Gold noticed unimaginable value features in 2024, rising from US$2,000 per ounce to shut to US$2,800.

Varied elements have lent assist, together with 75 foundation factors value of rate of interest cuts from the US Federal Reserve, geopolitical instability in Jap Europe and the Center East and uncertainty in world monetary markets.

In fact, it wasn’t all an upward climb for gold — following the US presidential election, Donald Trump emerged victorious, and the gold value skilled volatility as buyers flocked to Bitcoin.

Learn on for extra on what elements moved the gold value in This autumn, adopted by a glance again on the complete 12 months.

Gold value in This autumn

The gold value started This autumn at US$2,660.30, however shortly noticed a retraction to US$2,608.40 on October 9. Nonetheless, the decline did not final, and gold once more rose, setting a brand new file excessive of US$2,785.40 on October 30.

The surge upward was fueled by a weaker-than-expected September US shopper value index report, which confirmed annual inflation of two.4 % and month-to-month inflation of 0.2 %. These numbers have been greater than analysts’ forecasts of two.3 and 0.1 %, elevating expectations that the Fed would lower charges at its November assembly.

Gold was in retreat to begin November, dropping to US$2,664 on November 6 after Trump’s victory. The following day, it briefly surged above the US$2,700 mark because the Fed lower rates of interest by 25 foundation factors on November 7.

By November 15, the value of gold had fallen to its quarterly low of US$2,562.50.

The top of the month noticed gold leap to US$2,715.80 on November 22. Following this peak, gold entered December beneath the US$2,700 mark, closing at US$2,660.50 on December 9.

Gold value, This autumn 2024.

Chart by way of Buying and selling Economics.

Geopolitical impacts have been necessary to gold in This autumn.

Along with Trump’s re-election, which has prompted turmoil in varied kinds, on November 17 the US approved Ukraine to make use of ATACMS long-range missiles to assault targets deeper into Russian territory. The UK and France mirrored this transfer, giving Ukraine the inexperienced gentle to make use of long-range missiles within the ongoing battle.

Tensions continued to ratchet up within the days following as Russia introduced it was decreasing the edge for nuclear retaliation to incorporate typical assaults from international locations backed by nuclear nations. In an illustration of its capabilities, Russia launched an intermediate-range ballistic missile for the primary time on November 21. Whereas the missile appeared solely to hold inert warheads, it’s able to delivering each typical and nuclear armaments.

The specter of a major escalation has bolstered gold’s attraction as a safe-haven asset and retailer of worth.

How did gold carry out for the remainder of the 12 months?

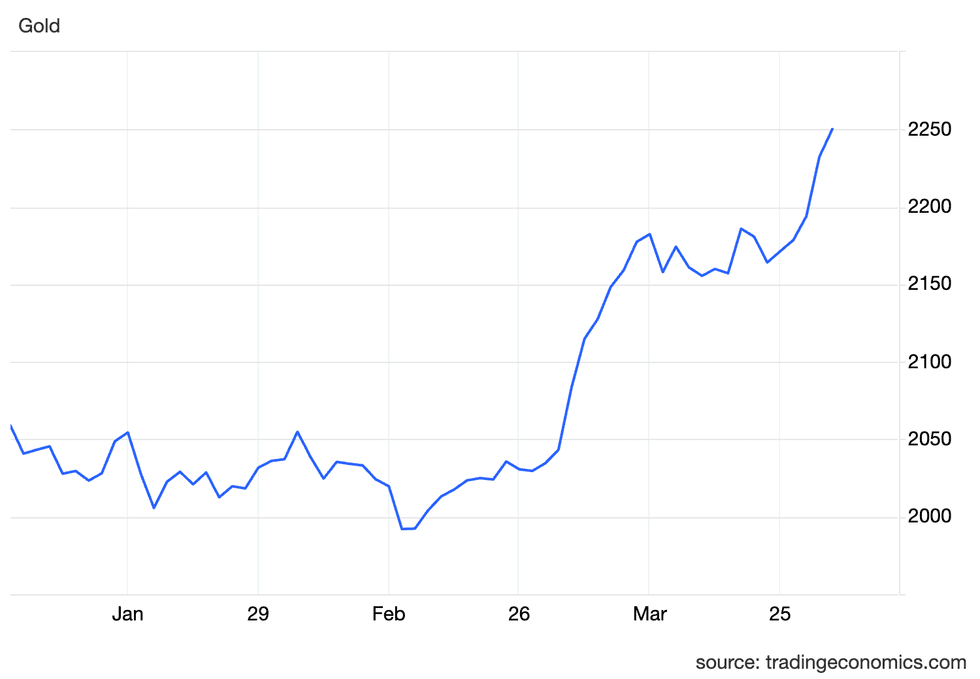

Gold value in Q1

Gold set its first file value of the 12 months at US$2,251.37 on March 31.

