Ladies’s financial clout is on the rise. They’re producing and managing a rising quantity of world wealth. They’re more and more taking part within the workforce, main main firms, beginning new companies, and inheriting wealth. These optimistic shifts have translated into actual monetary energy—and sure right into a rising phase of what you are promoting.

However actually attending to know girls traders would require you to know (after which meet) their particular wants. Right here, we’ll talk about a number of key traits which have been uncovered relating to girls traders that can give you precious insights into this key demographic.

Make It Private

In line with current estimates, girls will management practically $22 trillion in private wealth by 2020, and they’re anticipated to inherit $28.7 trillion in intergenerational wealth within the subsequent 40 years (see chart under). However do you know that ladies who inherit wealth from their spouses or households usually tend to swap advisors if the present advisor didn’t put money into constructing a private reference to them within the previous years? Making it private issues.

To know why girls might not really feel personally linked to their advisors, it could assist to consider some common classes of ladies traders. New York Life Investments not too long ago performed a survey of 800 U.S. girls and recognized 4 distinct subsegments with the next traits:

-

“Instantly single”: Outlined as girls who’ve been separated, divorced, or widowed previously 5 years, 32 % of the all of the sudden single group really feel patronized by monetary advisors. Additional, 51 % stated they could not work with an advisor once more.

-

“Married breadwinner”: These skilled girls characterize the first supply of earnings for the family, with 44 % feeling that monetary advisors deal with girls in another way than they do males.

-

“Married contributor”: On this group are skilled and nonprofessional girls whose main contributions to the family are usually nonfinancial. Right here, 32 % really feel unconsciously excluded in conversations with advisors.

-

“Single breadwinner”: This phase contains skilled and nonprofessional girls who reside alone or as a single-family unit. Of those girls, 27 % would really like better monetary training.

It appears the monetary providers trade has come up quick in its efforts to construct connections with girls traders. However to make strides, advisors must seize girls’s hearts and minds, plus have a heightened consciousness of unconscious biases that could be at work.

Construct Belief Via Communication

Probably the greatest methods to ascertain a private connection is thru efficient communication. Ladies need their investing concepts to be taken significantly. On the similar time, some really feel their lack of economic training is an impediment to investing. Many ladies will definitely worth your information, however they might additionally prefer to develop confidence in their very own skills.

So, how will you develop a relationship through which your feminine shoppers really feel understood, empowered, and revered? Discuss to them—not right down to them. Needless to say girls typically go for face-to-face conferences, are very conscious of physique language, and like accessible language over monetary jargon. Lastly, if given the choice, many ladies will select to attend in-person instructional occasions relatively than an internet class or a social media group.

Welcome Ladies to the Investing Desk

It has been stated that in contrast with males, girls have fewer property, don’t prefer to take dangers, are usually not considering investing, and are usually not as crucial to decision-making. However we all know that ladies management a considerable quantity of wealth. Ladies additionally make most, if not all, shopper buying selections. They tend to ask extra questions and could also be extra cautious than males. This method doesn’t essentially imply they’re extra danger averse than their male friends. Slightly, it displays their consciousness of the monetary—and emotional—dangers concerned with investing.

Simply as with many different points of their lives, girls are sometimes looking for the proper steadiness between danger and return. Maybe riskier investments fall outdoors of their consolation zone. In that case, you may play a crucial function by specializing in the dangers that matter and connecting that data with their objectives to affect productive funding conduct.

