KEY

TAKEAWAYS

- Progress shares regaining management over worth

- Small and mid-cap progress sectors main the cost

- Massive-cap worth presently the weakest market phase

Progress vs Worth Rotation, the pendulum swings once more

Relative Rotation Graphs (RRG) will not be solely good for visualizing sector rotation, however they’re additionally useful instruments for visualizing different market dynamics. For instance, the relationships between Progress and Worth shares or Massive-cap vs. mid- and Small-cap shares and the mix of those two breakdowns of the market.

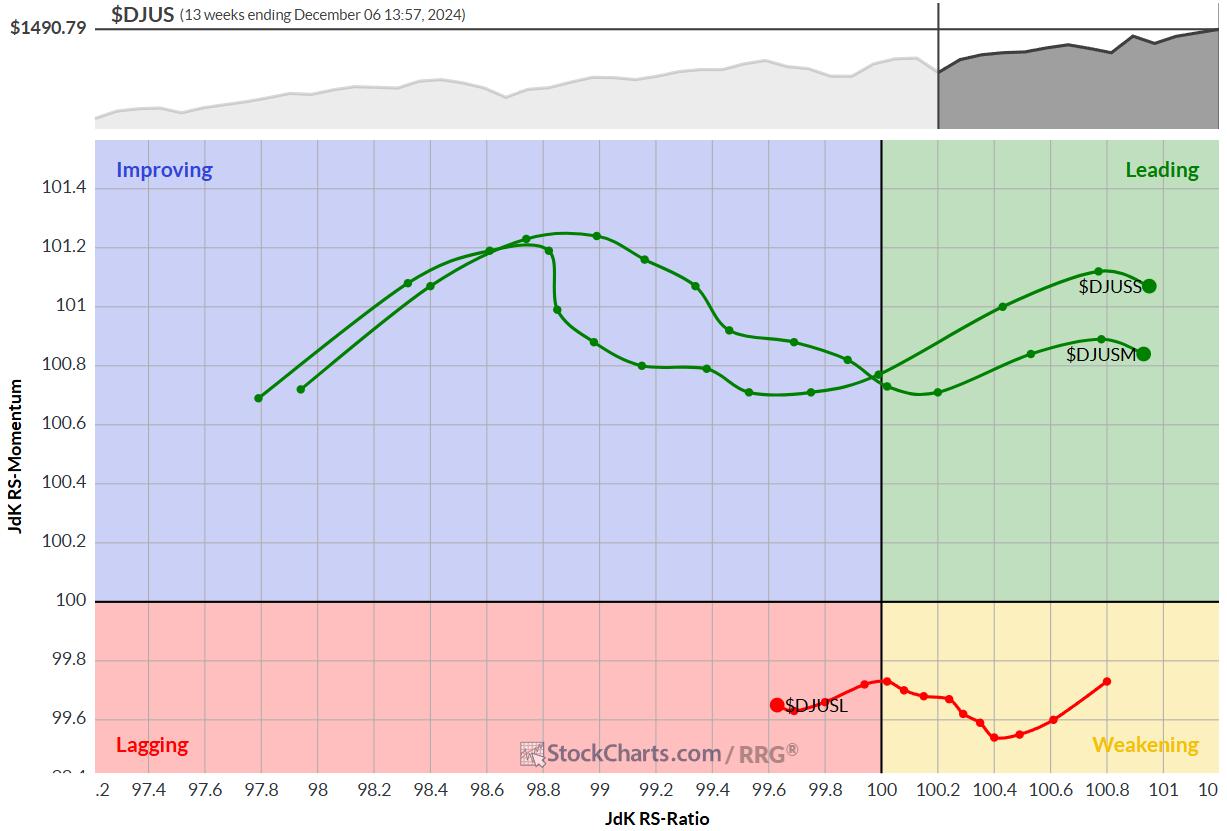

The pure growth-value rotation, as proven within the RRG above, RRG tells an fascinating story.

Worth had its second within the solar from August to early October, however the tides have turned since then.

Across the week ending Sept 27, the worth tail began to roll over whereas nonetheless contained in the enhancing quadrant and the expansion tail did the alternative contained in the weakening quadrant. Mainly signaling the tip of a brief countertrend transfer.

Now, it is clear that progress is as soon as once more beating worth.

Dimension Issues: Small and Mid-Caps Take Middle Stage

After we add the RRG exhibiting rotations of huge, mid, and small-cap shares, the image turns into even clearer.

Small and mid-cap shares are nonetheless gaining relative power within the main quadrant.

In the meantime, massive caps are languishing within the lagging quadrant, persevering with to lose floor.

