Earlier this month, I loved a socially distanced spherical of golf with a few pals, and the dialog inevitably turned to the inventory market. One in all my compadres is a self-admitted novice on the subject of investing and prefers to maintain his portfolio allotted to a sequence of low-cost passive merchandise designed to trace broad indices just like the S&P 500. It is a smart technique for certain, as he usually spends as a lot time researching investments for his portfolio as he does on his golf sport (i.e., not a lot)!

Happily, my buddy’s low-maintenance method to managing his 401(okay) has yielded pretty good outcomes as of late. After the shock and horror he felt after taking a look at his portfolio assertion on March 31, he was pleasantly shocked to see that his account stability was again to the place it was at the beginning of the yr by the point his June 30 quarterly assertion had arrived within the mail.

A Look Beneath the Hood

The S&P 500 is modestly constructive for the yr as of this writing, however a glance below the hood reveals that this index has been removed from boring to this point in 2020. The U.S. fairness market has more and more been pushed larger by a slim universe of shares that, happily for buyers in index-based merchandise, are represented within the high 10 holdings. The slim “breadth” of the market is illustrated within the chart under. It reveals a document variety of index constituents underperforming the S&P 500 by greater than 10 p.c, together with a document low 22 p.c of shares outperforming the index.

Supply: The Each day Shot, Wall Avenue Journal

What’s Driving the Market?

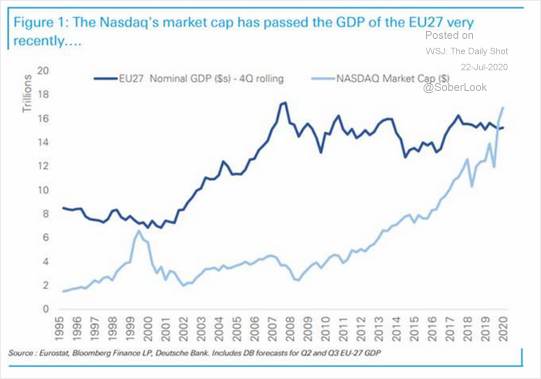

Maybe the worst-kept secret of what has been driving the market this yr is the truth that the expertise sector—together with client bellwether Amazon (AMZN)—has been on a tear. The magnitude of this drive could shock some buyers, particularly once they study that Microsoft’s (MSFT) market cap is approaching that of the U.Okay.’s whole FTSE 100 Index or that the Nasdaq market cap is now exceeding the GDP of your complete EU (see chart under).

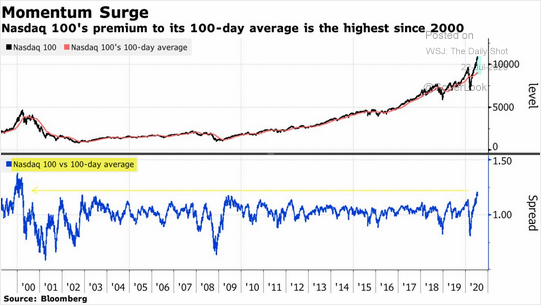

To drive residence the purpose of simply how sturdy the momentum has been with the tech-heavy Nasdaq index as of late, simply check out the chart under. Transferring averages are a terrific gauge of relative energy. We’re approaching ranges in the present day that had been final seen throughout the dot-com bubble on the flip of the century.

Will Historical past Repeat Itself?

The interval after the dot-com bubble (2000–2002) was definitely not form to buyers within the Nasdaq, however there are notable variations in the present day that might end in historical past not essentially repeating itself. Lots of the web and tech shares that garnered such a frenzy within the late Nineties had little or no or detrimental earnings, and valuations had been past excessive. Development at an affordable value was changed with progress at any value, as retail buyers piled into something with “.com” in its firm title.

Shares like Apple, Microsoft, and Amazon are all usually labeled as progress shares, simply as web shares had been within the Nineties. However these firms are additionally persevering with to ship stable earnings experiences on a quarterly foundation. Time will inform if these progress charges will justify what buyers are prepared to pay for his or her shares in the present day, however the indicators of valuation extra don’t seem as rampant in the present day as they had been 20 years in the past.

