 indicating US$2.78 billion after-tax internet current worth (NPV) utilizing an 8 % low cost fee and an inside fee of return (IRR) of 24.2 % at US$ 3.68/lb copper, US$12.90/lb molybdenum and US$21.79/oz silver, with an estimated preliminary capital price of US$2.44 billion. The PFS additionally highlighted a building interval of three.25 years and a payback interval of two.5 years from preliminary manufacturing.

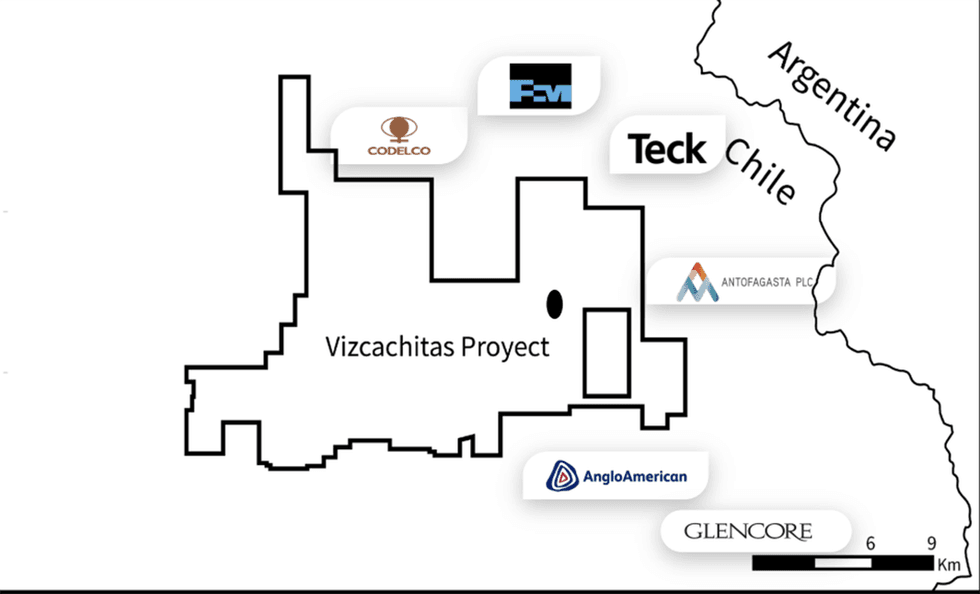

The Vizcachitas mission is surrounded by mining majors

Los Andes works carefully with the local people to help the event of native companies and social organizations. The corporate has joined the Affiliation of Small Miners of Putaendo and has established a number of packages to help social organizations, native technical excessive faculties and feminine entrepreneurs. Los Andes can also be environmentally conscious and strives to keep up a wonderful ESG score.

The corporate’s administration group is skilled within the pure assets business, together with consultants in geology, group affairs, and company finance.

Firm Highlights

- Los Andes Copper is a Vancouver-based mining firm targeted on growing its world-class Vizcachitas copper mission in Chile.

- To help the mission, the corporate has obtained a mixed US$14 million in investments from Queen’s Street Capital and US$ 20 million from Ecora Sources.

- The Vizcachitas mission has great blue-sky potential and is the biggest superior copper mission within the Americas owned by a junior miner.

- The corporate launched the outcomes of its pre-feasibility examine (PFS) in 2023 with a US$2.8 billion post-tax NPV8 and 24 % IRR at US$3.68 copper.

- The corporate strives to keep up a wonderful ESG score and works carefully to help the local people and decrease the mission’s environmental affect.

- An skilled administration group leads Los Andes Copper with a spread of expertise all through the mining business.

