Investor Perception

Within the present robust market dynamic for uranium, Skyharbour Assets is a compelling funding alternative pushed by its giant portfolio of exploration belongings in Canada’s most prolific uranium district within the Athabasca Basin.

Overview

Nuclear power is a essential element within the transition to web zero. There is a rising acknowledgment of the pivotal function nuclear energy can play in assembly decarbonization targets, because of its clear emissions profile, reliable baseload capabilities, and safe operation.

World electrical energy demand is about to develop 50 % by 2040 and nuclear power will play an integral function in assembly this demand. That is evident within the lately launched World Vitality Outlook 2023 revealed by the Worldwide Vitality Company (IEA) which highlighted the function that nuclear power can play in making the journey in the direction of net-zero quicker, safer, and extra inexpensive. With 439 reactors working globally, about 61 reactors underneath development in 15 nations and an additional 400 which can be both ordered, deliberate or proposed, the IEA anticipates a considerable development of over 43 % in put in nuclear capability from 2020 to 2050

Uranium costs have been the very best since 2008 at over US$80/lb. Costs are anticipated to stay robust because of the ongoing tightness within the uranium provide/demand stability. As talked about earlier, this tightness is prone to intensify over the following 24 months as demand continues to rise, new provide stays restricted, and inventories/stockpiles proceed to decrease. The dangers to the provision aspect far outweigh dangers to the demand aspect provided that greater than 50 % of worldwide uranium manufacturing comes from nations with important geopolitical threat.

That is the place corporations corresponding to Skyharbour Assets (TSXV:SYH,OTCQX:SYHBF,FWB:SC1P), with a presence in jurisdictions such because the Athabasca Basin in Canada, stand out for its geopolitical stability. The Athabasca Basin is the world’s most prolific uranium jurisdiction, boasting uranium grades averaging over ten to twenty occasions larger than these discovered elsewhere, with ranges at 3.95 % U3O8 in distinction to the worldwide common of 0.15 %.

