Investor Perception

With a number of vital gold and copper discoveries lately, Awalé Assets has constructed a compelling worth proposition that permits traders publicity to West Africa’s wealthy mineral useful resource.

Overview

Awalé Assets (TSX:ARIC) is a mineral exploration firm targeted on high-quality gold and copper-gold deposits. The corporate’s Odienné undertaking is situated in Côte d’lvoire (Ivory Coast) in West Africa, near the borders of Guinea and Mali.

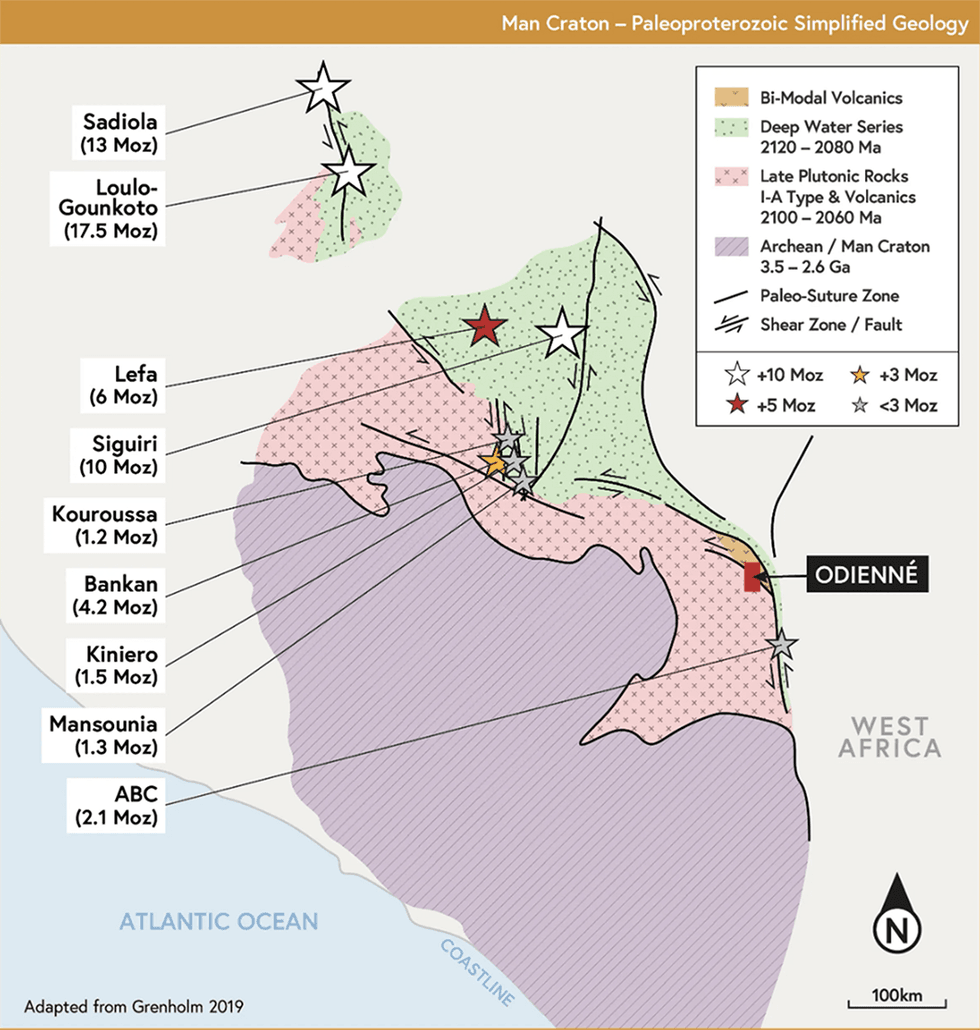

Côte d’lvoire has earned a fame as a beautiful funding vacation spot for mining, primarily based on a number of elements. First, its steady regulatory framework mirrors French civil legislation, and the federal government has lowered forms and established transparency. Second, the area has glorious infrastructure comprising highway networks, ports, airports, and electrical energy networks. Third, the nation’s enticing geological profile is wealthy in a number of minerals together with gold, copper, manganese, bauxite and iron. West Africa is broadly considered a promising gold-producing area with 300 Moz of gold assets. Fourth, its socio-economic atmosphere displays its numerous financial system with a considerable labor power. Lastly, the nation provides a number of tax incentives to draw overseas traders.

