Investor Insights

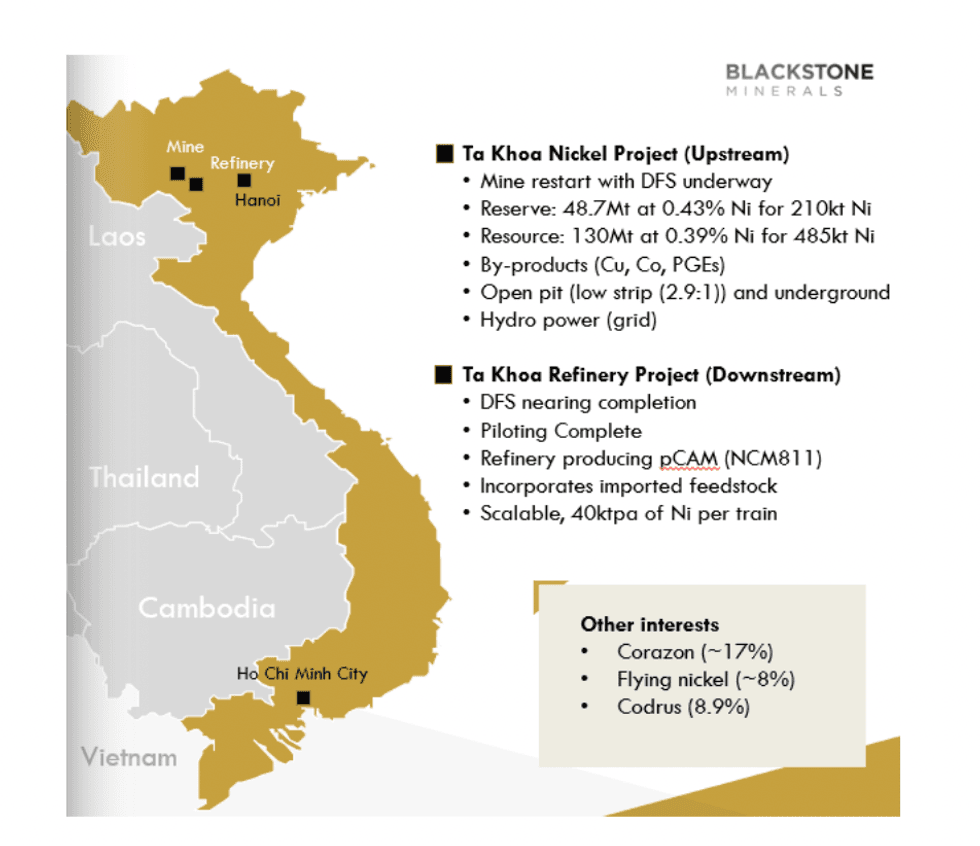

Blackstone Minerals is well-positioned to leverage a projected nickel provide deficit because it strives to grow to be a vertically built-in producer of low-cost, low-carbon, battery-grade nickel. Key to that is Blackstone’s Ta Khoa undertaking in Vietnam, an rising hub for the electrical car market.

Overview

Because the world strikes nearer to a sustainable net-zero future, the necessity for battery metals continues to mount and nickel could quickly be among the many metals to see a provide crunch. Although its roots are within the stainless-steel sector, it is also a vital part of lithium-ion batteries.

On condition that many countries are aiming to switch combustion autos with electrical automobiles by 2030, the steel is already experiencing an enormous spike in demand. Benchmark Minerals expects the necessity for battery-grade nickel will enhance about 950 % by 2040.

It is crucial to ramp up world nickel manufacturing however the useful resource sector, for its half, should accomplish that with a much-reduced carbon footprint to affect the sustainability of the whole worth chain. Blackstone Minerals (ASX:BSX,OTC:BLSTF,FRA:B9S) acknowledges this. As a vertically built-in producer of low-cost, low-carbon nickel, the corporate goals to grow to be a number one supply of low CO2 emission nickel sulphide. Its flagship Ta Khoa undertaking in Vietnam is consultant of that objective.

