The Indian telecommunications market will enter 2025 in just some days, as we start one other yr on this transformative journey towards larger connectivity with Gigabit speeds. That stated, non-public operators, Bharti Airtel, Vodafone Thought, and Reliance Jio are specializing in their respective progress methods. As we progress via December and markets enter vacation mode, let’s take a snapshot of the present state of affairs for Indian non-public telecom operators, primarily based on their current quarterly experiences.

Additionally Learn: Airtel Urges Further Tariff Revisions to Maintain Investments

Bharti Airtel

Bharti Airtel reported sturdy progress in its Cellular ARPU, which reached Rs 233 (USD 2.8) in Q2FY25. The second-largest telecom operator in India reported 263.6 million cell smartphone prospects (4G/5G) as of the quarter ending September 2024, with cell information consumption per buyer at 23.9GB per thirty days. The operator added 26.2 million subscribers, growing its market share within the smartphone (4G/5G) phase.

Postpaid Phase

Airtel additionally strengthened its “management place within the postpaid phase” with a internet addition of 0.80 million prospects in Q2FY25, growing its postpaid buyer base to 24.7 million. Nonetheless, the general Airtel postpaid subscriber base, together with IoT and M2M connections, is round 53.11 million.

Reliance Jio

Reliance Jio, the most important telecom operator in India, reported a complete subscriber base of 479 million as of September 2024 (Q2FY25), with 148 million 5G subscribers contributing to 34 % of wi-fi information utilization. Notably, Jio stated it reached these True5G subscribers in lower than two years of launching and continues to be the most important 5G operator exterior of China. Jio additionally claimed to be the fastest-growing fastened wi-fi operator globally, with over 2.8 million JioAirFiber connections.

ARPU

Jio reported an ARPU of Rs 195.1, pushed by the partial influence of a tariff hike and the scale-up of dwelling and digital companies companies. Jio has by no means disclosed its postpaid numbers, so there aren’t any particular figures obtainable to report. Nonetheless, Jio gives very aggressive postpaid tariffs to its customers.

Additionally Learn: Jio Reviews Quickest FWA Progress Globally with Over 2.8 Million AirFiber Connections

Vodafone Thought

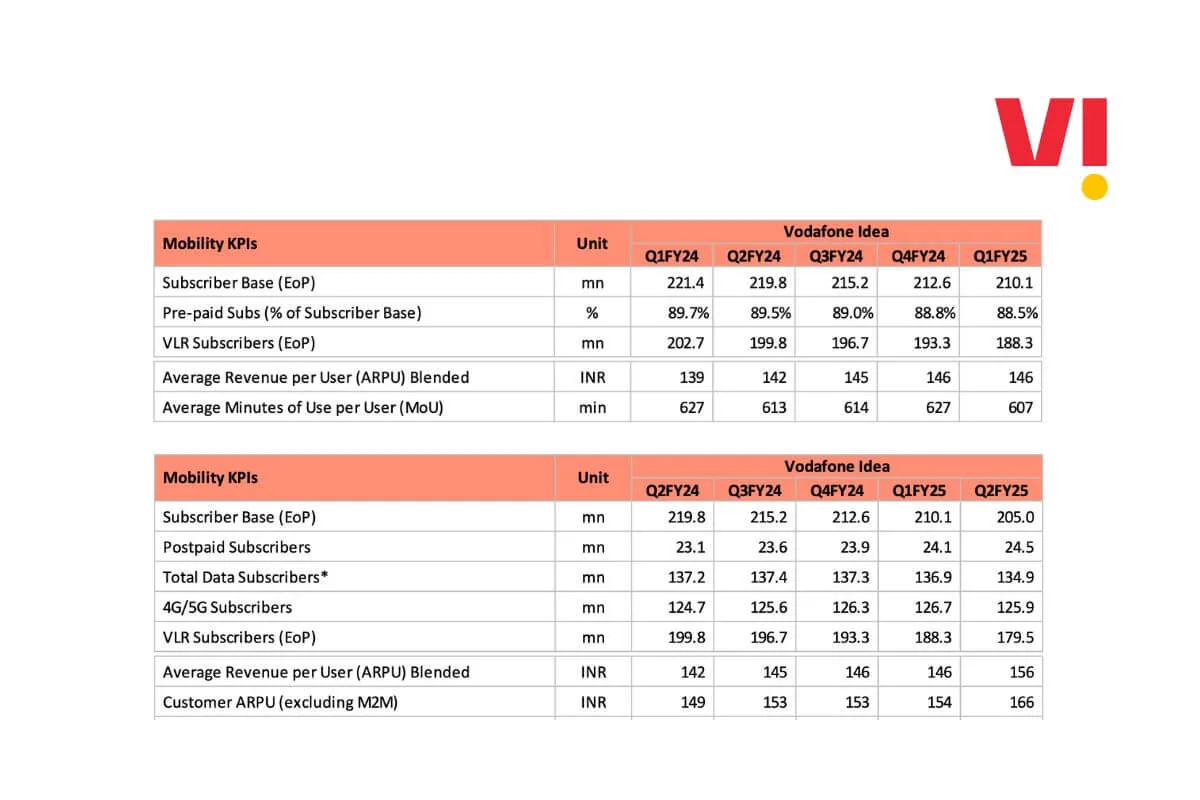

Vodafone Thought, in its Q2FY25 report, stated its 4G enlargement is progressing with a goal to attain 4G inhabitants protection of 1.1 billion by March 2025 and 1.2 billion by September 2025.

As of September 30, 2024, Vodafone Thought had 205 million subscribers, with roughly 61 % of them utilizing 4G/5G companies. Though Vi reported 4G/5G subscribers, because the telco has not launched 5G companies, we will assume these subscribers are utilizing 4G, as Vi has adopted totally different conventions for reporting 4G customers throughout its experiences. That stated, Vi reported a 4G subscriber base of 125.9 million on the finish of Q2FY25.

Blended ARPU

Apparently, Vi modified the way it experiences ARPU on this quarter. The third-largest Indian operator reported an ARPU of Rs 166, excluding M2M, whereas the operator didn’t specify such M2M exclusions till Q1FY25, when ARPU stood at Rs 146.

To make clear, Vi reported blended ARPU till Q1FY25, whereas it began reporting buyer ARPU excluding M2M in Q2FY25. If we use the operator’s earlier apply of reporting, the blended ARPU as of Q2FY25 can be Rs 156. Nonetheless, in Q2FY25, Vi reported buyer ARPU excluding M2M at Rs 166, showcasing a rise.

Additionally Learn: Vodafone Thought Reviews Rs 7,176 Crore Loss in Q2, ARPU at Rs 166

Postpaid Phase

Concerning the postpaid subscriber base, Vi emphasised the postpaid phase in its quarterly report, stating, “Within the postpaid phase, we now have been in a position to enhance our buyer base on a QoQ in addition to YoY foundation. Whereas a bigger a part of this enhance is from the M2M phase, we now have seen a constant enhance in retail postpaid prospects over the past yr.”

The corporate additionally modified the way it experiences its postpaid subscriber base this time. Vi reported a postpaid subscriber base of 24.5 million in Q2FY25. Nonetheless, it isn’t clear if these numbers embrace M2M connections. Till Q1FY25, the operator reported the pay as you go subscriber base as a share of the entire base, from which the postpaid consumer base could possibly be derived.

In conclusion, as per the current bulletins, Vi is specializing in 4G community enlargement with plans to roll out 5G in key geographies beginning in Q4FY25.