Why Awalé Assets is a model new alternative

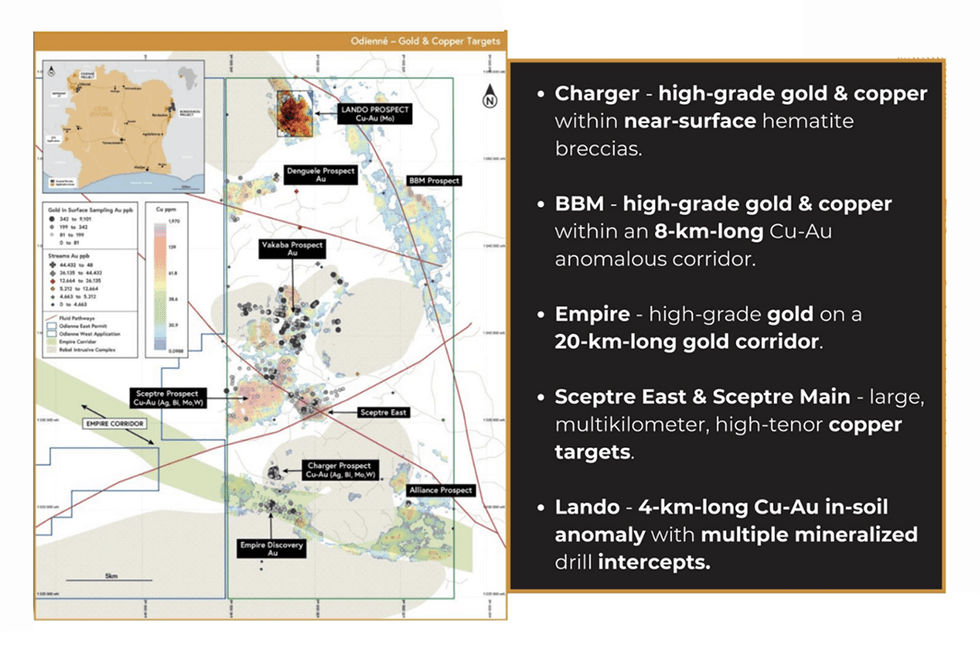

The Odienné undertaking provides Awalé Assets a significant foothold on this promising gold province. The undertaking space spans 2,462 sq km over seven permits and is dwelling to a number of gold and copper-gold discoveries.

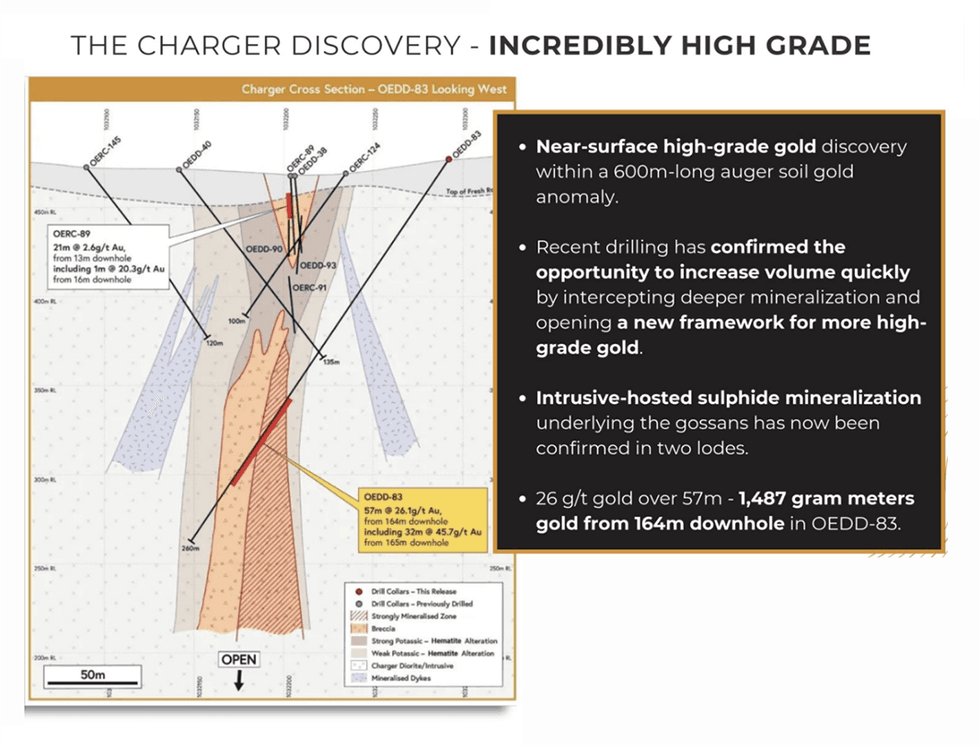

The undertaking has seen 4 vital discoveries, together with three in 2023 (Empire, Charger, and Sceptre East) and one in early 2024 (BBM). Empire returned high-grade gold intercepts, whereas Charger and Sceptre East returned iron oxide copper gold (IOCG) model mineralization.