Key Mission

Vizcachitas Copper Mission

https://investingnews.com/shares/tsxv-la/los-andes-copper/

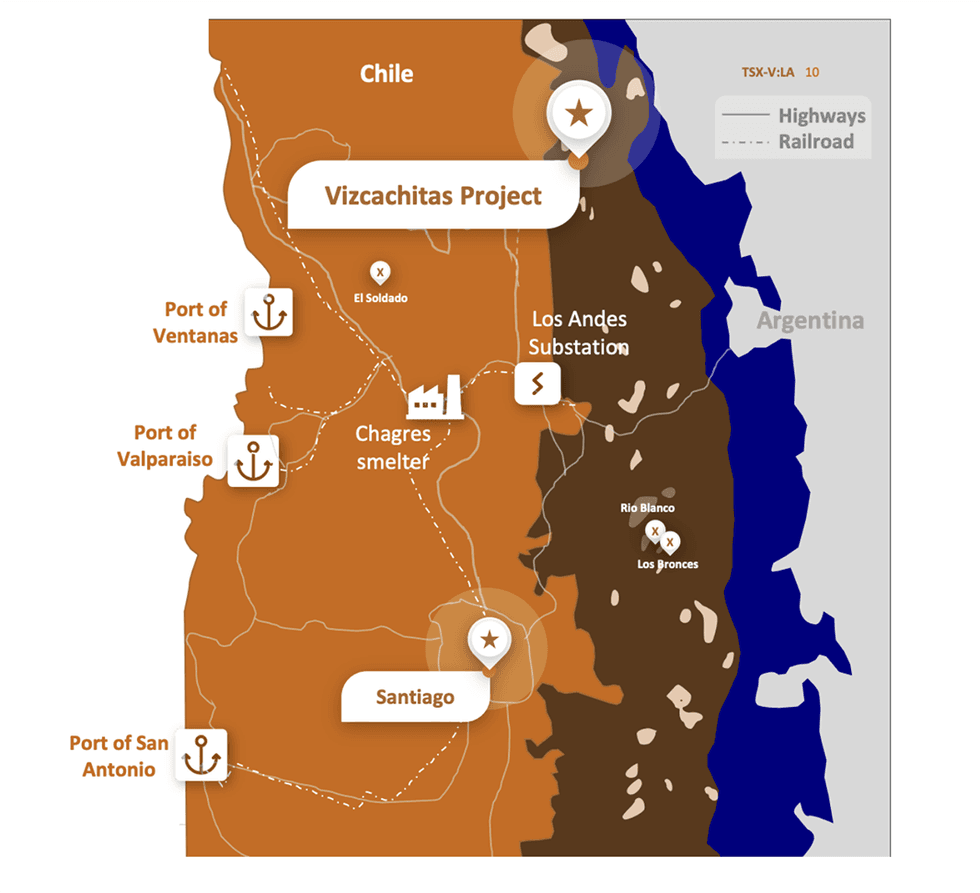

The 100-percent-owned Chilean Vizcachitas copper mission is likely one of the largest superior copper deposits within the Americas and the biggest deposit owned by a junior miner. The mission is positioned within the Rio Rocin Valley, roughly 150 kilometers northeast of Santiago.

Mission Highlights:

- Robust Current Infrastructure: The mission is accessed by a 124-kilometer paved freeway, a close-by railway and transport ports. As a result of presence of current copper mines, smelting services are accessible by railway. Moreover, there are a number of giant energy substations close to the mission.Accomplished PFS: 2023 Pre-Feasibility Research outcomes indicated:

- US$2.78 billion after-tax NPV utilizing an 8 % low cost fee and an IRR of 24.2 % at US$ 3.68/lb copper, US$12.90/lb molybdenum, and US$21.79/oz silver, with an estimated preliminary capital price of US$2.44 billion.

- A building interval of three.25 years and a payback interval of two.5 years from preliminary manufacturing.

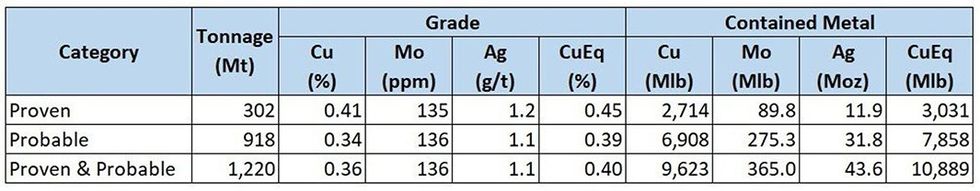

- A 16-percent improve in measured and indicated assets from the preliminary financial evaluation dated June 13, 2019, to 14.8 billion kilos (lbs) copper equal grade (CuEq).

- measured assets of two.61 billion lbs copper, 84 million lbs molybdenum, and 11 million ounces (Moz) silver;

- indicated assets of 10.42 billion lbs of copper, 442 million lbs of molybdenum, and 43 Moz of silver;

- and improve inferred assets by 130 % to fifteen.4 billion lbs CuEq (13.75 billion lbs copper, 495 million lbs molybdenum, 55 Moz silver).