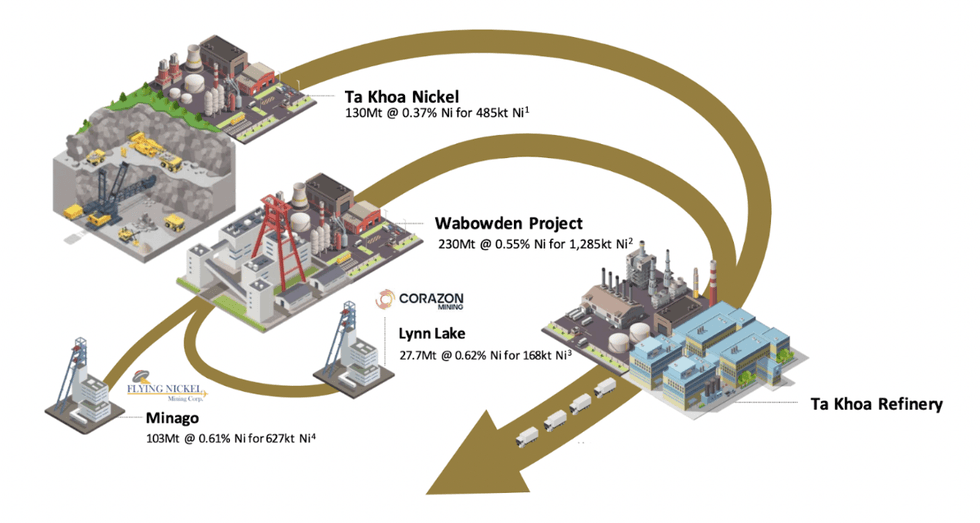

Blackstone Minerals enterprise construction schematic

With over 20 energetic mines and a burgeoning know-how sector, Vietnam is on the highway to turning into a hub of electrical car manufacturing and innovation, with low labor prices and controlled electrical energy pricing additional driving its development. Steadily growing international direct funding within the area is indicative of this because the nation seeks to draw $50 billion in new international funding by 2030.

Blackstone is uniquely positioned to reap the benefits of this, thanks to 2 elements. US President Joe Biden’s Inflation Discount Act, which got here into drive in August 2022, represents the most important funding into local weather motion in United States historical past. An analogous initiative is rolling out within the European Union (EU), which maintains a Free Commerce Settlement with Vietnam — one thing a number of companions of the corporate have expressed curiosity in.

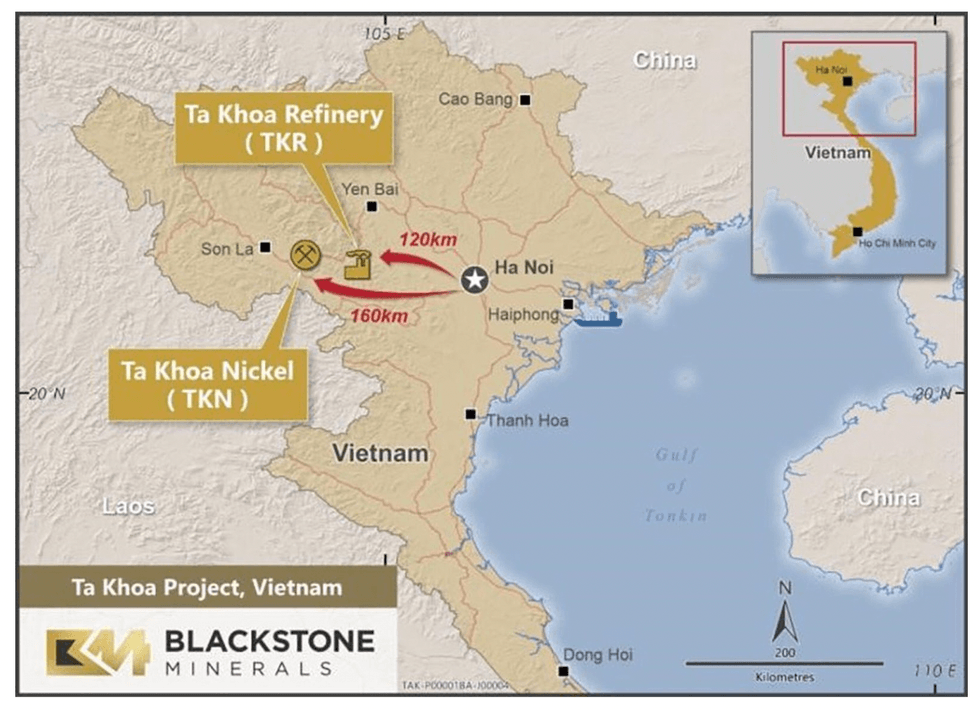

Blackstone’s Ta Khoa Undertaking consists of two streams, the Ta Khoa Nickel Mine and the Ta Khoa Refinery. Current milestones level to Blackstone’s dedication to advancing this game-changing undertaking.

