KEY

TAKEAWAYS

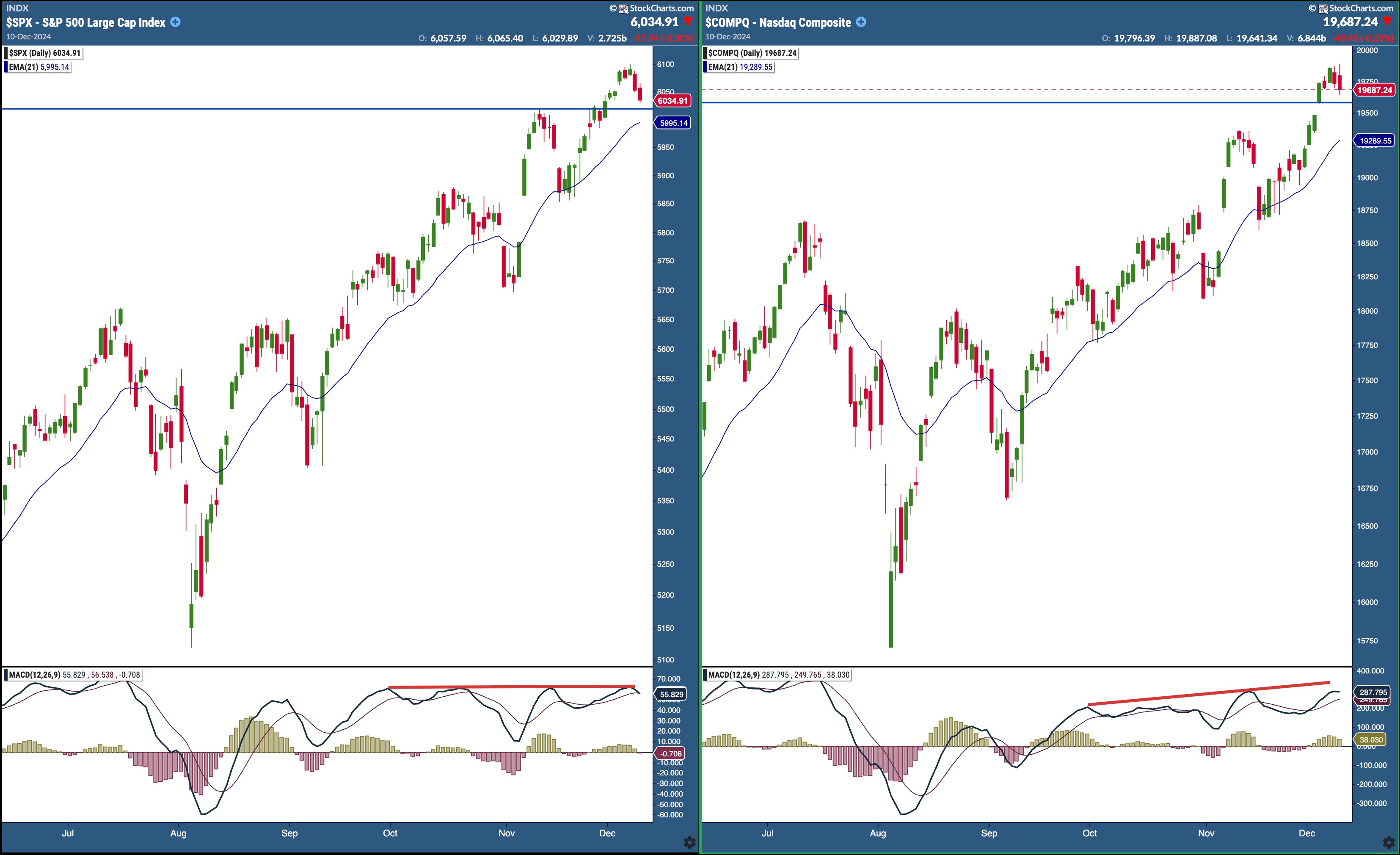

- The S&P 500 and Nasdaq Composite are inching towards key help ranges.

- Gold costs have risen on information of China’s central financial institution’s resolution to purchase gold.

- NVDA is underneath investigation for antitrust actions, and its inventory value is declining.