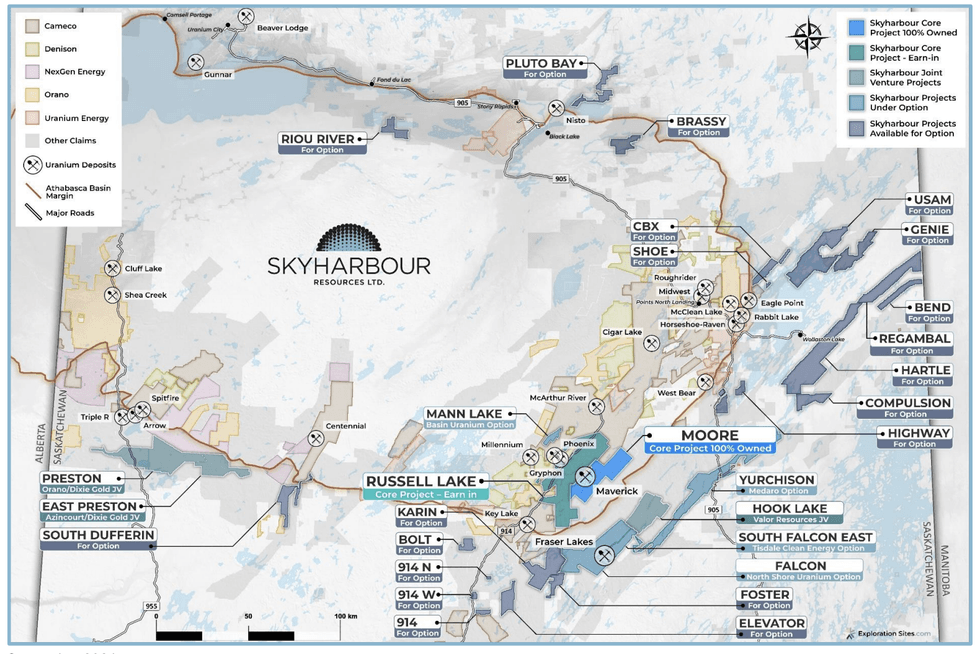

Skyharbour Assets possesses a broad portfolio of uranium exploration initiatives throughout the Athabasca Basin and is strategically positioned to capitalize on the enhancing fundamentals of the uranium market. The corporate follows a twin technique of mineral exploration at its core initiatives (Russell and Moore) whereas using the prospect generator mannequin to advance its secondary initiatives with strategic companions. Using the prospect generator mannequin offers benefits to Skyharbour as accomplice corporations finance exploration and improvement actions, in addition to making money and inventory funds on to Skyharbour Assets as they earn in on the initiatives. The mannequin permits Skyharbour to retain upside publicity by minority pursuits and royalties on the accomplice initiatives whereas limiting fairness dilution and making certain that accomplice corporations fund nearly all of exploration prices.

The corporate has eight accomplice corporations: Orano Canada, Azincourt Vitality, Thunderbird Assets (beforehand Valor), Basin Uranium Corp, Medaro Mining, Terra Clear Vitality (beforehand Tisdale), North Shore Uranium, and UraEx Assets. Skyharbour’s possibility agreements whole over C$38 million in exploration expenditures, with greater than C$29 million in inventory being issued and over C$21 million in money funds doubtlessly coming into Skyharbour.

The corporate has lately entered right into a property buy and sale settlement with Cosa Assets whereby Skyharbour will promote two mineral claims to Cosa, comprising roughly 6,049 hectares. These two claims characterize a small portion of Skyharbour’s Karin Property and are positioned in Saskatchewan about 22 km south of the Key Lake Mill. Skyharbour initially acquired the claims by low-cost, on-line staking. The corporate retains possession in 5 different adjoining claims constituting the brand new Karin Challenge which is now 19,116 hectares.

In October 2024, Skyharbour entered into an possibility settlement with UraEx Assets for its South Dufferin and Bolt uranium initiatives, which is able to permit UraEx to amass as much as one hundred pc curiosity within the properties, which comprise 12 mineral claims spanning roughly 18,000 hectares. Beneath the settlement, UraEx can earn an preliminary 51 % within the initiatives by C$4.6 million in mixed challenge consideration, and as much as one hundred pc by C$9.8 million in mixed challenge consideration consisting of money and share funds in addition to exploration expenditures over a five-year interval.

Firm Highlights

- Skyharbour Assets is a junior mining firm with an intensive portfolio of uranium exploration initiatives in Canada’s Athabasca Basin. They comprise 29 uranium initiatives, 10 of that are drill-ready, totaling over 580,000 hectares.

- The Athabasca Basin is the world’s most prolific uranium jurisdiction, boasting uranium grades averaging over 10-20 occasions larger than these discovered elsewhere.

- The corporate employs a multi-faceted technique of targeted mineral exploration at its core initiatives (Russell and Moore) whereas using the prospect generator mannequin to advance its secondary initiatives with strategic companions.