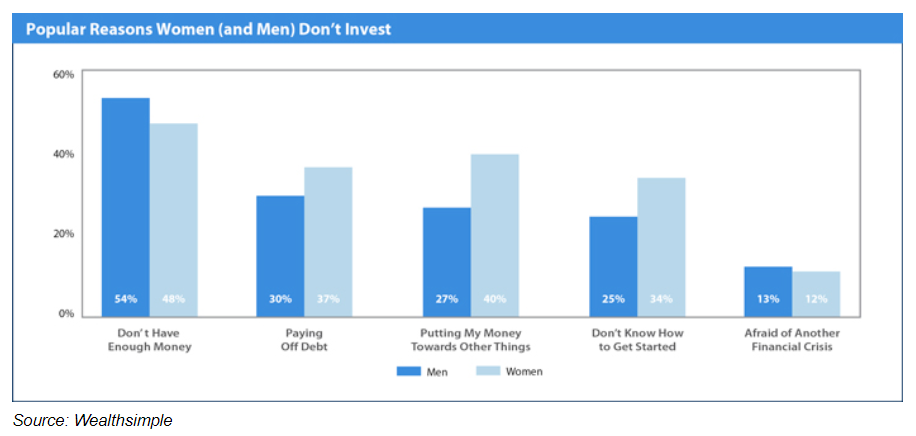

Ladies, typically, do have a tendency to speculate lower than males. But it surely’s not as a result of they’re averse to investing or to risk-taking. A Wealthsimple survey of a pattern of Canadian faculty graduates between the ages of 30 and 35 discovered that one-third of the ladies surveyed reported not figuring out learn how to get began with investing (see chart under). Plus, the notorious pay hole between women and men leaves girls with comparatively fewer property to speculate versus their male counterparts. With this in thoughts, training and outreach are key to bringing this large shopper base to the investing desk.

Seize the Alternative

Usually talking, girls traders don’t focus solely on beating the benchmark. Consequently, they’re typically much less inclined to alter monetary advisors based mostly on poor efficiency alone. Ladies’s decision-making tends to be values-based and intrinsically linked to their monetary objectives and priorities. Ladies might take longer to make selections and outline ability as understanding the market and the dangers. They’re apt to think about completely different points and views earlier than making a choice and commerce much less. Even after they belief an advisor with their cash, girls traders nonetheless need to really feel like they’re in management. As such, they search for advisors who’re aligned with these values and who’re personally invested of their success.

To make inroads with this demographic, remember that ladies are prone to place a excessive worth in your interpersonal expertise. They need to really feel linked, to know that their voices are being heard, and to make sure that their wants and issues are being addressed. Cookie-cutter options received’t work! However recommendation on holistic monetary well-being that’s particular to their distinctive wants simply would possibly. In an ever-changing atmosphere the place many are feeling elevated strain from robo-advisors, the need for a extra personal touch is definitely excellent news.

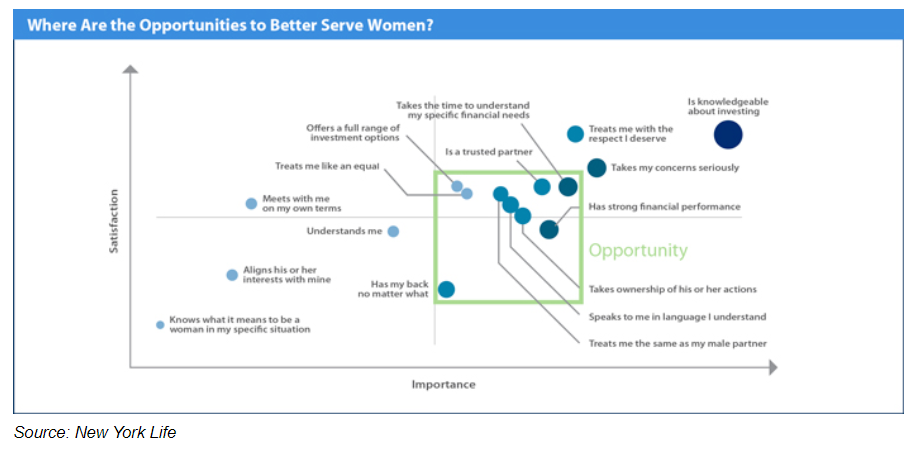

The chart under highlights areas that ladies rank excessive in significance however low in satisfaction. If addressed appropriately, they might current alternatives for monetary advisors to raised serve girls.

One Measurement Does Not Match All

After all, girls are usually not a one-size-fits-all market area of interest or phase that may be addressed with a single playbook. They’ve had multidimensional journeys and maintain distinctive monetary priorities and values. However there are subsets of ladies traders with comparatively widespread points that, if addressed appropriately, may help you differentiate your self and scale up.

To efficiently leverage this comparatively untapped alternative set, you have to look previous generalizations about “girls’s points.” With consistency, diligence, and respect, you may evolve your follow to satisfy the wants of what’s going to more and more develop into a female-dominated shopper base. Keep in mind, girls are usually sticky shoppers. So as soon as received over, they are going to be with you for the lengthy haul.