Walmart is the most important US retailer general, whereas Amazon dominates on-line retail. Over the previous a number of years, Amazon’s income development has considerably outpaced Walmart’s, and its earnings have additionally surged. To grasp the components behind these developments, we analyzed their revenues and earnings throughout enterprise segments, geographic areas, and product/service classes.

NOTE – For our evaluation, we examined the latest annual financials of each corporations. Amazon’s fiscal 12 months (FY) ends in December, that means its 2023 revenues characterize the 12 months ending on December 31, 2023. Walmart’s fiscal 12 months ends in January, so its FY24 revenues correspond to the 12 months ending on January 31, 2024. Since 11 of these 12 months fall inside 2023, we in contrast Walmart’s FY24 revenues with Amazon’s 2023 revenues.

Following are three choose insights from our evaluation.

- Amazon’s development far outpaces Walmart and the retail sector.

Amazon annual revenues reached $575 billion in 2023, and Walmart whole revenues reached $648 billion. Over the past 5 years (2018-2023), Amazon achieved a cumulative annual development price (CAGR) of 20%, considerably outpacing each Walmart’s 5% development and the 7% development in whole US retail gross sales (excluding auto and gasoline). Extending the evaluation to a 13-year interval (2010-2023), Amazon’s CAGR stood at a formidable 24%, in comparison with 3% for Walmart and 5% for the broader US retail trade.

In This autumn 2024, Amazon’s quarterly revenues may surpass Walmart’s for the primary time. For context, in Q1 2010, Amazon’s quarterly revenues have been a modest $7 billion in comparison with Walmart’s $100 billion. Nevertheless, over the subsequent decade, Amazon skilled speedy development, fueled by its enlargement into new markets and providers. In This autumn 2024, consensus estimates venture Amazon’s quarterly revenues to succeed in $186 billion, narrowly surpassing Walmart’s anticipated $180 billion (see determine beneath).

- Amazon widens the online revenue hole with Walmart.

