The cryptocurrency market has skilled a outstanding transformation over the previous yr, marked by robust investor curiosity and a big resurgence in costs for each Bitcoin and Ether.

As of December 9, Bitcoin was up near 120 p.c year-to-date, whereas Ether was up simply over 55 p.c.

Momentum has been fueled by the approval of spot Bitcoin exchange-traded funds (ETFs) within the US and enhanced institutional curiosity. This exercise has spilled over into the burgeoning altcoin market, signaling a broader shift.

Hold studying to be taught extra about what developments drove the crypto market increase in 2024.

How did the Bitcoin worth carry out in 2024?

The yr started strongly for Bitcoin. The US permitted permitted spot Bitcoin ETFs on January 10, bringing development in institutional curiosity together with greater costs — Bitcoin hit its first new all-time excessive of 2024 on March 13.

Bitcoin’s sensitivity to macroeconomic situations was evident in its worth volatility in the course of the first quarter, however total sentiment remained optimistic, with specialists pointing to growing regulatory readability and the Bitcoin halving on April 19 as key components that may form the market’s trajectory transferring ahead.

Nonetheless, this yr’s Bitcoin halving occasion didn’t comply with historic developments.

Chatting with the Investing Information Community, WonderFi CEO Dean Skurka defined the variations he’s noticed in comparison with previous post-halving durations: “Earlier halvings tended to trigger some volatility instantly after the occasion, with important jumps in worth within the six to 12 months following.”

Bitcoin efficiency after 2020’s halving.

Chart through CoinGecko.

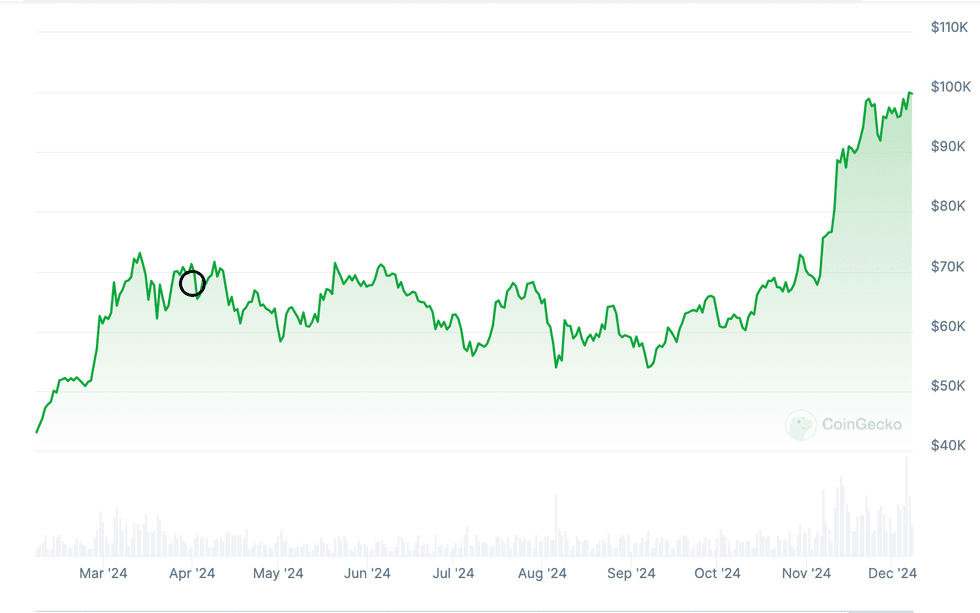

This time, Bitcoin’s worth reached an all-time excessive earlier than the occasion and skilled a downtrend within the following months, falling from US$73,097 pre-halving to beneath US$60,000 in Might and July. It did not break US$73,000 once more till October, boosted by the prospect of a extra crypto-friendly political local weather.

“This present post-halving interval didn’t comply with the identical speedy trajectory because the three earlier occasions, however the constructive alerts despatched out by each international jurisdictions and institutional buyers in latest months have accelerated the curiosity in digital currencies throughout the board,” Dean defined.

Bitcoin efficiency after 2024’s halving.

Chart through CoinGecko.

Bitcoin’s 40 p.c achieve in November has largely been attributed to Republican victories within the Home and Senate, together with Donald Trump’s presidential win. Amongst different corporate-friendly initiatives, the celebration ran on a platform of looser rules for crypto and a authorities stake in Bitcoin within the type of a nationwide Bitcoin reserve.

Since declaring victory, Trump has introduced plans to inventory his cupboard with pro-crypto members and has maintained shut ties to trade insiders like Elon Musk and Coinbase’s Brian Armstrong.

Beginning on November 5, Bitcoin was capable of set new all-time highs on practically a weekly foundation — the favored cryptocurrency topped US$100,000 for the primary time in historical past on December 4.

“Traditionally, Bitcoin has averaged a +10 p.c enhance in December, with blockbuster performances in 2010, 2011, and 2020,” 10x Analysis founder and CEO Markus Thielen instructed Cointelegraph on December 2, including that returns have averaged 28 p.c throughout halving years. “Even when we’d do half of the 2021 transfer, that may nonetheless put the value at round US$150K,” he speculated of Bitcoin’s present worth discovery section.