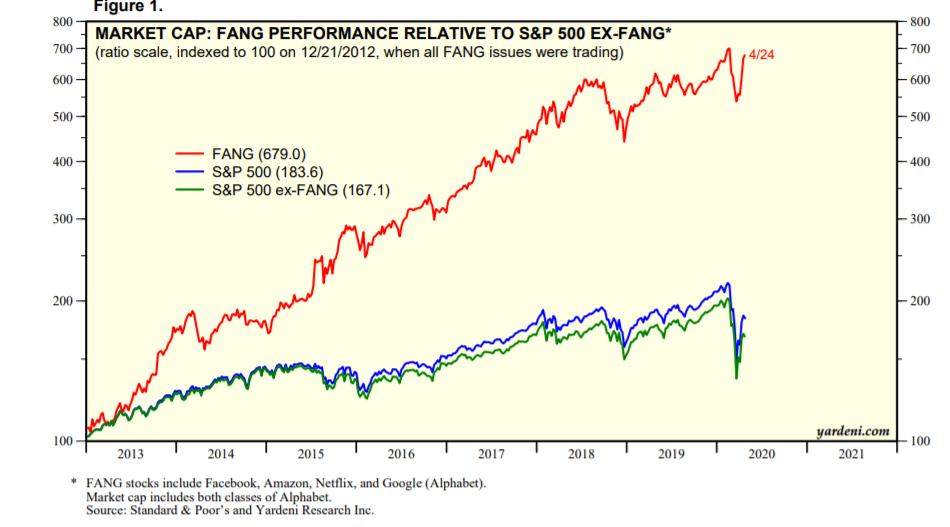

You will need to observe, nevertheless, that the bar has been set larger for these Nasdaq darlings given their current interval of energy. The notorious FANG shares (i.e., Fb, Amazon, Netflix, Google) have delivered outsized returns since all of them began buying and selling. Nevertheless it may be cheap to consider that their magnitude of outperformance could also be tough to maintain in perpetuity. Any sustained rotation into cyclically oriented worth shares might end in a reversion to the imply for a few of these Nasdaq highfliers, and future returns could also be disappointing for many who have lately bought exchange-traded funds (ETFs) that monitor the index.

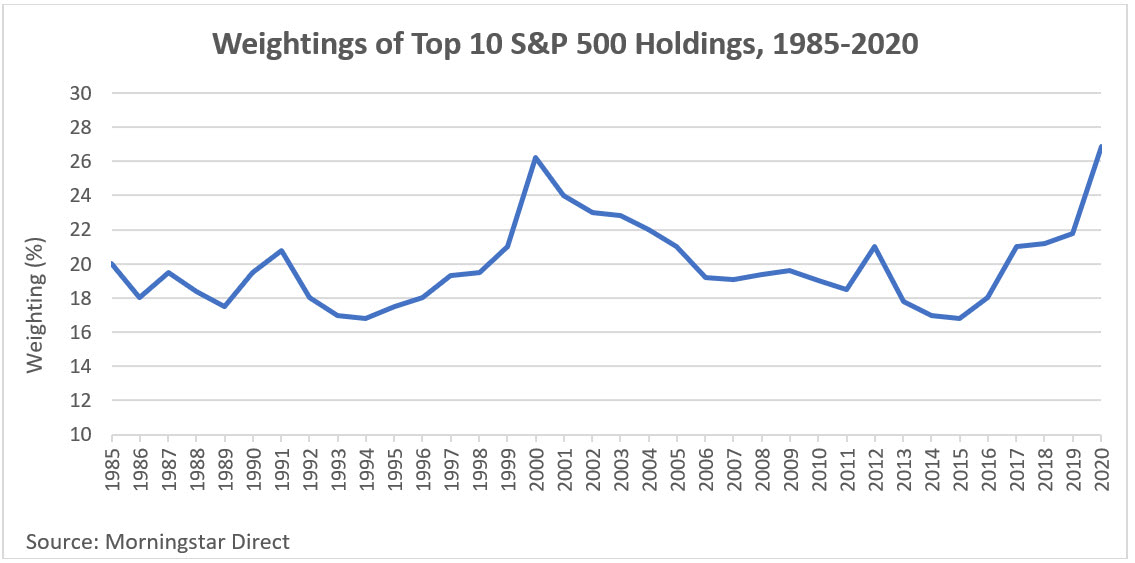

Focus Issues

The numerous rally within the high holdings within the Nasdaq 100 Index additionally has implications for broader indices just like the S&P 500. At the moment, the highest three shares within the broadly adopted S&P 500 are Microsoft, Apple, and Amazon, with an mixture weighting of roughly 16 p.c. Add in the remainder of the highest 10 index holdings, and the whole weighting of those constituents is greater than 26 p.c of your complete S&P 500. It is a stage of focus not seen because the dot-com bubble in 2000. Gulp!

There was a big motion out of actively managed mutual funds and into passively managed merchandise like ETFs and different index funds. These merchandise have an a variety of benefits, like tax effectivity and low price, and they need to all the time be a part of the consideration when setting up a portfolio. Buyers in index merchandise which can be designed to trace the Nasdaq and S&P 500 needs to be conscious, nevertheless, of present sector and safety weightings of those standard benchmarks. They’re considerably top-heavy as of this writing, with shares which have carried out extraordinarily effectively over the previous few years.

A very good train for purchasers to periodically carry out is to assessment their general asset allocation and concentrate on the ensuing sector publicity. You could have a portfolio that seems balanced at first look, however a deeper evaluation of sector allocation might present a a lot larger weighting in sure areas and particular person securities than in any other case could also be most well-liked. That is very true in the present day on account of the market’s slim breadth and important share value appreciation of high holdings in indices just like the S&P 500.

The Pattern Is Your Buddy (for Now)

Markets usually observe cyclical patterns, and the period of those intervals can differ over time. We have now been in a chronic interval of sturdy efficiency from progress shares and, extra particularly, the data expertise sector and client firms like Amazon. The pattern is your buddy for now, however buyers needs to be conscious of the exposures throughout their portfolios and be certain that they’re correctly diversified when the present cycle turns.

Editor’s Notice: The unique model of this text appeared on the Impartial Market Observer.