Micron Know-how, Inc. (MU) designs, develops, manufactures, and sells reminiscence and storage merchandise worldwide. The corporate operates by way of 4 segments: Compute and Networking Enterprise Unit, Cellular Enterprise Unit, Embedded Enterprise Unit, and Storage Enterprise Unit. Micron Know-how, Inc. was based in 1978 and is headquartered in Boise, Idaho.

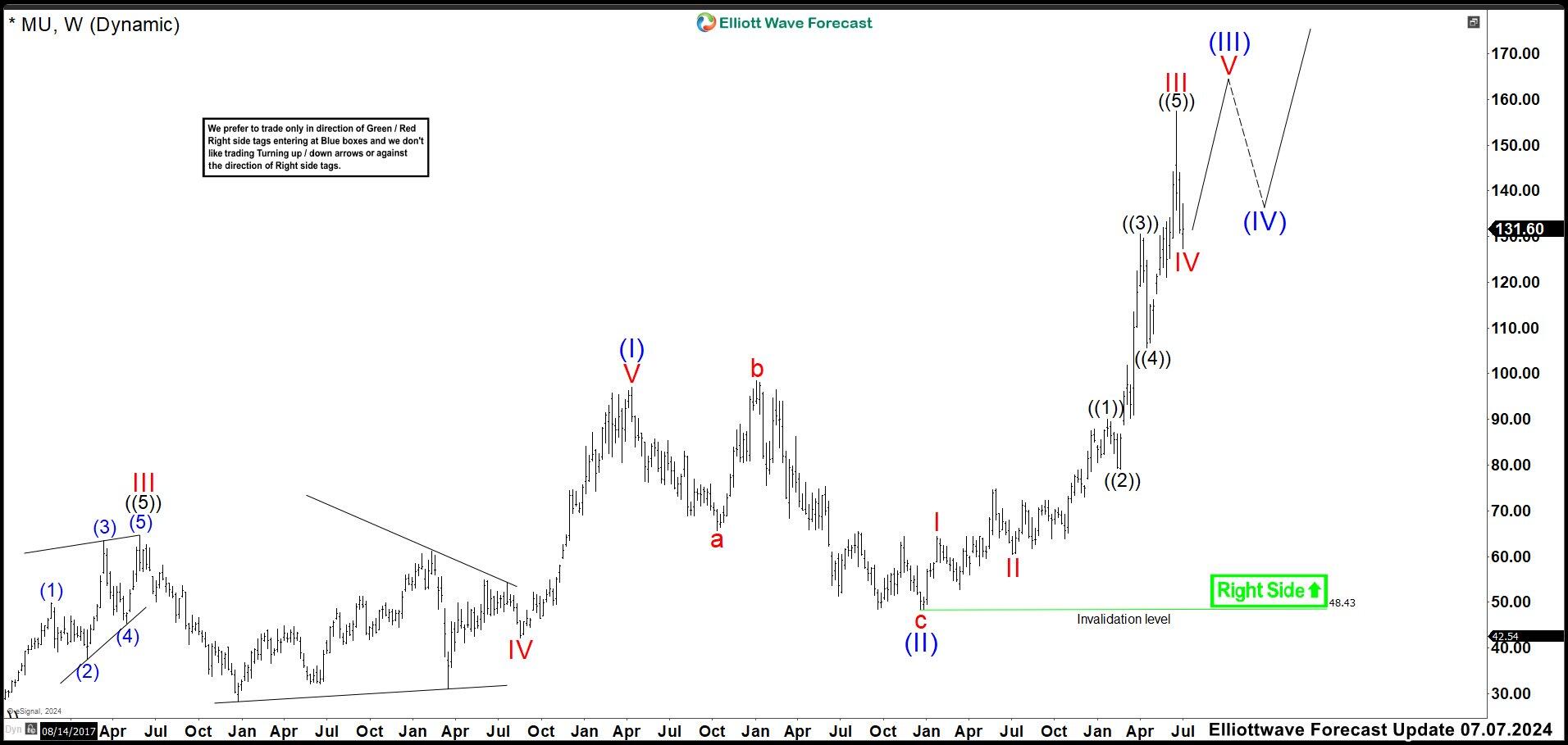

MU weekly chart March 2023

As we see within the chart above, we ended an impulse as wave I at $96.96 excessive. Then, the market did an expanded flat correction (3-3-5) inflicting the value to drop to $48.43. We labelled this low as wave II. From right here, we anticipated to proceed the rally so long as the value stays above wave II. (If you wish to study extra about flat corrections, please observe these hyperlinks: Elliott Wave Training and Elliott Wave Concept).

