Investor Perception

Troy Minerals’ clear technique for progress, pushed by two doubtlessly near-term high-purity silica initiatives and a diversified exploration portfolio for crucial minerals, makes the corporate an funding alternative price protecting a detailed eye on.

Overview

Troy Minerals (CSE:TROY;OTCQB:TROYF;FSE:VJ3) is a quickly rising participant within the crucial minerals area, specializing in the event of high-purity silica and different important supplies for the clear power transition.

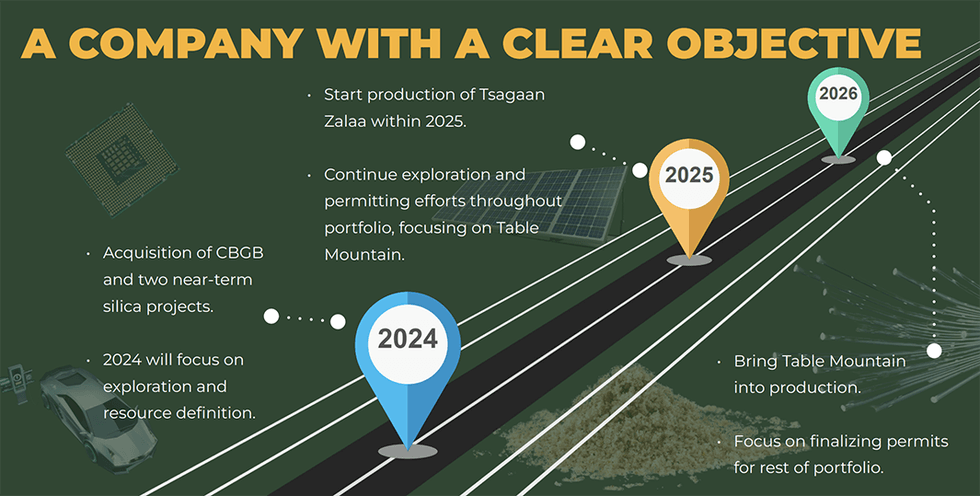

The corporate’s numerous portfolio is designed to capitalize on the growing demand for uncooked supplies wanted in high-growth industries similar to renewable power and semiconductors. On the forefront of its portfolio are two high-purity silica initiatives: Desk Mountain in British Columbia and the Tsagaan Zalaa challenge in Mongolia. These initiatives have been acquired by way of the strategic buy of CBGB Ventures in September 2024. Each initiatives are being focused for close to time period manufacturing, with Tsagaan Zalaa focused to come back on-line in 2025 and Desk Mountain in 2026. These acquisitions align with Troy Minerals’ strategic objective of turning into a key participant in supplying crucial minerals for the worldwide power transition.

Pattern high-purity silica

Along with its high-purity silica property, Troy Minerals can also be making important strides in vanadium and uncommon earths exploration, with two further initiatives situated in Wyoming, USA, and Quebec, Canada. These initiatives present additional diversification and improve the corporate’s publicity to crucial minerals which might be very important to high-growth industries, starting from aerospace to power storage.

The corporate’s property are strategically positioned in areas with favorable entry to infrastructure and proximity to massive consuming markets like america and China. Troy Minerals is dedicated to leveraging these property to unlock important shareholder worth by way of the profitable exploration, improvement, and eventual manufacturing of crucial minerals.

Excessive-purity silica is an important mineral for the clear power transition, significantly within the manufacturing of photo voltaic panels, semiconductors and high-performance glass. The purity and high quality of the silica deposits at Troy’s property make them ideally suited for these high-tech purposes. By 2030, the high-purity silica market is projected to develop to US$104.34 billion, pushed by growing demand for photovoltaic cells utilized in photo voltaic panels, in addition to developments in electronics and fiber optics.

The worldwide scarcity of high-purity silica, exacerbated by provide chain disruptions and geopolitical tensions, has created an pressing want for brand spanking new suppliers. Troy Minerals is well-positioned to advance and develop its initiatives to assist meet this demand by focusing on near-term manufacturing on each of its silica initiatives which have high-grade silica

Along with its concentrate on high-purity silica, Troy Minerals maintains a diversified portfolio by way of its vanadium and uncommon earth parts (REE) property. These minerals are important for varied industries, together with electrical autos (EVs), renewable power storage and superior electronics. The corporate’s Lake Owen challenge in Wyoming is potential for vanadium, whereas the Lac St. Jacques challenge in Quebec is targeted on REE, significantly neodymium and praseodymium.

