With India witnessing decrease native prices, many price-sensitive patrons are actually choosing heavier jewellery items. Picture: Bloomberg

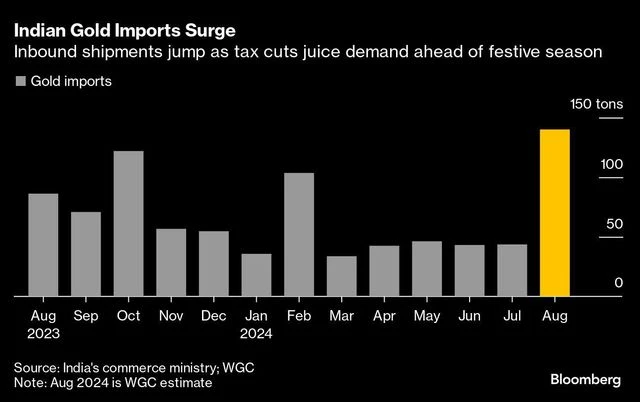

Indian gold demand seems set for a robust few months as a minimize to the import tax and what’s more likely to be a buoyant pageant and wedding ceremony season drive purchases on this planet’s second-biggest shopper of the dear metallic.

)

Jewellery shopping for will collect tempo in a few weeks because the world’s most-populous nation enters the pageant and wedding ceremony season — when carrying and gifting gold is taken into account auspicious. Hindu festivities will culminate with Diwali in November, whereas December and January can be busy months for marriages.

“The professional-gold coverage measures are positively impacting the home gold market,” stated Sachin Jain, regional CEO for India on the World Gold Council.

The modifications may assist add 50 tons or extra to gold demand within the second half of 2024 versus final 12 months, he stated, including that total necessities might be between 750 tons and 850 tons this 12 months.

The momentum comes after inbound shipments rose simply 4.8 per cent from a 12 months in the past to 305 tons within the first half of this 12 months, in keeping with the commerce ministry.

The purchases reinforce the South Asian nation’s place as a worldwide vibrant spot for bodily consumption, at a time when jewellery purchases have tanked within the greatest purchaser China. Customers there have grappled with an financial downturn throughout what needs to be one of many busiest occasions of the 12 months.

With India witnessing decrease native prices, many price-sensitive patrons are actually choosing heavier jewellery items, bucking a long-term desire for cheaper light-weight objects, stated Chirag Sheth, principal advisor for South India at Metals Focus. “Instantly you’ve seen gold cheaper by 9 per cent — and all these individuals who have been ready on the sidelines for the costs to drop have all rushed to the market.”

It’s not simply bodily gold that’s drawn consideration. Internet additions to Indian gold-backed trade traded funds have been constructive for 4 straight months, with inflows hitting a report in August, in keeping with the WGC.

As Indians pour trillions of rupees into an more and more scorching native inventory market, bullion-backed ETFs have turn out to be a portfolio diversifier for the typical investor who usually trades in equities solely, stated Gnanasekar Thiagarajan, director at Commtrendz Danger Administration Companies.

In India, it’s all the time “contact and really feel,” he stated. “We go to the jewellery retailer, negotiate with the sellers. However for the primary time, persons are investing in paper gold through the ETF route. It’s a really new expertise for the nation.”

First Printed: Sep 26 2024 | 7:51 AM IST

&w=860&resize=860,0&ssl=1)