Altcoin curiosity jumps on Bitcoin increase, DeFi consideration

Dean mentioned halving cycles additionally are likely to drive extra curiosity elsewhere in crypto.

“Extra eyes are on the crypto trade as a complete, and different cryptocurrencies not topic to halving get investor consideration, resulting in surges in altcoin markets in addition to innovation within the area,” he mentioned.

This commentary has certainly held true, notably within the second half of 2024, with altcoins experiencing important market positive factors. This shift has been marked by a wave of recent funding alternatives throughout the crypto panorama, underscoring the broader impression of evolving market dynamics within the trade.

The launch of spot Bitcoin ETFs within the US January, adopted by spot Ether ETFs in July, fueled institutional demand for diversified crypto publicity. Since then, VanEck, 21Shares and Franklin Templeton have pursued Solana ETFs.

The growth of crypto funding autos highlights the maturing and evolving nature of the trade.

This surge in curiosity has additionally been pushed by a revival of decentralized finance (DeFi) protocols, which have performed a key position in growing the worth and adoption of each Solana and Ether.

DeFi affords a variety of permissionless and clear monetary providers constructed on blockchain expertise, and each Solana and Ether have emerged as main platforms for DeFi improvement.

Solana is a horny platform for DeFi purposes because of its excessive throughput and low transaction charges. Improvements like layer-2 scaling options on the Ethereum community strengthen its place as a number one DeFi platform.

Establishments embrace crypto

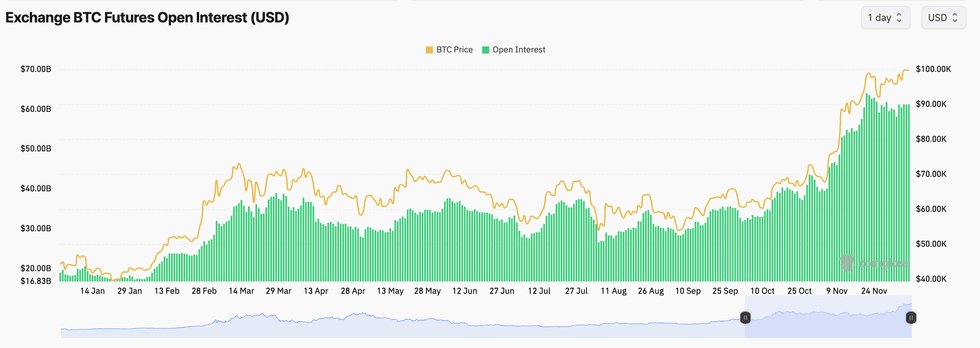

Past the rise of DeFi, 2024 has witnessed a big pattern towards the institutionalization of cryptocurrencies, as evidenced in record-breaking buying and selling volumes on centralized crypto exchanges.

These surges in buying and selling exercise strongly counsel elevated participation from institutional buyers who’re utilizing these platforms for each spot buying and selling and complex derivatives methods.

In line with Coinglass information, whole Bitcoin choices open curiosity has gone from lower than US$25 billion for a lot of the yr to round US$40 billion since November 20.

Bitcoin futures open curiosity in 2024.

Chart through Coinglass.

Alongside the broader institutional adoption of staking, 2024 noticed the rise of modern options like liquid staking.

Liquid staking protocols concern spinoff tokens representing staked belongings, permitting establishments to keep up liquidity whereas incomes staking rewards. Lido, a liquid staking protocol, allows customers to stake ETH with out locking it up and points stETH tokens in return. stETH tokens have elevated over 67 p.c in worth year-on-year.

Taking it a step additional, EigenLayer, backed by Andreessen Horowitz, has pioneered restaking, a protocol that enables staked belongings to be leveraged throughout a number of protocols for optimum capital effectivity. Knowledge tracked by DeFiLlama reveals over US$20 billion in whole worth locked in EigenLayer as of December 8.

These advances have offered new alternatives for establishments to maximise returns and take part extra deeply within the shortly creating cryptocurrency ecosystem.

Investor takeaway

The cryptocurrency market’s resurgence in 2024 has been pushed by a confluence of things which have propelled the trade into a brand new period of development and innovation. Whereas challenges and uncertainties stay, the general trajectory factors towards continued growth and the mixing of cryptocurrencies into the worldwide monetary panorama.

As institutional buyers deepen their involvement and regulatory frameworks evolve, the crypto market is poised for additional transformation, shaping the way forward for finance and funding.

Do not forget to comply with us @INN_Technology for real-time updates!

Securities Disclosure: I, Meagen Seatter, maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: The Investing Information Community doesn’t assure the accuracy or thoroughness of the data reported within the interviews it conducts. The opinions expressed in these interviews don’t mirror the opinions of the Investing Information Community and don’t represent funding recommendation. All readers are inspired to carry out their very own due diligence.

From Your Web site Articles

Associated Articles Across the Internet