The Tuesday afternoon selloff brings the broader indexes near key help ranges. Within the first half of the buying and selling day, the S&P 500 ($SPX) and Dow Jones Industrial Common ($INDU) have been buying and selling barely larger. The Nasdaq Composite ($COMPQ) was the chief within the morning hours. However in the direction of the final couple hours of the buying and selling day, all three indexes bought off.

The larger query is how a lot harm two down days in a row prompted. With the broader inventory market indexes rising to new highs, seeing two down days in a row is a bit disappointing. However a selloff is wholesome, particularly as we method the top of the 12 months, so long as the bullish development remains to be intact.

The chart of the S&P 500 and Nasdaq Composite under reveals that each indexes have an upward trending 21-day exponential transferring common (EMA). Nonetheless, the S&P 500 is getting near its November excessive, which is a sound help stage. The Nasdaq has a methods to go earlier than it reaches its November excessive. A better help stage is a low of the December 4 value transfer, a niche up.

FIGURE 1. S&P 500 AND NASDAQ COMPOSITE SELL OFF. Though the bullish development remains to be in play, watch the help ranges and transferring common convergence/divergence (MACD) for indicators of a downtrend.Chart supply: StockChartsACP. For academic functions.

The transferring common convergence/divergence (MACD) within the decrease panel reveals that the S&P 500 is the weaker of the 2 indexes, technically talking. Since October, the MACD has been comparatively flat whereas the S&P 500 was rising. The MACD for the Nasdaq was in a slight incline whereas the index was rising.

The excellent news is that the seasonally robust a part of the month is but to return. December and January are likely to do nicely with the Santa Claus rally, the January Impact, and the January Barometer, three seasonal patterns mentioned within the Inventory Dealer’s Almanac. The Cboe Volatility Index ($VIX) stays low, which is one other variable that helps the bullish transfer in equities. We must always get extra readability on Wednesday after the November CPI knowledge is launched.

Treasured Metals Rise

Whereas equities have been promoting off, gold and silver costs began inching larger. The surge in gold costs may be attributed to China’s central financial institution deciding to purchase gold, one thing it hasn’t performed in a number of years.

Gold costs pulled again to the 100-day SMA after reaching an all-time excessive on the finish of October. Since then, it has been trending larger and will make one other try to succeed in its excessive (see chart of gold steady contract under).

FIGURE 2. GOLD FUTURES TRYING TO BREAK OUT OF A RESISTANCE LEVEL. If gold costs break above the resistance stage, value might make an try to succeed in its all-time excessive.Chart supply: StockCharts.com. For academic functions.

Tuesday’s low coincided with the 50-day SMA, and the excessive coincided with earlier highs. You might say that $GOLD traded between a help and resistance stage. A profitable break above Tuesday’s excessive would affirm that gold costs might intention to succeed in an all-time excessive.

A number of geopolitical occasions surfaced this week that will have contributed to the rise in crude oil costs, which noticed Treasury yields rise barely. However these might be short-lived news-driven reactions.

NVIDIA’s Slide

One inventory I will be intently watching is NVIDIA Corp. (NVDA). The Chinese language authorities is investigating the corporate for antitrust actions. NVDA closed under its 50-day SMA on Tuesday with a declining StockCharts Technical Rank (SCTR) rating of fifty.20. The MACD can be indicating slowing momentum (see chart under).

FIGURE 3. NVIDIA’S STOCK PRICE FALLS BELOW 50-DAY MOVING AVERAGE. As well as, the SCTR rating is at 50, which signifies weak technical energy. The MACD reveals momentum is declining.Chart supply: StockCharts.com. For academic functions.

An extra decline in NVDA’s inventory value, which makes up about 7% of the S&P 500, might decrease the index’s worth.

The underside line: November CPI will probably be launched on Wednesday morning, 8:30 AM ET. Economists estimate a 2.7% year-over-year improve whereas the core CPI is anticipated to rise 3.3%. This may dictate Wednesday’s value motion.

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your personal private and monetary scenario, or with out consulting a monetary skilled.

Jayanthi Gopalakrishnan is Director of Web site Content material at StockCharts.com. She spends her time developing with content material methods, delivering content material to teach merchants and traders, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising company for monetary manufacturers. Previous to that, she was Managing Editor of Technical Evaluation of Shares & Commodities journal for 15+ years.

Study Extra