Central financial institution shopping for, notably China’s buy of twenty-two metric tons of gold within the first two months of the 12 months, supported the value. Turkey, Kazakhstan and India additionally considerably elevated their holdings firstly of the 12 months.

Additional momentum got here from Chinese language wholesale demand, which jumped to 271 metric tons in January, the strongest ever recorded. Buyers have been turning to the yellow metallic as a protection towards falling actual property and inventory costs. At the moment, the nation’s shares had misplaced almost US$5 trillion in worth over the previous three years.

Gold value, Q1 2024.

Chart by way of Buying and selling Economics.

“As central banks proceed to be important consumers and geopolitical dangers and world uncertainties drive buyers in direction of the perceived security of gold, the present setting underscores gold’s significance as a strategic asset for portfolio diversification and threat mitigation. Subsequently, whereas there might have been a notion of western disinterest in gold, current developments point out a sustained and broad-based demand for the valuable metallic,” Joe Cavatoni, market strategist, Americas, advised the Investing Information Community (INN) in an e-mail on the time.

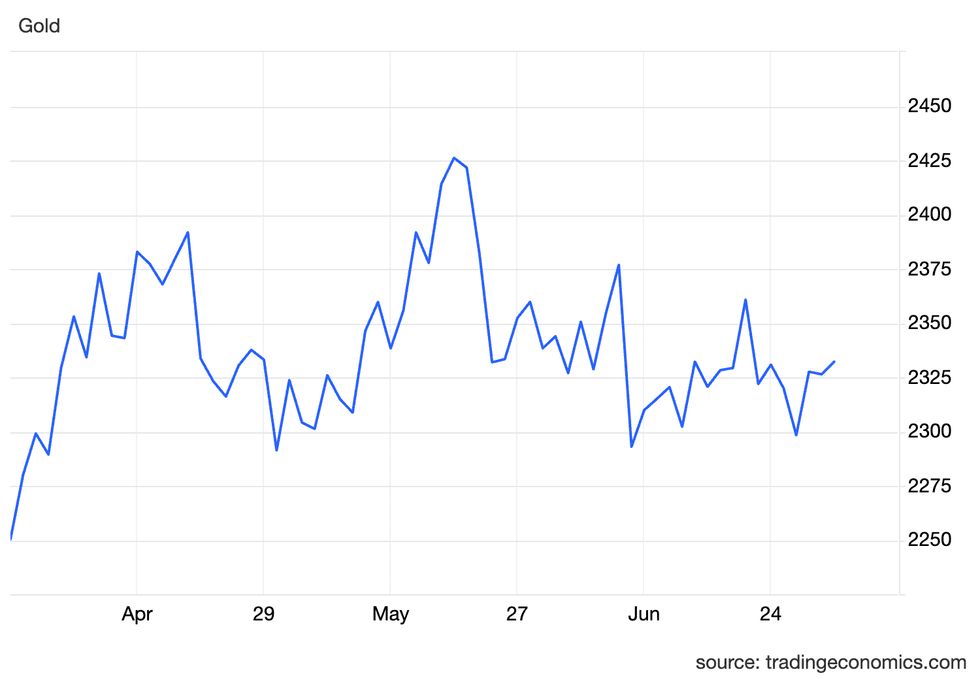

Gold value in Q2

The gold value noticed growing momentum in Q2, setting a brand new all-time of US$2,450.05 on Might 20.

Beneficial properties by the quarter have been influenced by sturdy central financial institution demand. Investor sentiment towards the yellow metallic additionally shifted, with outflows from western exchange-traded funds beginning to sluggish.

Though European funds nonetheless noticed important declines, it wasn’t all dangerous information — the US-based SPDR Gold Shares (NYSE:GLD), the Sprott Bodily Gold Belief (NYSE:PHYS), Eire’s Royal Mint Responsibly Sourced Bodily Gold ETC (LSE:RMAU) and Switzerland’s UBS ETF Gold (SWX:AUUSI) all noticed will increase.

Gold value, Q2 2024.

Chart by way of Buying and selling Economics.

In a Might interview with INN, Jeff Clark, editor of Paydirt Prospector, famous a number of different market dynamics that prompted the value of gold to rise dramatically. He stated the actual start line for the valuable metallic’s features was the top of February, when the Fed indicated it was anticipating three or 4 charge cuts in 2024.

“Abruptly, gold was off to the races. It jumped so excessive that abruptly, you had some quick protecting that wanted to occur then as properly. So that you had quick protecting, which implies they’re shopping for. And then you definately had momentum chasers and merchants leaping all in. That was a fairly good spike … that is what sort of began all of this,” he stated.

