Investor Perception

Working in a quickly increasing fintech trade, IODM is well-positioned to leverage the growing demand for accounts receivable automation, significantly in medium to giant ERP firms.

Overview

IODM (ASX:IOD) is a cloud-based working capital administration software program answer designed to automate and streamline the accounts receivable perform for universities, industrial firms and different enterprises. This platform helps organizations effectively talk with their shoppers, debtors or college students, facilitating the gathering of funds whereas lowering guide processes. By integrating with a corporation’s current accounting programs, IODM goals to enhance money movement administration and optimize working capital.

Certainly one of IODM’s key strengths is its skill to handle advanced billing cycles, usually related to worldwide funds. This characteristic makes it particularly interesting to establishments with important cross-border transactions, comparable to universities with worldwide college students. As of 2024, ten UK universities have applied IODM’s platform, and the corporate is working to develop its presence in different areas, together with North America, Asia and Europe.

IODM’s strategic partnerships, comparable to with Convera, have allowed it to penetrate the college market within the UK and European Union (EU). The preliminary success in these markets has set the stage for broader worldwide growth, highlighting the platform’s scalability and potential to grow to be a worldwide chief in accounts receivable options.

From an funding perspective, IODM presents a lovely alternative because of its sturdy progress potential and worldwide scalability. Working in a quickly increasing trade, IODM is well-positioned to capitalize on the growing demand for accounts receivable automation, significantly in markets that contain excessive volumes of cross-border transactions. The platform is very scalable, which permits IODM to develop into new areas and industries with minimal extra prices, making the enterprise mannequin extremely environment friendly with an awesome diploma of operational leverage.

IODM’s monetary efficiency displays this potential, with money receipts for fiscal 12 months 2024 at AU$2.05 million, marking a 70 p.c improve over the earlier 12 months. This spectacular progress is pushed by the corporate’s skill to safe recurring income streams by its versatile pricing fashions.

Relying on the shopper, IODM makes use of both a income share mannequin or a license-based mannequin. Within the schooling sector, income is primarily generated by a share of funds processed through international trade suppliers like Convera. For enterprise shoppers, IODM sometimes costs an annual license charge for entry to the platform. This mix of recurring and performance-based income streams ensures a gradual monetary basis for continued progress, making IODM a compelling funding alternative.

Firm Highlights

- IODM is a cloud-based accounts receivable communications platform designed to automate and streamline money assortment processes throughout the phrases of commerce.

- The platform seamlessly integrates with ERP programs like Oracle, SAP, Microsoft Dynamics and Xero, lowering the necessity for guide invoicing and follow-ups.

- IODM targets medium to giant firms and might deal with seamlessly these with a number of divisions with a number of reporting capabilities

- IODM has been profitable in universities and enterprises, with a deal with managing advanced billing cycles and cross-border funds.

- The corporate is already utilized by ten UK universities, with plans to develop into North America, Asia and Better Europe.

- IODM operates with a scalable income mannequin, combining income share and license-based pricing to cater to completely different buyer segments.