The BBM goal, found in January 2024, is a brand new gold-copper discovery with vital scope for fast growth. Along with the brand new discovery, additional vital outcomes with seen gold have been returned from the primary two scout holes on the Lando Goal, which lies 10 kilometres northwest of BBM.

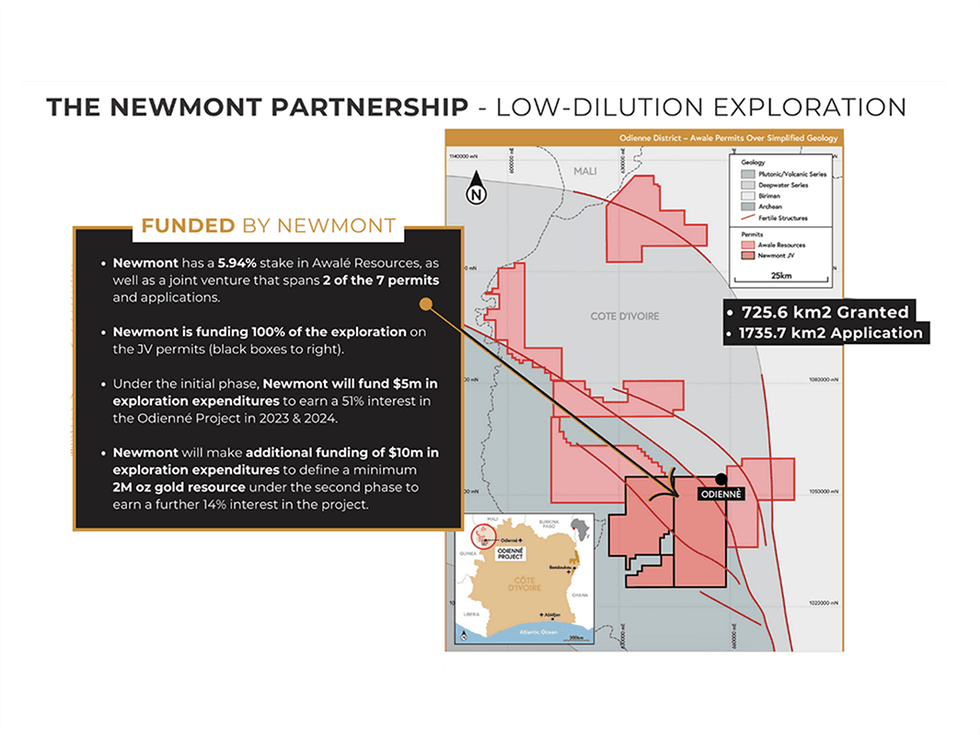

One other necessary characteristic of the corporate’s vivid prospects is its relationship with Newmont, the world’s main gold firm. Newmont elevated its stake in Awalé to fifteen.48 p.c in December 2023 following a non-public placement of almost C$1 million. This funding will allow Awalé to speed up the exploration of its wholly owned permits and alerts a vote of confidence within the vital potential of Awalé.

Newmont holds a three way partnership settlement on two of the seven permits on the Odienné undertaking and is funding one hundred pc of the exploration on the JV permits. Newmont has the choice to earn as much as a 75 p.c curiosity within the Odienné undertaking by funding US$15 million in exploration expenditures and defining a gold useful resource of two million ounces.

Underneath the preliminary section, Newmont invested US$5 million in exploration expenditure which can permit it to earn 51 p.c curiosity within the Odienné undertaking. With profitable Part 1 outcomes, together with constructive drill outcomes and 4 discoveries, Newmont has progressed to Part 2 of the earn-in settlement. It is a vital milestone that underscores the continued success and potential of the Odienné gold-copper undertaking by means of which Newmont may earn an additional 14 p.c curiosity (for a complete 65 p.c curiosity) by spending $10 million in exploration and defining a minimal 2-million-ounce gold useful resource.