Vanadium is crucial to supply vanadium redox move batteries (VRFBs), a promising power storage know-how that provides long-term stability and scalability for renewable power methods. REEs, then again, are used within the manufacturing of everlasting magnets, that are integral to wind generators, EV motors and varied digital gadgets.

Firm Highlights

- Troy Minerals acquired CBGB Ventures in September 2024, securing two flagship high-purity silica initiatives in British Columbia and Mongolia.

- The Tsagaan Zalaa challenge in Mongolia is being focused to start high-purity silica manufacturing by 2025, thereby positioning the corporate as a key provider for photo voltaic and semiconductor industries.

- The Desk Mountain challenge in British Columbia is being focused to start high-purity silica manufacturing by 2026, with a 24-month improvement timeline.

- Excessive-purity silica, much like the corporate’s initiatives, is crucial for photo voltaic panel manufacturing, semiconductors, fiber optics and high-performance glass.

- The corporate additionally maintains an exploration portfolio of crucial mineral property, together with vanadium and REE, in tier 1 jurisdictions.

Key Tasks

Tsagaan Zalaa Mission (Mongolia)

The Tsagaan Zalaa challenge, situated close to the China-Mongolia border, is a near-term high-purity silica asset that’s being focused to start manufacturing by 2025. The challenge’s proximity to key consuming markets, similar to China, Japan and Korea, offers important logistical benefits for the transportation of silica.

Tsagaan Zalaa’s silica deposits boast purity ranges above 99 p.c, making them appropriate for superior technological purposes similar to photo voltaic panels, semiconductors and fiber optics. The challenge’s minimal overburden and low strip ratio make extraction cost-effective, additional enhancing its financial potential. Given the worldwide demand for high-purity silica, this challenge has the potential to generate important income for Troy Minerals.

Desk Mountain Mission (British Columbia)

The Desk Mountain challenge, situated in British Columbia, Canada, is one other high-purity silica asset with near-term manufacturing potential. Masking 1,698 hectares, the challenge is strategically positioned with entry to key infrastructure, together with roads, energy and pure gasoline, making it a logistically engaging asset for North American markets.

The high-grade silica at Desk Mountain is good for purposes similar to photo voltaic panels, high-performance glass and electronics. The challenge is being focused to start manufacturing by 2026, following a 24-month improvement timeline. Given the growing demand for high-purity silica in North America, the Desk Mountain challenge may play a crucial position in lowering reliance on imports and enhancing the area’s provide chain resilience.

Lake Owen Mission (Wyoming)

The Lake Owen challenge, situated 50 km southwest of Laramie, Wyoming, is an exploration-stage asset targeted on vanadium and titanium. The challenge spans 1,932 acres (782 hectares) and is a part of the Proterozoic Lake Owen mafic to ultramafic layered intrusive complicated, which is understood for its wealthy vanadium and titanium deposits.

Lake Owen is benefiting from the US Geological Survey’s “Giant-scale Earth MRI” program, which offers worthwhile geological insights and value financial savings for exploration. The challenge has important potential for semi-massive to huge titanomagnetite deposits with excessive concentrations of vanadium pentoxide and titanium dioxide. The exploration potential for platinum group parts and gold additional provides to the challenge’s attractiveness.

