Worldwide criticism of quick trend’s waste, labor abuses and carbon emissions has accomplished little to decelerate the trade. However new laws might alter the flood of products — just like the floral print jumpers priced at, say, $2.99, the children’ T-shirts promoting for $4.26 or the tank tops for $4.88.

The time period “quick trend” — which emerged within the Nineteen Nineties alongside Zara, a European firm promoting runway-inspired kinds at inexpensive costs — has come to outline stylish, low-cost clothes to put on and throw away.

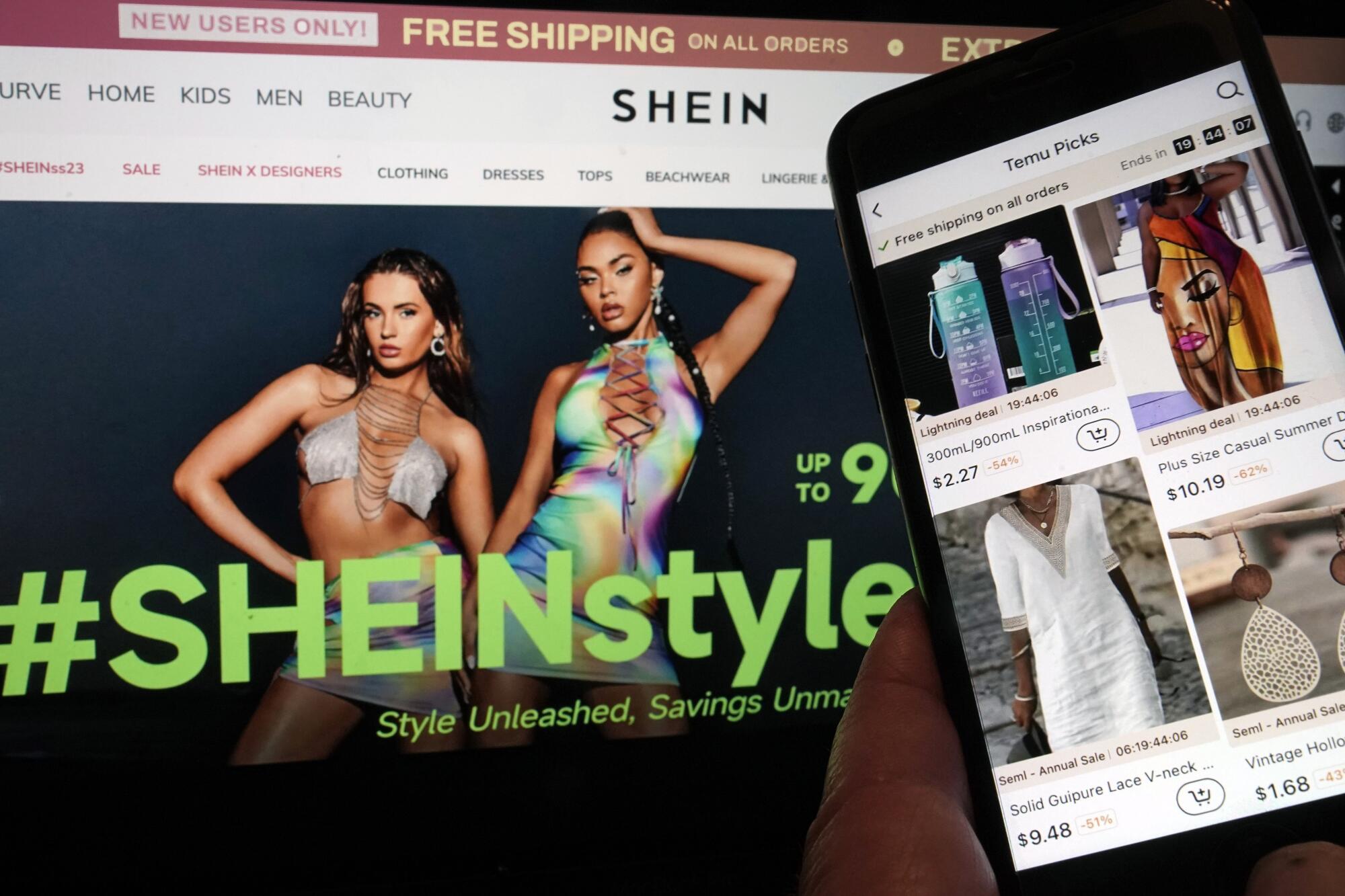

The enterprise mannequin has been widespread amongst buyers and types, which maintain their inventories low, attempt to predict what clients need and use highly-flexible provide chains for fast turnaround. The most recent iterations are epitomized by the wildly profitable Chinese language e-commerce platforms Shein and Temu.

A conventional retailer could supply 1,000 totally different kinds per yr, stated Sheng Lu, professor and graduate director of trend and attire research on the College of Delaware. Examine that to the primary era of fast-fashion manufacturers, Zara and H&M, which put out about 20,000 per yr. Shein, he added, which has garnered the label of “ultra-fast trend,” churns out 1.5 million totally different kinds per yr.

Clothes manufacturing doubled between 2000 and 2014, a consulting agency estimates, and the variety of clothes bought per capita rose 60%.

(Thibault Camus / Related Press)

Based on consulting agency McKinsey & Co., which estimates the worldwide trend trade to be price $1.7 trillion, clothes manufacturing doubled between 2000 and 2014, and the variety of clothes bought per capita elevated by 60%. On the present tempo, McKinsey predicts clothes and footwear consumption will enhance from 62 million tons in 2019 to 102 million tons in 2030, “equal to greater than 500 billion extra T-shirts,” in accordance with the Clear Garments Marketing campaign.