Awalé underwent a significant overhaul in Could 2023, appointing a brand new CEO and board. Underneath the brand new administration, led by CEO Andrew Chubb, the Awalé group is nicely positioned to guide the corporate in its future development endeavors.

Firm Highlights

- Awalé Assets is a mineral exploration firm targeted on discovering gold and copper-gold deposits in Côte d’Ivoire (Ivory Coast).

- The corporate’s flagship Odienné undertaking is situated within the northwest Denguélé Area of Côte d’Ivoire in West Africa.

- The undertaking spans over 2,462 sq. km in space with seven permits and is in a area that boasts over 300 million ounces (Moz) of gold deposits. The geological setting of the Odienné district is corresponding to that of different vital iron oxide copper gold (IOCG) provinces globally, rising the possibilities of the Odienné Challenge changing into the primary main IOCG deposit in West Africa.

- The undertaking yielded three vital discoveries in 2023 – Empire, Charger, and Sceptre East. Furthermore, in January 2024, the corporate introduced a brand new discovery in BBM and inspiring outcomes for the Lando goal.

- A key constructive for the corporate is its relationship with Newmont, the world’s main gold mining firm. Newmont holds a three way partnership settlement on two of the seven permits on the Odienné undertaking and is a major shareholder, proudly owning 11.2 p.c of the corporate.

- Underneath the management of CEO Andrew Chubb, the corporate has achieved vital milestones, together with 4 discoveries, and is nicely positioned on its development journey.

Key Challenge

Odienné Challenge

The Odienné undertaking is the corporate’s flagship asset. The undertaking spans over 2,462 sq km and contains seven permits, of which two are beneath a JV settlement with Newmont. These permits maintain nice promise for gold and copper-gold deposits.

The undertaking has comparable geological traits to the Carajas Mineral Province and different IOCG provinces which can be main suppliers of gold and copper. It’s in West Africa, which boasts over 300 Moz of gold deposits. There are a number of +10 Moz deposits adjoining to the undertaking’s boundaries. Different adjoining gold assets embrace Predictive’s deposit in Guinea, and Centamin’s deposit which is roughly 50 kilometres south of the Odienné undertaking.

The undertaking is characterised by a number of high-potential targets and discoveries. These embrace: 1) Empire discovery situated alongside the 20-kilometre Empire Gold Hall; 2) Sceptre East and Major copper-gold targets; 3) Charger, a high-grade gold-copper discovery; 4) Lando, a 4-kilometre-long copper-gold goal; 5) and BBM, a 3.5-kilometre-long copper-gold goal.

The primary discovery was at Empire, a high-potential gold prospect situated round 5 kilometres from Sceptre and different copper-gold targets on the 20-kilometre-long Empire structural hall.

Thus far, solely 5 kilometres of this pattern have been drilled. The important thing outcomes for this goal embrace – 1) Gap OEDD-2: 27 metres at 3.1 grams per ton (g/t) gold from 43.2 metres, and a couple of) Gap OEDD-24: 15 metres at 13.1 g/t gold from 69 metres. Past this fundamental goal, there may be potential for locating massive gold deposits alongside the east-west hall.

The second discovery was at Charger, the place a number of phases of drilling have been accomplished. A complete of 11 holes had been drilled at Charger with Gap OEDD-45 containing three high-grade intervals inside a 65-metre-wide zone of mineralization, together with 12 metres at 4.9 g/t gold. A number of the key outcomes at Charger embrace 32 metres @ 3.0 g/t gold, 0.17 p.c copper, and 6.6 g/t silver, together with 4 metres @ 12.4 g/t gold, 0.7 p.c copper, and 30 g/t silver from 78 metres.