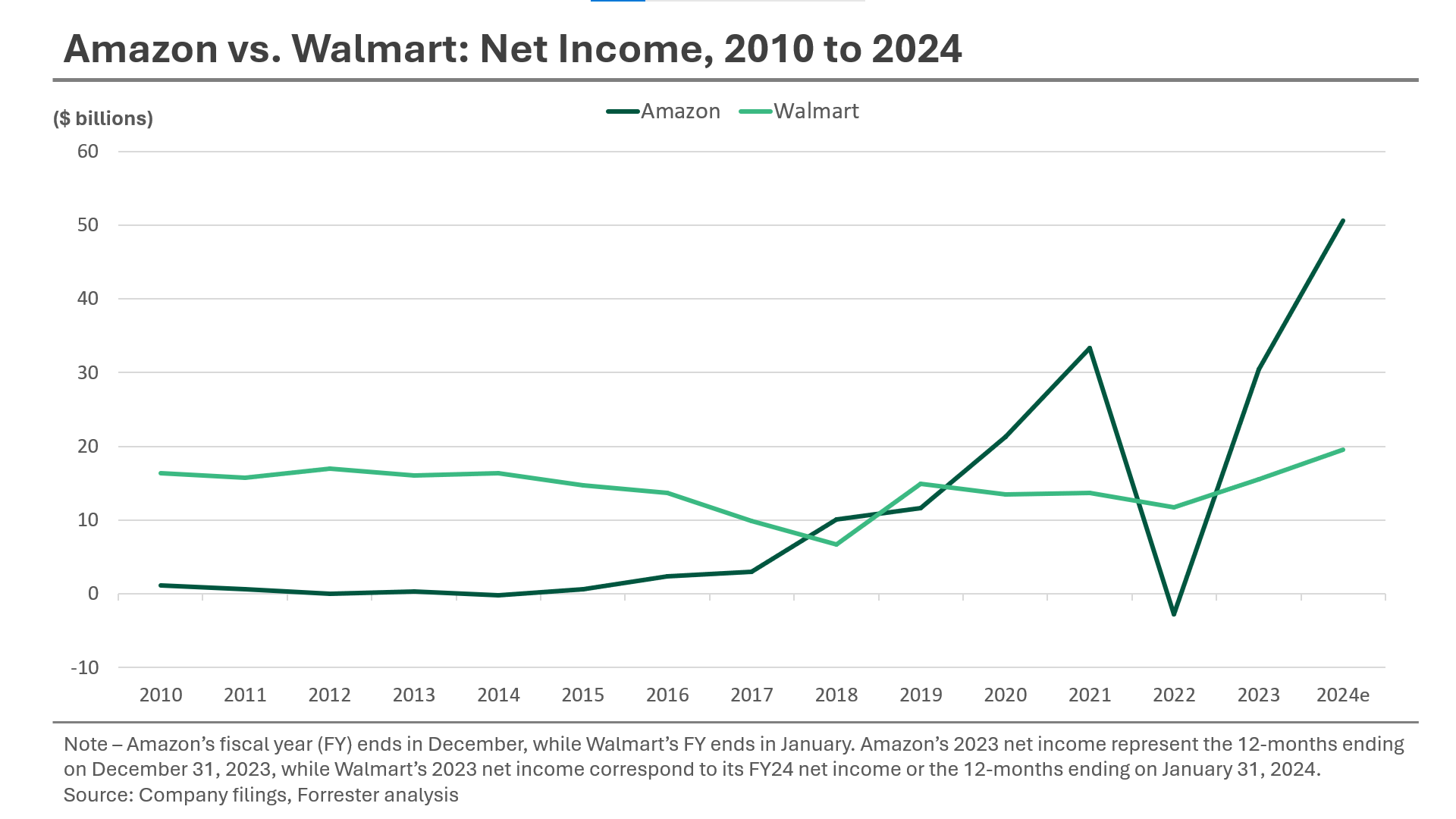

Amazon continues to outpace Walmart in web revenue. The consensus estimates venture Amazon’s web revenue rising to $51 billion in 2024, up from $30 billion in 2023, with its web revenue margin growing to eight% from 5% (see determine beneath).

As compared, Walmart’s web revenue will develop steadily, reaching $20 billion in FY25 with a 3% margin, up from $16 billion (2% margin) in FY24.

Wall Avenue analysts anticipate the online revenue hole between the 2 corporations to maintain widening, pushed by Amazon’s profitability features in Amazon Internet Providers (AWS) and its retail media operations. The consensus estimates venture Amazon’s web revenue to extend to $63 billion in 2025 and $79 billion in 2026, in comparison with Walmart’s projected web revenue of $22 billion in 2025 and $24 billion in 2026.

- Walmart’s retail is worthwhile, however AWS enormously boosts Amazon’s general earnings.