These milestones embrace a memorandum of understanding with Cavico Laos Mining to collaborate in quite a lot of areas related to CLM’s nickel mine in Lao Folks’s Democratic Republic and provide of nickel merchandise for Blackstone’s Ta Khoa Refinery in Vietnam.

Blackstone additionally partnered with Arca Local weather Applied sciences to additional examine the carbon seize potential on the Ta Khoa Undertaking by way of carbon mineralisation, and discover alternatives to utilise Arca’s carbon seize applied sciences throughout the undertaking.

In a bid to collaborate on the provision of renewable wind vitality to the Ta Khoa Undertaking, Blackstone signed a direct energy buy settlement with Limes Renewables Power.

Blackstone obtained AU$2.8 million as an advance from a analysis & growth (R&D) lending fund backed by Uneven Innovation Finance and Fiftyone Capital. The superior fee displays the numerous funding by Blackstone to develop the Ta Khoa Refinery course of and Blackstone’s distinctive technique to convert nickel focus blends into battery merchandise within the type of precursor cathode energetic materials (pCAM).

In December 2023, Blackstone entered into an possibility settlement with CaNickel Mining to accumulate the Wabowden nickel projectlocated within the world-class Thompson Nickel Belt in Manitoba, Canada.

The Wabowden undertaking could have the potential to fill the Ta Khoa Refinery, eradicating dependence on third celebration feed sources.

The corporate has signed a non-binding MOU with the Growth for Assets Environmental Expertise joint inventory firm (DRET) to analyze alternatives to repurpose and commerce waste materials (or residue) from the Ta Khoa Refinery into building materials merchandise. Furthermore, it has additionally progressed the Ta Khoa Refinery byproduct offtake technique with Vietnam Chemical Group (VinaChem), PV Chemical and Tools Company (PVChem) and Nam Phong Inexperienced Joint Inventory Firm (Nam Phong) to promote Ta Khoa Refinery byproducts, being manganese sulphate (or epsomite) and sodium sulphate.

As the corporate plans to construct a worldwide nickel enterprise, Blackstone signed a non-binding memorandum of understanding with Yulho Co. Ltd (Yulho) and EN Plus Co. Ltd (EN Plus) to determine a collaboration throughout the companies together with EN Plus and Yulho who’re in three way partnership on the Ntaka Hill nickel sulphide undertaking in Tanzania, and the Dinagat Island nickel laterite undertaking within the Philippines.

Blackstone holds a 90 % curiosity within the Ta Khoa Nickel-Copper-PGE Undertaking, positioned 160 kilometers west of Hanoi within the Son La Province of Vietnam. It contains an current trendy nickel mine constructed to Australian Requirements, which is presently underneath care and upkeep. The Ban Phuc nickel mine efficiently operated as a mechanized underground nickel mine from 2013 to 2016.

Blackstone intends to enhance the present mine by way of the set up of a big concentrator, refinery and precursor facility, supporting built-in on-site manufacturing of nickel, cobalt and manganese precursor merchandise for the Asia-Pacific market. One in every of Blackstone’s key Analysis and Growth aims with Ta Khoa is to develop a flowsheet that may help this manufacturing.

To meet this objective, Blackstone is specializing in a partnership mannequin, collaborating with teams dedicated to sustainable mining. It is usually working to reduce its carbon footprint and implement a vertically built-in provide chain.

Undertaking Highlights:

- A number of Huge Sulphide Deposits: The Ta Khoa undertaking options a number of extremely promising deposits together with King Snake (as much as 4.3 % nickel and 18.2 grams per ton (g/t) PGE), Sui Phong (2.95 meters @ 2.42 % nickel, 0.52 % copper, 0.06 % cobalt and 0.05 g/t PGE), and Ban Chang. The undertaking can be the positioning of the Ban Phuc nickel mine, which was operated from 2013 to 2016 by Asia Mineral Assets, together with a number of exploration targets which have but to be examined.