MU weekly chart July 2024

In July, we adjusted the labels by calling (I) and (II) the place waves I and II have been on the chart a yr in the past. As you would see, MU hit the underside and began a brand new bullish cycle breaking above $150.00. This generated a return of greater than 200% of the capital. We referred to as a wave III of (III) at $157.54 excessive and wave IV ended at $127.27 low. We anticipated to commerce increased in wave V of (III) to achieve the perfect zone of $164.83 – $176.47 the place we must always see a market response.

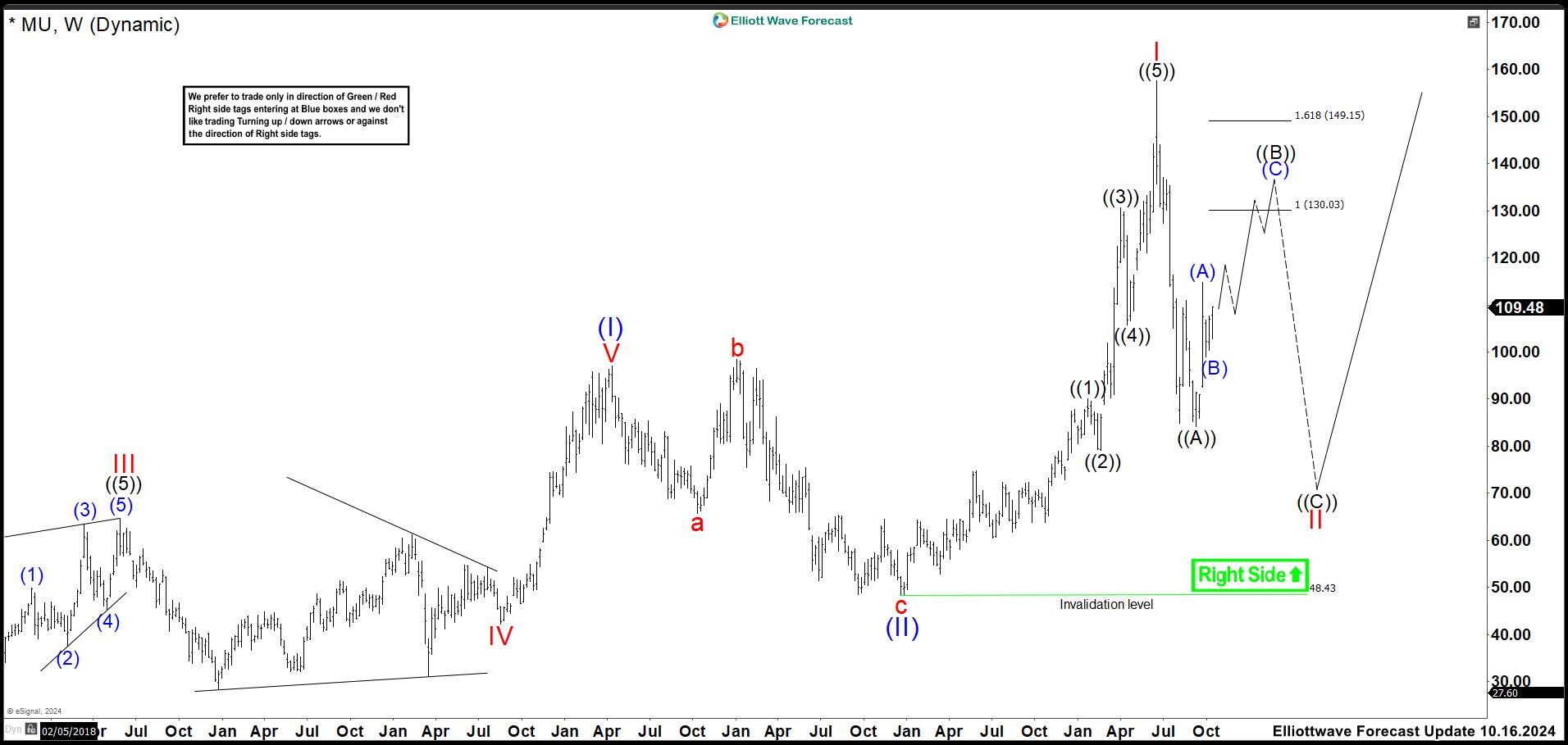

MU weekly chart October 2024

That is the newest replace of Micron. Wave IV failed to face up to the market onslaught and broke under $127.27. This ended the cycle that began in December 2022 and we adjusted the motion as wave I of (III) ended at $157.57 excessive. MU did a bearish impulse ending at $84.12 low and we referred to as it wave ((A)) of II. Presently, it’s buying and selling within the corrective wave ((B)). Wave (A) ended at $106.75 excessive. The correction ended wave (B) at $98.94 low. Now wave (C) has already began a brand new rally and we anticipate to achieve the $130.03 – $149.15 space to culminate wave ((B)) and switch decrease in ((C)). The concept is legitimate so long as the market stays under $157.57 or above $48.43. If the market breaks above wave I, then wave II is most certainly over.