Good morning and welcome to this week’s Flight Path. Equities noticed the “Go” pattern continued this week and value gapped increased after some weaker aqua bars. We now see GoNoGo Pattern portray sturdy blue bars at new highs. Treasury bond costs remained in a “NoGo” pattern however the week ended with a weaker pink bar. The U.S. commodities index noticed a robust finish to the week as shiny blue “Go” bars returned and the greenback likewise noticed energy with sturdy blue “Go” bars the second half of the week.

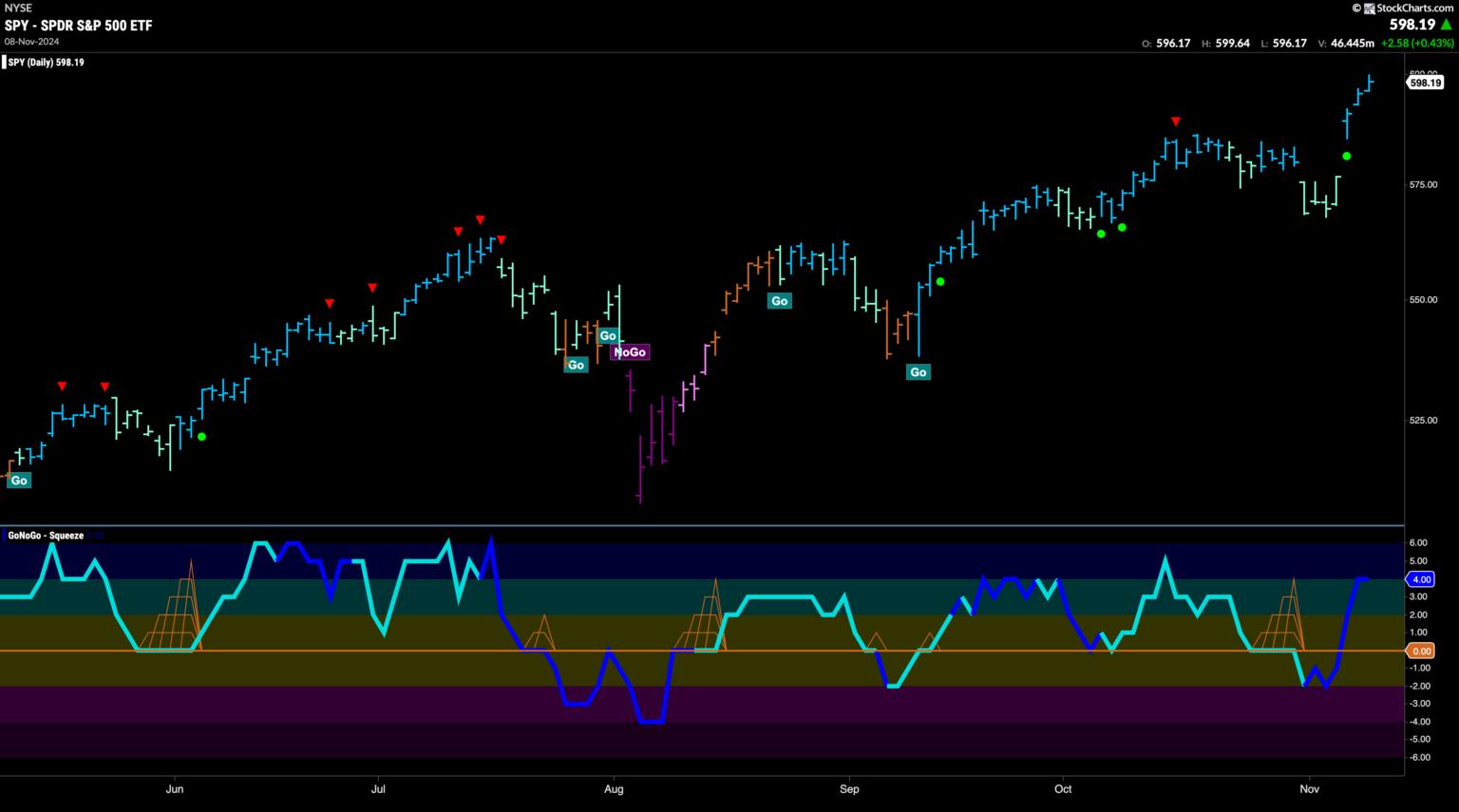

$SPY Gaps Increased on Sturdy Blue “Go” Bars

The GoNoGo chart under reveals that after some weak spot that noticed value fall from the final Go Countertrend Correction Icon (purple arrow), value gapped increased on Wednesday and costs soared to new highs within the aftermath of the election. GoNoGo Oscillator was capable of recuperate optimistic territory after having fallen into unfavourable territory the week earlier than. Now, with the oscillator in optimistic territory at a worth 4 on heavy quantity, we all know that momentum is on the facet of the “Go” pattern as soon as once more.

A brand new increased weekly shut was painted on the chart this previous week. After a few consecutive decrease closes after the current Go Countertrend Correction Icon (purple arrow), we noticed value surge to a brand new increased shut. GoNoGo Oscillator had been falling towards the zero degree however reversed course sharply this week and is now breaching overbought territory at a worth of 5. We’ll see how a lot increased value can go from right here. We’ll search for it to a minimum of consolidate at these ranges going ahead.

Treasury Charges Cool after Increased Excessive

Treasury bond yields noticed the “Go” pattern proceed this week however we noticed somewhat weak spot creep in with GoNoGo Pattern portray an aqua bar. This comes after we noticed a Go Countertrend Correction Icon (purple arrow) indicating that value might wrestle to go increased within the brief time period. We’ll watch to see if value finds help right here and units a brand new increased low. GoNoGo Oscillator has fallen to check the zero line from above and we all know that if the “Go” pattern is to stay wholesome it ought to discover help at that degree. If it could rally again into optimistic territory then we’ll know that momentum is resurgent within the path of the underlying “Go” pattern.

The Greenback Jumps Increased

Final week we noticed some weak spot within the “Go” pattern because the indicator painted a string of weaker aqua bars following a Go Countertrend Correction Icon (purple arrow). This Icon warned us that value might wrestle to go increased within the brief time period. As value fell from its most up-to-date excessive, we turned our consideration to the oscillator panel. GoNoGo Oscillator fell to check the zero degree and rapidly discovered help as quantity elevated (darker blue of oscillator line). Now, with value making new increased highs and GoNoGo Pattern as soon as once more portray sturdy blue bars we all know that momentum is resurgent within the path of the “Go” pattern.

Tyler Wooden, CMT, co-founder of GoNoGo Charts, is dedicated to increasing using information visualization instruments that simplify market evaluation to take away emotional bias from funding choices.

Tyler has served as Managing Director of the CMT Affiliation for greater than a decade to raise traders’ mastery and ability in mitigating market danger and maximizing return in capital markets. He’s a seasoned enterprise government centered on instructional know-how for the monetary companies business. Since 2011, Tyler has offered the instruments of technical evaluation all over the world to funding corporations, regulators, exchanges, and broker-dealers.

Study Extra

Alex Cole, CEO and Chief Market Strategist at GoNoGo Charts, is a market analyst and software program developer. Over the previous 15 years, Alex has led technical evaluation and information visualization groups, directing each enterprise technique and product improvement of analytics instruments for funding professionals.

Alex has created and applied coaching packages for giant firms and personal shoppers. His instructing covers a large breadth of Technical Evaluation topics, from introductory to superior buying and selling methods.

Study Extra