Nos últimos dias, a polícia do Reino Unido anunciou o desmantelamento de uma organização de culto, gerando ampla discussão na Internet.

Ao contrário dos cultos habituais que fazem lavagem cerebral através da religião, os membros deste grupo aderiram voluntariamente, com o único propósito de “castrar-se”.

Embora histórias relacionadas com a castração tenham ocasionalmente chegado às manchetes nos últimos anos, o surgimento de seguidores semelhantes a um culto aumentou o limiar de curiosidade entre os espectadores.

Um porta-voz da polícia afirmou: “Entre 7 e 10 de dezembro de 2021, a polícia de Londres revistou uma residência em Finsbury Park, prendendo 7 membros do culto ‘Nullo’, com idades entre 30 e 60 anos, que já haviam cortado seus próprios pênis e recolhido lá para ver outros passarem pelo procedimento.”

O líder era um norueguês de 44 anos conhecido como “O Criador de Eunucos”, que admitiu ter castrado dezenas de homens. Ele agora foi preso sob suspeita de conspiração e de causar lesões corporais graves. (Ele já foi libertado sob fiança)

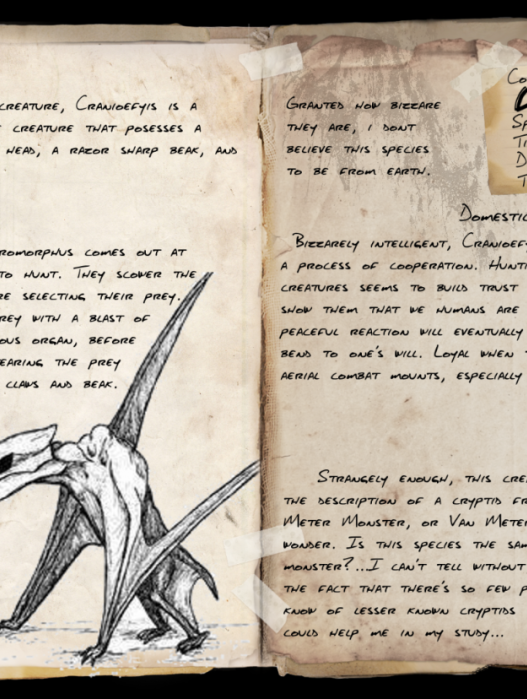

A organização de culto “Nullo” não é apenas o nome deste pequeno grupo; seu nome completo é “anulação genital”, termo usado para designar aqueles que “removem voluntariamente seus órgãos sexuais”.

De acordo com estatísticas incompletas, cerca de 10.000 a 15.000 pessoas em todo o mundo praticam a castração, mas o número real permanece um mistério.

O relatório afirma que este grupo é influenciado por subculturas, considerando-se “sem género”, independente de identidades masculinas ou femininas, predominantemente masculinas. Elas optam por se submeter a uma cirurgia voluntária de remoção genital, desejam remover seus pênis, mas não se consideram mulheres após a cirurgia.

“Todos os dias acordo rezando para que meu pênis desapareça, mas ele ainda está lá.”

“Não consigo nem começar a dizer o quanto quero me livrar dessas partes desnecessárias.”

Sob o princípio da “castração voluntária”, a comunidade Nullo tem sido um nicho, ao ponto de ser virtualmente invisível, até que este evento trouxe uma grande força policial para prender pessoas, o que remonta ao homem norueguês que organizou isto.

Muitos anos atrás, o norueguês realizou uma castração DIY em si mesmo, e seu caso de sucesso atraiu muitas outras pessoas a procurarem sua ajuda.

Com anos de “produção estável”, ele transformou isso em um negócio, abrindo um estúdio de cinema para gravar os procedimentos e publicá-los em fóruns da dark web, cobrando por visualização e às vezes até por streaming ao vivo.

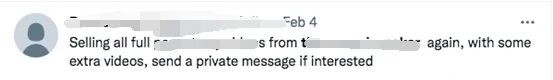

O que é ainda mais absurdo é que para expandir sua “fama”, ele anunciou no Twitter…

(Captura de tela de outras contas; a conta do perpetrador foi excluída)

Essa solicitação flagrante naturalmente chamou a atenção da polícia do Reino Unido, que, seguindo inúmeras pistas online, encontrou esta casa de streaming restrita e passou três dias procurando e coletando evidências.

Os vizinhos ficaram bastante chocados com a comoção, dizendo à mídia: “A polícia cercou a casa durante dias e levou embora desktops, laptops e outras coisas”.

Agora que o caso foi divulgado, só podemos imaginar o que os vizinhos devem estar pensando…

A polícia não revelou muito, mas à medida que o evento se espalhava, grandes meios de comunicação como o Daily Mail, The Sun e The Independent rapidamente o acompanharam, revelando mais detalhes.

Embora esta seja a primeira organização Nullo descoberta no Reino Unido, a ideia de transmissão ao vivo de castração com fins lucrativos pode ter sido inspirada no Japão.

Em 2012, o artista japonês de 22 anos, Mao Sugiyama, optou por se submeter à castração no dia de seu aniversário, retirando completamente o pênis e os testículos.

Dois meses depois, Sugiyama decidiu processar “artisticamente” seus órgãos genitais removidos.

Ele postou nas redes sociais: “Por favor, compartilhe, venderei meu pênis, que foi removido do meu corpo, por 100.000 ienes (aproximadamente £ 880) para fazer uma refeição para você. Vou cozinhá-lo de acordo com o pedido e localização do comprador. “

Para evitar problemas desnecessários, embora Sugiyama afirmasse particularmente que não tinha doenças, ele enfatizou que os hóspedes deveriam assinar um termo de responsabilidade: se adoecessem por comer seu pênis, ele não seria responsável.