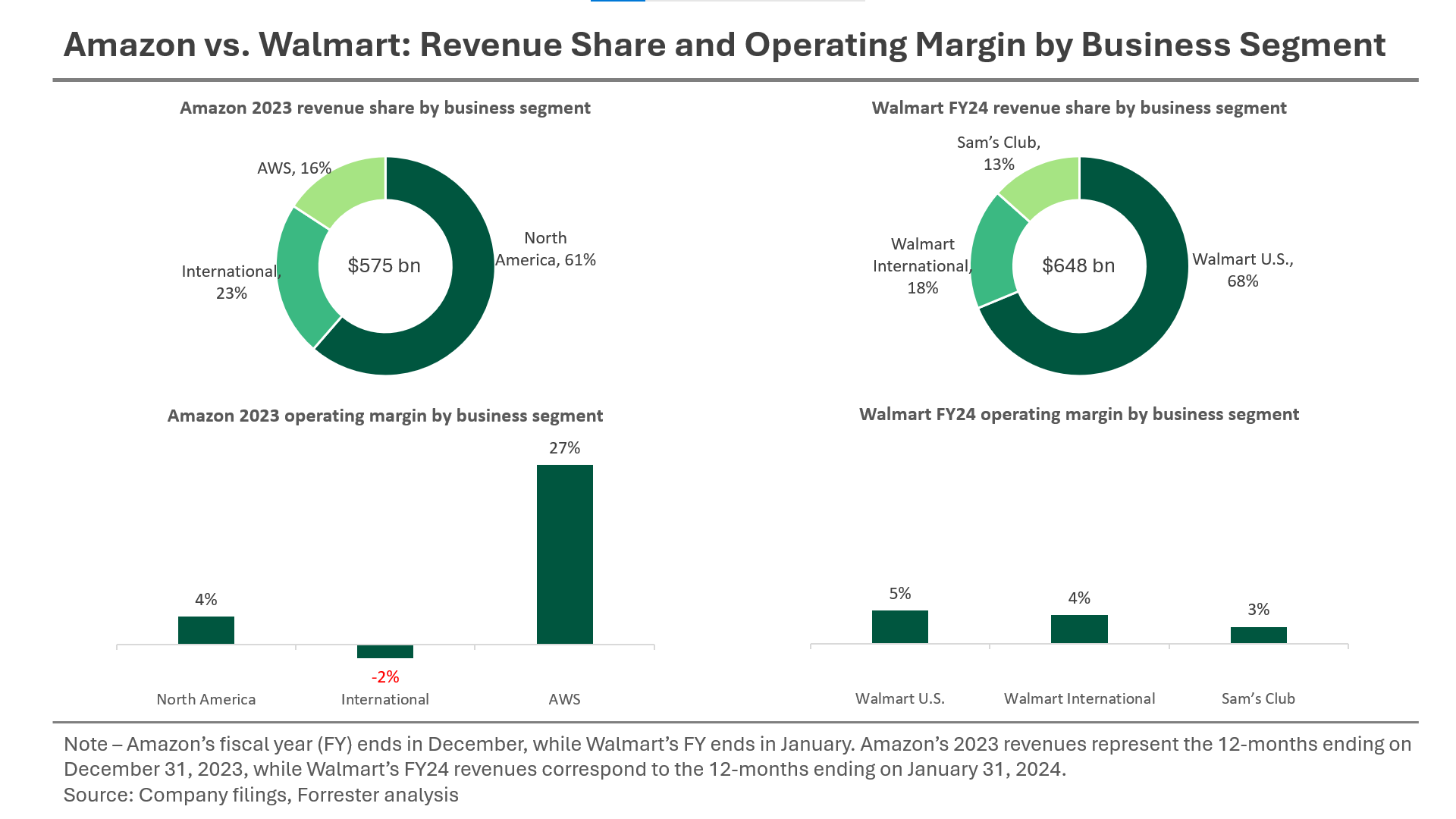

Amazon reviews revenues and working earnings for 3 enterprise segments: North America, Worldwide, and AWS. In 2023, Amazon’s North America section generated $353 billion (61% of whole income). The Worldwide section contributed $131 billion (23%) and AWS added $91 billion (16%). Amazon reported AWS as a enterprise section for the primary time in 2015, when it generated $8 billion in income for the corporate.

As for working earnings and margins: in 2023, Amazon’s North America section generated $15 billion in revenue (4% margin). Its Worldwide section incurred a $3 billion loss (-2% margin), whereas AWS generated $25 billion in revenue (27% margin) (see determine beneath).

Walmart’s three enterprise segments are: Walmart U.S., Walmart Worldwide, and Sam’s Membership. In FY24, Walmart U.S. introduced in $442 billion (68% of whole income), adopted by Walmart Worldwide at $115 billion (18%) and Sam’s Membership at $86 billion (13%).

Walmart’s working revenue and margins are extra constant: Walmart U.S. generated $22 billion in working revenue (5% margin), Walmart Worldwide $5 billion (4% margin), and Sam’s Membership $2 billion (3% margin).

Forrester expects a continued shift in retail market share in direction of Amazon and Walmart over the subsequent 5 years, as each corporations spend money on synthetic intelligence and machine studying, automation and buyer expertise, and rising different sources of revenues and earnings reminiscent of retail media. As the 2 corporations compete fiercely for larger gross sales development, smaller opponents will wrestle to maintain up as a result of robust steadiness sheets, pricing energy, and know-how capabilities of those giants. Smaller retailers might want to obtain vital differentiation by way of service, assortment, and retailer/on-line expertise.

Per Forrester’s US On-line Retail Forecast, 2024 To 2029, the mixed US retail gross sales of Amazon and Walmart will attain $1.5 trillion by 2029, capturing one-fourth of the entire US retail market. By 2029, the mixed US e-commerce gross sales of the 2 corporations will attain $1.1 trillion, accounting for two-thirds of whole US on-line retail gross sales.

If you’re a Forrester consumer and want to study extra, please schedule an inquiry or steering session with me!