Taxes. You could attempt to think about them as little as attainable, however they’re on our minds rather a lot. Particularly after they relate to investments. That’s as a result of we’re at all times seeking to maximize our clients’ potential take-home returns—and key to that pursuit is minimizing how huge of a chunk taxes take.

On that entrance, our Tax Coordination function is a fully-automated strategy to an funding technique referred to as asset location—and it’s obtainable at no further price. If you happen to’re saving for retirement in a couple of sort of account, then asset location normally, and our spin on it particularly, may help to extend your after-tax anticipated returns with out taking over further danger. Right here’s how.

How Tax Coordination works

Many Individuals wind up saving for retirement in some mixture of three account sorts:

- Taxable

- Tax-deferred (Conventional 401(ok) or IRA)

- Tax-exempt (Roth 401(ok) or Roth IRA)

Every sort of account will get a unique tax remedy, and totally different property are taxed otherwise as effectively. These guidelines make sure investments a greater match for one account sort over one other.

Returns in IRAs and 401(ok)s, for instance, don’t get taxed yearly, so they typically shelter development from tax higher than a taxable account. We’d relatively defend property that lose extra to tax in these kinds of retirement accounts, property similar to bonds, whose dividends are normally taxed yearly and at a excessive fee.

Within the taxable account, nevertheless, we’d usually want to have property that don’t get taxed as a lot, property similar to shares, whose development in worth (“capital beneficial properties”) is taxed at a decrease fee and crucially solely after they’re “realized,” or in different phrases, after they’re offered at the next value than what you paid for them.

Properly making use of this technique to a globally-diversified portfolio can get sophisticated rapidly. Try our full Asset Location methodology in case you’re curious what that complexity appears like—or hold studying for extra of the simplified clarification.

The large image diversification of asset location

When investing in a couple of account, many individuals choose the identical portfolio in every one. That is straightforward to do, and while you add every part up, you get the identical portfolio, solely greater.

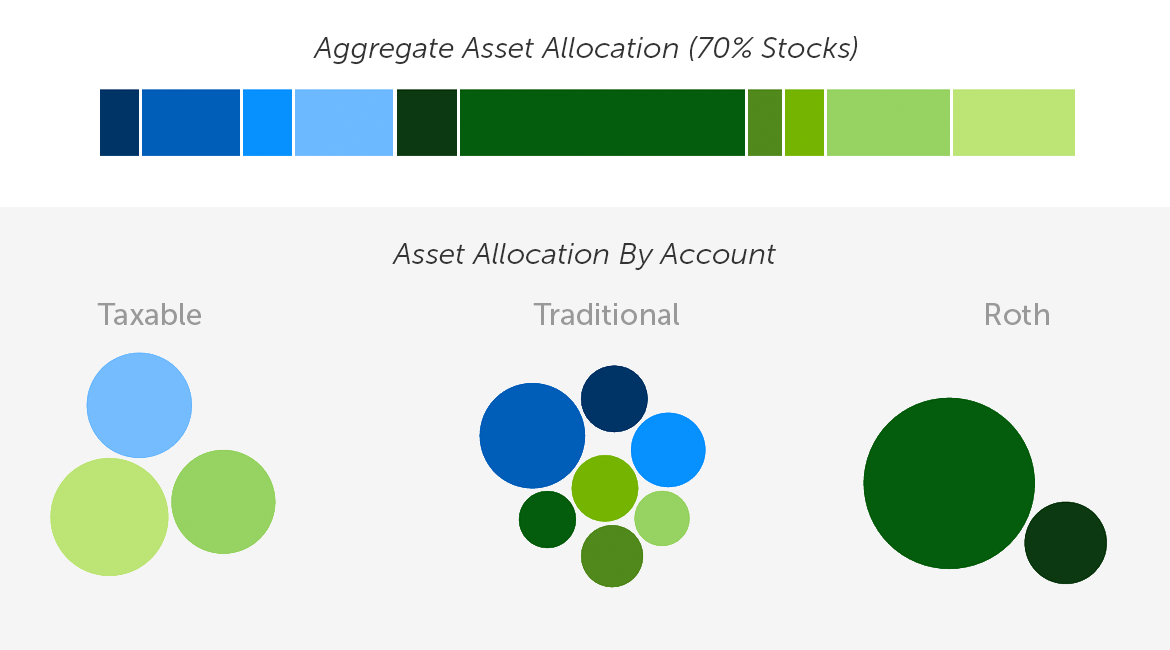

As an example this strategy, right here’s what it appears like with a hypothetical asset allocation of 70% shares and 30% bonds. The totally different shades of inexperienced symbolize varied kinds of shares, and the totally different shades of blue symbolize varied kinds of bonds.

However so long as all of the accounts add as much as the portfolio we would like, every particular person account by itself doesn’t should mirror that portfolio. Every asset can go within the account the place it makes essentially the most sense from a tax perspective. So long as we nonetheless have the identical portfolio once we add up the accounts, we are able to improve the after-tax anticipated return with out taking over extra danger. That is asset location in motion, and right here’s what it appears like, once more for illustrative functions:

This is similar general portfolio as we initially confirmed, besides we redistributed the property inconsistently to cut back taxes. Word that the mixture allocation continues to be a 70/30 break up of shares and bonds.

The idea of asset location isn’t new. Advisors and complex do-it-yourself traders have been implementing some model of this technique for years. However squeezing it for extra profit could be very mathematically-complex. It means making vital changes alongside the best way, particularly after making deposits to any of the accounts. Our expert-built know-how handles the entire complexity in a manner {that a} handbook strategy simply can’t match.

Our rigorous analysis and testing, as outlined in our Asset Location methodology, demonstrates that accounts managed by Tax Coordination are anticipated to yield meaningfully increased after-tax returns than uncoordinated accounts.

profit from Betterment’s Tax Coordination

To learn from from our Tax Coordination function, you first should be a Betterment buyer with a stability in at the very least two of the next kinds of Betterment accounts:

- Taxable account

- Tax-deferred account: A Conventional IRA or a Betterment Conventional 401(ok) provided by your employer.

- Tax-exempt account: A Roth IRA or a Betterment Roth 401(ok) provided by your employer.

Word which you can solely embody a 401(ok) in a objective utilizing Tax Coordination if it’s one we handle on behalf of your present or former employer. In case your employer doesn’t presently use Betterment to offer their 401(ok) plan, inform them to offer us a have a look at betterment.com/work!

You probably have an previous 401(ok) with a earlier employer, you’ll be able to nonetheless profit from our Tax Coordination function by rolling it over to a Betterment IRA.

For step-by-step directions on how you can arrange Tax Coordination in your Betterment account, in addition to solutions to regularly requested questions, head on over to our Assist Heart. Or in case you’re not but a Betterment buyer, get began by signing up as we speak.