CAC 40 (France) Elliott Wave Evaluation Buying and selling Lounge day chart.

CAC 40 Elliott Wave technical evaluation

-

Operate: Counter Development.

-

Mode: Corrective.

-

Construction: Grey Wave 2.

-

Place: Orange Wave 3.

-

Subsequent increased diploma path: Grey Wave 3.

-

Particulars: Grey Wave 1 seems accomplished, with Grey Wave 2 of Orange Wave 3 at present lively.

-

Wave cancellation degree: 7,031.04.

The CAC 40 day chart Elliott Wave evaluation signifies a counter-trend setup in corrective mode, specializing in grey wave 2. Positioned inside the bigger construction of orange wave 3, the evaluation means that grey wave 1 has accomplished, with grey wave 2 now unfolding inside orange wave 3. This corrective section in grey wave 2 suggests a short-term reversal in opposition to the primary development, probably signaling a pullback or consolidation earlier than orange wave 3 resumes its upward trajectory.

With the invalidation degree set at 7,031.04, this level acts as a crucial threshold for the present wave construction. If costs keep above this degree, the corrective motion of grey wave 2 stays intact, indicating a probable return to an upward development inside the broader context of grey wave 3. Conversely, a drop under this degree would invalidate the present wave evaluation, doubtlessly signaling a shift away from the present counter-trend view.

The positioning of grey wave 2 inside orange wave 3 underscores a corrective section inside the general development. With grey wave 1 accomplished, the corrective nature of grey wave 2 would possibly current alternatives for reversal earlier than a possible continuation of the first development. Merchants and analysts watching the CAC 40 might contemplate this section as a chance for a brief pullback, with shut consideration to the 7,031.04 invalidation degree to make sure adherence to the wave construction.

In abstract, the CAC 40 day chart Elliott Wave evaluation indicators a counter-trend corrective section with grey wave 2 now lively. Positioned inside orange wave 3, this evaluation suggests potential consolidation or pullback earlier than the first development resumes. The 7,031.04 degree is a key threshold for sustaining the present wave construction, and holding above this degree would mark the top of the corrective section.

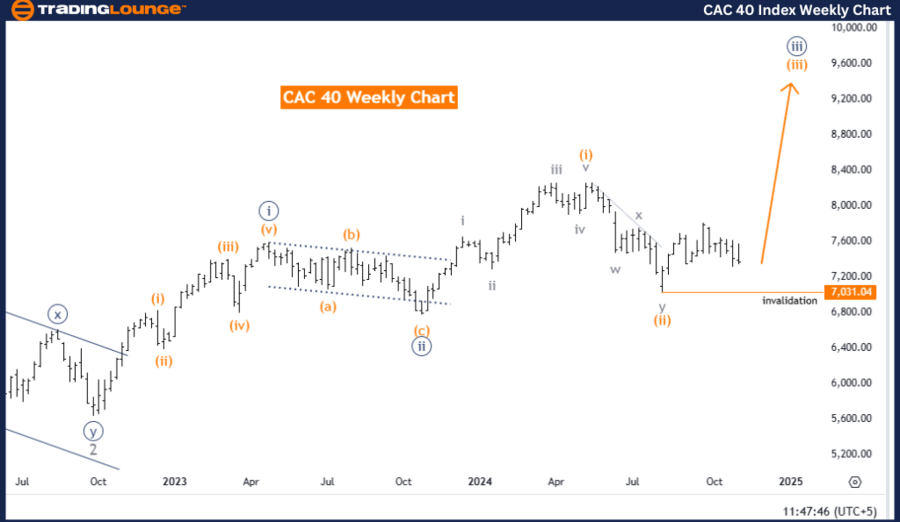

CAC 40 (France) Elliott Wave Evaluation Buying and selling Lounge weekly chart

CAC 40 Elliott Wave technical evaluation

-

Operate: Bullish Development.

-

Mode: Impulsive.

-

Construction: Orange Wave 3.

-

Place: Navy Blue Wave 3.

-

Subsequent increased diploma path: Orange Wave 3 (began).

-

Particulars: Orange Wave 2 seems accomplished, with Orange Wave 3 now lively.

-

Wave cancellation degree: 7,031.04.

The CAC 40 weekly chart Elliott Wave evaluation signifies a bullish development in an impulsive mode, specializing in the development of orange wave 3. Inside this construction, navy blue wave 3 is in progress, aligning with the not too long ago began bigger orange wave 3. This sample means that orange wave 2 has accomplished, and the CAC 40 index is now getting into an upward section inside orange wave 3.

The event of orange wave 3 indicators a continuation of the major bullish development, reflecting sustained shopping for momentum available in the market. With orange wave 2 not too long ago accomplished, orange wave 3 is anticipated to additional prolong the general upward motion, reinforcing a optimistic outlook for the CAC 40 index inside the broader wave construction.

The wave invalidation degree is about at 7,031.04, marking a crucial help degree for the present bullish configuration. If costs stay above this degree, the evaluation favors a continuation of the upward development, validating the continuing development of orange wave 3. Nevertheless, a drop under this degree would invalidate the present wave construction, probably altering the bullish outlook and indicating a necessity for reassessment.

In abstract, the CAC 40 weekly chart evaluation displays a bullish development in an impulsive wave construction, led by orange wave 3. Following the completion of orange wave 2, the chart suggests a powerful upward motion inside orange wave 3, in keeping with the broader bullish sample. The 7,031.04 degree serves as an important threshold, supporting the present development so long as costs stay above it. This bullish configuration suggests continued development potential for the CAC 40 index inside the ongoing Elliott Wave framework.

![CAC 40 Elliott Wave technical evaluation [Video] CAC 40 Elliott Wave technical evaluation [Video]](https://i2.wp.com/editorial.fxstreet.com/miscelaneous/CAC-638665632386199801.png?w=860&resize=860,0&ssl=1)