A Extra Granular Look: The place the Motion Is

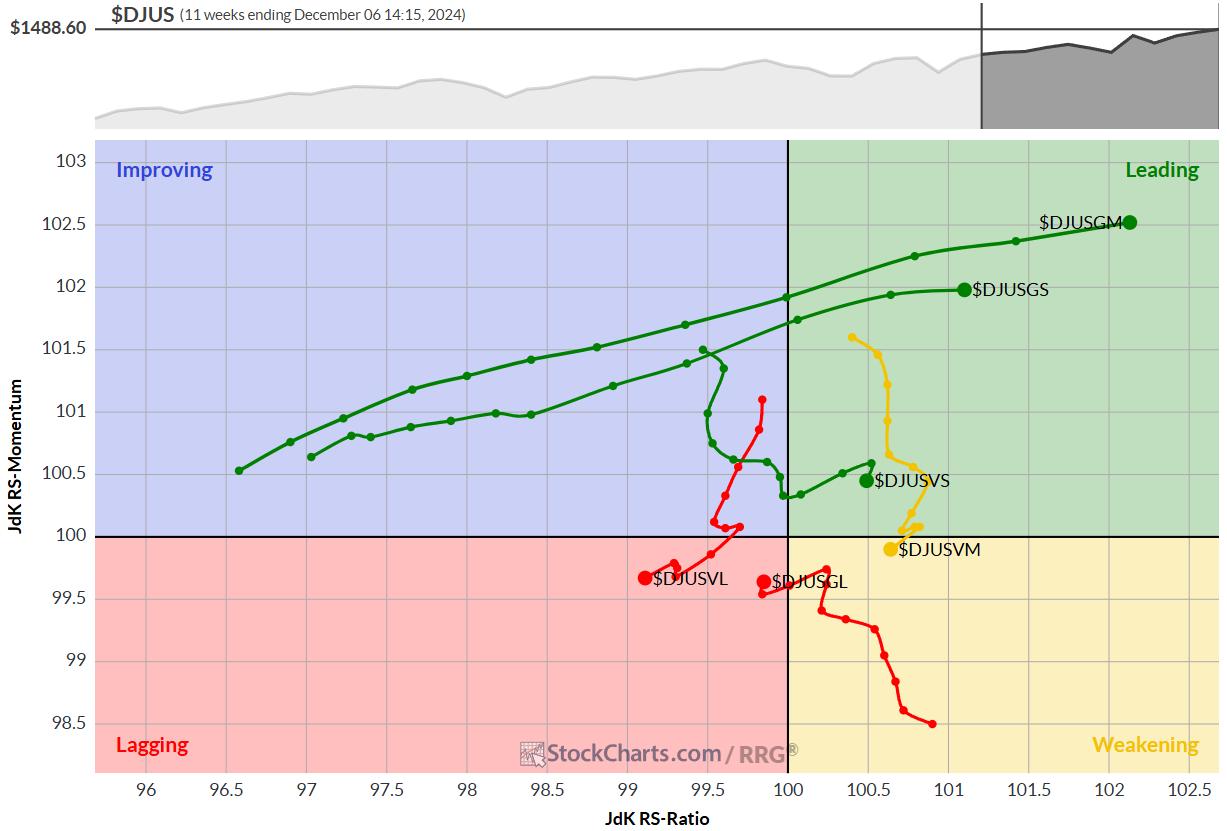

Now, let’s get into the nitty-gritty. We get a extra nuanced view by combining the breakdown of the US inventory universe into progress and worth with massive, mid, and small caps.

The ensuing RRG with six tails, three for progress and three for worth damaged down into three dimension segments, paints a vivid image:

Mid and small-cap progress shares are the clear leaders, deep within the main quadrant and heading additional into it.

Worth small-cap and mid-cap shares on the fitting aspect of the graph are holding their very own, though they’re shedding some relative momentum.

Each the large-cap tails contained in the lagging quadrant present this phase’s present weak point. Nonetheless massive cap progress has simply began to twist again up a bit whereas massive cap worth continues to move South-West.

Because of this large-cap worth is now the weakest phase out there. Contained in the lagging quadrant and touring on a adverse RRG-Heading.

What This Means for Buyers

Massive-caps typically, significantly large-cap worth, are finest averted for now.

Small-cap and mid-cap progress shares deserve your consideration — they’re the place the motion is.

Market Outlook: Regular as She Goes

Regardless of these rotations, the general outlook for the inventory market within the coming weeks stays wholesome.

The S&P 500 chart exhibits the rhythm of upper and decrease lows is undamaged. Divergences inflicting concern have been negated, and breadth metrics have normalized—they’re now not sending too many adverse alerts.

#StayAlert and have an incredible weekend. –Julius

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels beneath the Bio beneath.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can not promise to answer each message, however I’ll definitely learn them and, the place fairly attainable, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered logos of RRG Analysis.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This distinctive methodology to visualise relative power inside a universe of securities was first launched on Bloomberg skilled providers terminals in January of 2011 and was launched on StockCharts.com in July of 2014.

After graduating from the Dutch Royal Army Academy, Julius served within the Dutch Air Power in a number of officer ranks. He retired from the navy as a captain in 1990 to enter the monetary trade as a portfolio supervisor for Fairness & Legislation (now a part of AXA Funding Managers).

Be taught Extra