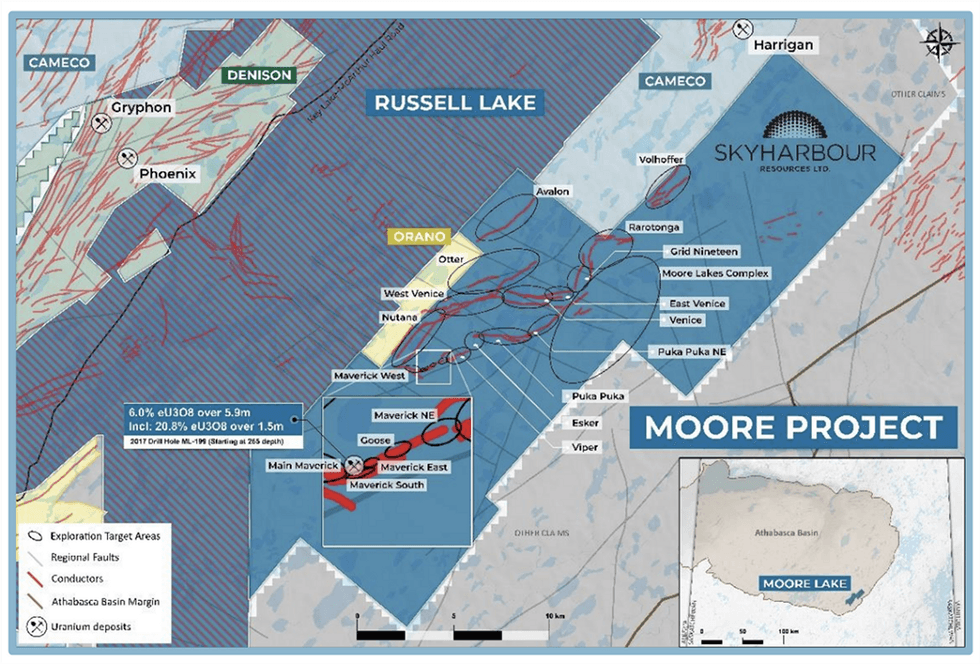

- The corporate’s co-flagship Moore challenge is an advanced-stage uranium exploration asset that includes high-grade uranium mineralization on the Maverick Zone. Earlier drilling has returned outcomes of 6 % U3O8 over 5.9 meters, with a notable intercept of 20.8 % U3O8 over 1.5 meters, at a vertical depth of 265 meters.

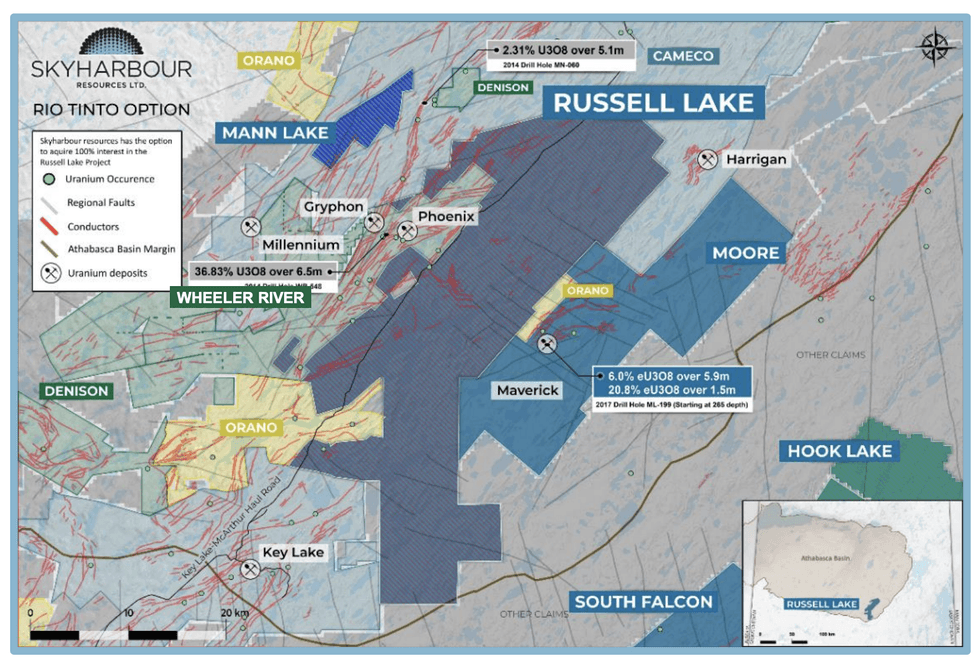

- Adjoining to the Moore challenge is Skyharbour’s second core challenge, the Russell Lake uranium challenge, whereby Skyharbour has accomplished the acquisition of 51 % curiosity from Rio Tinto. The Russell Lake uranium challenge is a big, advanced-stage uranium exploration property totaling 73,294 hectares.

- The 2024 winter drill program on the Russell Lake uranium challenge led to a brand new discovery of high-grade, sandstone-hosted mineralization as much as 2.99 % U3O8 intersected over 0.5 meters.

- Administration intends to proceed constructing the prospect generator enterprise by providing initiatives to companions who will fund the exploration and supply money/inventory to Skyharbour for an possession curiosity within the initiatives; Skyharbour sometimes retains minority pursuits within the initiatives and fairness holdings within the companions.

