KEY

TAKEAWAYS

- SOXX is lagging SMH because it broke the 200-day SMA and confirmed a bearish sample.

- SMH is holding up as a result of its prime element stays robust.

- However SMH is at a second of fact forward of an enormous earnings report from Nvidia.

Although the iShares Semiconductor ETF (SMH) and the VanEck Semiconductor ETF (SOXX) have many similarities, there are some massive variations of their element weightings and efficiency. Particularly, SMH permits extra focus than SOXX and SMH is holding up higher than SOXX. SOXX already broke down on the value chart and SMH is at a vital juncture as its greatest element studies earnings this week.

SOXX) and SMH are the 2 largest semiconductor ETFs by AUM (belongings underneath administration). Nevertheless, as I discovered from this video at nAnalyze, their weighing guidelines are very totally different. Specifically, SOXX caps the weighting of the highest 5 shares at 8% every and rebalances. SMH, then again, caps the load of the highest three at 20% every after which rebalances. This larger threshold permits extra room for a momentum run. It’s little shock that the highest three holdings in SMH are Nvidia (23.66%), Taiwan Semiconductor (13.2%) and Broadcom (7.71%). The highest three holding for SOXX are Nvidia (10.12%), Broadcom (8.77%) and Superior Micro Gadgets (8%).

The PerfChart beneath reveals the one-month proportion change for ten semiconductor shares. It’s a blended bag with 4 up and 6 down. Nvidia (pink bar) is up 1.5%, two are down double digits (AMD and Micron) and just one is up double digits (Marvell). Quick-term, it has been a tough journey for the group.

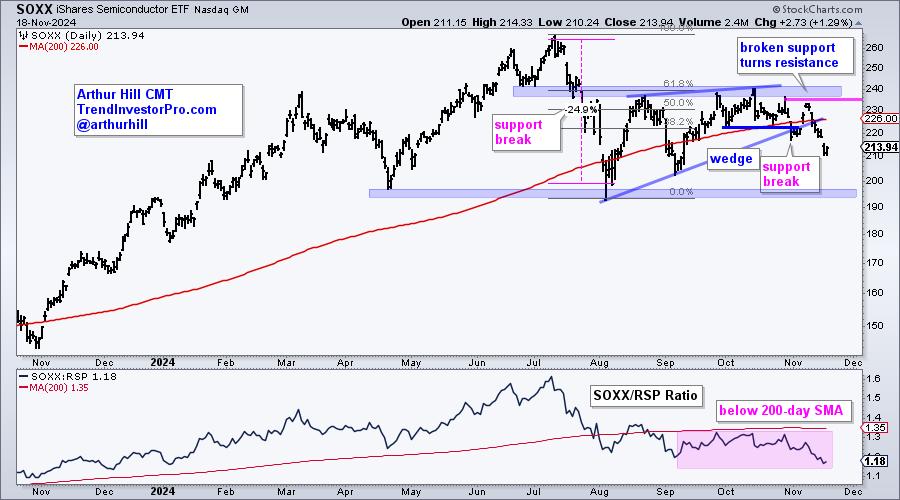

The subsequent chart reveals SOXX breaking wedge help and its 200-day SMA with a pointy decline on October thirty first. SOXX rebounded again into the wedge with a three-day election bounce after which fell beneath its late October low. This implies the wedge break is in play with the primary goal zone within the 195 space. An in depth above 235 would name for a re-evaluation. The indicator window reveals relative efficiency utilizing the SOXX/RSP ratio (SOXX divided by the S&P 500 EW ETF (RSP)). This ratio has been beneath its 200-day SMA since late August, which implies SOXX has been underperforming for round three months.

What’s the significance of a rising wedge? A rising wedge is a bearish continuation sample that marks a counter-trend bounce after a trend-changing decline. SOXX fell round 25% from mid July to early August after which retraced round 61.8% with the rising wedge to 240. Each the sample and the retracement quantity are typical for counter-trend bounces. The wedge break in October reversed the medium-term uptrend and signaled a continuation of the July-August decline. A 25% decline from the wedge excessive would goal a transfer to the 180 space.

Click on right here to study extra about TrendInvestorPro and get two bonus studies!

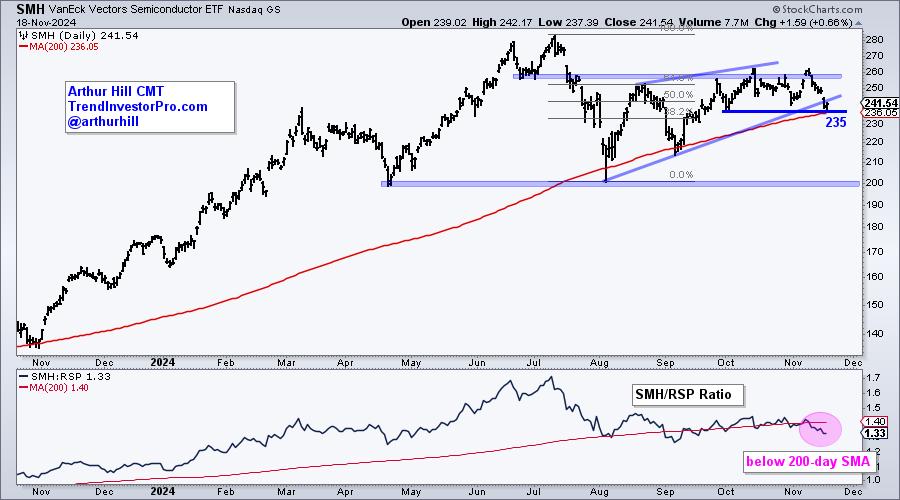

The subsequent chart reveals SMH with a rising wedge, however the ETF has but to interrupt the October low (235) or the 200-day SMA. SMH did break the decrease line of the wedge with a decline final week. Additionally discover that SMH is buying and selling beneath the extent it was buying and selling at earlier than the election. SMH is at a make or break stage with Nvidia (NVDA) set to report earnings on Wednesday after the shut. SMH stays bullish so long as 235 holds. A break would verify the wedge and goal a transfer to the 200 space.

Keep on the best aspect of the development with our weekly studies and movies. Our sturdy top-down strategy began with broad market evaluation to set the general tone. We then drill to down to search out ETFs and shares with bullish setups inside long-term uptrends.

Highlights from Latest Weekly Stories/Movies:

- S&P 500 breadth stays robust and Nasdaq 100 breadth stays robust sufficient, however Nasdaq 100 is lagging as a result of a 3rd of its shares are in long-term downtrends.

- Fintech, Cybersecurity, Software program and Cloud Laptop ETFs had been main earlier than the election surge and have become very prolonged with the election surge. Time for some persistence.

- The Gold ETF grew to become oversold for the primary time this yr.

- Copper, Base Metals and Copper Miners failed maintain their breakouts as they bought hit publish election.

- The ten-yr Treasury Yield is on the rise as TLT strikes sharply decrease. What’s the market telling us?

Click on right here to study extra and get two bonus studies!

///////////////////////////////////

Select a Technique, Develop a Plan and Observe a Course of

Arthur Hill, CMT

Chief Technical Strategist, TrendInvestorPro.com

Creator, Outline the Development and Commerce the Development

Wish to keep updated with Arthur’s newest market insights?

– Observe @ArthurHill on Twitter

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic strategy of figuring out development, discovering alerts throughout the development, and setting key value ranges has made him an esteemed market technician. Arthur has written articles for quite a few monetary publications together with Barrons and Shares & Commodities Journal. Along with his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Enterprise Faculty at Metropolis College in London.

Study Extra