- Devoted to a robust ESG score: The PFS targeted on using the most recent sustainable mining strategies which resulted in a 50 % discount in water consumption, and a 25 % discount in vitality use and confined the mission to 1 valley, decreasing the mission footprint. The corporate has additionally dedicated to utilizing desalinated water, making certain a sustainable water provide. Moreover, the corporate works carefully with native communities to enhance the information and understanding of the longer term Vizcachitas Mission and of the a number of alternatives {that a} sustainable mining mission like Vizcachitas will deliver to the group.

- Royalty Settlement with Ecora Sources: Los Andes closed a royalty settlement with Ecora Sources, a number one royalty and streaming firm targeted on investing in future-facing commodities. The settlement features a $20 million money consideration paid to Los Andes in return for royalty funds equal to 0.25 % internet smelter return royalty on minerals bought on open pit operations and 0.125 % NSR on underground operations.

- Allow to Restart Drilling: The Second Environmental Courtroom in Chile dominated that Los Andes has complied with all of the situations imposed on July 20, 2022 and is now approved to restart drilling.

Administration Staff

Santiago Montt – CEO

With 11 years of expertise within the mining sector, Santiago Montt has a regulation diploma from the College of Chile, a J.S.D. regulation diploma (PhD) from Yale College, and a Grasp’s in Public Coverage from Princeton College. He has labored for BHP from 2011 to 2021 in varied roles: vice-president of company affairs for the Americas, VP of ligation (World), VP of authorized Brazil, and VP of authorized copper. He’s an skilled skilled within the areas of stakeholder administration, danger administration, disaster administration, mission administration and business and authorized affairs

Antony Amberg – Chief Geologist

Anthony Amber is a chartered geologist with 32 years of various expertise working in Asia, Africa, and South America. Amberg is a professional particular person underneath NI 43-101. He has managed varied exploration initiatives starting from grassroots by to JORC-compliant feasibility research. In 2001, he returned to Chile the place he began a geological consulting agency specializing in mission analysis and NI 43-101 technical stories. He started his profession in 1986 working with Anglo American in South Africa earlier than transferring on to work for the likes of Severin-Southern Sphere, Bema Gold, Rio Tinto and Kazakhstan Minerals Company.

Ignacio Melero – Director of Company Affairs and Sustainability

Ignacio Melero is a lawyer with a level from Pontificia Universidad Católica de Chile with huge expertise in company and group affairs. Earlier than Los Andes, Ignacio was liable for group affairs at CMPC, having managed group and stakeholder affairs for plenty of its pulp and forestry divisions all through the nation. Ignacio has labored for the Authorities of Chile, within the Ministry Normal Secretariat of the Presidency. He was liable for the inter-ministerial coordination of the ChileAtiende mission, a multi-service community linking communities, regional governments and public companies.

Gonzalo Saldias – Geologist Guide

Gonzalo Saldias is a geologist with a level from the Universidad Católica del Norte, Chile, with greater than 35 years of expertise working inside Chile and internationally. He labored for Antofagasta Minerals from 2007 to 2015, and for Placer Dome Latin America for ten years. He additionally labored for Codelco as head of exploration geology for the El Salvador Division.

Harry Nijjar – Chief Monetary Officer

Harry Nijjar holds a CPA CMA designation from the Chartered Skilled Accountants of British Columbia and a Bachelor of Commerce from the College of British Columbia. He’s a managing director of Malaspina Consultants. Nijjar has been working with private and non-private firms for the previous 10 years in varied roles. He’s additionally presently the CFO of Darien Enterprise Growth and Clarmin Explorations.

Manuel Matta – Senior Mining and Mission Guide

Manuel Matta is a mining engineer from the College of Chile, with greater than 30 years of expertise in operations, planning and initiatives. He labored for Falconbridge and Xstrata as vice-president of initiatives and growth the place he led the growth of the Collahuasi mine. He was additionally the overall supervisor of Altonorte Smelter in Chile. Matta additionally labored for Barrick Gold in Chile and the Dominican Republic and was the overall supervisor of Las Cenizas copper mines in Chile.