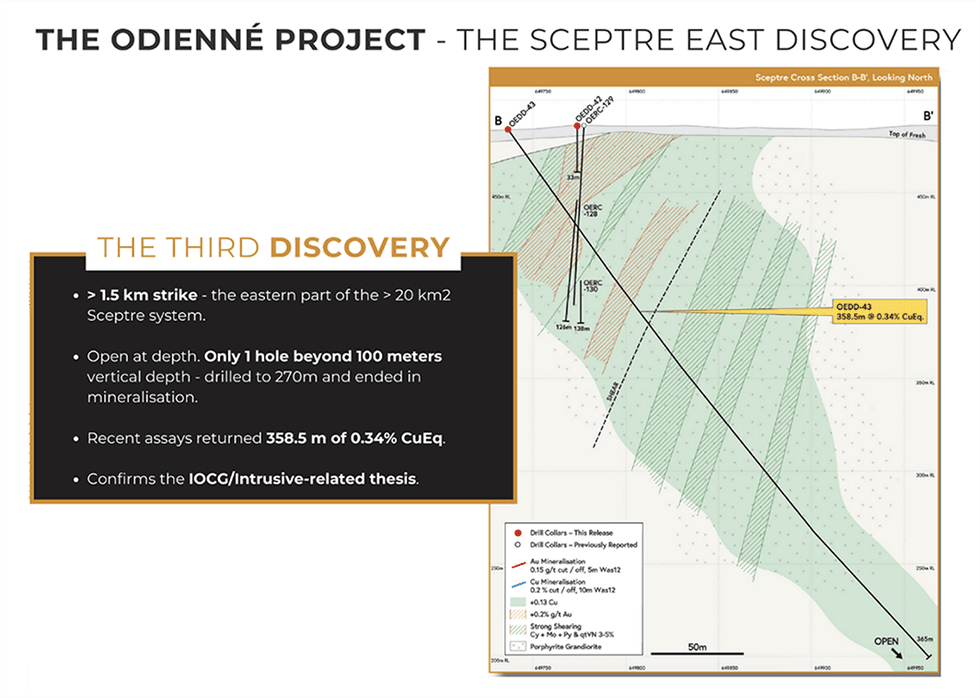

The third discovery was on the Sceptre East goal that spans round a 1.5-kilometere-long copper-gold-molybdenum-silver anomaly. Sceptre East is a part of the massive 20 sq km gold/copper/silver/molybdenum bearing mineralized system, known as Sceptre. Discovery drilling commenced at Sceptre East in This autumn 2022, and the preliminary section comprised a complete of seven holes totaling 1,092.2 metres. Observe-up drilling in Q2 2023 consisted of 9 reverse circulation (RC) and three diamond drill holes for a complete of 1,730 metres. The important thing ends in the follow-up program embrace gap OEDD-43, which returned 358.5 metres at 0.34 p.c copper equal from 6.5 metres downhole.

Moreover these three discoveries, the corporate introduced a brand new gold-copper discovery in January 2024 on the BBM goal. A complete of 4 holes had been drilled at BBM, all of which intersected high-grade gold. The important thing outcomes had been:

- Gap OEDD-59: 44 metres at 1.1 g/t gold and 0.2 p.c copper

- Gap OEDD-61: 51.9 metres @ 0.5 g/t gold, 0.27 p.c copper and 1.5 g/t silver from 25 metres

- Gap OEDD-62: 18.25 metres at 1.8 g/t gold, 0.3 p.c copper and 1.4 g/t silver from 156 metres

Moreover, vital outcomes with seen gold have been returned from the primary two scout holes on the Lando Goal, which lies 10 kilometres northwest of the brand new BBM discovery. Preliminary drilling at Lando is encouraging and warrants additional systematic drilling at this goal.

Administration Group

Andrew Chubb – CEO

Andre Chubb holds a BSc diploma from the College of New England, Australia, and is a member of the Australian Institute of Geologists and the Society of Financial Geologists. He’s a geologist with greater than 20 years of expertise in exploration and mining in several geographies, together with Africa, Europe and Australia. His expertise spans totally different domains together with main massive groups, operations and advisory roles. He was concerned in main the Mantra Assets’ Mkuju Challenge in Tanzania, from exploration by means of to feasibility and eventually to takeover by ARMZ/Uranium One for AU$1.02 billion.

Andrew Smith – VP Exploration

Andrew Smith is an achieved financial geologist with over 14 years of exploration and mining expertise. Smith has confirmed discovery success in each greenfield and near-mine gold exploration. He has well-developed expertise in each technical and administration roles for exploration and improvement initiatives throughout West Africa and Canada. Extra not too long ago, this has included roles as director of exploration geology for Coeur Mining, chief geologist for Awalé Assets, and exploration supervisor for Randgold Assets in Senegal. Smith has an Honours Diploma in Geology and Petroleum Geology from the College of Aberdeen in Scotland, is a fellow of the Geological Society of London, and member of the Society of Exploration Geologists.