Assim que o anúncio foi feito, o evento de Sugiyama atraiu atenção significativa e, surpreendentemente, cinco clientes ofereceram £ 250 cada por esta refeição única.

Para aumentar a conscientização sobre “terceiro gênero, assexuais e minorias sexuais”, Sugiyama decidiu transformar a degustação originalmente privada em um banquete público para 70 pessoas.

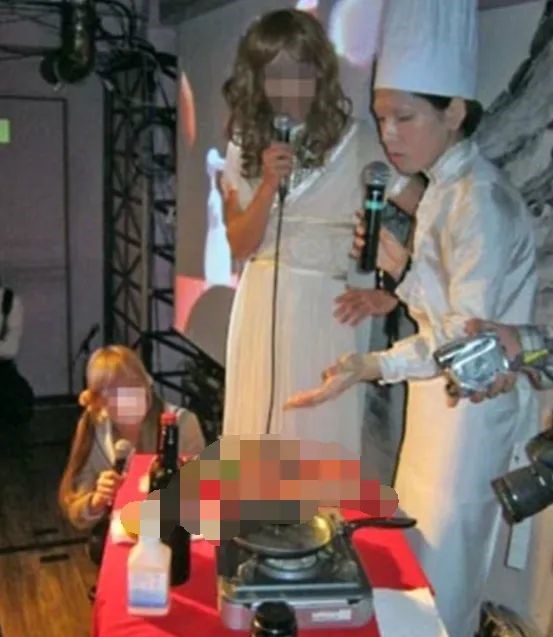

No dia do banquete, todos os convidados foram convidados para um restaurante no bairro Suginami, em Tóquio, onde Sugiyama até preparou uma apresentação de piano antes do início do evento.

Segundo imagens da noite, Sugiyama, vestido de chef, preparou pessoalmente este jantar especial para os cinco comensais, servindo “pênis como prato principal” com salsa e cogumelos como acompanhamentos. Outros convidados comeram carne bovina e de crocodilo.

Durante o cozimento, Sugiyama comentou brincando: “Não haverá mais chances de acusações de exposição indecente”.

Infelizmente, o prato não fez tanto sucesso quanto se imaginava. Um cliente descreveu: “A refeição não deixou uma impressão forte; as pessoas na mesa disseram que era muito insípida, com uma textura parecida com borracha…”

Essa crítica negativa chamou a atenção de um diretor de culinária de um site de culinária, que, no espírito de não perder nenhuma emoção, escreveu para Sugiyama, dizendo: “Que desperdício de um pênis perfeito! É muito duro e precisa ser cozido lentamente, sous-vide ou guisado.”

Verdadeiramente… ame seu trabalho, ame sua vida~

Embora a lei japonesa não criminalize o canibalismo, este evento de degustação ainda chamou a atenção da polícia. Um porta-voz do Departamento de Polícia Metropolitana de Tóquio declarou: “Exibir publicamente um pênis decepado para uma multidão reunida” é uma exposição indecente, o que pode levar a uma pena de prisão de dois anos e uma multa de até 2,5 milhões de ienes.

No entanto, à medida que a popularidade do evento diminuiu, essas acusações foram retiradas em 2013.

Depois de testemunhar o culto à castração e o “banquete do pênis”, os internautas estrangeiros ficaram chocados com esta notícia explosiva.

“Ah, como vou olhar para as decorações de cogumelos agora!”

“Me lembra os Imaculados de ‘Game of Thrones’.”

“Quase engasguei com meu café lendo esta notícia.”

A escolha de Sugiyama por essa abordagem pesada também está relacionada a “fetiches” específicos dentro da “cultura de castração”.

Além da castração física, o “canibalismo” e a “agressão sexual” são duas questões importantes que a comunidade Nullo não pode evitar.

Embora esse grupo não tenha um público amplo, nos casos que vêm à tona, os castrados muitas vezes sofrem agressões sexuais e, em casos mais extremos, o pênis retirado é comido pelo “cirurgião”.

Este fenômeno tem uma base; escolher um hospital de boa reputação para castração não é apenas caro, mas também exige uma longa espera. Assim, pessoas com motivos mistos tornam-se “cirurgiões”, alguns dos quais também fazem parte da comunidade Nullo.

Uma pesquisa com 2.971 pessoas que foram submetidas à castração descobriu que os “cirurgiões” tinham três vezes mais probabilidade de se envolver em comportamentos inadequados do que os “pacientes”.

Sobre esta situação, alguém que foi submetido à castração em 1994 explicou: “É preciso dizer que todo o processo cirúrgico pode ser realmente emocionante”.

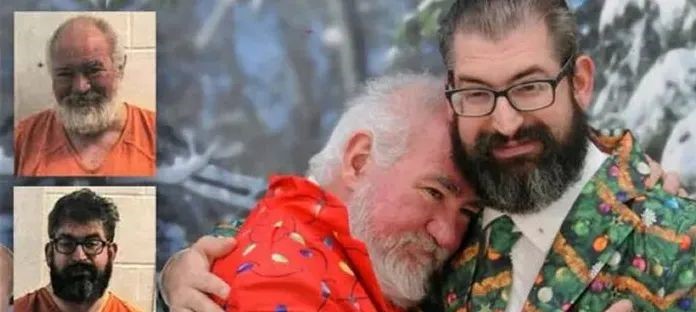

Há alguns meses, também escrevi sobre um caso canibal semelhante, em que um casal americano, Gates e Allen, atraiu vítimas sob o pretexto de uma cirurgia gratuita de remoção do pênis.

Concluída a cirurgia, eles abandonavam as vítimas porque seu objetivo final era obter os pênis decepados para consumo futuro.

Depois que o caso veio à tona, a polícia encontrou uma geladeira cheia de pênis em sua residência…