- Skilled Management: Internally, Blackstone’s homeowners’ crew brings over 50 years of expertise in management roles at main nickel mines and refineries globally. This expertise has been complemented by ALS Group, Wooden, Future Battery Industries CRC, Curtin College and the Electrical Mining Consortium.

- Giant Reserve and Mining Stock: The whole lot of Ta Khoa is estimated to comprise possible reserves of 48.7 Mt at 0.43 % nickel for 210 kilotons (kt) of nickel and a mining stock of 64.5 Mt at 0.41 % nickel for 265 kt nickel. This excludes Ban Khoa and different growing prospects.

- A Lengthy-lived Undertaking: The Ta Khoa mine is anticipated to provide a yearly common of 18 kt of annual nickel focus over its ten-year lifespan. Blackstone believes the refinery can probably lengthen its life previous ten years.

- An Established Mining Operation: Present infrastructure onsite features a 450 ktpa Mill and mining camp. The mine can even profit from a extremely supportive group and favorable authorities laws — Blackstone is dedicated to collaborating with group stakeholders within the undertaking’s growth.

- Feed Flexibility: Ta Khoa’s refinery will supply a number of feed choices, together with nickel focus, blended hydroxide precipitate, nickel matte and black mass. This flexibility enormously improves the safety and enormously reduces the danger of the undertaking general.

- Valued Partnerships: Blackstone is collaborating with a number of business leaders and teams within the growth of Ta Khoa

- Compelling Pre-feasibility Examine: The monetary outcomes of a base case pre-feasibility research on the undertaking are promising. Based mostly on a conservative NCM811 precursor worth forecast, Ta Khoa shows an distinctive inner return fee on capital invested.

- Built-in Vertical Technique: Blackstone is setting up each the Ta Khoa mine and refinery towards a extremely supportive ESG, macroeconomic and monetary backdrop. This together with Ta Khoa’s low capital depth offers the corporate a big benefit over opponents. Mentioned low depth is the results of a number of elements, together with aggressive labor prices, favorable laws and low-cost renewable hydroelectric energy.

- A Chief in Low Emissions: Unbiased assessments from Digbee, Minviro and Circulor, alongside an audit from the Nickel Institute, have confirmed that Ta Khoa would be the lowest-emitting flowsheet within the business, at 9.8 kilograms of CO2 per kilogram of precursor with alternatives for even additional discount.

- Promising Pilots: With the help of ALS and course of engineering associate Wooden, Blackstone lately accomplished a 12-month programme of labor that developed a scaled model of its focus to sulphate flowsheet. The refinery, which processed greater than 9 tonnes of focus and MHP, efficiently achieved battery-grade nickel sulphate of 99.95 %, with a nickel restoration fee of 97 %.

- Present Roadmap: Blackstone’s subsequent precedence is to finish a collection of definitive feasibility research. As soon as these are full, it can concentrate on totally integrating the mine into the electrical car client provide chain and finalizing its refining partnership construction.

Administration Crew

Hamish Halliday – Non-executive Chairman

Hamish Halliday is a geologist with over 20 years of company and technical expertise. He’s additionally the founding father of Adamus Assets Restricted, an AU$3 million float that grew to become a multimillion-ounce rising gold producer.

Scott Williamson – Managing Director

Scott Williamson is a mining engineer with a commerce diploma from the West Australian College of Mines and Curtin College. He has over 10 years of expertise in technical and company roles within the mining and finance sectors.

Dr. Frank Bierlein – Non-executive Director

Dr. Frank Bierlein is a geologist with 30 years of technical and company expertise, specializing in grassroots to mine-stage mineral exploration, goal era, undertaking administration and oversight, due diligence research, mineral prospectivity evaluation, metallogenic framework research and mineral assets market and funding evaluation.

Alison Gaines – Non-executive Director

Alison Gaines has over 20 years of expertise as a director in Australia and internationally. She has expertise within the roles of board chair and board committee chair, significantly remuneration and nomination and governance committees. She can be the managing director of Gaines Advisory P/L and was lately world CEO of worldwide search and board consulting agency Gerard Daniels, with a big mining and vitality observe.