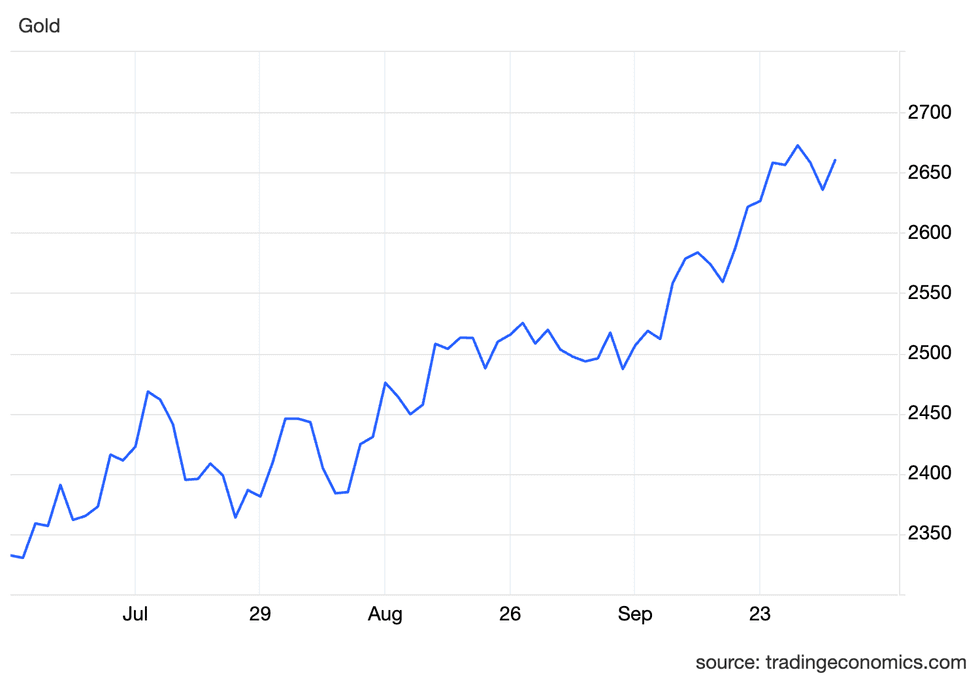

Gold value in Q3

Gold set one other file value in the course of the third quarter, reaching US$2,672.51 on September 26.

The excessive got here only a week after the conclusion of the Fed’s September assembly, when it introduced a jumbo 50 foundation level lower to the federal funds charge. Whereas the Individuals’s Financial institution of China maintained its pause on gold purchases within the third quarter, it granted a number of regional banks new import quotas in August.

Gold value, Q3 2024.

Chart by way of Buying and selling Economics.

David Barrett, CEO of the UK division of world brokerage agency EBC Monetary Group, recommended on the time that Fed charge cuts have been much less of an element for gold than central financial institution shopping for. “I nonetheless see the worldwide central financial institution shopping for as the primary driver — because it has been during the last 15 years. This demand removes provide from the market. They’re the last word buy-and-hold individuals and have been shopping for large quantities,” he advised INN by way of e-mail.

The quarter additionally noticed important merger and acquisition exercise, with South Africa-based Gold Fields (NYSE:GFI,JSE:GFI) asserting plans to accumulate Canada’s Osisko Mining (TSX:OSK) for C$2.16 billion, and South African gold miner AngloGold Ashanti (NYSE:AU) agreeing to buy UK-based Centamin (TSX:CEE,LSE:CEY) for US$2.5 billion.

Investor takeaway

Total, uncertainty has been a key driver for gold in 2024.

Central banks have continued to extend their bodily holdings towards an more and more polarized political panorama. The most up-to-date knowledge from the World Gold Council exhibits that they added 186 metric tons of gold to their coffers in the course of the third quarter, with the Nationwide Financial institution of Poland main the best way with 42 metric tons.

The World Gold Council notes that on a rolling four-quarter foundation, central financial institution shopping for has slowed to 909 metric tons — that is in comparison with 1,215 metric tons one 12 months in the past.

Buyers additionally started returning to the valuable metallic all through 2024 as geopolitical tensions and fragile economies pushed them towards gold as a secure haven to assist defend their portfolios from volatility.

With the world’s largest financial system set to welcome Trump again to the White Home in 2025, there are numerous unknowns. His financial insurance policies may trigger inflation to start creeping up. In distinction, his international insurance policies may create new ripples by world commerce and monetary markets provided that he campaigned on extra protectionist insurance policies.

Remember to comply with us @INN_Resource for real-time updates!

Securities Disclosure: I, Dean Belder, maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: The Investing Information Community doesn’t assure the accuracy or thoroughness of the knowledge reported within the interviews it conducts. The opinions expressed in these interviews don’t mirror the opinions of the Investing Information Community and don’t represent funding recommendation. All readers are inspired to carry out their very own due diligence.

From Your Web site Articles

Associated Articles Across the Net