To start with of 2024, the broader indexes have been being pushed larger largely by mega-cap progress shares. However the market’s management has modified in current months, with stodgy blue chip dividend and worth shares posting sizable features.

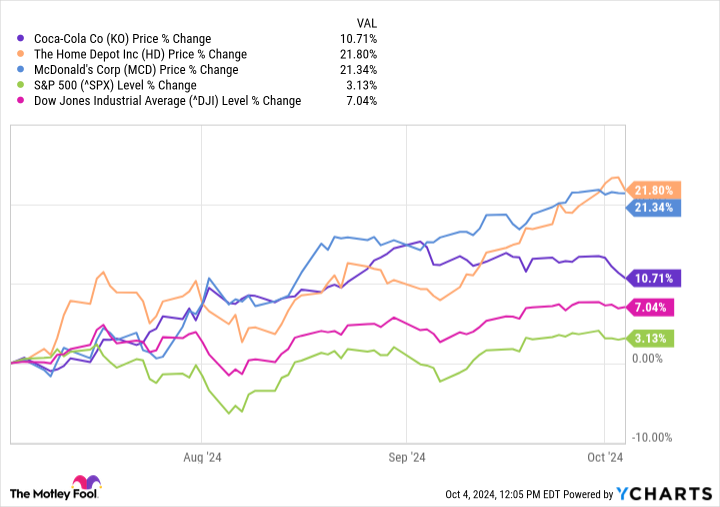

For instance, Nvidia is down 3.1% within the final three months whereas the S&P 500 is up 3.2% and the Dow Jones Industrial Common has elevated 7.1%. In the meantime, Dow parts Coca-Cola (NYSE: KO), Dwelling Depot (NYSE: HD), and McDonald’s (NYSE: MCD) are up much more.

This is why these three blue chip dividend shares might be strong buys in October for people trying to generate passive earnings.

Coca-Cola is returning to progress

Coca-Cola is a superb instance of why a stodgy, low-growth firm is usually a nice funding when it exceeds investor exceptions.

Coca-Cola is a longtime, mature firm with a worldwide beverage portfolio. Traders probably gravitate towards shopping for and holding Coke inventory for regular earnings and dividend progress, and since it may possibly ship outcomes it doesn’t matter what the economic system or the remainder of the inventory market is doing. Because of this, Coke does not have to supply breakneck double-digit earnings progress to impress buyers — it simply has to develop its earnings sufficient to justify affordable dividend raises whereas sustaining a strong steadiness sheet.

Since Coke’s most up-to-date dividend increase was a wholesome 5.4% enhance and the corporate is projected to report report earnings this fiscal 12 months, it is comprehensible why the inventory has been on a tear in current months.

After its gross sales nosedived in the course of the pandemic’s top, Coke did a wonderful job navigating inflationary pressures. The corporate’s pricing energy has been on full show because it continues to take advantage of its rising portfolio of sentimental drinks, espresso, tea, juice, power drinks, water, and glowing water.

The run-up in Coke’s inventory value has dropped its yield to 2.7% and pushed its price-to-earnings (P/E) ratio above historic ranges. Nevertheless, Coke is well-positioned to keep up excessive margins and cross earnings to shareholders.

Coke may pull again on account of valuation considerations. Nevertheless, the underlying enterprise is in wonderful form, suggesting Coke remains to be a very good purchase for long-term buyers in search of dependable dividend shares.

The worst of Dwelling Depot’s downturn might be nearing an finish

Dwelling Depot’s outcomes have been comparatively weak lately. Within the firm’s newest report, it lowered its full-year steering, anticipating decrease gross sales and earnings in fiscal 2024 in comparison with fiscal 2023. Regardless of the awful outlook, Dwelling Depot has been one of many hottest shares within the Dow in current months, and it simply blasted to a brand new all-time excessive on Oct. 2.