Ardem Keshishian – VP Company Improvement and Investor Relations

Ardem Keshishian brings over 15 years of progressive expertise in company improvement, investor relations, finance, and capital markets, specializing within the mining sector. Most not too long ago, Ardem served as VP of company improvement and investor relations at Moneta Gold, a Canadian gold developer with belongings within the Timmins Gold Camp, Ontario, till its merger with Nighthawk Gold. Previous to Moneta Gold, he held roles at Royal Highway Minerals, Pollitt & Co., Haywood Securities, and Van Berkom & Associates. He’s a CFA constitution holder and holds a Bachelor of Science from Concordia College and a Grasp of Enterprise Administration from the John Molson College of Enterprise.

Stephen Stewart – Chair of the Board of Administrators

Stephen Stewart holds a BA diploma from Western College in London, Ontario, an MBA from the College of Toronto, and an MSc diploma from the College of Florida. He has greater than 18 years of senior management expertise with a number of Canadian corporations, together with Orecap, QC Copper & Gold, Mistango River Assets and Baselode Vitality. He’s additionally the founder and chairman of the biggest mining-focused charitable group and fund in Canada, the Younger Mining Professionals Scholarship Fund.

Anthony Moreau – Director

Anthony Moreau is the CEO and Director of American Eagle Gold and likewise serves as a Director of QC Copper & Gold, Orecap Make investments, and Mistango River Assets. He was previously with IAMGOLD, the place he held numerous roles in Enterprise Improvement and Innovation. Anthony can also be the chief of the Younger Mining Professionals Toronto. He additionally co-founded the YMP Scholarship Fund, which has raised over $1.25 million since its inception seven years in the past. Anthony is a Queen’s College of Enterprise graduate and a Chartered Monetary Analyst (CFA).

Karl Akueson – Director

Karl Akueson is an Ivorian born pure assets entrepreneur who co-founded Awalé Assets following a profession in metals and mining funding banking at BMO Capital Markets in London. He not too long ago based and is the present CEO of Swap Metals, a personal exploration firm targeted on expertise metals in Cote d’Ivoire. Karl relies in Abidjan. He’s a graduate from Imperial Faculty Royal College of Mines – MSc Metals and Vitality Finance, and the College of Manchester – MEng Chemical Engineering.

Charles Beaudry – Director

Charles Beaudry holds a BSc diploma in geology from the College of Ottawa and a grasp’s diploma in geology from McGill College. He has three a long time of expertise in enterprise improvement, exploration, and undertaking administration. Beforehand, he has been related to IAMGOLD and Noranda-Falconbridge-Xstrata.

John Scott – Principal Geologist

Dr. John Scott is a results-focused exploration geologist, with greater than 27 years of expertise inside groups which have delivered quite a few discoveries and vital enterprise development in each near-mine and greenfield settings internationally. John’s profession as a seasoned technical lead has spanned North America, Sub-Saharan Africa, the Center East, Southeast Asia and Australasia. Scott makes a speciality of sensible mentorship to upskill area groups, goal technology, figuring out mineralization controls, and growing strong geologic fashions at deposit, district and nation scales. He holds a Bachelor of Science with Honors (First Class) from the College of Adelaide, Australia, in addition to a PhD in Structural Geology from the College of Otago, New Zealand. Scott can also be a fellow of the Society of Financial Geologists and a member of each the Australasian Institute of Mining and Metallurgy, and the Society for Geology Utilized to Mineral Deposits.

Kirmat Noormohamed – Exploration Supervisor

Kirmat Noormohamed is an exploration geologist with technical and operational expertise developed by means of greater than 25 years in firm and consulting roles throughout the mining and exploration trade throughout a number of nations in Africa. She has in depth expertise from greenfield exploration to feasibility research as a part of numerous groups inside multinational corporations akin to Anglo American, AngloGold Ashanti, Falconbridge, Redback Mining, Kinross Gold and Teranga Gold, the place she has led and been a part of groups discovering over 2.5 million ounces of gold. She holds a BSc from Abilene Christian College within the US, and is presently finishing her MBA at College of Illinois.

Sharon Cooper – CFO

Sharon Cooper is certified as a chartered accountant, with over 10 years of expertise in accounting and auditing roles for mining and mining-related corporations. Earlier than Awalé, she was related to Ernst and Younger and a number of other junior exploration and mining corporations.

Karl Akueson – Native Advisor

Karl Akueson holds an MSc diploma in chemical engineering from the College of Manchester and MSc in metals and power finance from the Royal College of Mines. He’s a co-founder of the corporate and has served as an advisor since itemizing. He has additionally labored with BMO Capital Markets in London.