Key Product

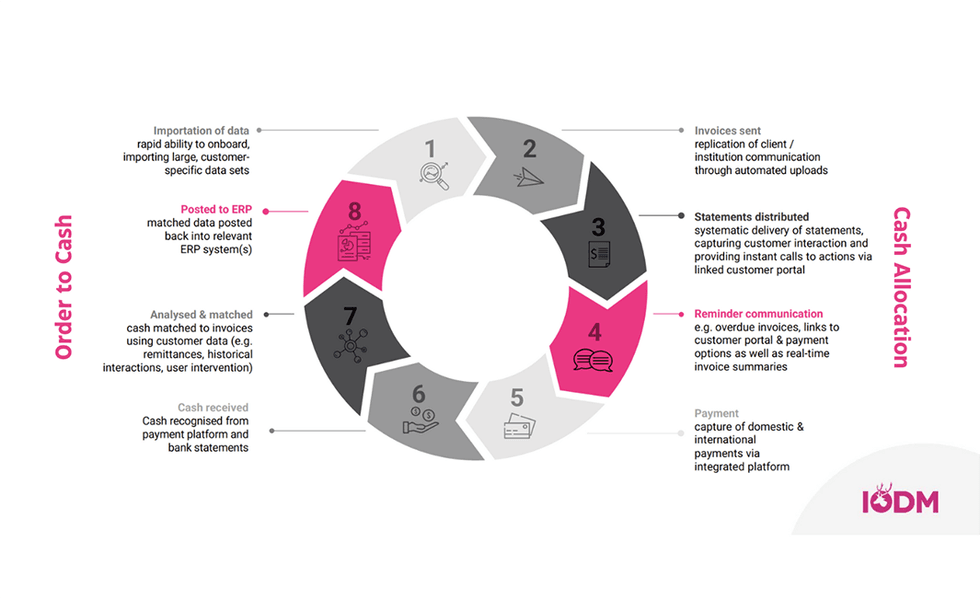

IODM Join illustration

IODM Join

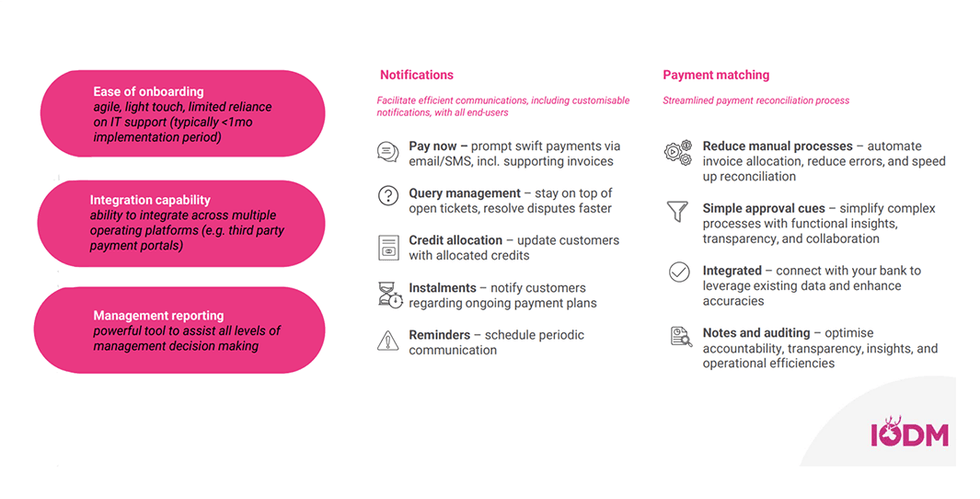

IODM’s flagship product, IODM Join, is an clever accounts receivable platform that permits companies to automate bill reminders, fee collections, and money allocation processes. The platform integrates seamlessly with main enterprise useful resource planning (ERP) programs comparable to Oracle, SAP, Microsoft Dynamics and Xero, permitting organizations to undertake the answer with out important disruption to their current monetary workflows.

One of many major benefits of IODM Join is its skill to automate lots of the time-consuming duties concerned in accounts receivable administration. For instance, the platform can ship automated reminders to clients when funds are due, lowering the necessity for guide follow-ups and enhancing the effectivity of money assortment.

Along with its automation capabilities, IODM Join provides superior money allocation and reconciliation options. These options allow companies to match funds to invoices extra precisely, lowering the danger of errors and guaranteeing that accounts are balanced in a well timed method. That is significantly necessary for organizations that handle excessive volumes of transactions or take care of cross-border funds, the place the complexity of reconciling completely different currencies and fee strategies could be a main problem. IODM Join simplifies this course of, permitting companies to deal with their core operations slightly than the intricacies of accounts receivable.

IODM Join customisable options

The platform can also be extremely scalable and customizable, making it appropriate for companies of all sizes and industries. As organizations develop, they’ll simply add new divisions, jurisdictions, and fee strategies to the system with out the necessity for a significant overhaul. This scalability, mixed with the power to combine with third-party fee platforms, enhances IODM Join’s worth proposition by permitting companies to handle each home and worldwide funds effectively. General, IODM Join gives a complete answer for automating and optimizing accounts receivable processes, serving to companies enhance money movement, cut back operational prices, and streamline monetary administration.

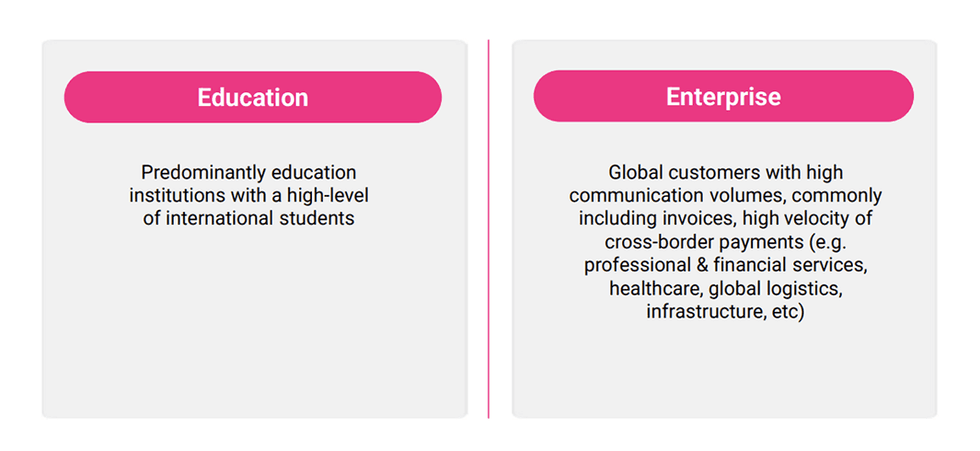

Goal Market: Universities and Enterprise Shoppers

IODM primarily targets universities and huge enterprises that take care of sophisticated billing cycles, usually involving cross-border transactions. The schooling sector, specifically, has emerged as a key focus, with IODM aiding universities in managing funds from worldwide college students. The system is designed to streamline invoicing, handle fee reminders, and deal with a number of currencies and languages, which is important for establishments with college students from numerous international locations.