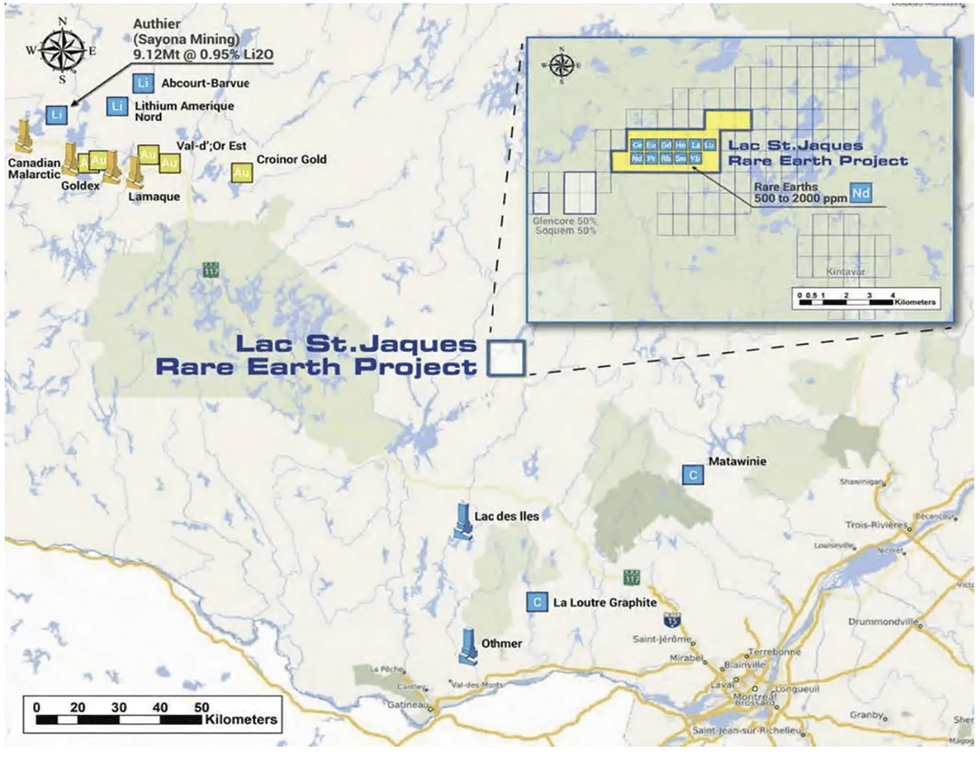

Lac St. Jacques Mission (Quebec)

The Lac St. Jacques challenge, situated 250 km north of Montreal, Quebec, is an REE exploration asset. The challenge spans 2,889 acres (1,169 hectares) and is definitely accessible through roads and proximity to hydro energy traces, providing cost-effective logistics and sustainable power choices for future operations.

The uncommon earth mineralization at Lac St. Jacques is related to pegmatitic syenite and granite intrusives. The challenge’s carbonatite deposit is wealthy in gentle uncommon earth parts, significantly neodymium and praseodymium, that are important to supply everlasting magnets utilized in EV motors and wind generators. Samples from current drilling have proven promising concentrations of REEs, with outcomes indicating between 500 and a couple of,000 components per million of neodymium and praseodymium.

Administration Staff

Rana Vig – President, CEO and Director

Rana Vig has greater than 30 years of enterprise expertise, serving to launch 5 enterprise ventures within the non-public sector. He has been concerned in publicly traded corporations since 2010, and from 2011 to 2016 he was the president of Musgrove Minerals, an Idaho-focused gold and copper mining exploration firm. From 2013 to 2016, he was the chairman and CEO of Continental Valuable Minerals, a TSX senior board listed mining exploration firm with a concentrate on advancing one of many largest uranium deposits on this planet situated in Sweden.

In November 2017, he acquired the the Senate a hundred and fiftieth Anniversary Medal, awarded to prime Canadians actively concerned of their communities who, by way of generosity, dedication and laborious work, make their hometowns and communities, a greater place to dwell.

Norman Brewster – Director

Norman Brewster’s mineral trade profession consists of serving on varied firm boards, financing and growing the Aguas Tenidas Mine in Spain, and negotiating the acquisition of the Condestable Mine in Peru. He additionally led the committee in reviewing the profitable acquisition of Iberian Minerals by the Trafigura Group in an all-cash takeover valued at round $497.8 million.

Gurdeep Bains – Director

Gurdeep Bains is a chartered skilled accountant. He acquired his chartered accountant designation from the Institute of Chartered Accountants of BC in 2003 and in 2004 graduated from Simon Fraser College with a Bachelor of Enterprise Administration. From 2000 to 2005, he was a senior auditor, assurance companies at KPMG.

From 2005 to 2014, Bains was with Canaccord Genuity as vice-president, inside audit and monetary evaluation the place he was concerned within the firm’s world enlargement by performing the due diligence and integration of $850 million in acquisitions in Canada, US, UK, Australia and China. From June 2014 to October 2017, he was the CFO at OK Tire Shops, an automotive firm with over 330 places throughout Canada. From October 2017 to March 2019, Bains was CFO at Zenabis, contributing in each finance and enterprise improvement roles.

Regina Lara Yunes – CFO

Lara Yunes is a chartered skilled accountant with a Bachelor of Know-how in accounting from the British Columbia Institute of Know-how. She is at the moment a monetary reporting supervisor at Treewalk, offering accounting, monetary reporting and compliance companies to publicly listed corporations. Previous to this, she labored at Smythe LLP as an accountant, providing audit and tax companies to each non-public and public corporations.