- The rising deal with nuclear power by governments globally to attain decarbonization objectives bodes effectively for uranium costs. Skyharbour, with key uranium belongings in a high mining jurisdiction, stands to profit from this shift within the world power combine.

Flagship Tasks

The Moore Challenge

This challenge covers an space of 35,705 hectares, positioned within the jap Athabasca Basin close to current infrastructure with recognized high-grade uranium mineralization and important discovery potential. Skyharbour acquired the challenge from Denison Mines (TSX:DML), a big strategic shareholder of the corporate. The challenge could be simply accessed year-round through winter and ice roads, streamlining logistics and lowering bills. In the course of the summer time months, a good portion of the property stays accessible as effectively. The property has been the topic of intensive historic exploration with over $50 million in expenditures, and over 140,000 meters of diamond drilling accomplished traditionally.

Moore hosts high-grade uranium mineralization on the Maverick zones. Over the previous few years, Skyharbour Assets has performed diamond drilling packages, ensuing within the intersection of high-grade uranium mineralization in quite a few drill holes alongside the 4.7-kilometer-long Maverick structural hall. A few of the high-grade intercepts embody:

- Gap ML-199 which intersected 20.8 % U3O8 over 1.5 meters at 264 meters,

- Gap ML-202 from the Maverick East Zone which intersected 9.12 % U3O8 over 1.4 meters at 278 meters.

- Gap ML20-09 which intersected 0.72 % U3O8 over 17.5 meters from 271.5 meters to 289.0 meters, together with 1 % U3O8 over 10.0 meters represents the longest steady drill intercept of uranium mineralization found thus far on the challenge.

- Drill gap ML-61 returned 4.03 % eU3O8 over 10 meters;

- Drill gap ML -55 encountered high-grade mineralization, returning 5.14 % U3O8 over 6.2 meters

- Drill gap ML -47 intersected 4.01 % U3O8 over 4.7 meters

Merely 50 % of the entire 4.7-kilometer promising Maverick hall has undergone systematic drilling, indicating important discovery potential each alongside its size and throughout the underlying basement rocks at depth. Skyharbour lately accomplished a winter drill program which consisted of two,800m of drilling on the challenge which targeted on infill/growth drilling on the Fundamental Maverick Zone.Assay outcomes from this system intersected 5 metres of 4.61 % U3O8 from a comparatively shallow downhole depth of 265.5 metres to 270.5 metres together with 10.19 % U3O8 over 1 metre on the Fundamental Maverick Zone from gap ML24-08. Skyharbour will proceed to advance Moore by a 2,500 metre summer time drill program.

Aside from the Maverick Zone, diamond drilling in numerous different goal areas has encountered a number of conductors linked with notable structural disturbances, sturdy alteration, and anomalous concentrations of uranium and related pathfinder parts.

Russell Lake Uranium Challenge

The Russell Lake challenge is a big, advanced-stage uranium exploration property spanning 73,294 hectares, strategically positioned between Cameco’s Key Lake and McArthur River initiatives. Skyharbour has accomplished its earn-in necessities for an possibility settlement with Rio Tinto and has now acquired 51 % possession curiosity within the Russell Lake challenge. Skyharbour made a money fee of C$508, 200, issued 3,584,014 frequent shares of the corporate to Rio Tinto and incurred an mixture of $5,717,250 in exploration expenditures on the property over the 3-year time period of the earn-in.

The challenge is adjoining to Denison’s Wheeler River challenge and Skyharbour’s Moore uranium challenge. It’s supported by wonderful infrastructure when it comes to freeway entry in addition to high-voltage energy strains. The challenge has undergone a big quantity of historic exploration which incorporates over 95,000 meters of drilling in over 220 drill holes. The exploration recognized quite a few potential goal areas and several other high-grade uranium showings in addition to drill gap intercepts.

The property hosts a number of noteworthy exploration targets, together with the Grayling Zone, the M-Zone Extension goal, the Little Man Lake goal, the Christie Lake goal, and the Fox Lake Path goal. Skyharbour accomplished a 19-hole drilling program totaling 9,595 meters in three phases in 2023. The preliminary drilling part encompassed 3,662 meters throughout eight accomplished holes on the Grayling Zone, adopted by a second part involving 4 holes totaling 2,730 meters drilled on the Fox Lake Path Zone. The third drilling part concerned 3,203 meters throughout seven holes concentrating on extra areas throughout the Grayling Zone.