Gaines has a Bachelor of Legal guidelines and a Bachelor of Arts (hons) from the College of Western Australia, a Graduate Diploma in Authorized Follow from Australian Nationwide College and an honorary doctorate of the College and Grasp of Arts (Public Coverage) from Murdoch College. She is a fellow of the Australian Institute of Firm Administrators and holds the INSEAD certificates in company governance. She is presently the governor of the Faculty of Regulation Ltd, and non-executive director of Tura New Music.

Dan Lougher – Non-executive Director

Daniel Lougher’s profession spans greater than 40 years involving a spread of exploration, feasibility, growth, operations and company roles with Australian and worldwide mining corporations together with a interval of eighteen years spent in Africa with BHP Billiton, Impala Plats, Anglo American and Genmin. He was the managing director and chief government officer of the profitable Australian nickel miner Western Areas Ltd till its takeover by Independence Group.

Lougher additionally holds a firstclass mine supervisor’s certificates of competency (WA) and is a fellow of the Australasian Institute of Mining and Metallurgy (AusIMM). Lougher is the chair of the corporate’s technical committee and nomination committee.

Jamie Byrde – CFO and Firm Secretary

Jamie Byrde has over 16 yr’s expertise in company advisory, private and non-private firm administration since commencing his profession with massive 4 and mid-tier chartered accounting corporations positions. Byrde focuses on monetary administration, ASX and ASIC compliance and company governance of mineral and useful resource targeted public corporations. He’s additionally presently firm secretary for Enterprise Minerals Restricted.

Tessa Kutscher – Government

Tessa Kutscher is an government with greater than 20 years of expertise in working with C-Stage government groups within the fields of enterprise technique, enterprise planning/optimisation and alter administration. After beginning her profession in Germany, she has labored internationally throughout completely different industries, corresponding to mining, finance, tourism and tertiary schooling.

Kutscher holds a grasp’s diploma in literature, linguistics and political science from the College of Bonn, Germany and a grasp’s diploma in instructing from Ludwig Maximilian College of Munich.

Andrew Strickland – Government

Andrew Strickland is an skilled research and undertaking supervisor, a fellow of the Australian Institute of Mining and Metallurgy, College of WA MBA graduate, with undergraduate levels in chemical engineering and extractive metallurgy from Curtin and WASM.

Earlier than becoming a member of Blackstone, Strickland was a senior research supervisor for GR Engineering Companies the place he was accountable for delivering a collection of scoping, PFS and DFS research for each Australian and worldwide tasks. Over his profession, he has held quite a lot of undertaking growth roles throughout each junior to mid-tier builders (together with Straits Assets, Perseus Mining and Tiger Assets) and main multi-operation producers (South32).

Graham Rigo – Government

Graham Rigo is an skilled research supervisor with over a decade of on-site manufacturing expertise, holding undergraduate levels in chemical engineering and finance from Curtin College, WA.

Earlier than becoming a member of Blackstone, Rigo was a research supervisor for Ausenco the place he was accountable for delivering a collection of scoping, PFS and DFS research for each Australian and worldwide tasks over a spread of various commodities.

Rigo has over 11 years of web site expertise in nickel and cobalt hydromet manufacturing expertise, in supervisory/superintendent degree roles in addition to course of engineer expertise.

Lon Taranaki – Government

Lon Taranaki is a global mining skilled with over 25 years of in depth expertise in all facets of assets and mining, feasibility, growth and operations. Taranaki is a certified course of engineer from the College of Queensland Australia. He holds a Grasp of Enterprise Administration, and is a fellow of the Australian Institute of Firm Administrators. Taranaki has established his profession in Asia the place he has efficiently labored (and lived) throughout a number of jurisdictions and commodities starting from technical, mine administration and government administration roles.

Previous to becoming a member of Blackstone in February 2022, Taranaki was the chief government officer of Minegenco, a renewable-energy-focused impartial energy producer. Previous this, he was managing director of his non-public consultancy, AMG Mining World, the place he was offering providers to the mining business in Singapore, Guyana, Indonesia and Cambodia. Moreover, Taranaki has held numerous senior positions with Sakari Assets, PTT Asia Pacific Mining, Straits Assets, Sedgmans and BHP Coal.