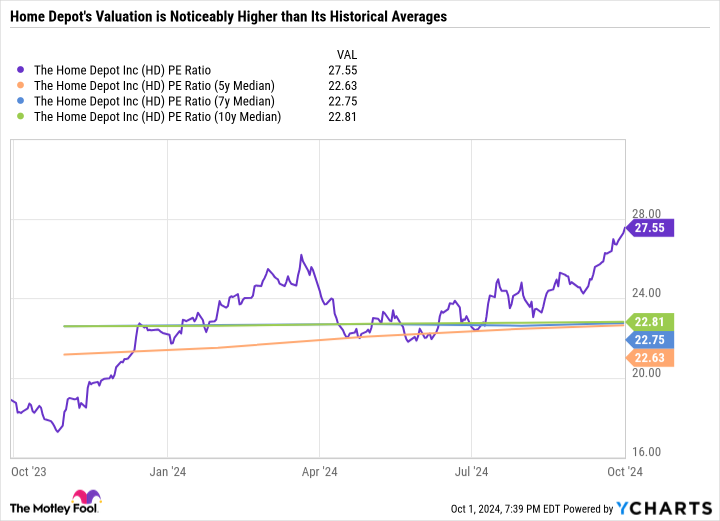

The 2 greatest elements probably driving Dwelling Depot larger are that it was an inexpensive blue chip dividend inventory in an in any other case costly market, and that decrease rates of interest might be a boon for the housing market, and in flip, the house enchancment market. As you possibly can see within the following chart, Dwelling Depot’s P/E ratio was proper round its five-, seven-, and 10-year median ranges, however has since spiked in lockstep with its larger inventory value.

Decrease mortgage rates of interest may spur an uptick in client spending, benefiting Dwelling Depot’s ahead outcomes. However it’s price understanding that the run-up in Dwelling Depot inventory is not primarily based on what the corporate has carried out, however slightly on what it may do beneath extra favorable financial situations.

Given the costly valuation, Dwelling Depot is not as compelling a purchase anymore. It may nonetheless be a very good long-term buy-and-hold dividend inventory, although.

The corporate has a confirmed monitor report of rising its earnings and dividend at spectacular charges and investing by the cycle. Dwelling Depot made a large $18 billion acquisition earlier this 12 months — one of many largest in its historical past. It did so with the understanding that the transfer may take some time to repay. There aren’t many corporations that may make that a lot of a splash throughout an business downturn.

With a 2.2% dividend yield, Dwelling Depot may nonetheless be a very good purchase for buyers who like the corporate’s strategic choices and imagine it might be a coiled spring for a rebound within the housing market.

A more healthy client could be good news for McDonald’s

In July, McDonald’s was knocking on the door of a brand new 52-week low. Traders grew involved that the corporate was shedding pricing energy and prospects have been gravitating towards extra inexpensive choices. However McDonald’s has roared practically 20% larger within the final three months, blasting to a brand new 52-week excessive.

The transfer might recommend that McDonald’s has turned the nook. However administration is not assured concerning the firm’s near-term prospects. Persons are nonetheless being selective with their purchases, and decrease rates of interest are unlikely to alter that conduct in a single day.