Drilling at Russell in 2024 was accomplished in two separate phases with a complete of three,094 metres drilled in six holes. Part One in all drilling resulted within the greatest intercept of uranium mineralization traditionally on the property from gap RSL24-02, which returned a 2.5 metre large intercept of 0.721 % U3O8 at a comparatively shallow depth of 338.1 metres, together with 2.99 % U3O8 over 0.5 metres at 339.6 metres simply above the unconformity within the sandstone. This high-grade intercept represents a discovery in a newly delineated goal space and will probably be a top-priority goal within the upcoming absolutely funded summer time/fall drill program.

Secondary Tasks

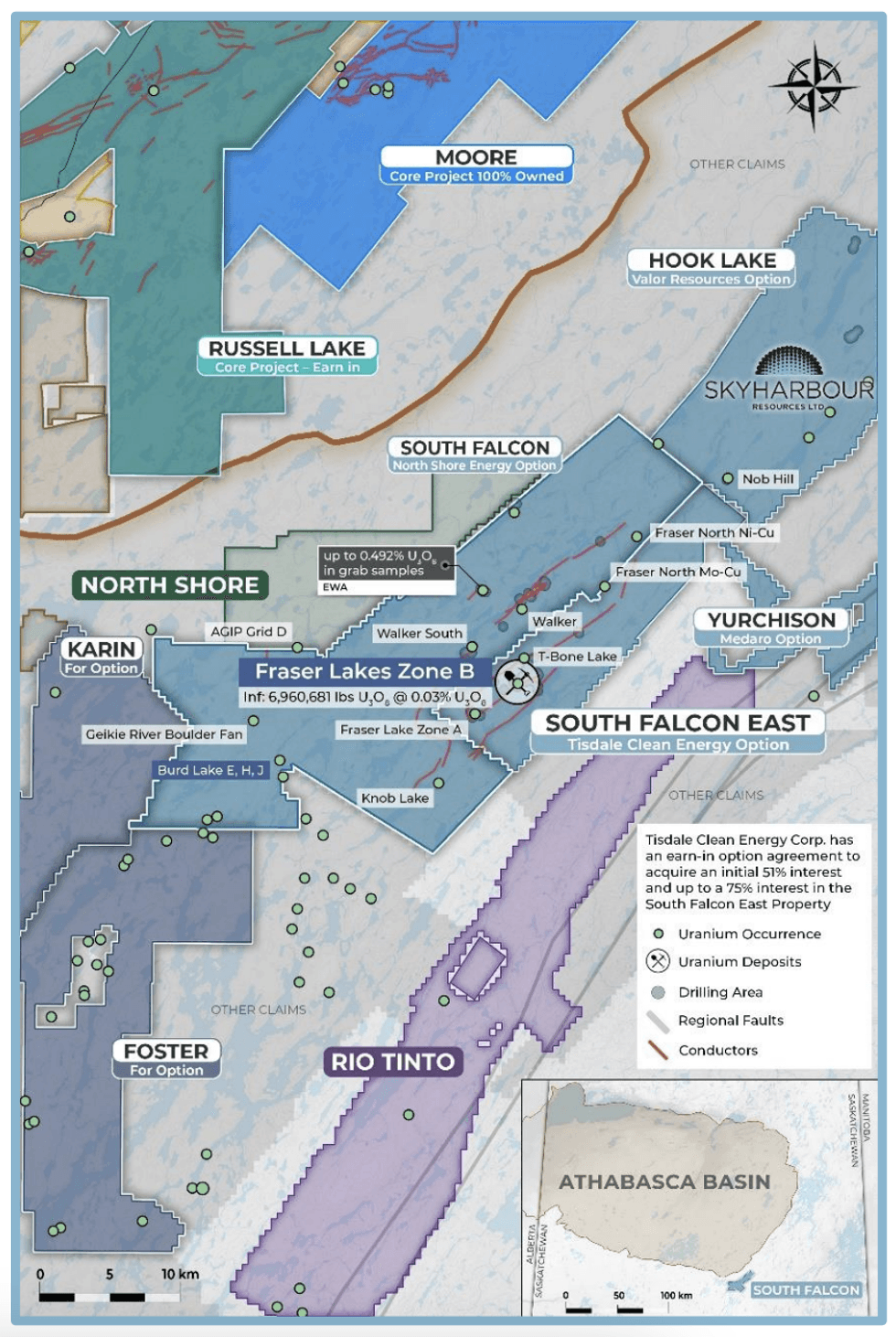

Falcon Uranium Challenge

This challenge includes 11 claims overlaying 42,908 hectares positioned roughly 50 km east of the Key Lake mine. Skyharbour Assets has entered into an possibility settlement with North Shore Uranium which offers North Shore with an earn-in possibility to amass an preliminary 80 % curiosity and as much as a one hundred pc curiosity within the Falcon Property. North Shore can purchase an preliminary 80 % curiosity within the claims inside three years by assembly mixed commitments of C$5.3 million in money, share issuance, and exploration expenditures. Moreover, there’s an possibility to purchase the remaining 20 % for an additional C$10 million in money and shares.

North Shore has collected a number of samples from two of the primary three uranium prospects drilled at its 55,699-hectare Falcon property in 2024. The samples returned anomalous uranium values of larger than 300 ppm U3O8 and as much as a most of 572 ppm U3O8. An exploration allow has been secured for the challenge, which is able to permit North Shore to conduct exploration actions on the property, together with prospecting and floor geophysics, path and drill web site clearing, line reducing, drilling of as much as 75 exploration drill holes and storage of drill core.

South Falcon East