As clothes costs have plummeted — a number of months in the past, McKinsey reported that the common worth of a product on Shein is $14, $26 at H&M and $34 at Zara — clients have fewer qualms about tossing them. Lower than 1% of trend textiles are recycled, McKinsey reported, and three out of each 5 clothes find yourself in a landfill or are incinerated per yr.

However as quick trend’s reputation rises, so has the backlash towards it, drawing the ire of environmental teams, labor activists and lawmakers throughout Europe and the USA. “The dialogue on quick trend is shortly shifting from the standard enterprise side to the coverage side,” Lu stated.

Latest laws in a number of nations is geared toward curbing the environmental affect of the style trade, whose planet-warming greenhouse gasoline emissions are estimated to exceed these of worldwide flights and maritime transport mixed. McKinsey estimates that the style trade accounts for between 3% and eight% of the world’s greenhouse gasoline emissions, and will enhance by one other 30% by 2030.

Dame Sall types and folds secondhand denims imported from Italy at a warehouse in Dakar, Senegal. Secondhand T-shirts, denims and attire are piled excessive for blocks alongside the busy streets in Dakar’s Colobane neighborhood, the place individuals purchase them at a fraction of their authentic worth.

(Jane Hahn / Related Press)

France is main the hassle to push again towards quick trend. In March, the decrease home of Parliament permitted a invoice that will ban promoting for such gadgets and impose penalties per piece of clothes bought. France has proposed a European-Union-wide ban as nicely on used clothes exports to discourage discarding low-cost items that find yourself in landfills abroad.

New York lawmakers have crafted a invoice that will require main trend manufacturers doing enterprise within the state to map and disclose provide chains to keep away from labor exploitation and environmental hurt.

Based on McKinsey’s 2024 State of Trend report, 87% of trend executives surveyed consider sustainability laws will have an effect on their enterprise this yr. “The sport is altering,” Lu stated. “These laws and shopper altering habits will actually place some strain on these fast-fashion manufacturers.”

Shein, which makes use of predictive analytics to find out what clothes designs will promote finest, has argued that its enterprise mannequin is much less wasteful than conventional retailers’ as a result of it produces solely as a lot as clients order.

Nonetheless, these corporations most related to the phenomenon try to diversify their choices to eschew the label of quick trend and all its adverse connotations.

With a brand new third-party market, Shein clients can now discover secondhand luxurious items on its web site. Zara, the onetime fast-fashion pioneer, has pledged to transition to all sustainable, natural or recycled materials by 2025, and incorporate choices of upper high quality and value to its product traces.

However the affect of quick trend isn’t going away — exemplified by the worldwide garment provide chain, which has been altered as conventional retailers have adopted practices to extend their very own pace and suppleness.

Earlier than the arrival of quick trend, a typical piece of attire took about two months to supply, in accordance with Raymond Wong, a professor within the division of logistics and maritime research at Hong Kong Polytechnic College. Now quick trend can produce an merchandise, from idea to supply, in lower than two weeks.

And as manufacturing capabilities have sped up, so have the life cycles of the clothes that retailers are promoting. Whereas clothes collections have historically been seasonal, fast-fashion manufacturers can launch a minimum of one new assortment per thirty days now, Wong stated.

Quick-fashion sellers Shein and Temu have proved to be wildly widespread in the USA.

(Richard Drew / Related Press)

And being quick, manufacturers have discovered, pays off.

Revenue margins at corporations that embrace quick trend are typically larger than conventional retailers, Wong stated, as a result of they prioritize gross sales quantity and low-cost manufacturing. Preserving sparse stock additionally implies that they don’t have to supply steep reductions to dump unsold merchandise.

“That is the philosophy of the quick trend retailer: Should you can put your merchandise within the retailer someday earlier, you may have larger chance and likelihood to promote extra,” Wong stated.

A extra versatile manufacturing cycle implies that manufacturers are working with extra distributors, producers and suppliers than earlier than. That makes assessing the availability chain for transgressions in labor and environmental requirements tougher.

Sanchita Saxena, a professor at UC Berkeley who research labor and garment provide chains in Asia, stated that whereas extra manufacturers try to enhance sustainability, their value expectations make it troublesome for suppliers, a lot of that are taking losses on accepted orders, to take motion.

The affect of quick trend is “horrible for employees as a result of the cycle is so fast and the turnaround time is so quick, there isn’t a approach a human being can produce the quantity of products that’s required,” Saxena stated. “However they’re getting unbelievable strain to try this, they usually’re at all times getting pushed on worth.”

Regardless of issues concerning the adverse impacts of quick trend and sustainability pledges, specialists say customers alone received’t have a lot affect in how the clothes provide chain adapts.

Garment staff work at Arrival Trend Restricted in Bangladesh. Critics of quick trend have lengthy warned customers to cease treating garments like throwaway gadgets.

(Mahmud Hossain Opu / Related Press)

“The patron is making statements that they need to buy extra ethically and responsibly, however they’re probably not exhibiting that within the scale that’s essential to make manufacturers act,” stated Divya Demato, chief govt of San Francisco-based provide chain consulting agency GoodOps.

Temu, a low-cost purchasing app that gained reputation final yr, was created by the Chinese language e-commerce platform Pinduoduo to faucet into that worth sensitivity amongst U.S. customers.

Based on McKinsey, 40% of U.S. customers have shopped at Shein or Temu within the final 12 months. Many survey respondents stated they meant to purchase extra from these fast-fashion manufacturers within the subsequent two to a few years.

“It turns into form of a chicken-or-egg state of affairs. Manufacturers say ‘Shoppers need it, so we give it to them,’ and customers say, ‘Effectively, manufacturers are doing this, so we’re shopping for it,’” Saxena stated. “Which got here first? I don’t know — however somebody must cease that cycle.”

Particular correspondent Huiyee Chiew in Taipei, Taiwan, contributed to this report.