As of September 30, 2024, IODM had onboarded ten universities within the UK, together with distinguished names just like the London Faculty of Economics and Coventry College, with a further 18 universities within the onboarding course of. This represents a considerable portion of the UK’s larger schooling market, the place one in 4 college students are worldwide, contributing to a complete market measurement of roughly 679,000 college students. IODM’s fast goal is to service round 242,000 of those worldwide college students, capitalizing on the rising demand for environment friendly fee administration.

The rising variety of worldwide college students in areas like Europe, North America and Australia is a significant driver for IODM’s progress. With 2.1 million worldwide college students throughout the US and Canada, and over 679,000 within the UK alone, IODM is aiming to faucet right into a substantialglobal market.

Universities face challenges in managing tuition charges, lodging costs, and different related funds from worldwide college students, particularly within the wake of fluctuating trade charges and cross-border transaction complexities. IODM’s platform simplifies these processes, making it simpler for universities to handle their money movement whereas lowering administrative burdens.

Strategic Partnerships

IODM has secured key international partnerships which have accelerated its progress. Within the schooling sector, the corporate has partnered with Convera, previously Western Union Enterprise Options, to handle cross-border funds effectively. This partnership has been instrumental in increasing IODM’s attain within the UK and EU, permitting universities to course of funds seamlessly by the Convera platform.

Along with Convera, IODM has entered a partnership with Corpay, (NYSE:CPAY), which focuses on cross-border funds for North American enterprise shoppers. This partnership opens new alternatives for IODM in sectors comparable to manufacturing and international logistics.

These strategic partnerships allow IODM to scale globally with out the necessity for giant regional gross sales groups, leveraging current shopper relationships to speed up progress.

Market Drivers

The demand for IODM’s platform is being pushed by a number of key elements, significantly within the schooling sector and amongst enterprises managing worldwide transactions. Probably the most important drivers is the rising variety of worldwide college students, particularly in areas like Europe, North America and Australia. Universities are more and more looking for environment friendly options to handle the complexities of cross-border funds, which regularly contain fluctuating trade charges and diversified fee timelines. This creates a robust want for platforms like IODM that may simplify and streamline these processes.

Moreover, with the price of doing enterprise rising because of inflation and growing rates of interest, universities and enterprises are underneath strain to enhance their money movement administration. Accumulating funds in a well timed and environment friendly method is changing into extra important, making accounts receivable automation a key precedence for organizations seeking to keep monetary stability. The financial setting is forcing establishments to deal with money assortment as a method of optimizing their operations, and IODM’s platform addresses this want by automating many guide processes, lowering errors and accelerating fee assortment.

Administration Workforce

Mark Reilly – Chief Govt Officer

Mark Reilly is a chartered accountant with over 30 years of expertise within the banking and finance sectors, significantly in advisory roles. Earlier than becoming a member of IODM, he labored at Coopers & Lybrand (now PwC) in insolvency, and later based his personal accounting apply. Reilly has held director positions at Black Star Petroleum, Harvest Minerals, and Ochre Group. His experience lies in advising organizations of all sizes on progress methods, company restructuring and valuations.

Petrina Halsall – Chief Working Officer

Petrina Halsall joined the corporate in 2023 and brings a wealth of knowledge know-how expertise. She has labored in important IT roles throughout the FMCG, automotive, transport, logistics and public sectors. Notably, she served as head of IT for the Victorian Division of Treasury and held management positions at GUD Holdings for seven years. Her intensive background in managing business-critical infrastructure and authorized safety makes her a key asset for IODM’s operational effectivity.

James Burke – Chief Expertise Officer

James Burke has intensive expertise in overseeing advanced technological infrastructures and safety programs. Earlier than becoming a member of IODM, Burke held roles that centered on important infrastructure administration in numerous sectors. His management and technical abilities in IT safety have performed a vital position in creating and sustaining the sturdy technological infrastructure at IODM, serving to the corporate obtain scalable progress.

Graham Smith – Head of Operations UK and North America

Graham Smith has over six years of expertise within the monetary companies trade. Previous to becoming a member of IODM, he labored at Western Union Enterprise Options in numerous roles, together with regional supervisor for channels and partnerships. Smith’s experience in managing partnerships and increasing enterprise into new areas is central to IODM’s continued progress in these key worldwide markets.