This challenge includes 16 claims overlaying 12,234 hectares positioned roughly 55 km east of the Key Lake mine. Skyharbour has optioned as much as a 75 % curiosity in a portion of the challenge to Terra Clear Vitality (beforehand Tisdale). Terra will problem Skyharbour Assets 1,111,111 shares upfront, fund exploration expenditures totaling C$10.5 million, and pay Skyharbour Assets C$11.1 million in money of which C$6.5 million could be settled for shares over a five-year earn-in. Skyharbour Assets will retain a minority curiosity within the South Falcon East.

East Preston

This challenge includes 20,674 hectares positioned on the west aspect of the Athabasca Basin. In March 2017, Skyharbour Assets signed an possibility settlement with Azincourt Uranium (TSXV:AAZ) to possibility 70 % of a portion of the East Preston challenge to Azincourt. Since then, Azincourt earned a majority curiosity within the challenge which at the moment stands at 85.8 %. Skyharbour retains 9.5 % possession and Dixie Gold owns the remaining 4.7 %.

Azincourt accomplished a 2023 drill program comprising 3,066 meters in 13 drill holes. The corporate additionally accomplished the winter 2024 diamond drill program of 1,086 meters of drilling in 4 diamond drill holes and outcomes indicated the next:

- Dravite and Kaolinite clay alteration zone expanded in Ok and H Zones

- Illite, Dravite and Kaolinite clay alteration recognized in G Zone

- Illite and Kaolinite clay alteration recognized in A Zone

Preston

This challenge includes 49,635 hectares strategically positioned close to Fission’s Triple R deposit and NexGen’s Arrow deposit. In March 2017, Skyharbour Assets signed an possibility settlement with Orano (previously AREVA) Assets Canada to possibility a majority stake within the Preston challenge. Orano has fulfilled its first earn-in possibility curiosity for 51 % within the challenge. Following this, Orano has fashioned a three way partnership (JV) with Skyharbour and Dixie Gold for the development of the challenge. Orano holds 51 % curiosity, and the remaining is break up evenly (24.5 % every) between Skyharbour and Dixie Gold.

Orano Canada has accomplished a geophysical programat the 49,635-hectare Preston uranium challenge which included a floor electromagnetic survey (ML-TEM) and a floor gravity survey. Orano is now making ready for a Spatiotemporal Geochemical Hydrocarbons (SGH) soil sampling program that may happen this summer time on the challenge.