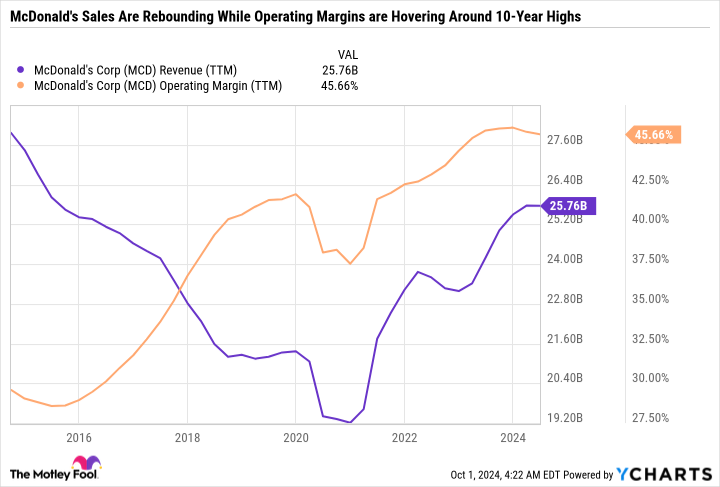

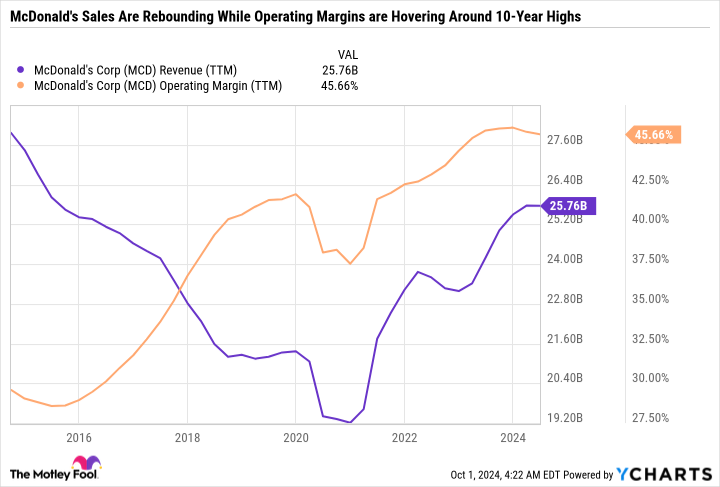

It is also price understanding that McDonald’s is not an organization that ought to be valued primarily based on conventional metrics just like the P/E ratio, as a result of simply 5% of shops are company-owned and operated. The franchise enterprise mannequin may end up in inconsistent earnings, so it is higher to have a look at McDonald’s income and working margin over an prolonged time period.

As you possibly can see within the chart, McDonald’s gross sales have rebounded from their pandemic lows, and the corporate has grown margins, indicating it has loads of room to decrease costs if wanted, or lengthen promotions like its $5 meal deal.

With McDonald’s, plainly buyers are taking an ultra-long-term view on the inventory and taking a look at the place the corporate can be at the least a 12 months from now, slightly than the place it’s immediately.

One other catalyst that might be driving the inventory’s transfer larger is China. China just lately introduced a stimulus package deal geared toward driving financial progress and boosting client spending. Given its presence within the nation, a doubtlessly stronger Chinese language economic system is nice information for McDonald’s.

McDonald’s is not the screaming purchase it was just a few months in the past, however it nonetheless stands out as a worthwhile dividend inventory to purchase now. McDonald’s just lately raised its dividend by 6% to $1.77 per quarter, or $7.08 per 12 months — representing a ahead yield of two.3%. That is not a nasty passive earnings supply, when you think about that the S&P 500 yields simply 1.3%.

3 affordable buys for long-term buyers

Coca-Cola, Dwelling Depot, and McDonald’s are three phenomenal companies that have been bargains however have undergone important run-ups of their inventory costs in a comparatively quick interval. Any time a inventory makes an enormous transfer primarily based on expectations, it pressures the corporate to ship or face a pullback in its inventory value.

Whereas all three corporations aren’t pretty much as good a deal as they have been earlier within the 12 months, they don’t seem to be essentially overpriced for buyers in search of blue chip dividend shares. In truth, they’re the precise form of corporations buyers can rely on to persevere by a recession.

Should you’re keen to put money into high quality, it is likely to be clever to intently consider all three shares, holding in thoughts that the present rally may cool off quickly.

Must you make investments $1,000 in Coca-Cola proper now?

Before you purchase inventory in Coca-Cola, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Coca-Cola wasn’t considered one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $765,523!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 30, 2024

Daniel Foelber has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Dwelling Depot and Nvidia. The Motley Idiot has a disclosure coverage.

Coca-Cola and These 2 Crimson-Sizzling Dow Dividend Shares Are Up 10% to 22% in 3 Months, and They May Nonetheless Be Value Shopping for in October was initially printed by The Motley Idiot