Hook Lake

This challenge includes 16 claims overlaying 25,847 hectares on the east aspect of the Athabasca Basin. In February 2024, Thunderbird Assets (beforehand Valor) accomplished an earn-in for 80 % curiosity and fashioned a JV partnership with Skyharbour which retains the remaining 20 % curiosity.

Yurchison Lake

This challenge consists of 13 claims totaling 57,407 hectares within the Wollaston Area. In November 2021, Medaro signed an settlement to amass an preliminary 70 % curiosity by spending C$5 million on exploration, C$800,000 in money funds, and C$3 million in Medaro shares over 4 years. Medaro might purchase the 30 % curiosity, inside 30 enterprise days of incomes the preliminary 70 % curiosity, by issuing C$7.5 million of shares and a money fee of $7.5 million to Skyharbour.

Mann Lake

This challenge is strategically positioned on the east aspect of the Athabasca basin, 25 km southwest of Cameco’s McArthur River Mine and 15 km northeast and alongside strike of Cameco’s Millennium uranium deposit. In October 2021, Basin Uranium signed an earn-in possibility to amass a 75 % curiosity within the challenge. Basin pays a mix of money and shares over three years comprising C$4.85 million in money plus exploration expenditure and C$1.75 million price of shares.

South Dufferin and Bolt

The South Dufferin Challenge totals 13,205 hectares overlaying 10 claims and is positioned instantly south of the southern margin of the Athabasca Basin in northern Saskatchewan. The property covers the southern extension of the Virgin River Shear Zone, which hosts recognized high-grade uranium mineralization at Cameco Corp.’s Dufferin Lake zone roughly 13 kilometres to the north (spotlight drill outcomes of 1.73% U3O8 over 6.5 metres) and Cameco Corp.’s Centennial deposit roughly 25 kilometres to the north (consists of drill intersections as much as 8.78% U3O8 over 33.9 metres).

The Bolt Challenge consists of two contiguous claims one hundred pc owned by Skyharbour Assets Ltd. totalling 4,726 hectares and is positioned roughly 7 km west of the Freeway 914 and about 32 km southwest of Cameco’s Key Lake Operation (which produced 209.8 million kilos of U3O8 at a mean grade of two.32 % U3O8 from 2 deposits, the place ore from the McArthur River mine is at the moment processed).

A definitive settlement was lately signed in October of 2024 with UraEx Assets to earn an preliminary 51 % and as much as one hundred pc of each the South Dufferin and Bolt Tasks, collectively. For an preliminary 51 %, UraEx will problem frequent shares having an mixture worth of C$1.15 million, make whole money funds of $450,000, and incur $3 million in exploration expenditures on each the South Dufferin and Bolt properties over a 3 12 months interval. UraEx has an possibility to amass the remaining one hundred pc by issuing frequent shares having an mixture worth of C$2.5 million, making money funds of $1.2 million and incurring $1.5 million in exploration expenditures over a further two-year interval.

Along with the initiatives being superior by Skyharbour and its companions, the corporate has 18 extra one hundred pc owned initiatives that they’re actively looking for to possibility out to potential new companions sooner or later so as to add to their rising prospect generator enterprise. All in all, Skyharbour could be very effectively positioned to profit from an accelerating uranium bull market with rising demand within the backdrop of a strained provide aspect.

Administration Staff

Jordan Trimble – President and CEO

With a background in entrepreneurship, Jordan Trimble has held numerous positions within the useful resource business, specializing in administration, company finance, technique, shareholder communications, enterprise improvement, and capital elevating with a number of corporations. Previous to his function at Skyharbour, he was the company improvement supervisor at Bayfield Ventures, a gold firm with initiatives in Ontario. Bayfield Ventures was subsequently acquired by New Gold (TSX:NGD) in 2014. All through his profession, Trimble has established and assisted within the administration of quite a few private and non-private enterprises. He has performed a pivotal function in securing important capital for mining corporations, leveraging his in depth community of institutional and retail buyers.

Jim Pettit – Chairman of the Board

Jim Pettit at the moment serves as a director on the boards of varied public useful resource corporations, drawing from over 30 years of expertise within the business. His experience lies in finance, company governance, administration and compliance, notably within the early-stage improvement of each personal and public enterprises. Over the previous three many years, he has primarily targeted on the useful resource sector. Beforehand, he served as chairman and CEO of Bayfield Ventures, which was acquired by New Gold in 2014.

David Cates – Director

David Cates at the moment serves because the president and CEO of Denison Mines (TSX:DML). Earlier than assuming the function of president and CEO, Cates was the vice-president of finance, tax, and chief monetary officer at Denison. In his capability as CFO, he performed a pivotal function within the firm’s mergers and acquisitions actions, together with spearheading the acquisition of Rockgate Capital and Worldwide Enexco. Cates joined Denison in 2008, initially serving as director of taxation earlier than he was appointed CFO. Previous to becoming a member of Denison, he held positions at Kinross Gold and PwC with a deal with the useful resource business.

Joseph Gallucci – Director

Joseph Gallucci was beforehand a senior supervisor at a number one Canadian accounting agency. He possesses greater than 20 years of experience in funding banking and fairness analysis, specializing in mining, base metals, treasured metals, and bulk commodities worldwide. He serves as a senior capital markets government and company director. Presently, Gallucci is the managing director and head of funding banking at Laurentian Financial institution Securities, the place he assumes duty for overseeing the whole funding banking observe.

Brady Rak – VP of Enterprise Growth

Brady Rak is a seasoned funding skilled who has focussed on the Canadian capital markets over his 13-year profession at a number of unbiased dealer sellers together with Ventum Monetary, Salman Companions and Union Securities. As a registered funding advisor within the personal shopper division of Ventum Monetary, Brady has been concerned in advising high-net-worth and company purchasers, structuring transactions, elevating capital and navigating world market sentiment. Brady graduated from Northwood College with a BBA in Administration and holds his Choices license.

Serdar Donmez – Vice-president of Exploration

A acknowledged geoscientist with many years of expertise in uranium exploration and improvement, Serdar Donmez has performed an energetic function in quite a few grassroots and superior uranium exploration initiatives in northern Saskatchewan and Zambia. Donmez has an engineering diploma in geology and is a registered skilled geoscientist with the Affiliation of Skilled Engineers and Geoscientists of Saskatchewan. Throughout his 17-year tenure at Denison Mines, Donmez was pivotal in advancing quite a few uranium exploration and improvement initiatives. He was concerned in numerous capacities with the Phoenix and Gryphon uranium deposits on Denison’s Wheeler River challenge, from preliminary discovery to the completion of the feasibility examine in 2023. As useful resource geology supervisor, he was integral to the event of mineral useful resource estimates and NI 43-101 technical experiences for a number of superior exploration initiatives within the Athabasca Basin. Moreover, he was a part of a group exploring the appliance of in-situ restoration mining methods for high-grade uranium deposits within the Athabasca Basin.

Dave Billard – Head Consulting Geologist

Dave Billard is a geologist with over 35 years of expertise in exploration and improvement, specializing in uranium, gold and base metals in western Canada and the western US. He served as chief working officer, vice-president of exploration, and director for JNR Assets earlier than its acquisition by Denison Mines. He performed a vital function within the discovery of JNR’s Maverick and Fraser Lakes B zones. Earlier in his profession, he contributed to the invention and improvement of a number of important gold deposits in northern Saskatchewan. Previous to becoming a member of JNR, Billard labored as a geological guide specializing in uranium exploration within the Athabasca Basin. He additionally spent over 12 years with Cameco Company.

Christine McKechnie – Senior Challenge Geologist

Christine McKechnie is a geologist with a specialization in uranium deposits, notably these hosted within the basement and related to unconformities within the Athabasca Basin and its neighborhood. All through her profession, she has labored with numerous corporations corresponding to Claude Assets, JNR Assets, CanAlaska Uranium and Cameco, partaking in gold and uranium exploration actions. She accomplished her B.Sc. (Excessive Honors) in 2008 from the College of Saskatchewan and accomplished a M.Sc. thesis on the Fraser Lakes Zone B deposit on the Falcon Level challenge. She additionally obtained the 2015 CIM Barlow Medal for Greatest Geological Paper.